Closing the Gender Gap in Retirement Savings

Addressing barriers to retirement savings for women

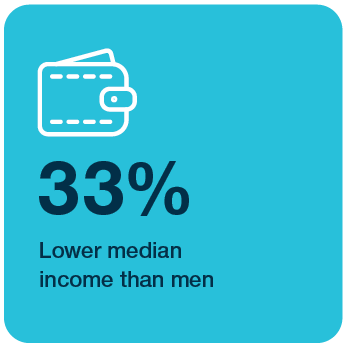

Women lag far behind men in terms of retirement savings. Employers and the retirement industry can help narrow this gap by ensuring that benefits programs, overall, can meet the needs of the female workforce.

Key findings from the study

Why are women falling behind?

Women are

40% less confident

in their retirement1

What can employers and financial professionals do?

Design Benefit Programs to “Lift All Boats”

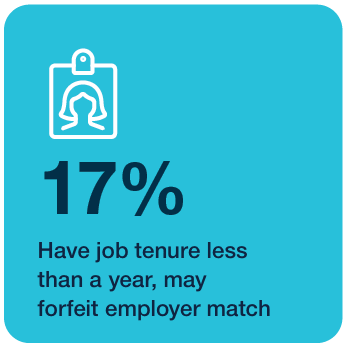

• Adopt auto-features

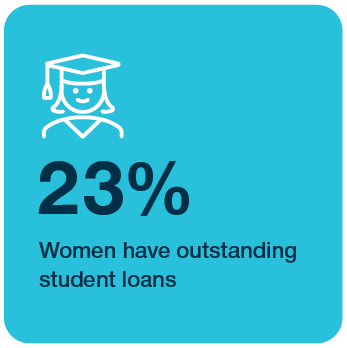

• Innovate benefits to help with student loan debt and emergency savings

Bolster Financial IQ to Improve Behavior

• Deliver personalized communications to encourage positive actions

Use Plan Data and Research to Help Improve Outcomes

• Implement targeted communications and education

• Understand employer’s competitiveness and enhance benefits if necessary

Use Other Platforms to Foster Organic Discussions

• Use business resource groups to promote underused benefits

See what else our research revealed

The T. Rowe Price Retirement Savings and Spending Study is a nationally representative online survey of 401(k) plan participants and retirees. The survey has been fielded annually since 2014. The 2022 survey was conducted between June 24 and July 22. It included 3,895 401(k) participants, full-time or part-time workers who never retired, currently age 18 or older, and either contributing to a 401(k) plan or eligible to contribute and have a balance of $1,000+. The survey also included 1,136 retirees who have retired with a Rollover IRA or left-in-plan 401(k) balance. NMG Consulting conducts this annual survey on behalf of T. Rowe Price.

1How confident are you about retirement (on a scale of 0 to 10)? 22% of women ranked in the top 3 boxes (those who rated their confidence levels at 8, 9, and 10) versus 37% of men, a difference of 40%.

202303-2753000