February 2023 / INVESTMENT INSIGHTS

The Need to Act and Think Differently

Fixed income portfolio construction amid changing dynamics

- Monetary policy has gone from a pre-pandemic world of QE to a postpandemic world QT, giving rise to higher levels of volatility than during the QE era

- Central banks have signaled they may raise rates more slowly in 2023. But they could still keep going for longer than markets currently anticipate

- Central banks believe they can deliver a soft landing in 2023, but the odds in favor are not great. Bond managers may soon have a good opportunity to extend duration

A growing consensus has emerged between portfolio managers and their clients that for investors, the world fundamentally changed following the COVID-19 pandemic. In a real sense, things are very different for asset managers in 2023 than they were during the pre- COVID era in 2019.

As a result, portfolio managers need to think differently and act differently today, adapting their investment strategies to the changed circumstances. For the investment manager, doing nothing has become a dangerous option. We saw this clearly in the negative returns posted by the majority of global fixed income markets in 2022.

Let's start by listing some of the important changes that have taken place since 2019. Among a list of important global macro factors one should mention deglobalization, trade wars and other forms of protectionism, climate change, geopolitical tensions, the war in the Ukraine, and workers seeking a new social contract in response to growing wealth and income inequality.

For the fixed income manager, if you had to focus on just one thing today, the choice is really not that difficult. In monetary policy terms, we have gone from a pre-pandemic world of quantitative easing, or QE, to a post-pandemic world of quantitative tightening, or QT. In my view, this simple one-factor model can explain much of what you need to know as an asset manager about the changing investment environment.

Global Policy Stimulus Is Over. We Do Not Expect An Early Return

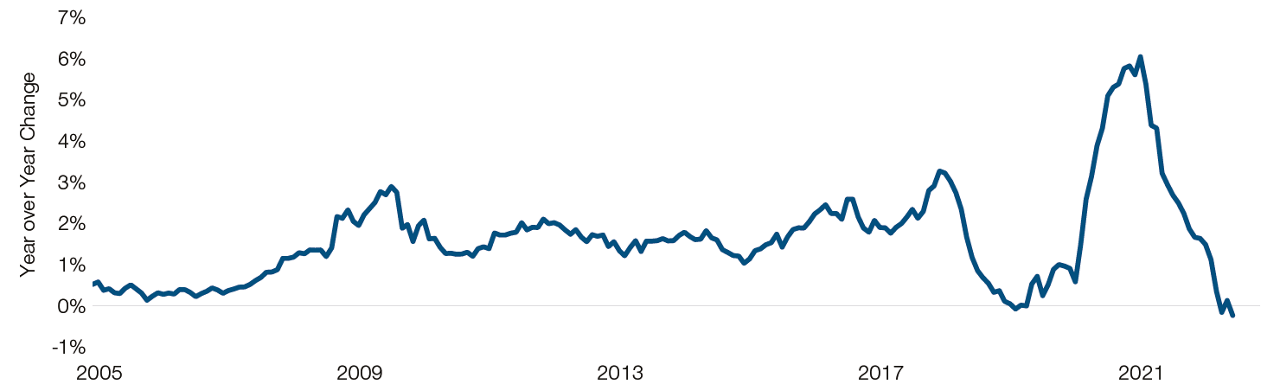

Figure 1 shows a ballpark or rough estimate of the annual change in the total quantity of global policy stimulus, both fiscal and monetary. It is expressed as a percentage of global financial assets. After the massive initial policy response to the COVID pandemic in 2020, the year-on-year growth in policy stimulus on this measure fell sharply and by mid- 2022 was set to turn negative.

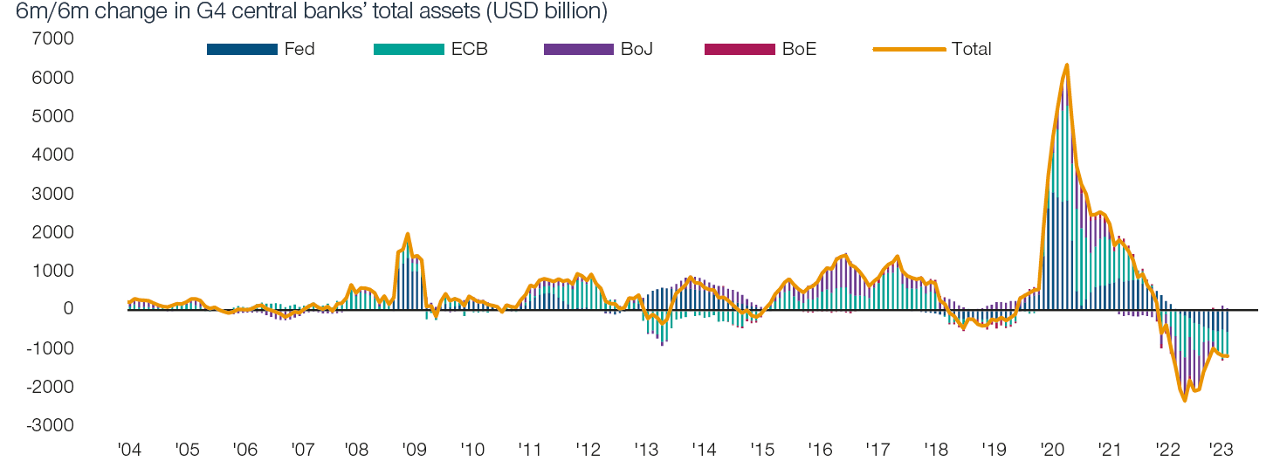

It is the monetary component of Figure 1 - the move from QE to QT – that is our primary focus here. Monetary policy in the form of QE has accounted for some of the sharpest swings in total policy stimulus since the global financial crisis in 2007. A proxy for global QE and QT is given in Figure 2. It shows the six-month changes (in USD billion) in central bank total assets for the G4 developed economies (the U.S., Eurozone, Japan, and the UK).

FIGURE 1: The Dramatic Decrease in Stimulus Continues

Global stimulus as % of global assets

January 2005 to July 2022

Most recent data available, as of December 2022.

Sources: Bloomberg Financial L.P, data analysis by T. Rowe Price.

FIGURE 2: Global QE Switched to Global QT in 2022

6m/6m change in G4 central banks’ total assets (USD billion)

As of January 20, 2023.

Sources: BofA Global Investment Strategy, Datastream, Bloomberg.

Reprinted by permission. Copyright© 2023 Bank of America Corporation (“BAC”). The use of the above in no way implies that BAC or any of its affiliates endorses the views or interpretation or the use of such information or acts as any endorsement of the use of such information. The information is provided "as is" and none of BAC or any of its affiliates warrants the accuracy or completeness of the information.

After the onset of the global financial crisis (GFC) in 2008 an unprecedented flood of liquidity hit financial markets as the world's major central banks engaged in quantitative easing en masse. They threw caution to the winds and simply threw money at what by then had become a very frightening and rapidly deteriorating economic situation.

A question I often like to ask investors is "Which financial assets went up in the decade that followed the GFC?" Ironically, the answer, is that virtually everything went up, whether it was traditional assets like bonds, and equities, or assets that didn't even exist pre-GFC, such as Bitcoin. It seems that the only thing that went down in the financial world after the GFC was volatility itself. This suppression of volatility was no coincidence. There was so much money from newly created central bank liquidity that it was effectively 'crowding in' the different opportunities, narrowing asset spreads and crushing risk premia in the process.

In 2022 Global QE Switched to Global QT

This trend is expected to continue in 2023, though at a slower rate. In this respect, investors hoping for easier liquidity conditions to drive equity markets in 2023 may be disappointed.

Let's consider the timing of unconventional monetary policies. QE is very much front-end loaded. Central banks simply go and purchase large quantities of long-dated government bonds in the open market. This effectively pumps central bank money or liquidity into the global financial system. It happens immediately and in this sense QE policy is very quick or 'up front,' as it directly impacts financial holdings.

QT, in contrast, is back-end loaded. That's just the way the operational mechanics work. Central banks don't actually go out and sell large quantities of long-dated bonds to the private sector. Instead, they prefer to sell short-term Treasury bills and let their bond portfolio mature gently. So QT is the opposite of QE in terms of timing in adding back duration to the market, as it is very much back-end loaded. The negative QT trend might begin to improve by midyear, though when a turning point will arrive is hard to predict.

At least for the first half of 2023, the current QE to QT transition is likely to be ongoing. It may thus continue to pose a problem for financial markets, giving rise to levels of volatility that are higher than investors had become accustomed to during the QE era. Under QT, volatility starts with the central bank and quickly flows through to volatility in rates, yields, credit, and equities. For the active manager, however, volatility is not something to be afraid of since it can often bring good investment opportunities.

Symptoms Versus Underlying Conditions

In analyzing financial markets, it is important to distinguish between what are symptoms and what are underlying problems or conditions. Only then can policymakers and investors decide on an appropriate course of action. Where I think many investors get confused is that they mistakenly view today's inflation as an underlying condition rather than the result of years of loose monetary policy under QE. If you focus only on the symptoms, then as an investor you are likely to end up with less good outcomes.

Investors in 2023 should not simply be asking whether yields have already peaked, though this is a pertinent question. On a more fundamental level, investors should realize that what has changed the most is the transition from QE to QT by the world's major central banks.

Our bottom line is that we think we have probably seen the peak in inflation, but that it is not going to come down as quickly as most people think, including central bankers. In turn, this means inflation expectations – which so far have been remarkably stable in the face of higher inflation – could move higher, posing a problem that most central banks would find difficult to ignore.

Scope For A Policy Error in 2023

We believe there is a risk in 2023 that central banks commit another policy error. Initially, the Fed regarded the rise in inflation in 2021 as largely transitory. As a result, they were not hiking interest rates nearly quickly enough, with the first increase in the Fed funds not taking place until March 2022. In market parlance, the Fed was "behind the curve."

Today, the rhetoric from central banks, especially the Fed, has changed. Central banks have signaled that they expect to raise rates more slowly in 2023. But they could still keep going for longer than markets currently anticipate, with rate cuts a distant prospect.

We are not yet out of the woods, not least because of the ongoing QT. Central banks may believe they can deliver a soft landing in 2023, but the odds in favor of them doing so are not that great. That could be good news for fixed income managers, who may soon have a great opportunity to extend duration!.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

February 2023 / INVESTMENT INSIGHTS

February 2023 / INVESTMENT INSIGHTS