May 2023 / INVESTMENT INSIGHTS

Perspectives on Securitized Credit

First Quarter 2023

Key Insights

- Securitized markets experienced turbulence in March amid banking system stress but generally rebounded in the first quarter, aided by supportive technicals.

- In our diverse markets, we see opportunities for both defensive investors seeking reliable income and more risk‑tolerant investors seeking larger gains.

- Despite risks in the commercial real estate market, we believe uncertainty should lead to opportunities for prudent investors.

Despite turbulence in March as banking system stress sapped recovering investor confidence, securitized credit sectors generally recorded gains in the first quarter of 2023. Most of those gains occurred in January, extending a rally that began in late 2022, on hopes that the Federal Reserve would soon finish tightening policy without triggering a recession. Credit spreads1 steadily tightened in January and February before spiking in March as a series of bank failures disrupted the “soft landing” narrative that had boosted investor sentiment. However, risk premiums steadied and generally rolled lower into April as sentiment improved after the Federal Reserve and other bank regulators took steps to provide the financial system with emergency liquidity and contain contagion.

The four major sectors—asset‑backed securities (ABS), collateralized loan obligations (CLOs), commercial mortgage‑backed securities (CMBS), and non‑agency residential mortgage‑backed securities (RMBS)—produced positive total returns in the first quarter on the back of declining Treasury yields. Excess returns over similar‑duration2 Treasuries were mixed as credit spread widening in March wiped out tightening‑driven gains experienced in January and February to varying degrees. The commercial mortgage sector was a notable standout—selling off to a greater extent and recovering to a lesser degree than peers—as the commercial real estate market, particularly the office subsector, became an increasing focus of investors’ concerns.

Conviction Shifted Amid Market Turbulence

After entering 2023 with a cautiously optimistic outlook, our securitized credit sector team turned more cautious on their asset class in early March on the heels of the strong recovery in credit spreads. They broadly lowered their conviction level, suggesting that our platform’s diversified fixed income mandates moderate exposure to the asset class.

In addition to less competitive relative valuations, the team highlighted the increased risk that interest rates could remain higher for longer given an exceptionally resilient labor market and slow progress on extinguishing high inflation. The team was concerned that if rates persisted at high levels, it could eventually become a true fundamental problem, with issuers facing uneconomical short‑term funding costs and potentially unable to refinance or extend maturing loans at affordable terms. Those risks would be exacerbated if a recession hits—a downside scenario that seemed increasingly likely as banks tightened lending standards and consumers, battered by inflation and declining savings, cut back on spending.

In the wake of the spread widening that transpired in March across sectors, the team upgraded the asset class back to a neutral conviction level at the end of the quarter. Credit spreads for each of the sectors had widened toward the top of the range that they had traversed since 2016, providing a more favorable risk/return profile. More liquid corporate credit sectors had also recovered more rapidly than securitized credit markets.

Along with improved relative value following March’s bank‑related stress, the risks of a higher‑for‑longer rate environment that had prompted the earlier downgrade had moderated. While we believe the Fed will wait as long as possible to cut rates, financial stability concerns should convince policymakers that they have tightened financial conditions sufficiently to return inflation to an acceptable level. The central bank being close to the end of its tightening cycle provided a more supportive macro backdrop for securitized markets, in our view. The reopening of the new issue market has provided more opportunities to invest at attractive spread levels. Light issuance in a more prohibitive rate environment should also be a tailwind that helps offset diminished bank demand, and we do not anticipate the same elevated levels of rate volatility and associated illiquidity that we experienced last year with the Fed closer to finished tightening.

Pockets of Opportunity Amid Risks

While fundamentals generally remain solid outside of commercial real estate (CRE), the direction of travel appears gradually weaker, with the Fed aiming to slow the economy by making credit more expensive. With banking concerns still percolating, the introduction of banking turmoil to an already unsettled environment could accelerate economic and credit deterioration. Securitized sectors, which, thus far, have been hurt mainly by interest rate and liquidity risk rather than true credit risk, would certainly not be immune to this. There are also still risks for more rate‑sensitive parts of CMBS and RMBS if we are wrong in our belief that the Fed is close to a pause. We are particularly cautious on CMBS, where we believe very careful credit underwriting is essential. Yet we see several pockets of opportunity across the asset class:

- For defensive‑minded investors, ABS and senior RMBS and CLOs could be attractive lower‑duration options. Seasoned RMBS that are priced at discounts following the rate surge in 2022 also offer potential near‑term price appreciation upside if we experience a further rate rally. If we do not, prices should return to par slowly but steadily barring any unexpected credit events. In ABS, we have seen opportunities in new issue and secondary market auto and equipment bonds. In RMBS, the higher‑quality M1 tranches of the credit risk transfer (CRT)3 market and seasoned single‑family rental (SFR) bonds continued to look attractive in our view, offering attractive spreads for relatively short duration profiles.

- For the more risk tolerant, opportunities are less evident in higher‑beta credit segments. But pricing in the subordinate parts of the RMBS and CMBS markets appears cheap and, in some cases, dislocated from fundamentals. For example, we see value in select lower‑rated CMBS and in certain high‑coupon, lower‑rated nonqualified residential mortgage bonds (non‑QM bonds). However, we anticipate ongoing volatility in CMBS as the commercial real estate correction and its market fallout take time to play out. We also believe that investors should be very careful where they take risk in CMBS, focusing more on the quality of property collateral rather than relying on the rating agencies’ credit ratings.4 This is a market in which we believe strong fundamental credit research and good security selection can pay dividends.

Higher Rates Have Discouraged Issuance, Providing Technical Support

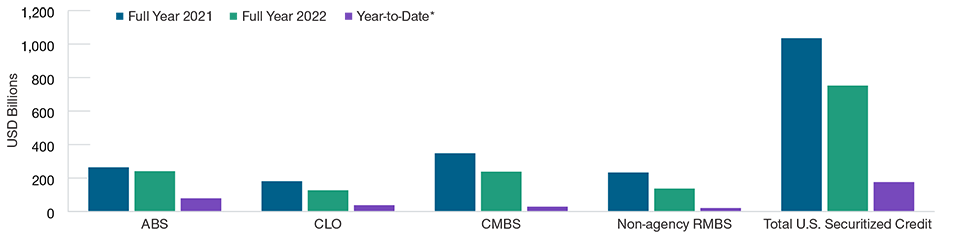

(Fig. 1) Gross Issuance Down Across Major Sectors

*Through April 28, 2023.

Source: JP Morgan, see Additional Disclosures.

While looking to add in these areas, we took advantage of improved liquidity to trim or eliminate marginal credits with less compelling risk/return profiles. We generally moved up in credit quality to more strongly fortified senior tranches that we are more confident can ride out a potential recession without experiencing credit losses.

Positive Returns Away From Lower‑Quality CMBS

Looking back at the first quarter, non‑agency RMBS were a large beneficiary of the decline in Treasury rates and rate volatility. While the diverse market is difficult to benchmark, a proxy index returned 3.04% for the quarter and further added to those gains in April.5 CRTs and non‑QM bonds performed particularly well, outpacing prime jumbo mortgages, which had a more difficult February as rates spiked due to hawkish Fed rhetoric before retreating again on bank concerns.

ABS returned 1.86%, roughly keeping pace with similar‑duration Treasuries.6 Higher‑yielding ABS below the top AAA rating level produced stronger returns, outpacing comparable Treasury securities by 49 basis points (bps). CLOs performed similarly, up 1.98% at the broad index level, with lower‑rated tranches faring even better.7 Meanwhile, CMBS returned 1.81% but trailed Treasury counterparts by a margin of 74 bps, reflecting investor caution on the sector.8 That caution was especially evident in the lower tiers of the market as BBB rated CMBS recorded absolute losses of ‑2.76%, equating to excess returns of ‑5.19%.

Issuance Much Lower Than 2022

As we expected, a significant reduction in issuance provided a technical tailwind for securitized markets thus far in 2023 that we expect will continue amid higher borrowing costs. Through the end of April, total gross issuance was on pace to fall well short of 2022 levels when issuers rushed to get ahead of higher rates and brought large volumes of bonds to the market despite extremely high rate volatility—a dynamic that contributed to very poor liquidity conditions last year (Figure 1).

At the end of April, non‑agency RMBS issuance stood at USD 24 billion compared with a total of USD 140 billion for all of 2022.9 Issuance was down from the same period of last year across the various RMBS subsectors. Though down nearly 49% versus the year‑ago period, non‑QM, which saw the heaviest volumes in 2022, continued to lead in 2023, but the supply was better digested.

CMBS also saw a major drop‑off in issuance, totaling just USD 32 billion through April compared with USD 241 billion for all of 2022. Major declines were seen across subsectors, though issuance in the traditional conduit market came in slightly higher than in the single‑asset/single‑borrower (SASB) and commercial real estate CLO markets, where most of the deals are floating rate. However, the CMBS calendar has begun to pick up, which is encouraging from a credit access perspective.

The ABS market saw a smaller decline compared with early 2022, coming in at USD 67 billion. Auto‑related debt—particularly prime and subprime loans—were the most prevalent deals. Esoteric subsectors saw a pickup, which is usually an encouraging sign for sentiment. By contrast, credit card, student loan, equipment, and unsecured consumer debt saw declines.

Finally, the CLO market saw USD 42 billion of issuance, putting it on pace to approach the USD 130 billion total in 2022 but fall short of the record USD 180 billion that was brought to market in 2021. Notably, the vast majority of that total was true new issuance, as there were very minimal refinancings, resets, and reissues of existing deals in a less accommodative spread environment.

Commercial Real Estate Fundamentals Causing Concerns

The CRE market has dominated headlines and has clearly entered an uncertain period. On average, prices are down about 15% from recent peaks across property types, with office valuations down the most (roughly 25%) based on the Green Street Commercial Property Price Index. The lodging sector has been a relative bright spot, down only slightly from the peak, benefiting from continued strong demand from leisure travelers and some recovery in business travel.

In addition to the rapid rise in rates directly hurting property valuations, most commercial real estate is debt‑financed, and financing costs have sharply risen. The universe of floating rate mortgages has increased over the past several years with the growth of the SASB and the CRE CLO market, making higher financing costs felt more quickly and acutely. Loan extensions often require issuers to purchase interest rate caps from lenders. Those caps have become very expensive, leading to concerns that some deals will not be able to be rolled over with a large maturity wall approaching in 2023 to 2024. At the same time that CMBS financing has become more expensive, banks have further retreated from lending following recent bank failures, cutting off other financing options. Like the CMBS market, a large portion of bank CRE loans is also floating rate. Borrowers are facing a quandary about whether it makes sense to maintain ownership of a property with debt costs sometimes exceeding the income generated from the property.

While no areas have been spared from the rate shock, office fundamentals have been a particular concern. The segment accounts for almost a fifth of commercial mortgage borrowing, second only to multifamily buildings. Offices also make up a disproportionally large share of upcoming 2023–2024 debt maturities. Office fundamentals have been stressed by high supply over the past several years; an increase in hybrid and remote work in the wake of the pandemic; businesses looking to downsize to trim real estate costs; and an increased focus on energy efficiency and other amenities, which has made many older office buildings obsolete. All of these factors have put downward pressure on rents.

We believe that the stress in the office market will take time to play out. The correction is still in the early stages due to office leases having longer terms and lease maturities being staggered. Delinquency rates remain relatively low but have ticked up and are expected to materially increase this year. Debt workouts are also complicated and time‑consuming, so we could be dealing with a stressed market for several years, similar to the experience of the global financial crisis (GFC). A distinction from the GFC is a greater proportion of SASB debt that has upcoming maturity extension dates in the next one to two years, with final maturity dates hitting in three to four years. There is also a lot of conduit debt with longer maturities that will not come due for five to seven years. As such, we could see a rolling wave in the delinquency rate as those windows are reached, rather than one large surge, as experienced in drawn‑out fashion in the GFC and very rapidly in the more recent pandemic‑driven crisis.

Despite this challenging backdrop, we believe that CMBS can deliver strong alpha potential if security selection is done carefully and investors are willing to endure near‑term pressures and periodic bouts of spread volatility. Our analyst team is focused on quality and is currently seeing value in:

- AAA and AA rated conduit tranches that offer strong credit enhancement to help counter losses on underlying loans.

- Specific deals backed by very high‑quality CRE assets. In those areas, we rely on our proprietary fundamental research rather than the grades from the major credit rating agencies.

- More seasoned conduit deals that benefited from price appreciation prior to the recent correction and have built up substantial equity. We believe this built‑up equity should better enable them to pay off loans at maturity.

- Lodging SASB bonds, which have continued to perform well. The segment has benefited from strong growth in revenue per available room and seen stronger investor demand, which improves refinancing prospects.

- High‑conviction office names, as we expect performance and demand to diverge materially across the space—a similar dynamic to what occurred for shopping malls in recent years. Essentially, the office market cannot be painted with a broad brush, and we believe that buildings in prime locations offering attractive amenities will persevere, while older buildings in less ideal locations with fewer perks will suffer.

Key Differences Versus the GFC Period

In closing, while there are true fundamental concerns in the CRE market that will likely affect performance negatively for some CMBS, we hold firm in our belief that we are not bound for a repeat of the GFC. The CRE loan market is roughly half the size of the single‑family residential housing market in 2008. We estimate that total CRE loan losses will total approximately 25% of the GFC residential loan losses.10 Unlike the 2008 situation, CRE debt is more concentrated in small and mid‑size banks rather than in systemically important financial institutions that could have larger contagion effects. There is less leverage in the CRE market today compared with housing in 2008, when investors used a variety of derivative instruments to make bets on the market. Finally, and perhaps most importantly, CRE underwriting standards are notably better than prior to the GFC, and we are confident in the due diligence of our analysts, who scrutinize and re‑underwrite every deal before we invest.

Additional Disclosures

“Bloomberg®” and the Bloomberg ABS and Bloomberg US CMBS: ERISA Eligible Index are services marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the index (collectively, “Bloomberg”) and have been licensed for use for certain purposes by T. Rowe Price. Bloomberg is not affiliated with T. Rowe Price, and Bloomberg does not approve, endorse, review, or recommend this product. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to this product.

Information has been obtained from sources believed to be reliable, but J.P. Morgan does not warrant its completeness or accuracy. The index is used with permission. The index may not be copied, used, or distributed without J.P. Morgan’s prior written approval. Copyright © 2023, J.P. Morgan Chase & Co. All rights reserved.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.