When Diversification Fails

Executive Summary

- The tendency of asset correlations to spike in down markets means that the benefits of diversification can disappear when investors need them most.

- Our own research confirms that correlation profiles in down and up markets have differed significantly across a number of key risky asset classes.

- Investors should avoid using full-sample return distributions in their asset allocation models and may want to consider additional risk management strategies.

Investors are often surprised to discover that the benefits of portfolio diversification can disappear right when they need them most—during down markets, especially during market panics, such as the 2008 global financial crisis.

Previous research has shown this effect to be pervasive for a wide variety of financial assets, including both individual stocks and equity sectors, currencies, bond markets, and hedge fund styles. Not only have correlations among these assets tended to rise on the downside, they also have significantly declined on the upside.

We believe that many investors still do not fully appreciate the impact of asymmetric correlations on portfolio efficiency. During “left‑tail” (i.e., extremely negative) market events, diversified portfolios actually may have greater exposure to loss than more concentrated portfolios.

In a recent study, we expanded on previous analyses in several ways.1 We included post‑2008 data, covered a broader set of markets, and took an in‑depth look at what drives correlations in numerous markets. We introduced a data‑augmentation technique to improve the robustness of tail correlation estimates and analyzed the impact of return data frequency on private asset correlations.

The Failure of Diversification in Risky Assets

Based on monthly data from January 1970 to June 2017, we calculated conditional correlations between U.S. and non-U.S. stocks as measured by the MSCI USA index and the MSCI EAFE index, respectively. These conditional correlation profiles differed substantially from their normally distributed counterparts. When U.S. stocks were rallying (in their 99th percentile), their correlation with non‑U.S. stocks dropped to ‑17%. During the worst 1% sell-offs in U.S. stocks, however, their correlation with non‑U.S. stocks rose to +87%. International diversification only worked on the upside.

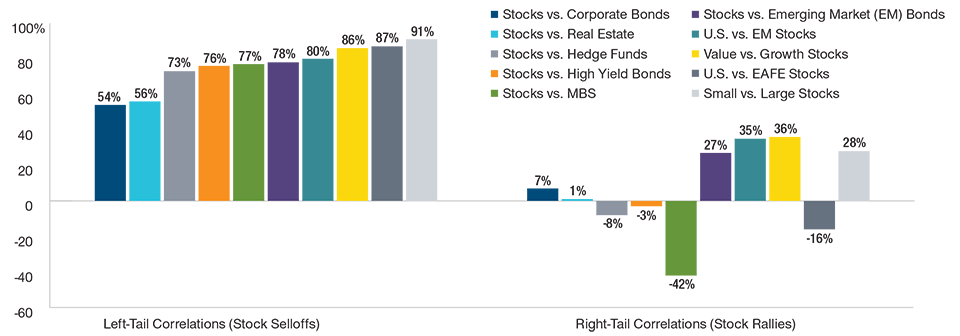

We found similar results across other risky assets. Figure 1 provides a comparison of left‑tail and right‑tail correlations for key asset classes. Note that we used bond returns net of duration‑matched U.S. Treasuries to isolate credit risk factors. We also show results for equity style and size categories. Diversification failed across styles, sizes, geographies, and alternative assets. Essentially, all the return‑seeking building blocks that asset allocators typically use for portfolio construction were affected.

Beyond traditional asset classes, investors have increasingly looked to alternatives for new or specialized sources of diversification. For Figure 1, we used a broad hedge fund index, but one could argue that hedge fund styles are so different from each other that they should be treated as separate asset classes. Unfortunately, several of the studied styles, including the market‑neutral funds, exhibited significantly higher left‑tail than right‑tail correlations.

As a caveat, conditional correlations represent only one way to measure diversification. Conditional betas, for example, take into account changes in relative volatilities as well as correlations. We chose to study correlations as they measure diversification directly, and have been used widely in prior studies.

Another caveat is that we did not forecast left-tail events; hence, although we know that correlations are likely to increase if markets sell off, we do not necessarily know when this shift will take place. Equity selloffs are, almost by definition, unexpected.

What About Private Assets?

Although many investors have become skeptical of the diversification benefits of hedge funds, the belief in the benefits of direct real estate and private-equity diversification has been persistent. Consultants have used mean-variance optimization in asset allocation or asset/liability studies to make a strong case for increased allocations.

Most investors know, however, that there is more to these statistics than meets the eye. Private assets’ reported returns suffer from the smoothing bias. Rolling annual correlations are less sensitive to the smoothing bias than those calculated on quarterly returns. On a marked‑to‑market basis, then, these asset classes are exposed to many of the same factors that drive stock and bond returns.

Not only is the true equity risk exposure of private assets higher than is implied by their reported returns, on average, but their left‑tail exposures are much higher. Also, academic studies have shown that private assets have exposure to credit risk, which does not truly diversify equity risk in times of market stress. Moreover, liquidity risk contributes to the asymmetry of private asset returns even more than to the asymmetry of hedge fund returns.

(Fig. 1) Left-Tail vs. Right-Tail Correlations for Key Risky Asset Classes

Diversification has failed in down markets across asset classes1

January 1970 Through June 2017

1 Monthly data. Data sources and start dates based on data availability are detailed at end of this research brief. Left tail and right tail correlations are at the 1st and 99th percentiles, but were adjusted by the data-augmentation methodology. Full correlation profiles (adjusted, unadjusted, and normal) are shown in the full paper’s referenced appendix B.

Sources: MSCI, Russell, Bloomberg Index Services Limited, NAREIT, and HFRI (see Additional Disclosures); all data analysis by T. Rowe Price.

Implications for Asset Allocation

We believe that investors should avoid the use of full‑sample correlations in portfolio construction—or, at least, that they stress‑test their correlation assumptions. Scenario analysis, either historical or forward‑looking, should take a bigger role in asset allocation than it does.

In addition, significant emphasis should be put on the stock/bond correlation and consideration of whether it will continue to be negative in the future. Shocks to interest rates or inflation can turn this correlation positive.

Finally, we believe investors should look beyond diversification to manage portfolio risk. Tail‑risk hedging (with equity put options or proxies), risk factors that embed short positions or defensive momentum strategies, and dynamic risk‑based strategies all may provide better left‑tail protection than traditional diversification.

Our study does not argue against diversification across

traditional asset classes, but investors should be aware that traditional

measures of diversification may underestimate exposure to loss in times of

stress. In our view, investors should calibrate their risk tolerance (against

return opportunities) accordingly.

1 Sébastien Page and Robert A. Panariello (2018) When Diversification Fails, Financial Analysts Journal, 74:3, 19-32, DOI: 10.2469/faj.v74.n3.3.

See the paper for full methodology, credited references, and the data-augmentation methodology.

Data Sources

The conditional correlations shown in Figure 1 were based on the following asset classes, indexes, and data series start dates. U.S. Stocks/Large Stocks: MSCI USA Index, January 1970; Developed Markets Stocks: MSCI EAFE Index (Local), January 1970; Emerging Markets Stocks: MSCI Emerging Markets Index (Local), January 1988; Growth Stocks1: Russell 1000 Growth Index, February 1978; Small Stocks: Russell 2000 Index, February 1978; Corporate Bonds: Bloomberg Barclays U.S. Corporate Index, August 1988; Mortgage Backed Securities: Barclays U.S. MBS Index, August 1988; High Yield Bonds: Bloomberg Barclays U.S. High Yield Index, August 1988; Emerging Market Bonds: Bloomberg Barclays Emerging Markets Bond Index, August 1988; Real Estate: NAREIT All Equity Index, January 1972; Hedge Funds: HFRI Global Hedge Funds Index, January 1988.

1Growth Stocks were conditioned against Value Stocks (represented by the Russell 1000 Value Index).

Additional Disclosures

Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). BARCLAYS® is a trademark and service mark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Bloomberg or Bloomberg’s licensors, including Barclays, own all proprietary rights in the Bloomberg Barclays Indices. Neither Bloomberg nor Barclays approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

FTSE is a trade mark of the LSE Group and is used by FTSE International Limited (“FTSE”) under license. “NAREIT” is a trade mark of the Nareit. All rights in the FTSE Nareit All Equity REITs Index (the “Index”) vest in FTSE and Nareit. Neither FTSE, nor the LSE Group, nor Nareit accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the FTSE or Nareit is permitted without FTSE’s express written consent. FTSE, the LSE Group, and Nareit do not promote, sponsor or endorse the content of this communication.

All data and content on the HFR website and in the HFR Database products are for your informational and personal use only. The total return data provided on the HFR website, the HFR Database products, and the reports generated from them are for internal, non-commercial use only. The data is not sufficient, comprehensive enough or approved for use in connection with investment products or instruments. You may not copy, redistribute, sell, retransmit, or make the data available to a third party, or otherwise use it for any commercial or public purpose unless you have a separate written agreement with HFR. You require a written license from HFR to use the HFR data, HFR marks and names and/or HFR Index names, including but not limited to use in connection with investment products and instruments (regardless of whether such products or instruments are based on, linked to or track an HFR Index), the name of investment products and instruments, in prospectuses, marketing and other materials publicly or commercially disseminated, benchmarking purposes, and any SEC, government or regulatory filings. Please contact HFR for additional information at: INDICES@HFR.COM

MSCI and its affiliates and third party sources and providers (collectively, “MSCI”) makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. Historical MSCI data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2019. FTSE Russell is a trading name of certain of the LSE Group companies. Russell® is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

Important Information

This material is being furnished for general informational purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, and prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

201908-940506