Understanding the tax efficiency benefits of exchange-traded funds (ETFs)

December 2025, Make Your Plan

- Key Insights

-

- Exchange-traded funds (ETFs) offer professional management and broad diversification with the added flexibility of intraday trading, making them attractive across a range of account types.

- For long‑term taxable account investors, ETFs are attractive because their in‑kind redemption capability helps to minimize year‑end capital gains for shareholders who haven’t sold.

- Active ETFs can potentially enhance these benefits by using the in‑kind process to proactively pursue investment opportunities while limiting year‑end taxable events for shareholders.

Predictability and control over how and when capital gains are realized are key components of any tax-efficient investing strategy.

Hi, I'm Lindsay Theodore, CERTIFIED FINANCIAL PLANNER® professional and thought leadership senior manager here at T. Rowe Price.

Let's walk through how holding ETFs, or exchange-traded funds, in your taxable accounts can help you achieve greater tax efficiency.

ETFs benefit from a unique structure. When shares are redeemed, the underlying securities can be delivered out of the portfolio in kind without selling them, as may be required in a mutual fund.

This in-kind redemption process enables ETFs to benefit from any growth of the underlying securities while realizing less taxable gains, which need to be distributed to shareholders at year-end.

For ETF shareholders, this means fewer surprise tax bills and greater predictability and control when it comes to income and tax planning.

And because our ETFs are actively managed, we're able to use this in-kind redemption process to our advantage, seeking to minimize year-end capital gain distributions while capitalizing on investment opportunities and aiming to deliver better after-tax outcomes for investors over the long term.

The bottom line: ETFs can help your money stay invested and working for you.

With our disciplined, research-driven approach, our active ETFs offer the potential for outperformance without the surprise tax bills along the way, because at T. Rowe Price, we are dedicated to offering investment choices that help you secure a brighter financial future.

For investors focused on maximizing long‑term returns and managing their tax exposure, exchange‑traded funds (ETFs) have become an increasingly popular choice. ETFs offer a unique combination of intraday trading flexibility, professional portfolio management, and generally lower costs. But one of their most significant advantages—specifically in taxable accounts—is their structural ability to minimize capital gain distributions. Here, we’ll explore how the underlying mechanics of ETFs can help investors grow their taxable investments while minimizing their year‑to‑year tax exposure.

Structure matters when it comes to taxes, trading, and efficiency

To better understand the unique nature of ETFs, it’s helpful to review how other investment vehicles are traded and operate—specifically, how shares are created and redeemed. Understanding these features and differences can help investors select the right mix of investment vehicles across varying account types to achieve their goals. In many cases, mutual funds continue to be a logical choice, especially when year‑end distributions aren’t immediately taxable, as with tax‑deferred accounts like traditional individual retirement accounts and 401(k)s. In other cases, especially in taxable accounts, ETFs may provide the tax efficiency features and characteristics that investors seek.

- Buying and selling stocks: Once a stock has been issued (or has gone public), a set number of shares are created and then traded electronically on exchanges like the NYSE or NASDAQ. Tax efficiency is one of the greatest benefits for holding individual stocks because shareholders maintain full control over when capital gains are realized and taxed. Unlike ETFs and mutual funds, individual stocks are not inherently diversified and require a higher degree of time, effort, and knowledge to properly manage and maintain.

- Buying and selling mutual funds: Mutual funds and ETFs both offer the benefits of built‑in diversification and professional oversight. In most cases, mutual funds are bought and sold directly from the fund company, so when there is a significant amount of cash needed to meet redemptions, the manager may need to sell holdings to meet that demand. In essence, redemption requests from other shareholders can have a direct influence on selling within the portfolio, which can lead to capital gains and losses. With both mutual funds and ETFs, any realized gains (that are not offset by losses) must be distributed to shareholders each tax year and ultimately reported on their individual tax returns.

- Buying and selling ETFs: Unlike mutual funds, ETFs aren’t bought and sold directly from the fund company. Instead, shares trade like stocks on an exchange, where buyers and sellers are matched electronically. Similar to stock trading, investors who want the ETF simply buy their shares from investors who are selling. If there is an imbalance between the number of buyers and sellers, professional institutional investors called authorized participants (APs) step in.

APs are specialized institutional traders within large financial institutions who help to facilitate the ETF creation and redemption process. The AP’s role is to work with the stock exchanges and the ETF companies to help maintain a balance between supply and demand.- Creation: When more shares are needed due to buying demand, the APs work with the ETF companies to create more shares.

The AP gathers all the underlying securities and sends that “creation basket” of stocks or bonds to the ETF company in kind and in exchange for ETF shares, which the AP can then hold or supply to the market. - Redemption: When there’s too much supply due to selling, the APs reduce (or redeem) the number of shares available on the market.

The AP sends the ETF shares back to the ETF company, and in return, the ETF delivers an equivalent “redemption basket” of underlying securities to the AP in kind. The AP can then sell the equivalent value of those securities on the market to net out the cost of the excess ETFs.

- Creation: When more shares are needed due to buying demand, the APs work with the ETF companies to create more shares.

This creation and redemption process allows ETFs to be redeemed without the need for the portfolio manager to sell securities. By delivering the underlying holdings “in‑kind” back and forth between the ETF issuer and the AP, the portfolio manager isn’t forced to sell securities as taxable events.1 Fewer internal transactions help reduce the frequency of capital gain distributions and lower the potential year‑to‑year tax cost for buy-and-hold ETF investors in a taxable account.

How active strategies can benefit from the ETF structure

As discussed, ETFs generally provide a level of tax efficiency because:

(A) They trade, first and foremost, over an exchange, where buyers and sellers are matched electronically without involving the ETF issuer at all.

(B) Their unique create/redeem mechanism enables ETF managers to facilitate larger outflows and investment activities through the in‑kind delivery of securities.

While passive ETF managers typically use the in-kind creation/redemption process to deliver a basket of securities that mirror an index or to address changes within an index, active managers can leverage the process to implement investment decisions. By actively choosing which securities to buy, sell, or transfer in kind, active ETFs can use the creation/redemption process to capitalize on opportunities while minimizing capital gain realization. Here are several strategies that active ETF managers can employ:2

- Gradually increasing the cost basis for the portfolio: Active ETFs can use the redemption process to deliver security tax lots with the highest embedded gains, rather than selling them and realizing capital gains. By removing lower cost basis shares in kind, the ETF raises the average cost basis of its remaining holdings, which helps reduce future capital gains if the manager later sells those positions.

- Selling positions at a loss to offset future gains: ETF issuers aren’t obligated to transfer securities in‑kind; they can also sell securities and transfer cash instead. If the portfolio has positions at a loss, the manager can sell those stocks to realize losses and offset future gains. These tax management strategies vary by portfolio but can make active ETFs attractive by allowing them to capture losses and deliver gains.

- Utilizing the creation and redemption process to manage and rebalance portfolios: Beyond handling everyday redemptions, some active ETF managers can leverage the in-kind mechanism when they want to make portfolio changes. For example, a manager can unwind positions that have appreciated by using the in-kind redemption process to reduce or eliminate specific securities from the portfolio. This flexibility enables the ETF to efficiently reposition its overall holdings, while generally minimizing taxable gains for shareholders.

How can this benefit an active ETF investor?

Consider two investors with taxable accounts:

One invests $100,000 in a mutual fund, the other in an ETF. Both pursue similar active large‑cap growth strategies, and each generates a 13% average annual return (pretax) over five years. At the end of five years, both investors have over $183,000 in their accounts. (See Figure 1.)

Same destination, but two very different tax journeys:

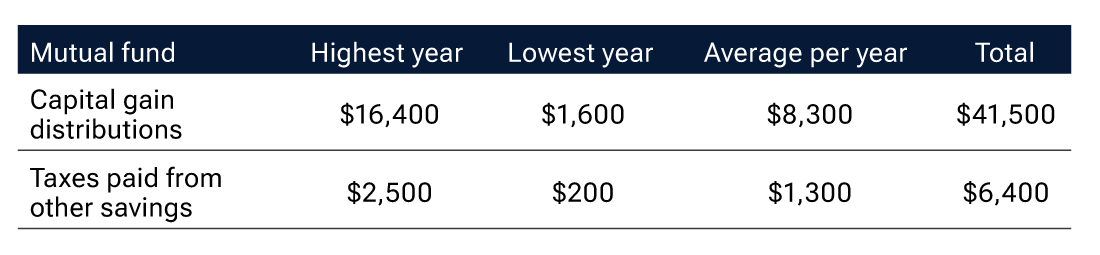

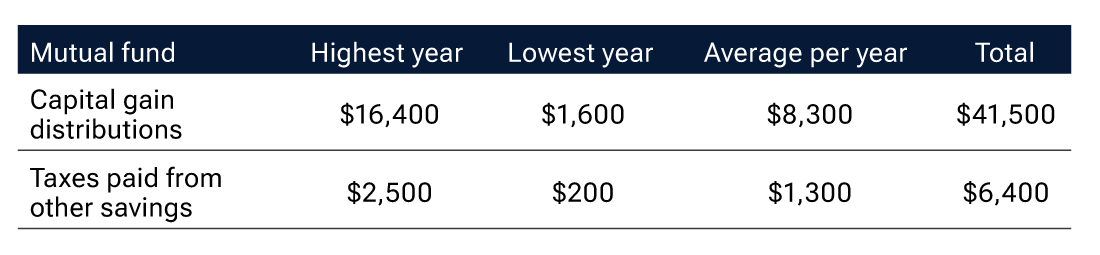

- Mutual fund investor: Over five years, the mutual fund paid out $41,500 in capital gain distributions, resulting in $6,400 of total tax bills for the investor, even though they hadn’t sold any shares. This is because when the fund manager sold securities—either to meet redemption requests or to adjust the portfolio—any net realized gains from those sales were distributed to all shareholders.

- ETF investor: The ETF investor was not subject to capital gain distributions and, therefore, paid $0 in taxes on their investment during the holding period.3 This is partly because ETF sales initiated by other shareholders were handled either over an exchange or via delivery of securities out of the portfolio in kind—both of which would have resulted in minimal capital gain exposure for the ETF shareholders who remained invested and didn’t sell.

Growth and tax impact over five years

(Fig. 1) Both funds are similarly managed, active, large‑cap growth strategies in a taxable account with a 13% average annual return (pretax).

Illustration Assumptions: This hypothetical is for illustration purposes only and does not reflect actual investment results or guarantee of future results. Respective gross annual returns in years 1–5 for both the mutual fund and ETF: 30%, 15%, ‑35%, 40%, 35%. Average annual return: 13%. On reinvested capital gain distributions, the short-term tax rate is 25% and the long-term tax rate is 15%. Ninety-five percent (95%) of capital gain distributions are long term. Over the investment period, the percentage of returns distributed at year‑end is approximately 50% for the mutual fund and 0% for the ETF. As is the case historically, ETFs may distribute zero or minimal capital gains, but this is not guaranteed. Because dividend and interest income must be paid out by both mutual funds and ETFs and cannot be minimized by ETF in-kind redemptions, they have been excluded from this comparison.

close

close

The bottom line:

- While the mutual fund delivered similar investment results (and reinvestments added to the shareholder’s overall cost basis), it was required to sell securities within the portfolio and then distribute net gains. This resulted in varied taxable gain distributions and less predictable tax bills for the mutual fund investor. (See Figure 2.)

- In contrast, the ETF investor’s year‑over‑year capital gains tax liability was minimal because it was not impacted by redemption activity of other ETF shareholders. At the end of five years, the ETF investor faces a larger unrealized gain ($83,700 versus $42,200 for the mutual fund investor) but is able to decide when to realize those gains and incur the associated taxes.

The mutual fund investor had less predictable taxable distributions, resulting in annual tax bills

(Fig. 2)

close

close

Potential for long‑term growth with fewer taxable distributions along the way

While similarly managed mutual funds and ETFs can deliver comparable gross investment returns, ETFs can offer distinct tax advantages for buy‑and‑hold investors in taxable accounts. The in‑kind creation and redemption mechanism helps minimize capital gain distributions and provides peace of mind for investors who would prefer that their year‑to‑year tax liabilities are driven less by the trading activity of other shareholders and more by when they choose to sell and realize their gains. Active ETFs extend these benefits by allowing professional managers to proactively position their portfolios for growth while attempting to minimize taxable events along the way. For investors who value professional management, cost effectiveness, and long‑term tax efficiency, active ETFs offer a sophisticated blend of these benefits.

Lindsay Theodore, CFP®

Thought Leadership Senior Manager

Lindsay Theodore, CFP®

Thought Leadership Senior Manager

Open a Brokerage account

Open a Brokerage account online to start investing in ETFs, stocks, and other investments.

1 Although the in‑kind creation and redemption process plays a key role in ETF tax efficiency, certain securities (e.g., fixed income, international equities) may be less conducive to in‑kind transfers.

2 Though these strategies are available to ETF managers, the degree to which they are utilized can vary across ETF issuers, managers, and strategies.

3 Historically, ETFs have distributed zero or minimal capital gains, but this is not guaranteed.

Important Information

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are those of the authors as of October 2025 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy.

Past performance is not a guarantee or a reliable indicator of future results. All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only.

ETFs are bought and sold at market prices, not NAV. Investors generally incur the cost of the spread between the prices at which shares are bought and sold. Buying and selling shares may result in brokerage commissions which will reduce returns.

Risks: All investments are subject to market risk, including the possible loss of principal. Active investing may have higher costs than passive investing and may underperform the broad market or passive peers with similar objectives. A fund that focuses its investments in specific industries or sectors is more susceptible to adverse developments affecting those industries and sectors than a more broadly diversified fund.

T. Rowe Price Investment Services, Inc.

© 2025 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, the Bighorn Sheep design, and related indicators (see troweprice.com/ip) are trademarks of T. Rowe Price Group, Inc. All other trademarks are the property of their respective owners.

- 202510‑4873064