Georgia Leading the Way on Governance

Executive Summary

- Robust fundamentals are supportive for Georgia’s dollar‑sovereign debt.

- Technical factors are positive as it is unlikely that the Georgian government will issue any more external bonds in 2019.

- Georgia has a strong track record of prudent macroeconomic policies, structural reforms, and an improving business environment.

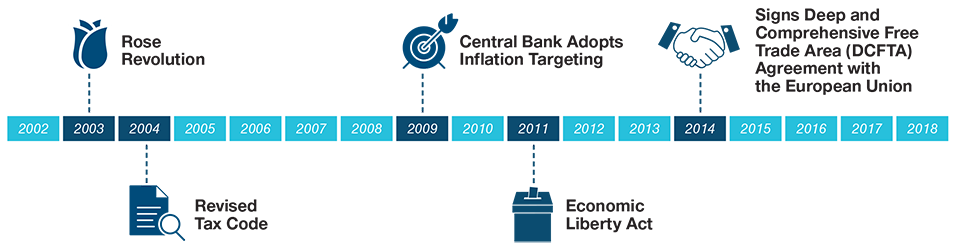

Georgia has shown one of the biggest improvements in governance over the past two decades. The 2003 Rose Revolution, which saw the peaceful, pro‑Western change of power in Georgia, was the catalyst for the start of a heavy reform agenda in the country that continues to this day. At T. Rowe Price, our analysts have been monitoring Georgia’s progress and have carried out several on‑the‑ground research trips to see firsthand how wide‑reaching reforms have helped to improve the country’s governance and business environment.

Timeline of Key Events in Georgia

As of November 30, 2019

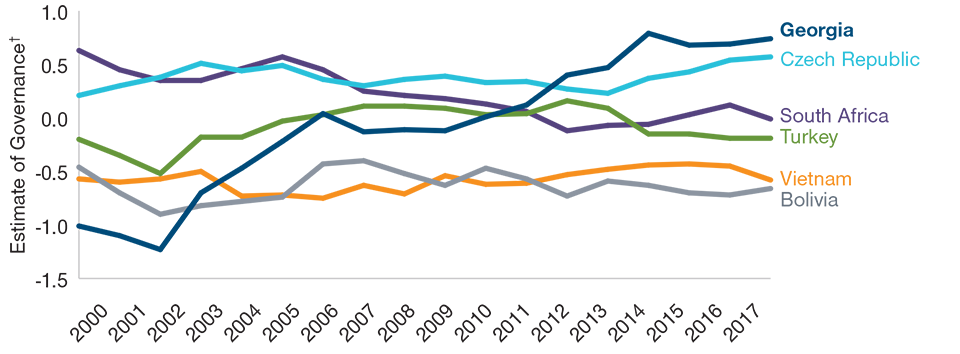

In the case of Georgia, significant progress has been made in terms of controlling corruption and improving the business environment.

In the case of Georgia, significant progress has been made in terms of controlling corruption and improving the business environment.

(Fig. 1) Georgia Overtakes EM Peers in Control of Corruption

Control of corruption*—Georgia vs. emerging markets peers, 2000 to 2017

As of December 31, 2017

Source: World Bank. Analysis by T. Rowe Price.

* World Bank: Reflects perceptions of the extent to which public power is exercised for private gain, including both petty and grand forms of corruption, as well as “capture” of the state by elites and private interests.

† A World Bank Indicator that ranges from 2.5 for strong governance performance to -2.5 for weak governance performance.

Fighting Corruption and Simplifying the Tax System

Following the Rose Revolution, one of the first areas the government tackled was corruption. The authorities took a zero‑tolerance approach, and to show their intent, a number of high‑level officials suspected of corruption were dismissed. This anti‑corruption fight came at a similar time to the government’s overhaul of the tax system. Loopholes were closed, and a new, simple code was introduced, which significantly reduced the number of taxes from 21 in 2004 to just seven the following year.1 The government also introduced an electronic tax‑filing system, which not only made it easier to pay taxes, but also helped reduce corruption opportunities. As a result of these changes, Georgia’s fiscal situation improved. For example, tax revenues—which are an important source of finance for government services—more than doubled, rising from 12% of gross domestic product (GDP) in 2003 to 25% in 2008.1

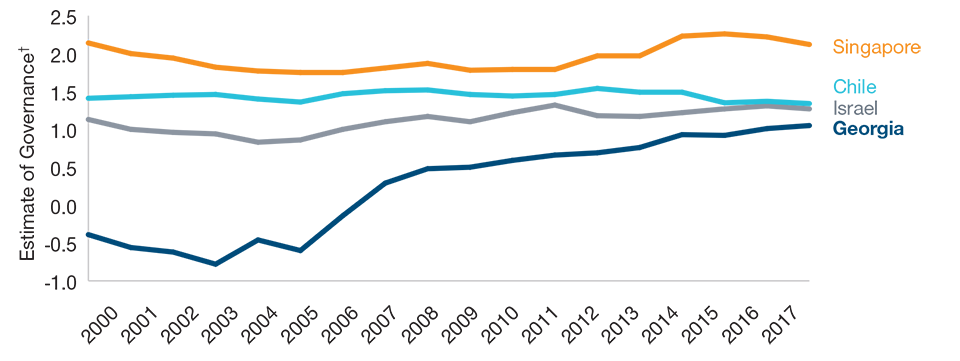

More than 15 years since these first reforms, Georgia continues to make progress in governance, ethical, and social standards. In the 2017 Worldwide Governance Indicators (WGI) from the World Bank published last year, Georgia achieved its highest ever percentile ranking for controlling corruption, beating most of its emerging markets peers and narrowing the gap with developed countries. In other key governance areas that the World Bank assesses, such as regulatory quality and government effectiveness, Georgia has made similar advancements in recent years, a testament to how successful its reforms have been.

Rules‑Based Fiscal Framework

Another key milestone in Georgia’s reform story is the Economic Liberty Act of 2011. This established a rules‑based fiscal framework with three main elements: a ceiling on state debt, a ceiling on the consolidated budget deficit, and a ceiling on general government expenditures. While this framework reduced fiscal flexibility, it provided a strong anti‑cyclical and institutional anchor to government budgets, and the result has been sustained low fiscal deficits and a stable government debt‑to‑GDP ratio.

Risks Roughly Balanced Ahead

Governance is one of the key areas that we assess when conducting our research. In the case of Georgia, significant progress has been made in terms of controlling corruption and improving the business environment. This, together with Georgia’s strong record of prudent monetary policy based on an inflation targeting regime, is supportive for fundamentals.

Technical factors are also positive as it is unlikely that the Georgian government will issue any more external bonds this year. It is also important to remember that risks , which we are monitoring, are still prevalent. Georgia is a small, open economy that is highly dollarized and vulnerable to external shocks. Geopolitics is also a risk given the unresolved conflict with Russia over two occupied regions.

(Fig. 2) Georgia Narrows Gap With Developed Markets in Terms of Regulatory Quality

Regulatory quality*—Georgia versus small, open developed market economies, 2000 to 2017

As of December 31, 2017

Source: World Bank. Analysis by T. Rowe Price.

* World Bank: Reflects perceptions of the ability of the government to formulate and implement sound policies and regulations that permit and promote private sector development.

† A World Bank Indicator that ranges from 2.5 for strong governance performance to -2.5 for weak governance performance.

Georgia at a Glance

Peter Botoucharov, sovereign analyst, explains how Georgia is leading emerging markets peers on governance quality.

- Gained independence from the Soviet Union in 1991.

- Situated in the intersection between Europe and Asia.

- Population of over

- 3.5 million people.1

- Rated Ba2, the same as Croatia and Brazil, by Moody’s Investors Service Inc.2

- Issued its first Eurobond in 2008.

Investment Case

- Robust fundamentals, with growth3 and inflation4 in Georgia averaging around 4%5 and 3%5 respectively since 2012.

- Technical factors are positive as it is unlikely that the Georgian government will issue any more external bonds this year.

- Strong track record of prudent macroeconomic policies, structural reforms, and improving business environment.

ESG in Depth

- Georgia has been a leader in improving governance, ethical and social standards, e.g. rule of law and business environment.

- Ranked seventh out of 190 countries in the World Bank’s ease of doing business index.6

- Georgia has made significant advancements in fighting corruption.

Georgia has made significant progress in implementing a wide-range of structural reforms and it’s now a leader amongst emerging markets in improving the rule of law and business environment.

Georgia has made significant progress in implementing a wide-range of structural reforms and it’s now a leader amongst emerging markets in improving the rule of law and business environment.

1Source: geostat.ge/en as of November 30, 2019.

2Source: Government bond credit ratings by Moody’s rating agency, as of November 30, 2019.

3GDP real growth rate (%).

4Annual core inflation rate %.

5Source: geostat.ge/en. Analysis by T. Rowe Price as of November 30, 2019.

6Source: The World Bank Group as of October 24, 2019.

What we're watching next

Going forward, it is important that we see the trend of positive reforms continue in Georgia, particularly in areas such as pensions and education.

IMPORTANT INFORMATION

This material is being furnished for general informational purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, and prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

201912-997898