February 2023 / INVESTMENT INSIGHTS

Transitioning to a New Paradigm

Three key investment themes for 2023

- A paradigm shift is underway in the world of investing and the pre-COVID regime of ample liquidity, low inflation, and low interest rates appears to be over

- The transition to the new regime will feature higher inflation, liquidity withdrawal, interest rate normalization, elevated volatility and de-globalization

- We are confident that a flexible, active and dynamic approach to investing can help investors to thrive in the new paradigm

At T. Rowe Price we believe it is likely that a paradigm shift is underway in the world of investing. Fresh investment approaches are going to be required that will cover wider macroeconomic, social and geopolitical factors, along with traditional valuations and company fundamentals. While the market dynamics may be changing, we think the potential for earning alpha or excess returns will remain available for investors who are willing and able to adapt to the new era. As our founder Thomas Rowe Price said, change is the investor's only certainty. The ability to recognize changing trends and patterns or a paradigm shift is one of the key reasons for choosing an active fund manager who is able to adapt, respond, and execute portfolio decisions according to the changing world around us.

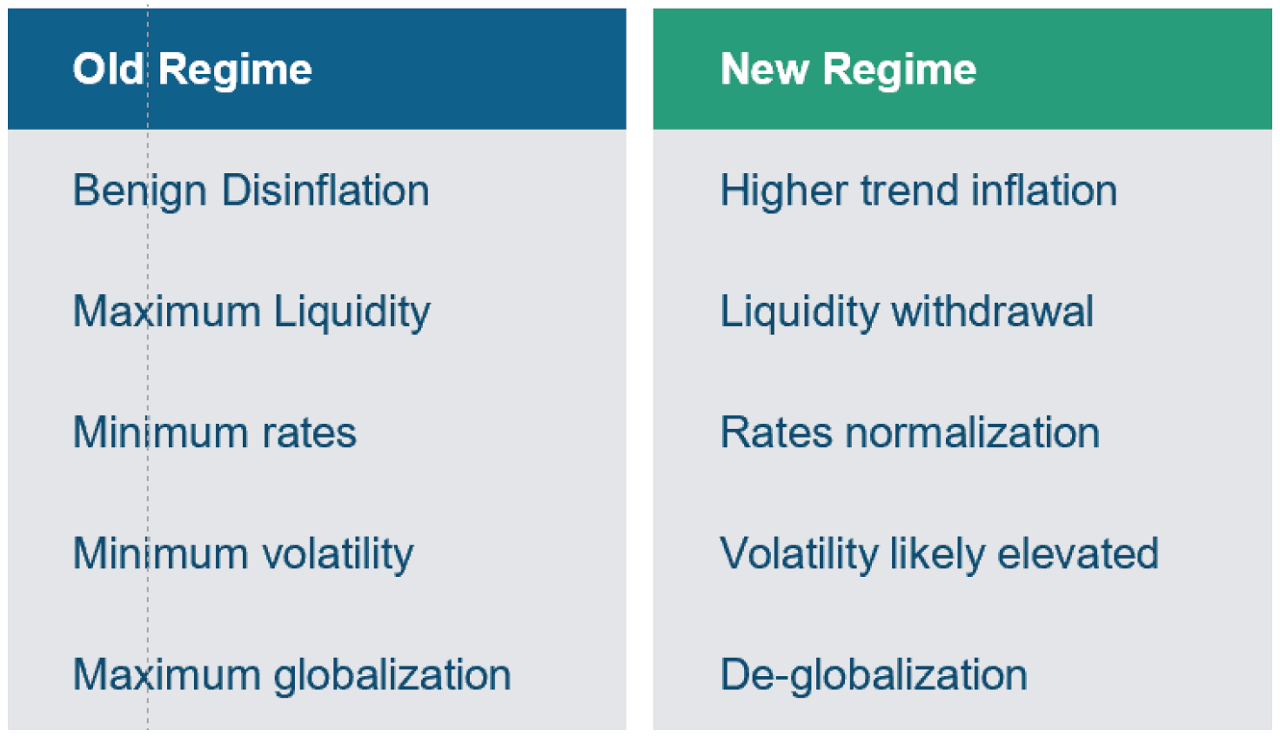

FIGURE 1: A Paradigm Shift in Investing is Underway

Key pillars of the new and old regimes

Source: T. Rowe Price

Defining the Paradigm Shift

So, how are we seeing this sea-change in the investment environment? The five key pillars of the paradigm shift are shown in the table in Figure 1 on a before and after basis, or "Old Regime, New Regime." Our interpretation is that we are currently moving (1) from a world of benign disinflation to one of higher trend inflation, (2) from many years where we've enjoyed maximum liquidity to one where liquidity is being rapidly withdrawn, and (3) most importantly, from an era of ultra-low rates to one of higher rates, and (4) from an era of suppressed volatility to an era where volatility is expected to be elevated. Finally, many economists and geopolitical analysts see us (5) moving from an era of maximum globalization to a world that is deglobalizing or decoupling. Evidence in support of the first four pillars of the paradigm shift appear in the charts in Figures 2 to 5. The last pillar – deglobalization – is currently more expectation than observable fact. Rather than thinking about globalization as “dying” it is probably more accurate to say that the nature of globalization is changing, as countries and companies respond to events of the past year that highlighted supply-chain and resource dependency.

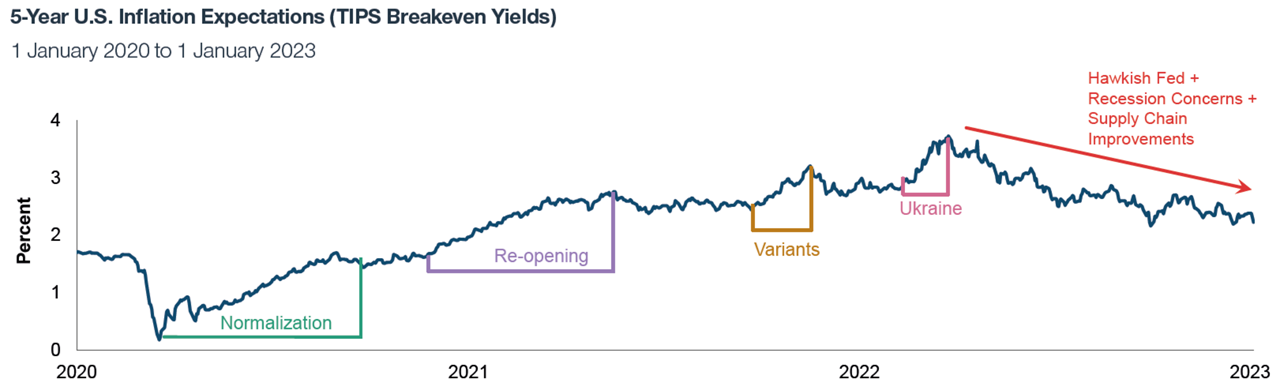

1. Higher Trend Inflation

In Figure 2, U.S. inflation is represented by the 5-year TIPS breakeven, calculated as the difference between the yield on a nominal 5-year U.S. Treasury bond and that on an inflation-protected government bond of similar maturity. Looking back, after the first global wave of COVID struck we had lockdowns accompanied by extraordinary amounts of monetary and fiscal stimulus meant to ward off a global recession. In retrospect, too much easing led to pent- up savings and extraordinary demand for goods that led to supply-side issues such as bottlenecks caused by too much demand as well as COVID-related disruption to world trade.

This combination created goods inflation. Although inflation is starting to trend down, the big issue today is where inflation lands. We accept that inflation has peaked and has started to roll over. But where will inflation stabilize? Investors have learnt that current inflation trends are stickier and less transient than they had been led to believe. Goods price inflation has spilled over to generate services price inflation, which we know from history tends to be particularly sticky.

2. Liquidity Withdrawal

FIGURE 2: Inflation Dynamics Have Shifted Sharply

U.S. inflation since COVID

Source: Bloomberg Finance L.P. Generic US 5-year breakeven inflation rates.

Analysis by T. Rowe Price.

As of January 1, 2023

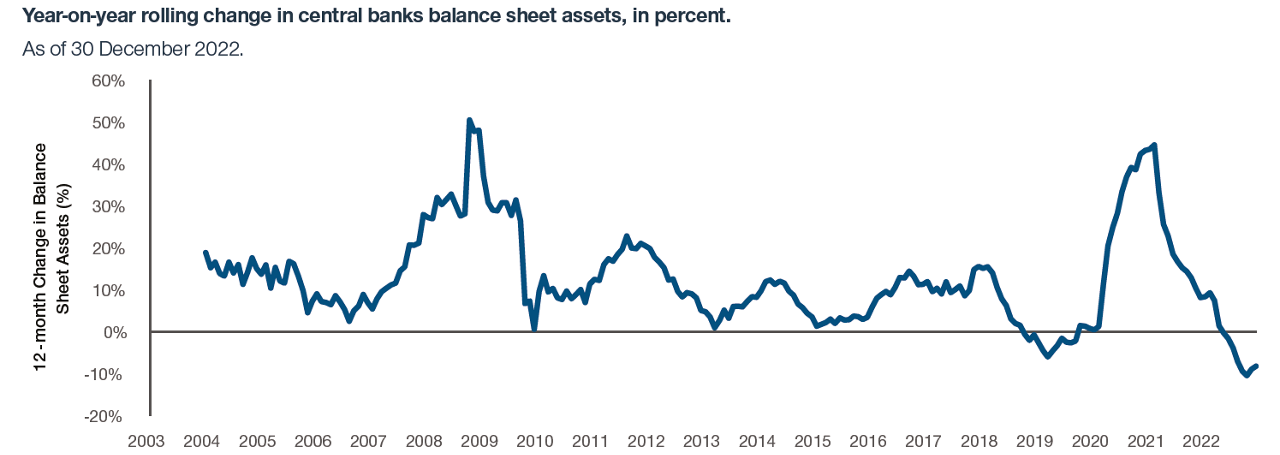

FIGURE 3: Global Liquidity Has Tightened Dramatically

Moving from QE to QT*

Sources: Federal Reserve Bank, European Central Bank, Bank of Japan, People’s Bank of China. Analysis by T. Rowe Price.

* QE = quantitative easing, QT = quantitative tightening

Turning to liquidity, the second pillar of the paradigm shift, Figure 3 shows the annual change in the balance sheets of the world's major central banks in trillions of U.S. dollars. As such, it measures the change in the quantity of money in the global economy upon which all other credit and liquidity must ultimately depend. Figure 3 shows that after unprecedented monetary injection in response to the COVID pandemic, central banks have recently begun to withdraw liquidity, reflected in a negative 12-month change in the size of their balance sheets.

Essentially, we are moving from QE, or quantitative easing, to QT, or quantitative tightening. What do we mean by QT? QT is simply the withdrawal of liquidity as central banks sell government securities into the market, reducing the holdings on their balance sheet. Following the enormous amount of QE in 2020, there is great uncertainty among economists and policymakers as the what the impact of Q2 is going to be on financial markets, asset prices and economies.

QE largely did what it was designed to do. It dampened volatility and reduced term premia and long-term interest rates. QT is supposed to create the opposite effect, but it may not be symmetrical. Whereas QE effects are front-end loaded, when it comes to quantitative tightening, we think they may be back-end loaded. Either way, investors can expect more volatility going forward as QT progressively tightens its grip.

3. Rates Normalization

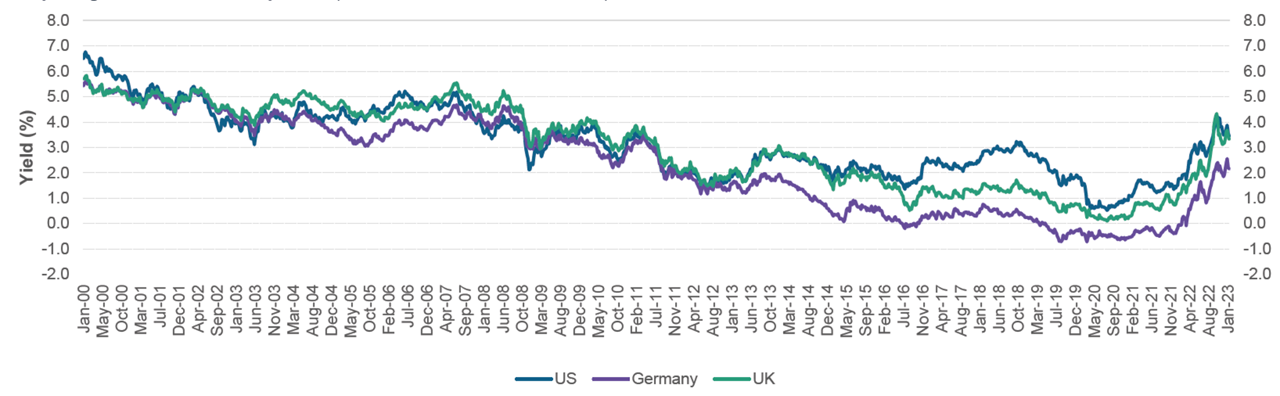

FIGURE 4: Rates are Normalizing Globally

10-year government bond yields (7 Jan 2000 to 13 Jan 2023)

Past performance is not a reliable indicator of future performance.

Source: Bloomberg Finance LP. Analysis by T. Rowe Price.

As of 13 January, 2023

The path of global interest rates will depend closely on that of inflation and the degree of success that central banks achieve in bringing inflation close to target levels, while managing the process in such a way that a deep recession is avoided. Prior to the post-pandemic inflation surge, bond yields were at 50-year lows while short-term rates in many countries were close to the zero lower bound, or even negative in some cases. That era is over and in the U.S. the Federal Reserve is overseeing one of the most aggressive rate hike cycles on record, giving other countries little choice but to follow suit with their own rate hikes. We have also been reminded how financial assets globally are very sensitive to an increase in the U.S. cost of capital.

There is still considerable uncertainty as to how high the terminal rate will be and how long peak rates will be sustained. While the markets and pundits try continuously to anticipate a Fed 'pivot' towards less hawkish policy, Powell himself continues to reiterate that the ultimate destination for rates will depend on how the overly-tight labour market and stubbornly persistent inflation evolves. With the CPI in the U.S. dropping from 8.2% in September 2022 to 6.5% in December, it would appear that the Fed’s efforts are bearing fruit, but a cautious investor might still believe that the Fed may continue to try to cool down the economy and bring demand and supply into balance.

4. Volatility May Stay Elevated

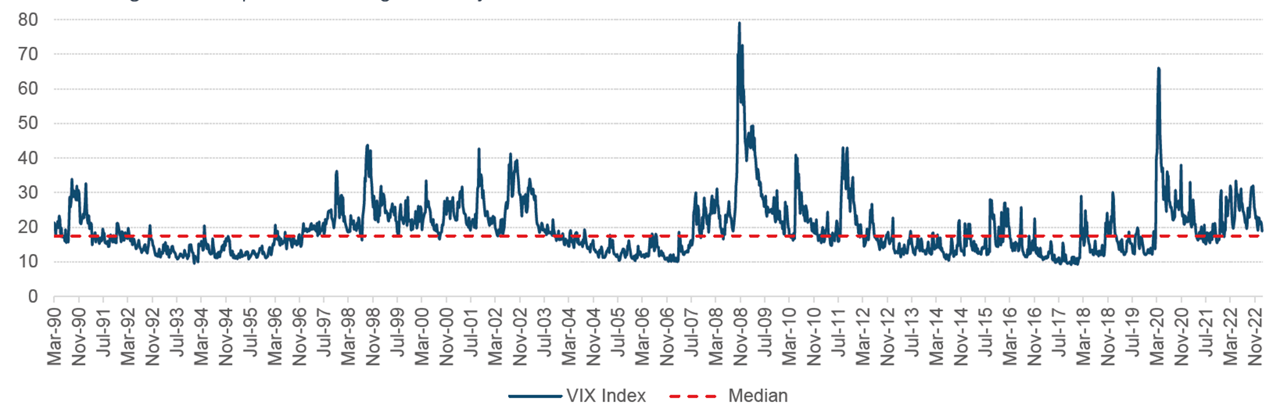

The fourth pillar of the paradigm shift is volatility, represented in Figure 5 by the Chicago Board Options Exchange Volatility Index or VIX, often referred to as the market's "Fear" gauge. VIX measures the market's expected volatility in S&P 500 Index options over the next 30 days. It tends to fall on days when the stock market rallies and soars to high levels whenever stocks plunge. But the key is to look at the VIX over time. It tends to be lower in bull markets and much higher when the bears are out in force. Figure 5 shows that since the pandemic we have clearly entered a period of higher volatility compared to 2012 to 2019, although the level is not unprecedented.

So we are living in a period of elevated volatility which may persist for a while longer. If we think about how bear markets progress, they usually come in three stages. First, there is valuation compression. We have largely been through that process, as taking U.S. equities as an example, there was a 25% multiple compression last year, from roughly 21x forward earnings at the peak to around 16-x forward earnings at the October low. The second phase is one where earnings reset. Q3 company results suggest we have just entered the second phase in the U.S. S&P 500 net profit margins contracted year- on-year for the first time since the pandemic while 2023 EPS growth forecasts are being cut.

The third phase of the bear market is typically capitulation. We may have witnessed capitulation in Hong Kong and Chinese equities in Q4 2022 in response to the CCP 20th Congress, though we have yet to see it in U.S. where retail investors have yet to throw in the towel. If that happens, we may well experience a 'super spike' in VIX along the lines of what we saw in 2008 and during the early onset of COVID in 2020.

5. Deglobalization

FIGURE 5: Volatility in 2022 Was Elevated Though Not Unprecedented

VIX or Chicago Board Options Exchange Volatility Index

Source: Bloomberg LP. VIX Index refers to the Chicago Board Options Exchange Volatility Index

As of 13 January, 2023.

The final 5th pillar of the paradigm shift is that globalization as a major force shaping the global economy may be waning. Some think globalization peaked in 2017 with the onset of Donald Trump's tariff wars against China. Deglobalization is a growing theme based on the economic fallout and supply chain disruptions from the pandemic, ongoing lockdowns in China due to the strict zero- COVID policy, sanctions against Russia after the war in Ukraine, and persistent US-China geopolitical tensions. Many commentators, not just the usual sceptics, proclaim the end of globalization as we know it.

Partially offsetting this potential negative, supply chain shifts can also open up new local and regional opportunities for investors. A full and swift global de-coupling of economies is unlikely, in our view. We believe China will still play a major role in global supply chains in both the near and the medium-term. Nevertheless, even a limited form of deglobalization could bring many near term challenges. For investors, the key to navigating the fifth pillar of the paradigm shift will be to focus on fundamentals, bottom-up research, and to be very selective.

Conclusion: Lessons for Investors

The old pre-COVID regime of ample liquidity, low inflation, and low interest rates appears to be over. A new regime, a paradigm shift for investors, is currently playing out. We have already seen in 2022 how its fundamental forces are already shaping financial markets. inflation is generally seen as the key transmission mechanism that underpins nearly all the other investment risks that we are facing. Markets have spent most of the year grappling with the worsening trade-off policymakers face between inflation and growth. Beyond the near-term struggles, we are likely going to have to learn to live with a structurally higher inflation rate going forward.

Inflation, whether structural or transitory, is arguably the biggest challenge facing investors today. It has turned out to be broader and more persistent than many expected, and central banks in many developed and emerging markets are now having to walk a tight rope. Importantly for investors, we’re transitioning to a different type of market regime of higher inflation, higher rates and higher volatility, and as we’ve seen in cycles from history, such periods tend to last a long time.

This means that the playbook for investors in this new regime will also have to change. Bond investors will need to think differently and adopt a broader, more flexible approach that emphasizes active duration management and volatility management. In countries where higher trend inflation is less of a concern, like China, changes to the investment landscape are also happening at a rapid pace. We need to look beyond today's benchmark heavyweights to identify the benchmark additions and winners of tomorrow.

An uncertain and more volatile path in the months and years ahead will be challenging for investors. But with it will also come opportunities for active, long-term investors like ourselves. We are confident that a flexible, active and dynamic approach to investing can help to make portfolios more resilient in challenging markets, and that those who look forward when seeking out investments will be able to thrive in the new paradigm.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

February 2023 / INVESTMENT INSIGHTS

February 2023 / INVESTMENT INSIGHTS