March 2023 / MARKETS & ECONOMY

Global Markets Monthly Update

Keep up-to-date on our views on developments in global capital markets.

Key Insights

- Equities recorded generally positive—although widely divergent—returns as banking turmoil in the U.S. and Europe brought lower interest rate and growth expectations.

- The decline in short‑term U.S. Treasury yields was particularly pronounced, but the Treasury yield curve remained inverted in a possible sign of a coming recession.

- February data indicated cooling inflation in the U.S., Japan, China, and most of Europe but a further acceleration in price pressures in the UK.

U.S.

The major indexes generated widely varied returns in March. Turmoil in the banking sector punished smaller‑cap, value‑oriented shares, particularly regional bank stocks, while providing a tailwind to large‑cap growth stocks via lower Treasury yields. The Russell 1000 Growth Index outpaced the small‑cap Russell 2000 Value Index by 1,401 basis points (bps), or 14.01 percentage points, on a total return (including dividends) basis; technology stocks in the S&P 500 Index outpaced financials by 2,048 bps.

Bond Yields Plummet, but Riskier Segments Lag

A “flight to safety” and the resulting sharp decrease in U.S. Treasury yields, especially for shorter‑term issues, helped foster gains across fixed income sectors. (Bond prices and yields move in opposite directions.) The yield on the two‑year U.S. Treasury note fell the most, tumbling 75 bps over the month. Growing financial stresses and recession worries weighed on some riskier issues and the corporate high yield bond market in particular. Notably, the Treasury yield curve “deinverted” to some degree over the month. Inverted yield curves have often—but not uniformly—been a signal of a coming recession.

The month began on a down note for markets, as investors worried that an apparent reacceleration in inflation to start the year and a stubbornly strong labor market would cause the Federal Reserve to keep interest rates “higher for longer.” The Commerce Department reported that orders for non‑defense capital goods excluding aircraft, often used as an indicator of business investment, rebounded sharply in February, while a separate gauge of factory activity ticked higher for the first time since May.

Employers added another 311,000 nonfarm jobs in February, well above expectations—although a surprise cooling in wage gains reflected many of the positions coming in relatively low‑paying sectors, such as leisure and hospitality and retail trade. The S&P 500 Index reached its lowest intraday level since early in the year on March 10, soon after Federal Reserve Chair Jerome Powell pointed to the tight labor market as one reason that policymakers were prepared to speed up the pace of tightening and raise rates higher than they had earlier anticipated.

Banking Turmoil Sends Stocks on Divergent Paths at Mid-month

Paradoxically, perhaps, the onset of turmoil in the banking sector seemed to help the broad equity market rally back in the second half of the month. Following a run on its deposits, Silicon Valley Bank (SVB) fell into FDIC receivership on March 10, followed that weekend by New York‑based Signature Bank. Reports of stressed balance sheets at other regional banks fed concerns that the industry—a key source of financing for commercial real estate and other smaller‑size businesses— would result in a severe tightening of credit conditions.

Working with other regulators, the Fed appeared to successfully stem the regional bank outflows, at least for the time being. More importantly for markets, policymakers acknowledged that tightening credit conditions had replaced further rate hikes in doing some of the work in cooling growth and inflation, and the Fed raised rates by another 25 bps at its March 22 meeting, less than the 50 bps many had feared early in the month. Contrary to the professed outlook of Fed officials, futures markets also began pricing in rate cuts by the end of the year.

Some reassuring inflation signals may have also fed the late‑month rally. The Fed’s preferred inflation gauge, the core (excluding food and energy) personal consumption expenditures (PCE) price index for February rose 4.6% on a year‑over‑year basis versus consensus expectations for 4.7%. Personal spending increased less than expected during the month, and the University of Michigan’s gauge of consumers’ inflation expectations over the following 12 months fell to 3.6%, below expectations and its lowest level in nearly two years. Falling gasoline prices appeared partly at work, with domestic oil prices retreating to their lowest level since late 2021.

Europe

While mostly positive in U.S. dollar terms, shares in Europe fell in local terms on fears triggered by strains in the banking industry after the collapse of two U.S. regional lenders and the takeover of Credit Suisse. Major indexes in Germany, France, Italy, Switzerland, and the UK also declined.

Bank Stocks, Debt Markets Roiled by Financial Strains

Banking stocks in the STOXX Europe 600 Index tumbled on concerns about the health of Credit Suisse. Fears of counterparty risk also pressured bank shares. The market steadied after the Swiss National Bank provided the embattled financial giant with a loan of roughly USD 50 billion and on news that UBS Group would take over the group in a government‑brokered deal. However, concerns that other problems may be lurking in the financial system weighed on some banks.

At the start of the month, European government bond yields rose to their highest levels in more than a decade as elevated inflation data raised concerns of aggressive monetary policy tightening by the European Central Bank (ECB). Yields dropped as investors flocked to traditional safe‑haven assets on concerns about the banking system but came off their lows after UBS Group’s acquisition of Credit Suisse was announced. In the UK, yields on 10‑year government debt climbed as investors ramped up expectations of another interest hike in May by the Bank of England (BoE).

ECB Sticks to Half-Point Rate Hike; Inflation to Stay Above Target

The ECB raised its deposit rate by half a percentage point to 3.0% to curb elevated inflation. The central bank reiterated that future decisions would be data dependent but gave no forward guidance. The ECB’s macroeconomic projections put average inflation at 5.3% in 2023 and 2.1% in 2025. Meanwhile, the annual rate of consumer price growth slowed to 6.9% in March from 8.5% in February, as energy costs receded.

The ECB also said that it is monitoring current market tensions closely and that “the euro area banking sector is resilient, with strong capital and liquidity positions.”

BoE Hikes Interest Rates After Surprise Surge in Inflation

The BoE raised interest rates to 4.25% from 4.00%, the 11th consecutive increase. Financial markets appear to expect rates to increase again in May amid few signs of any letup in inflation, which accelerated to 10.4% on an annual basis in February.

Minutes from the meeting showed that the Financial Policy Committee told policymakers before the vote that the “UK banking system maintains robust capital and strong liquidity positions,” and “that the UK banking system remains resilient.”

Pension Reforms Ignite French Protests

France was rocked by a series of large‑scale and often violent nationwide demonstrations against pension reforms that would raise the retirement age to 64, an increase of two years. President Emmanuel Macron triggered special constitutional powers to enact the changes without a vote in Parliament.

Japan

Japanese stocks generated a positive return in March, with the MSCI Japan Index up 1.76% in local currency terms. Gains were capped by the turmoil in the global banking sector, which weighed on risk appetite despite the limited direct impact on Japan’s financial system. Investors’ concerns eased somewhat as six major central banks, including the Bank of Japan (BoJ), announced coordinated action on March 19 to enhance the provision of liquidity and to ease strains in global funding markets. Some expectations that the U.S. Federal Reserve may moderate its monetary tightening also lent support.

Against this backdrop, the yield on the 10‑year Japanese government bond (JGB) fell to 0.32%, from 0.50% at the end of February, as investors sought out assets perceived as safer. The flight to safety also boosted the yen, which strengthened to around JPY 132.78 against the U.S. dollar, from the prior month’s JPY 136.15.

BoJ Leaves Monetary Policy Unchanged at Kuroda’s Last Meeting

The BoJ made no changes to its monetary policy at the final meeting chaired by outgoing Governor Haruhiko Kuroda, who steps down in April. The central bank kept its key short‑term interest rate at ‑0.1% and reiterated its 0% target for 10‑year JGB yields. It will also continue its large‑scale bond buying in the conduct of yield curve control (YCC), whereby 10‑year JGB yields are allowed to fluctuate in a range of 0.5 percentage point from the target level.

Investors’ focus now turns to the BoJ’s April meeting, which will be the first under incoming Governor Kazuo Ueda. Ueda has hinted at various possibilities for the future of the BoJ’s YCC framework, while emphasizing that the outlook for underlying prices will determine whether it is reviewed in the direction of normalization. There is some speculation that the BoJ could widen further the range in which JGB yields are allowed to fluctuate or abandon the framework altogether.

Japan’s Inflation Remains High, but Price Pressures Ease

On the economic data front, the rate of consumer inflation slowed in Japan, with the core consumer price index rising 3.1% year on year in February, down from January’s 4.2%, an over four‑decade high. The contribution from energy fell notably due to government electricity subsidies to cushion the impact of price pressures. Amid calls for further stimulus, a government panel endorsed plans to add more than JPY 2 trillion to existing inflation relief measures, which will go toward responding to the rise in energy prices as well as support to low‑income households.

Large Companies Agree on Biggest Wage Increases in Decades

Japan’s annual “shunto” spring wage negotiations, held between businesses, major industrial unions, and government leaders, wrapped up during the month. Many large Japanese companies, including some leading equipment manufacturers and automakers, agreed to the biggest wage increases in decades—according to initial data, the base‑pay rise was strong at 2.3%, ahead of economists’ consensus expectations of around 1.5%.

Prime Minister Fumio Kishida has repeatedly called for businesses to raise wages to compensate for the impact on households of rising living costs and to support the government’s “New Capitalism” agenda, which aims to ensure a fairer distribution of income and stronger growth.

China

Chinese stocks rallied in hopes that Beijing would maintain its accommodative stance to offset global banking turmoil. The MSCI China Index advanced 4.5% while the China A Onshore Index increased 0.08%, both in U.S. dollar terms.

Beijing set an economic growth target of around 5% this year at the National People’s Congress, China’s parliament, which took place in early March. The target was seen as conservative but still higher than last year’s 3% expansion, one of China’s lowest annual growth rates in decades. Later in the month, Premier Li Qiang, the country’s second‑ranking official, reinforced China’s commitment to open its economy and deliver reforms that would stimulate consumption and international business. Speaking at the Boao Forum for Asia, Li pledged that China’s recovery would deliver momentum to the world economy despite challenges in the geopolitical environment.

China’s parliament approved a plan for a sweeping reform of central government institutions under the State Council, the country’s cabinet. Reforms included establishing an enlarged financial regulatory body and a national data bureau and restructuring the country’s science and technology ministry. The changes marked the biggest bureaucratic restructuring in years and come as China seeks to accelerate the development of critical technologies, such as advanced semiconductors, to reduce its reliance on foreign technology.

In monetary policy news, the People’s Bank of China left its benchmark one‑year and five‑year loan prime rates unchanged for the seventh consecutive month. Analysts expected the move after the central bank left its medium‑term lending facility unchanged earlier in March and unexpectedly announced a 25 bps cut in the reserve requirement ratio for most banks.

China’s consumer price index rose 1% in February from a year earlier, trailing forecasts, down from a 2.1% rise the previous month. Producer prices also fell more than expected due to lower commodity costs. On the trade front, Chinese exports and imports extended declines in the first two months of the year as the global economic slowdown hit trade activity. The official manufacturing purchasing managers’ index (PMI) rose to a better‑than‑expected 51.9 in March, while the nonmanufacturing PMI increased to 58.2, the highest reading since May 2011. The latest data affirmed a muted recovery in China and raised expectations that policymakers would maintain supportive policies. In corporate developments, Chinese e‑commerce giant Alibaba Group proposed to break itself up into six business units that can independently raise capital and seek initial public offerings. Many analysts believe that the company’s overhaul may appease regulators and could mark the end of China’s yearslong crackdown on private enterprise.

Other Key Markets

Chilean Equities Lag Broad Emerging Markets

Chilean stocks, as measured by MSCI, returned ‑0.08% versus 3.07% for the MSCI Emerging Markets Index.

According to T. Rowe Price emerging markets sovereign analyst Aaron Gifford, who recently returned from a research trip to Chile and Peru, the rejection of the new constitution last September and the failure of tax reform to pass through Congress have significantly weakened the government of President Gabriel Boric. Gifford believes that their failure is symptomatic of the public’s shifting priorities and Boric’s low popularity in light of softening economic growth, high inflation, and rising public insecurity.

A second attempt to write and adopt a new constitution is now underway; the process will conclude with a nationwide mandatory plebiscite on December 17. New efforts to implement tax and pension reforms are also likely, but their timeline is likely to be stretched out, and Gifford expects that any reforms will be watered down. While both Boric and Finance Minister Mario Marcel intend to prioritize fiscal responsibility, the government desperately needs new revenue sources to fund social expenditures promised to the populace in the last few years.

Perhaps the most urgent near‑term issue for the Boric government to address is the crisis in the health system, where private insurers are financially strapped due in part to a Constitutional Court ruling mandating them to compensate individuals for past overcharges that in aggregate could exceed USD 1 billion.

Peru Outperforms as Political and Social Crisis Subsides

Peruvian stocks, as measured by MSCI, returned 4.13%, outperforming the MSCI Emerging Markets Index.

According to Gifford, the country’s political and social crisis—which culminated in ex‑President Pedro Castillo’s attempted self‑coup and subsequent impeachment in December— has meaningfully subsided. Protests are now few in number, and Castillo’s replacement, former Vice President Dina Boluarte, has been able to hold on to her seat given the lack of consensus within Congress to bring forward elections. The impasse is due to a stalemate between the president, who has the power to dissolve Congress following two no‑confidence votes in his or her Cabinet, and Congress, which has the power to impeach the president. Both are weak and want to keep their seats. Given the public’s demand for change, however, early elections are likely to take place in 2024, rather than 2026.

Gifford believes that the impact on the Peruvian economy of recent social and political turmoil is negative but manageable. The destruction of property and infrastructure, blockages of highways, and disruptions of tourism and mining have taken a toll on gross domestic product growth, with economic activity shrinking 1.1% year over year in January. However, the recent reopening of key roads and tourist destinations as well as the government’s ability to minimize disruptions to mining activity suggest that the impact will be temporary. Also, the government has been accelerating public works projects in order to stimulate economic activity.

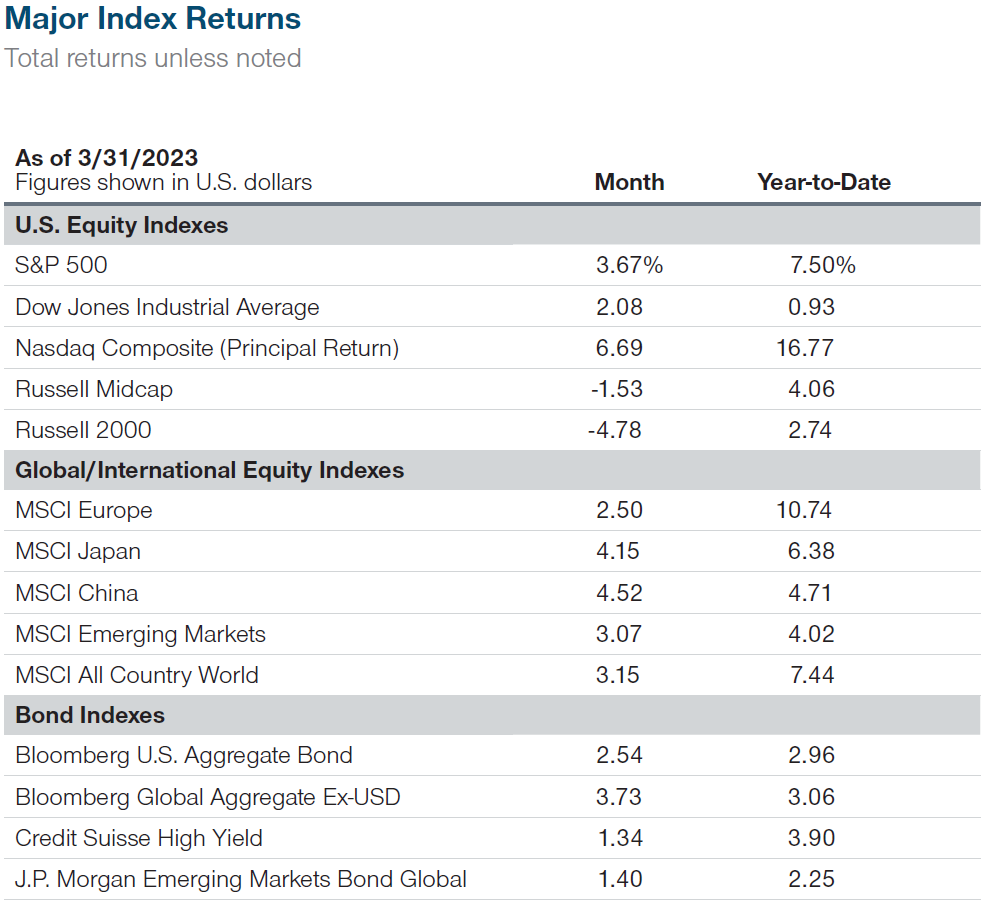

Major Index Returns

Total returns unless noted

Past performance is not a reliable indicator of future performance.

Note: Returns are for the periods ended March 31, 2023. The returns include dividends and interest income based on data supplied by third‑party provider

RIMES and compiled by T. Rowe Price, except for the Nasdaq Composite Index, whose return is principal only.

Sources: Standard & Poor’s, LSE Group, Bloomberg Index Services Limited, MSCI, Credit Suisse, Dow Jones, and J.P. Morgan (see Additional Disclosures).

Additional Disclosure

The S&P 500 Index is a product of S&P Dow Jones Indices LLC, a division of S&P Global, or its affiliates (“SPDJI”) and has been licensed for use by T. Rowe Price. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC, a division of S&P Global (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); T. Rowe Price is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500 Index.

London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2023. FTSE Russell is a trading name of certain of the LSE Group companies. “Russell®” is a trade mark(s) of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not

promote, sponsor or endorse the content of this communication. The LSE Group is not responsible for the formatting or configuration of this material or for any inaccuracy in T. Rowe Price Associates’ presentation thereof.

MSCI and its affiliates and third party sources and providers (collectively, “MSCI”) makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. Historical MSCI data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

“Bloomberg®” and Bloomberg U.S. Aggregate Bond, Bloomberg Global Aggregate Ex‑USD are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the index (collectively, “Bloomberg”) and have been licensed for use for certain purposes by T. Rowe Price. Bloomberg is not affiliated with T. Rowe Price, and Bloomberg does not approve, endorse, review, or recommend its products. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to its products.

© 2023 CREDIT SUISSE GROUP AG and/or its affiliates. All rights reserved.

Information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The index is used with permission. The Index may not be copied, used, or distributed without J.P. Morgan’s prior written approval. Copyright © 2023, J.P. Morgan Chase & Co. All rights reserved.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.