Have U.S. stocks become too expensive?

September 2025, Monthly Market Playbook

- Key Insights

-

- Valuations near historical highs may have some investors wondering if U.S. stocks are too expensive at a time when economic growth expectations are modest.

- High valuations are supported by capital spending on artificial intelligence (AI) in the technology sector, which is heavily weighted in the U.S. stock market.

- Thanks in part to the AI boom, healthy underlying fundamentals—such as operating margins and return on equity—appear to support U.S. equity return potential.

With equity valuations close to their historical highs, many investors are understandably nervous that U.S. stocks have become too expensive given a relatively modest outlook for economic growth. But the U.S. market is heavily tilted toward the ongoing buildout in artificial intelligence, or AI, which happens to be the part of the U.S. economy where growth is booming. This has led to strong and improving market fundamentals.

Valuations are near all-time highs

U.S. stock valuations have been steadily climbing since early May. As of August 25th, the forward price to earnings, or P/E, multiple for the S&P 500 Index stood at 22.24, just below the post-COVID peak set in August 2020 and the technology bubble peak from December 1999.

Such expensive valuations are particularly surprising now because the U.S. economic outlook appears relatively modest. According to Bloomberg’s most recent survey of economists, U.S. gross domestic product, or GDP, is expected to grow below the long-term historical average both this year and through 2027.

In addition to concerns about a sharp rise in tariffs, the interest-rate-sensitive sectors of the U.S. economy have shown significant weakness since the Federal Reserve hiked rates in 2022.

U.S. manufacturing, for example, has been muddling along for more than 2½ years. For 31 of the past 33 months, the Institute for Supply Management’s index of manufacturing conditions has been below 50, a level that indicates economic contraction rather than expansion. Such an extended period of U.S. manufacturing weakness is unheard of outside of a recession.

The housing sector also has been notably weak. Existing home sales and new housing permits both fell sharply in 2022 in reaction to a sharp rise in mortgage rates triggered by the Fed hiking cycle. There has been almost no rebound since then, as mortgage rates have remained stubbornly high.

AI spending is booming

There is one area where U.S. economic activity has boomed: artificial intelligence. Capital expenditures in this area have been driven by four mega-cap tech companies widely known as the “hyperscalers.” Wall Street analysts currently expect these companies to invest almost $430 billion next year into their AI capabilities.

So far, the hyperscalers have been able to fund AI capex spending from their own cash flows rather than taking on debt. This means that elevated interest rates have not been an obstacle. It also means that companies involved in the AI buildout—such as semiconductor producers and cloud computing, data center, and networking equipment providers—have enjoyed exceptional earnings growth.

Equity fundamentals are strong

The booming AI sector happens to carry a much heavier weight in the U.S. stock market than the interest-rate-sensitive sectors. This means U.S. stock market fundamentals can be strong despite modest overall economic growth.

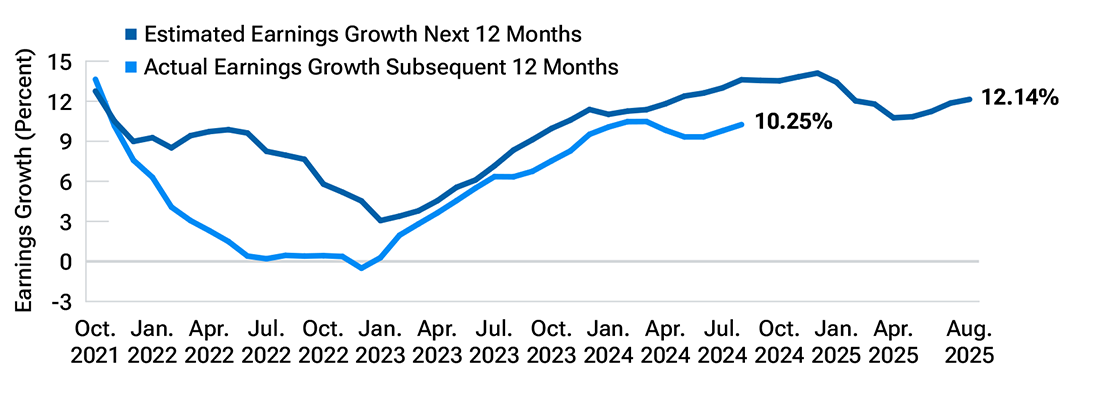

And they have been strong. Forward earnings estimates for the companies in the S&P 500 Index have risen steadily since the end of May. As of late August, S&P 500 earnings were projected to grow more than 12% over the coming 12 months. Actual results have been strong as well. S&P 500 earnings grew 10.25% over the 12 months ending August 25th, and growth has been trending higher since June.

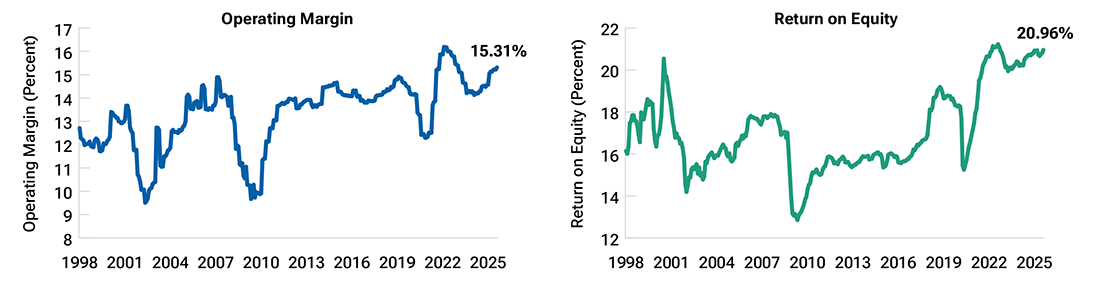

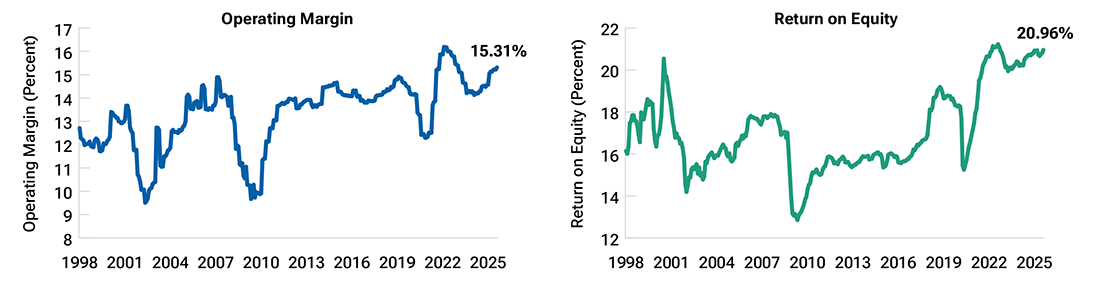

Meanwhile, S&P 500 profitability measures are also high and rising. Operating margins have topped 15%, continuing the long-term strengthening trend seen over the past 25 years. Return on equity also has continued to move higher, reaching nearly 21%. These fundamental metrics underpin the sustainability of the upwards trend in earnings.

Conclusion

U.S. equity valuations appear expensive, but are supported by strong and improving fundamentals. In our view, this means stock market returns can remain strong despite elevated valuations—as long as the fundamentals hold up.

But, if those fundamentals were to weaken, the potential for downside risk would be more significant than normal.

As a result, the T. Rowe Price Asset Allocation Committee currently maintains a neutral weight in U.S. stocks versus bonds despite elevated valuations. However, we will continue to keep a close eye on the underlying fundamentals.

Outside of the United States, this is intended for investment professional use only. Not for further distribution.

Many investors are understandably nervous that U.S. stocks have become too expensive given a relatively modest outlook for economic growth. But the U.S. market is heavily tilted toward the ongoing buildout in AI, where growth is booming. This has led to strong and improving market fundamentals.

U.S. stock valuations have been steadily climbing since early May. As of August 25, the forward price/earnings (P/E) multiple for the S&P 500 Index stood at 22.24, just below the post-pandemic peak set in August 2020 and the technology bubble peak from December 1999.

Such expensive valuations are surprising because the U.S. economic outlook appears relatively modest. According to Bloomberg’s most recent survey of economists, growth in U.S. gross domestic product is expected to be below the long-term historical average both this year and through 2027.

AI spending drives growth

In addition to concerns about a sharp rise in tariffs, the interest-rate-sensitive sectors of the U.S. economy have exhibited significant weakness since the Federal Reserve hiked rates in 2022. For 31 of the past 33 months, the Institute for Supply Management’s index of manufacturing conditions has been below 50, a level that indicates contraction rather than expansion. Such an extended period of U.S. manufacturing weakness is unheard of outside of a recession. The housing sector also has been notably weak, as mortgage rates have remained stubbornly high.

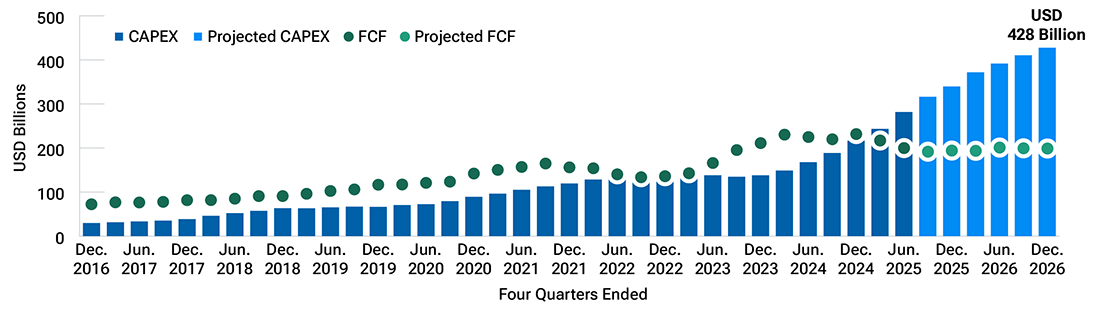

Capital expenditures on AI, on the other hand, have boomed, driven by four mega-cap tech companies known as the “hyperscalers” (Figure 1).1 Companies servicing the AI buildout—such as semiconductor producers and cloud computing, data center, and networking equipment providers—have enjoyed exceptional earnings growth.

So far, the hyperscalers have been able to fund AI spending from their own cash flows, so elevated interest rates have not been an obstacle.

AI capital spending keeps rising

(Fig. 1) Rolling four-quarter capex and free cash flow (FCF) for four “hyperscaler” companies

Actual data: Q1 2016 through Q2 2025. Projected: Q3 2025 through Q4 2026.

Actual future outcomes may differ materially from estimates.

Source: T. Rowe Price calculations using data from FactSet Research Systems Inc. All rights reserved.

close

close

Equity fundamentals are strong

The booming AI sector carries a much heavier weight in the U.S. stock market than the interest-rate-sensitive sectors. This means that U.S. stock market fundamentals can be strong despite modest overall economic growth.

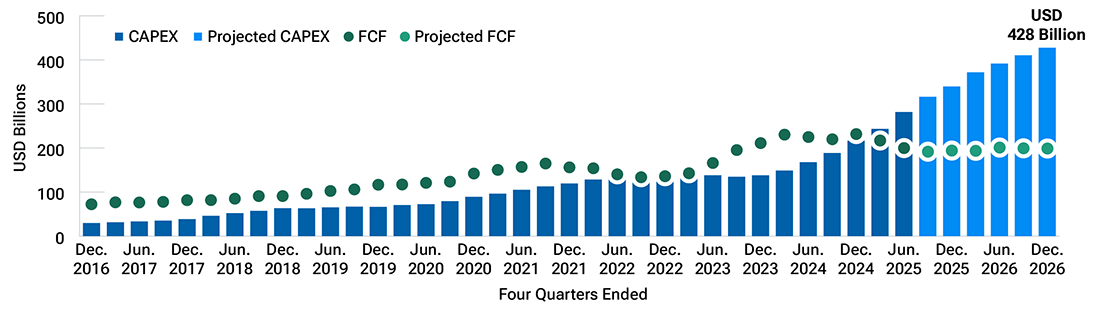

And they have been strong: Forward earnings estimates for the S&P 500 have risen steadily since the end of May (Figure 2). Actual results have been strong as well. S&P 500 earnings grew 10.25% over the 12 months ending August 25, and growth has been trending higher since June.

Strong earnings despite modest economic growth

(Fig. 2) S&P 500 Index estimated and actual earnings growth

October 1, 2021, to August 25, 2025.

Past performance is not a guarantee or a reliable indicator of future results.

Actual future outcomes may differ materially from estimates.

Index performance is for illustrative purposes only and is not indicative of any specific investment.

Investors cannot invest directly in an index.

Source: T. Rowe Price calculations using data from FactSet Research Systems Inc. All rights reserved.

close

close

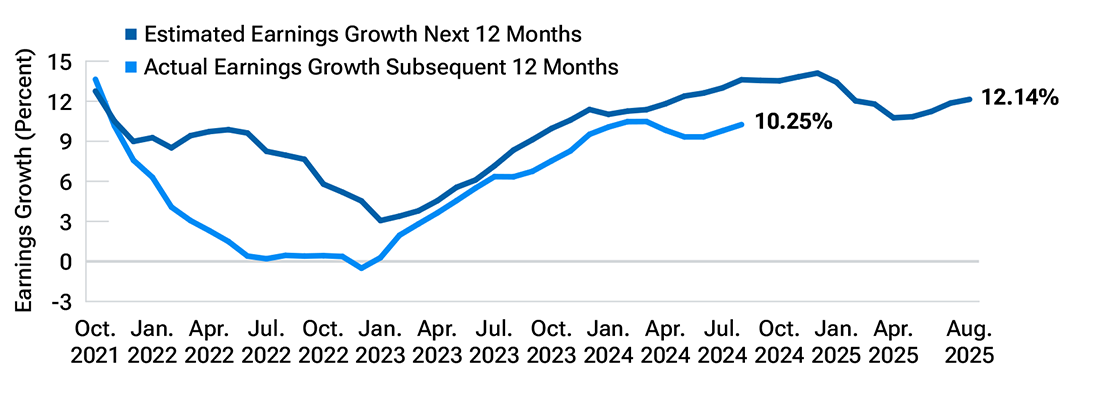

Meanwhile, S&P 500 profitability measures are high and rising (Figure 3). Return on equity also has continued to improve. These fundamental metrics underpin the sustainability of the upward trend in earnings.

Improving fundamentals

(Fig. 3) Operating margin and return on equity for the S&P 500 Index

January 31, 1998, to August 25, 2025. Month-end data for periods prior to August 25.

Past performance is not a guarantee or a reliable indicator of future results.

Index performance is for illustrative purposes only and is not indicative of any specific investment. Investors cannot invest directly in an index.

Source: T. Rowe Price calculations using data from FactSet Research Systems Inc. All rights reserved.

close

close

Conclusion

U.S. equity valuations appear expensive but are supported by strong and improving fundamentals. In our view, this means stock market returns can remain strong—as long as the fundamentals hold up. However, if those fundamentals were to weaken, the potential downside risk would be more significant than normal.

The T. Rowe Price Asset Allocation Committee currently maintains a neutral weight in U.S. stocks versus bonds despite elevated valuations. However, we will continue to keep a close eye on the underlying fundamentals.

Timothy C. Murray, CFA

Capital Markets Strategist

Timothy C. Murray, CFA

Capital Markets Strategist

Insights for every stage.

Practical guidance to support your journey—from saving to investing to retirement.

1The hyperscaler companies are Alphabet, Amazon, Meta, and Microsoft. The specific securities identified and described are for informational purposes only and do not represent recommendations.

Risks: Investing in technology stocks entails specific risks, including the potential for wide variations in performance and usually wide price swings, up and down. Technology companies can be affected by, among other things, intense competition, government regulation, earnings disappointments, dependency on patent protection and rapid obsolescence of products and services due to technological innovations or changing consumer preferences.

Important Information

Outside of the United States, this is intended for investment professional use only. Not for further distribution.

This material is being furnished for informational and/or marketing purposes only and does not constitute an offer, recommendation, advice, or solicitation to sell or buy any security.

Prospective investors should seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services.

Past performance is not a guarantee or a reliable indicator of future results. All investments involve risk, including possible loss of principal.

Information presented has been obtained from sources believed to be reliable, however, we cannot guarantee the accuracy or completeness. The views contained herein are those of the author(s), are as of September 2025, are subject to change, and may differ from the views of other T. Rowe Price Group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

All charts and tables are shown for illustrative purposes only. Actual future outcomes may differ materially from any estimates or forward‑looking statements provided. Index performance is for illustrative purposes only and is not indicative of any specific investment. Investors cannot invest directly in an index.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

USA—Issued in the USA by T. Rowe Price Investment Services, Inc., distributor and T. Rowe Price Associates, Inc., investment adviser, 1307 Point Street, Baltimore, MD 21231, which are regulated by the Financial Industry Regulatory Authority and the U.S. Securities and Exchange Commission, respectively.

© 2025 T. Rowe Price. All Rights Reserved. T. Rowe Price, INVEST WITH CONFIDENCE, the Bighorn Sheep design, and related indicators (see troweprice.com/ip) are trademarks of T. Rowe Price Group, Inc. All other trademarks are the property of their respective owners.

202509-4783943