retirement savings | april 4, 2024

Answers to 5 of the Most Popular Retirement Savings Questions

Answering these five questions can help put the future you want within reach.

Key Insights

Although every situation is unique, many investors share similar concerns about saving for retirement.

Guidelines can help investors get started even when they’re uncertain about the future.

Investors should regularly revisit their strategies and assumptions to keep their plans and goals aligned.

Judith Ward, CFP®

Thought Leadership Director

Roger Young, CFP®

Thought Leadership Director

Saving for retirement represents an important long-term financial goal for most investors. Although your saving strategy will reflect your personal circumstances and the type of retirement you envision, certain challenges are common to nearly everyone. For instance, those still in the workforce frequently want to know whether they are saving enough for retirement, while retirees often wonder how much they can afford to spend. The answers to these common questions may vary from person to person, but the following suggestions can help start you down the path toward retirement success.

1. How much should I save for retirement?

Exactly how much you need to save depends on several factors, including your lifestyle, how much you earn, and your unique vision for this next stage of life. However, by aiming to save at least 15% of your income—including any employer match—you can give yourself a good chance to maintain your current lifestyle in retirement.

Each extra percentage point you save will make a significant difference in your retirement savings over time. (See “Saving Regularly for Retirement.”) T. Rowe Price’s 15% guideline is based on several factors, including the potential that your retirement may last 30 years or longer. A long lifetime exposes you to increased risks, including the need to fund more years of spending, a decrease in purchasing power from inflation, and higher health care costs. A 15% target can help your savings generate a robust income stream in the face of these long-term challenges. Many individuals may set their saving rate through their workplace plan, such as a 401(k). Investors also can supplement these savings with an individual retirement account (IRA) or a regular taxable account.

Why now is the right time to review your portfolio.

Market uncertainty, major life events, and the rising cost of living can impact your investment strategy.

Get a free portfolio review:

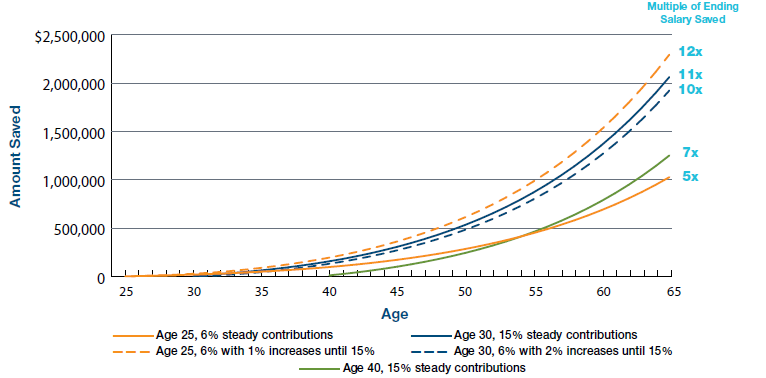

(Fig. 1) Saving Regularly for Retirement

The sooner you can start saving, the better off you’ll be in the long run. If you are able to save 15% or more of your income or salary (including any employer contributions), congratulations! For many individuals, this may be a stretch for their current financial situation. If you can increase the amount you save over time, it can make a significant difference and get your retirement savings on track.

Assumptions: Examples beginning at age 25 assume a beginning salary of $40,000 escalated 5% a year to age 45, then 3% a year to age 65. Examples beginning at age 30 assume a beginning salary of $50,000 escalated 5% a year to age 45, then 3% a year to age 65. Example beginning at age 40 assumes a beginning salary of $80,000 escalated 5% a year to age 45, then 3% a year to age 65. Annual rate of return is 7%. All savings are assumed tax-deferred. Multiple of ending salary saved divides final ending portfolio balance by ending salary at age 65. This example is for illustrative purposes only and is not meant to represent the performance of any specific investment option. The assumptions used may not reflect actual market conditions or your specific circumstances and do not account for plan or IRS limits. Please be sure to take all of your assets, income, and investments into consideration when assessing your retirement savings adequacy.

2. Have I saved enough for retirement so far?

Considering that you may spend 30 years or more in retirement, it’s important to have enough set aside so that your money will last. A quick way to check your progress is to assess how much you’ve saved by certain ages. We refer to the target levels as savings benchmarks.

To find your retirement savings benchmark, look for your approximate age and consider how much you’ve saved so far. (See “Benchmarking Your Progress.”) Compare that amount with your current income.

These benchmarks assume you’ll be dependent primarily on personal savings and Social Security benefits in retirement. However, if you are expecting other income sources (e.g., a pension), you may not have to rely as much on your personal savings, so your benchmark would be lower.

The midpoint benchmarks are a good starting point, but circumstances vary by person and over time. Key factors that affect the savings benchmarks include income and marital status. Depending on your personal circumstances, you may want to consider other targets within the ranges. As you’re nearing retirement, you’ll want to go beyond general benchmarks and think more carefully about your specific spending needs and income sources.

If it appears you’re falling below the benchmark and you’re behind on your savings goals, make sure you’re taking advantage of all the saving options available to you. Consider contributing more than 15% of your salary and taking advantage of both an IRA and a taxable account. If you’re age 50 or older, your contribution cap for your 401(k) and IRA will be higher than for those under age 50.

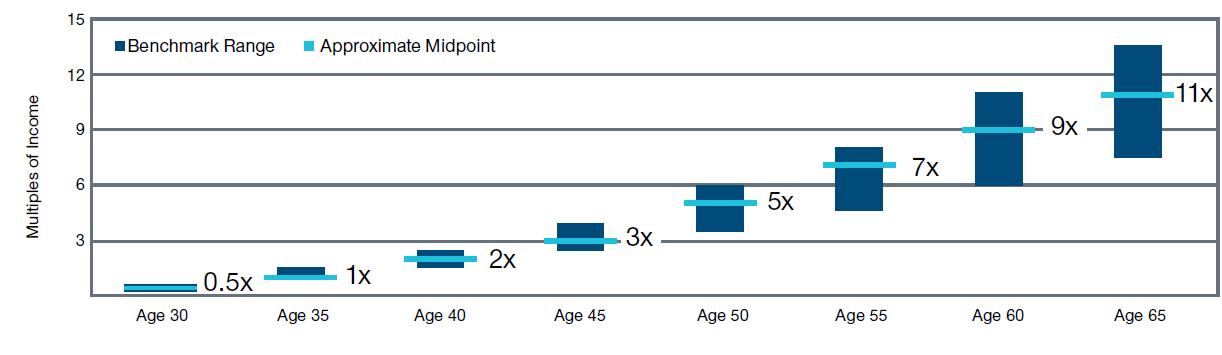

(Fig. 2) Benchmarking Your Progress

To find your savings benchmark, look for your approximate age. Divide the amount you’ve saved so far for retirement by your current gross income or salary, and compare that with the benchmark below.

Assumptions: Benchmarks are based on a target multiple at retirement age and a savings trajectory over time consistent with that target and the savings rate needed to achieve it. Household income grows at 5% until age 45 and 3% (the assumed inflation rate) thereafter. Investment returns before retirement are 7% before taxes, and savings grow tax-deferred. The person retires at age 65 and begins withdrawing 4% of assets (a rate intended to support steady inflation-adjusted spending over a 30-year retirement). Savings benchmark ranges are based on individuals with current household income approximately between $75,000 and $300,000 and couples with income between $100,000 and $400,000. Target multiples at retirement reflect estimated spending needs in retirement (including a 5% reduction from preretirement levels); Social Security benefits (using the SSA.gov Quick Calculator, assuming claiming at full retirement ages, and the Social Security Administration’s assumed earnings history pattern); state taxes (4% of income, excluding Social Security benefits); and federal taxes. We assume the household starts saving 6% at age 25 and increases the savings rate by 1% annually until reaching the necessary savings rate. Benchmark ranges reflect the higher amounts calculated using federal tax rates as of January 1, 2024, or the tax rates as scheduled to revert to pre-2018 levels after 2025. Approximate midpoints for age 35 and older are rounded up to a whole number within the range.

3. Should I contribute to a Roth IRA or a Traditional IRA?

Setting aside funds in a Roth IRA (if you meet income qualifications) can offer a few distinct benefits over saving in a Traditional IRA. Withdrawals from a Roth IRA are tax-free in retirement (generally, if you are age 59½ or older and have held the account for five years). By comparison, withdrawals from Traditional IRAs generally are taxed as ordinary income. Additionally, Roth IRA contributions can be withdrawn at any time, penalty- and tax-free, providing flexibility and access to these funds if needed.

Moreover, Roth IRAs aren’t subject to the required minimum distributions (RMDs) that apply to most retirement accounts starting at age 73,1 so you can choose to let Roth assets benefit from tax-deferred growth for the rest of your life. Roth contributions can be a good choice if you don’t expect your tax rate to decrease in retirement or if you already have significant traditional assets and won’t need all of those funds for income. While a Roth IRA is a good choice for many people, it’s not best for everyone. If you’re in your peak earning years, a Traditional IRA may be a better strategy.

When you retire, you might eliminate expenses. As a result, your income from Social Security and the amount you need to draw from retirement accounts likely will be less than what you earn today. So your federal tax bracket could be lower in retirement. In this case, taking the tax deduction during your working years with a traditional contribution may make more sense than the Roth contribution. You’ll help reduce your current taxable income while paying a higher tax rate and then make withdrawals at a potentially lower tax rate later in retirement. Keep in mind that your best choice between a Roth IRA and a Traditional IRA may change as you revisit your investment strategy over time.

Subscribe to T. Rowe Price Insights

Receive monthly retirement guidance, financial planning tips, and market updates straight to your inbox.

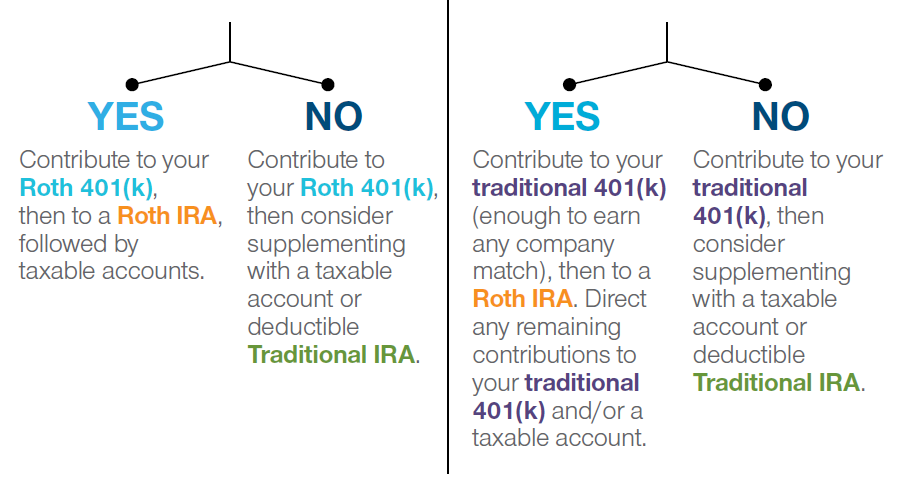

4. Which retirement account should I fund first?

The order in which you contribute to your retirement accounts could help increase future spendable income. When deciding on your approach, make sure not to miss out on any matching contributions (if offered) from your employer’s retirement plan. Also, consider taking advantage of the benefits of a Roth account—both within your employer’s retirement plan (if available) and/or through a Roth IRA (if you meet income qualifications).

Let’s look at an example: Suppose Roth contributions make sense for your situation and you’re eligible to contribute to a Roth IRA, but your company doesn’t offer a Roth option in its 401(k) plan. In this case, you can follow this order:

- Contribute enough to your traditional 401(k) to earn any company match.

- Contribute to a Roth IRA up to the contribution limit ($7,000 for those under 50 in 2024).

- Direct any supplemental savings to your traditional 401(k) and/or a taxable account.

(Fig. 3) Retirement Contribution Order at a Glance

Determining how to prioritize your contributions can help make the most out of your savings.

Do Roth contributions make sense for your situation?

Roth contributions can be a good choice if you don’t expect your tax bracket to decrease in retirement or if you already have significant traditional assets and won’t need all of those funds for income.

Does your company offer a Roth option for its 401(k) plan?

All participants are eligible to make designated Roth contributions within a 401(k) if offered by their employers, regardless of income.

Are you eligible to contribute to a Roth IRA?

You can contribute to a Roth IRA if your modified adjusted gross income (MAGI) is below the annual IRS limit for your tax filing status (e.g., single or married filing jointly).2

5. What should I consider when establishing an income plan for retirement?

Starting to draw down your savings can be a challenge after years of putting money aside. A strategy that includes a sustainable withdrawal rate and an order for which accounts to draw from3 can help ensure that you make the most of your savings.

T. Rowe Price suggests the 4% guideline as a starting point for a withdrawal strategy. This means that in the first year of retirement, you could consider a withdrawal amount that is 4% of your retirement account balance. Every year, reassess the following to adjust your withdrawal amount if needed:

Your spending needs

Portfolio performance

Market environment

You’ll want to assess and plan out your strategy well before RMDs come into play.

Also, consider your options for Social Security. You can start taking reduced Social Security benefits at age 62, but waiting until your full retirement age will allow you to claim full benefits. And the longer you wait—up to age 70—the higher your annual benefit will be. Consider coordinating your claiming strategy with your spouse. For instance, to maximize the benefit for a surviving spouse, the higher earner should wait as long as possible (up to age 70) before claiming benefits. Saving for retirement is a priority for most investors. Regularly reassessing these questions can instill confidence as you build your strategy to achieve your retirement goals. Saving for retirement is a priority for most investors. Regularly reassessing these questions can instill confidence as you build your strategy to achieve your retirement goals.

1The SECURE 2.0 Act of 2022 changes the RMD age to 73 for individuals who turn age 72 on or after January 1, 2023. The new law also provides that the RMD age will change again to 75 in 2033.

2Learn more about Roth IRAs. In order to contribute to a Roth IRA in 2023, single filers must have a MAGI under $153,000 and married couples filing jointly must have a MAGI under $228,000. In order to contribute to a Roth IRA in 2024, single filers must have a MAGI under $161,000 and married couples filing jointly must have a MAGI under $240,000.

3Withdrawal Strategies Report (PDF).

Important Information

The views contained herein are those of the authors as of February 2024 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy.

An IRA should be considered a long-term investment. IRAs generally have expenses and account fees, which may impact the value of the account. Nonqualified withdrawals may be subject to taxes and penalties. Maximum contributions are subject to eligibility requirements. For more detailed information about taxes, consult IRS Publication 590 or a tax professional regarding personal circumstances.

All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only.

View investment professional background on FINRA's BrokerCheck.

202402-3386944

Next Steps

Explore all the ways we can help you reach your retirement goals.

Contact a Financial Consultant at 1-800-401-1819.