Equities

How Large‑Cap Stock Investors Can Adapt to a Slowing Economy

September 3, 2019Key Points

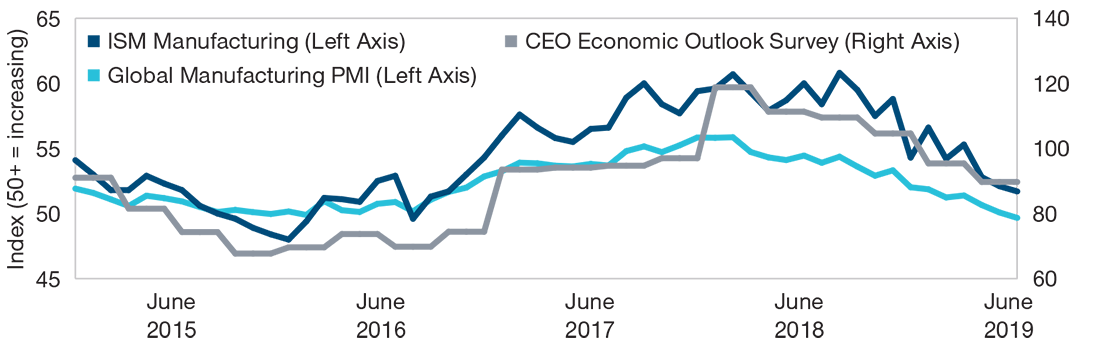

- U.S. economic growth is slowing, but a recession is not likely in the near term.

- Escalating trade tensions remain a risk, but durable and late‑cycle companies show promise.

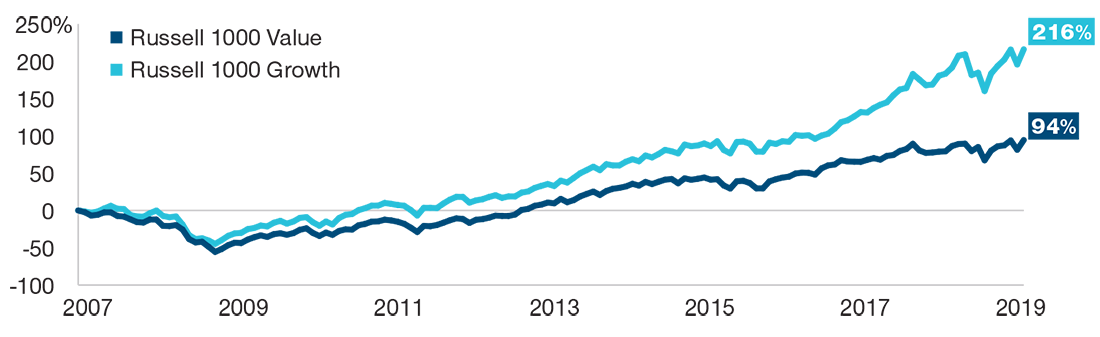

- Growth investing has significantly outperformed value investing over the past decade, but both strategies face different challenges in the current environment.

Q. How is the U.S. economic slowdown affecting large‑cap stocks?

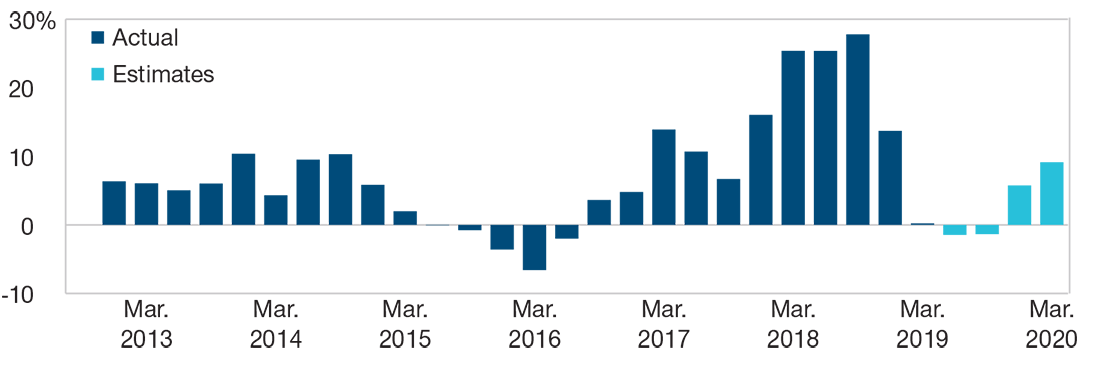

Joe Fath: The U.S. economy is showing steady, though slow, growth. The slowdown has not yet affected companies significantly in terms of their profit and loss statements, particularly the disruptive secular growers, such as the Googles and Amazons, as well as some software-as-a-service stocks like Salesforce.com, ServiceNow, and Workday. Also, we should be mindful that year‑over‑year comparisons will reflect the fact that the tax cuts of 2018 have begun to roll off.

The biggest weakness has been among cyclicals, but even the technology, health care, and consumer discretionary sectors—in which we have relatively higher exposures—have mostly done well. Defensive sectors—such as consumer staples, utilities, and real estate investment trusts (REITs)—and yield plays like the cell phone tower companies also have performed relatively well recently due to fears that we are in the later innings of the economic cycle coupled with a flattening or inverted interest rate yield curve.

Mark Finn: About half of the Russell 1000 Value Index is composed of companies with some level of cyclicality, including financials, energy, industrials, and materials. So an economic slowdown poses challenges for stock selection in those sectors in particular. What’s unique about this 10‑year bull market is that each time it appeared we were on the precipice of a recession, the central banks maintained their accommodative policy, so you should be cautious about getting too defensive even if you think we are near the end of the cycle. In the United States, a lot of the leading indicators are slowing, but employment has held up well. Outside the United States, developed market economies are notably more sluggish.

Q. What’s the impact of rising trade tensions between the U.S. and China?

Joe Fath: For the most part, companies have been able to mitigate the tariff impact. They either made adjustments in their business model or sought concessions from suppliers. The multinational industrials have been hit the hardest along with consumer companies like Dollar Tree and other retailers that import a lot from China. But I think more companies will aim to de‑risk by moving production away from China. With the United States expanding its tariffs to Chinese consumer goods, many companies will be forced to pass along those extra costs to consumers. It’s too early to tell the long‑term ramifications to markets, but the longer these additional costs are imposed, the more they will impact market conditions. In China, internet companies Alibaba and Tencent have solid business models. But trade tensions are a headwind to consumer sentiment and demand, and not just for these successful platforms.

Mark Finn: I agree that many U.S. companies have shifted supply lines to avoid tariffs. But you can’t totally reinvent your business model and just go unplug China and plug in 10 other countries. The longer the trade war goes on, the more risk there is because companies will be forced to reduce orders and relocate manufacturing away from China, and this will be costly to their businesses and to the economy.

My bias is to quality and to be modestly defensive.

My bias is to quality and to be modestly defensive.

- Mark Finn, Portfolio Manager, T. Rowe Price Value Fund

Q. What is your investment strategy in this environment?

Mark Finn: My bias is to quality and to be modestly defensive. Normally, at the end of a long expansion you would be tilting toward less cyclical exposure, including utilities, consumer staples, and REITs. The challenge is that the market has moved that way already. The higher-quality defensive stocks are expensive, and those with more cyclical exposure are relatively cheap. The Federal Reserve may do its best to avoid a natural slowdown or a recession. So I’ve tried to invest in cyclical stocks that offer a compelling investment case and reasonable valuation.

I am underweight financials because we are late in the credit cycle, and low interest rates are likely to compress margins. I’m underweight energy due to abundant supplies. Among cyclicals, I’m meaningfully overweight technology, where I see opportunities among semiconductors and semiconductor equipment manufacturers. Among materials, I’ve focused on some of the industrial gases that are tethered to the chemical and oil infrastructure.

Joe Fath: In the first half of this year, the defensive sectors and the high-growth sectors performed well, and the cyclicals had not really participated. So the market is generally telling you that investors are worried that we may be in the last innings of this economic expansion. But the late cyclicals are probably really attractive hunting ground now. To Mark’s point, I, too, favor some of the industrial gas companies, as they tend to do well late in the cycle. There is also opportunity in the industrial semiconductor industry, such as Texas Instruments.

Overall, my strategy looks like an upside‑down pyramid. The top sleeve is composed of secular growth names that represent 50% to 60% of the portfolio. The cyclical sleeve represents 15% to 25%. That’s where we have been doing more hunting lately. The bottom part of the pyramid, with a range of 15% to 25% consists of special situations, particularly companies exposed to industry structural change or companies pivoting from value to growth.

I favor companies that have more control over their destiny, are positioned to benefit from powerful secular trends, and are using innovation to disrupt less efficient business models and create new ones. I believe that firms effective at leveraging innovation will be able to sustain robust growth in earnings and revenues as they exploit new markets and seize share in existing ones. McDonald’s, for example, is undergoing a significant digital transformation that enhances the customer experience. In technology, I favor the platform business models and am underweight hardware-driven technology enterprises that tend to be more cyclical.

Q. What is your view of increased government scrutiny of the platform companies?

Joe Fath: We are closely monitoring the regulatory scrutiny facing the large platform companies. This is a unique situation given that these big tech firms have been largely viewed as a force for good, with the consumer as the primary beneficiary. However, the potential for stepped-up regulation of Amazon.com, Facebook, and Alphabet increases volatility risk and the potential to pressure the firms’ valuation multiples. We take a balanced view and should not lose sight of their competitive advantages and attractive long‑term growth prospects.

Q. What about the politics swirling around the health care sector?

Mark Finn: The health care sector is facing political headwinds, such as potential limits on drug pricing and single‑payer health care initiatives, but the sector should benefit longer term from secular tailwinds, including an aging population, new technology applications, and improved treatment options.

Joe Fath: Our allocation to health care is most leveraged to select therapeutics and medical device companies—such as Intuitive Surgical and Stryker—that are utilizing technology and that we believe have limited exposure to potential regulatory pressures. I’ve avoided material exposure to pharmaceuticals and biotechnology. The pace of innovation and growth in biotechnology has slowed quite a bit, and big pharma is in the bull’s-eye of efforts to lower drug care costs. We’ve also reduced our exposure to managed care due to elevated headline risk through next year’s election as several “Medicare For All” proposals would drive existential risk to these for‑profit businesses.

I think we’ll see overall growth slow, but the risks of a significant U.S. or global economic downturn still appear limited.

I think we’ll see overall growth slow, but the risks of a significant U.S. or global economic downturn still appear limited.

- Joe Fath, Portfolio Manager, T. Rowe Price Growth Stock Fund

Q. What is your outlook for the U.S. economy and corporate earnings?

Joe Fath: We haven’t seen the excesses that were evident in the last financial crisis, so if we have a recession, it should be more of a relatively normal recession in which gross domestic product declines by 1% to 2% over a few quarters. We’re already seeing weakening data in certain pockets, particularly transportation and manufacturing. But job growth and housing continue to look pretty good. I think we’ll see overall growth slow, but the risks of a significant U.S. or global economic downturn still appear limited.

In a slower growth environment, selectivity is key. Overall, there is a high degree of certainty that the rate of earnings growth will slow to some degree. The question is how much it affects the market’s valuation multiples. Does the market look past that, or is it a sign of more to come and multiples compress? The wild card is the 2020 presidential election. The rhetoric leading up to it could certainly affect sentiment and spur volatility.

Mark Finn: I also expect earnings growth to be more challenging, especially with the protracted trade negotiations. The U.S. economy is not going gangbusters, but it’s doing fine. The strong labor market and rising wages should continue to strengthen consumers’ balance sheets. However, the expansion may have difficulty maintaining its recent pace. A recession is definitely on the horizon, but we just don’t know how far off that is. When the labor market weakens and consumer credit suffers, that will tell you that the horizon could be very near. That’s why you need to balance your strategy between defensive and procyclical positioning.

Q. What should investors be mindful of in today’s climate?

Mark Finn: Low interest rates continue to support equities and those seeking to earn a reasonable return over time. I would not advocate that investors concerned about the end of the economic cycle sell their equity shares. You just need to be reasonably balanced in your overall investment strategy and perhaps be somewhat defensively positioned. In our strategy, we are ever diligent about the risks that companies face and how disruption is impacting companies more generally. That is really important for value investors because half the battle in value investing is avoiding value traps.

Joe Fath: As growth investors, we remain cautiously positive about U.S. equities. However, valuations are less forgiving today than at the start of 2019. And the key risks—escalating trade disputes, the slowing economy, and political uncertainty—could trigger renewed volatility and impede market performance. As active managers, we need to be very selective and make sure we invest in companies that are well positioned and have a very good management team that can navigate through choppier waters and execute well.

As of June 30, 2019, among stocks mentioned in this article, Alphabet (Google) made up 5.4% of the Growth Stock Fund; Dollar Tree, 0.8%; McDonald’s, 0.7%; Facebook, 5.8%; and Stryker, 1.9%. Among the stocks mentioned, Dollar Tree made up 1.4% of the Value Fund; McDonald’s 1.3%; Alphabet, 0.9%; Stryker, 0.8%; Facebook, 0.5%; and Texas Instruments, 0.03%. All investments are subject to market risk, including the possible loss of principal. The value approach to investing carries the risk that the market will not recognize a security’s intrinsic value for a long time or that a stock judged to be undervalued may actually be appropriately priced.

WHAT WE’RE WATCHING NEXT

Several factors could increase market volatility in the coming months, notably protracted trade friction between the United States and China, Persian Gulf tensions, and the U.S. presidential election campaign. The U.S. Department of Justice antitrust investigation of the dominant U.S. internet platform companies could also create bouts of volatility. However, as active managers, we always consider that volatility can be an investor’s friend, and we will continue to seek out opportunities in which markets unduly punish companies that feature strong business models and have the potential to gain market share.

Call 1-800-225-5132 to request a prospectus or summary prospectus; each includes investment objectives, risks, fees, expenses, and other information you should read and consider carefully before investing.

Additional Disclosure

Copyright 2019 FactSet. All Rights Reserved. www.factset.com

Copyright ©2019, Markit Economics Limited. All rights reserved and all intellectual property rights retained by Markit Economics Limited.

Information has been obtained from sources believed to be reliable, but J.P. Morgan does not warrant its completeness or accuracy. The index is used with permission. The Index may not be copied, used, or distributed without J.P. Morgan’s prior written approval. Copyright © 2019, J.P. Morgan Chase & Co. All rights reserved.

Important Information

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are those of the authors as of August 2019 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation, investment advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Investors will need to consider their own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy.

Past performance is not a reliable indicator of future performance. All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only.

201908‑935438