February 2023 / INVESTMENT INSIGHTS

The Ghosts of Inflation – Past and Present

What investment lessons can history hold?

Inflation, which is inextricably linked to monetary policy, has been foremost on investors’ minds this year. The re-emergence of elevated inflation in the U.S. has impacted stock market multiples and investors’ positioning as they grapple with the potential implications for returns across asset classes, equity sectors, and geographic regions. Since markets have not confronted high inflation for some time, a look back at history may offer some lessons for the way forward.

High Inflation is Not New

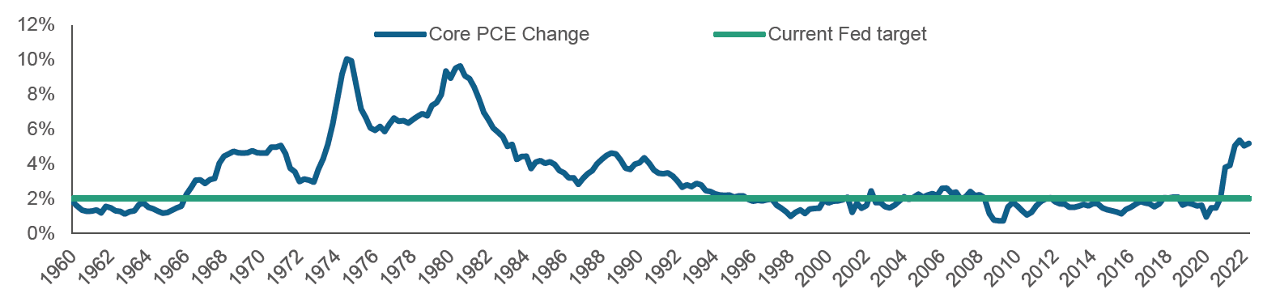

Open to debate is the source of today’s inflation, be it COVID-induced supply chain issues, Russia’s war against Ukraine, fiscal and monetary stimulus, or a combination of these factors. But the fact remains that high inflation is not a new phenomenon (Figure 1). Notably, inflation has exceeded the U.S. Federal Reserve’s (Fed’s) current target rate of 2% many times before.

Here are some interesting observations we can make about the data:

- Inflation was generally higher and more volatile post World War II to the 1980s compared with recent times. The median inflation rate from 1960 to 1965 was around 1.3%, moving up to around 4.4% from 1966 to 1970, and then to around 6.5% from 1971 to 1982. Inflation subsequently retraced its steps lower due to the Fed’s tightening actions.

- Rising inflation immediately after WWII was largely driven by the elimination of wartime controls on prices, as well as government actions that unleashed demand. In the 1970s, an oil embargo by the Organization of the Petroleum Exporting Countries (OPEC) and expansionary monetary policy led to a period known as the “Great Inflation.”

- Inflation broadly trended lower in the 1990s and 2000s, due in part to the impact of the Soviet Union’s break-up. Another factor was China’s increased participation in the global economy after joining the World Trade Organization, which ushered in a golden age of globalization.

FIGURE 1: Inflation has Waxed and Waned Over Time

Year-on-year change in U.S. personal consumption expenditure (PCE) core price index

Past performance is not a reliable indicator of future performance.

As of September 30, 2022.

U.S. PCE core price index data is quarterly.

Source: Bloomberg Finance L.P.

Against this backdrop, we dive deeper into the past for clues to address some of investors’ top questions:

- Can equity markets perform well in periods of high inflation?

- What does high inflation mean for corporate earnings and market multiples?

- What should investors consider for their portfolios?

1. Equity Markets and Inflation

History suggests that stock markets can perform well even when inflation is high, though there are some caveats to note.

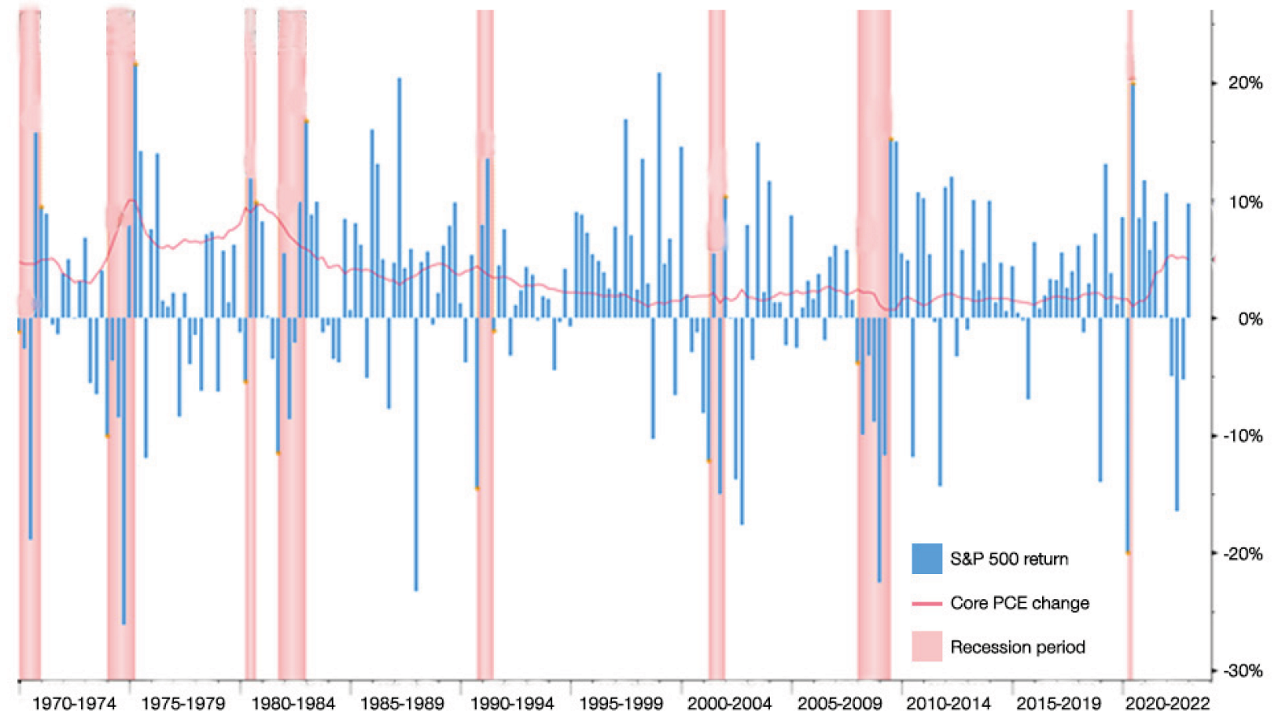

To start, we look at the S&P 500 Index’s quarterly returns across periods of inflation and recession in the U.S. (Figure 2). Equities have logged sessions of gains despite high or rising inflation before.

What then appears to be the main determinant of stock market performance is why inflation is high or rising. In our view, inflation levels or trajectories that portend a highly contractionary monetary response are more likely to be negatively perceived by equity markets.

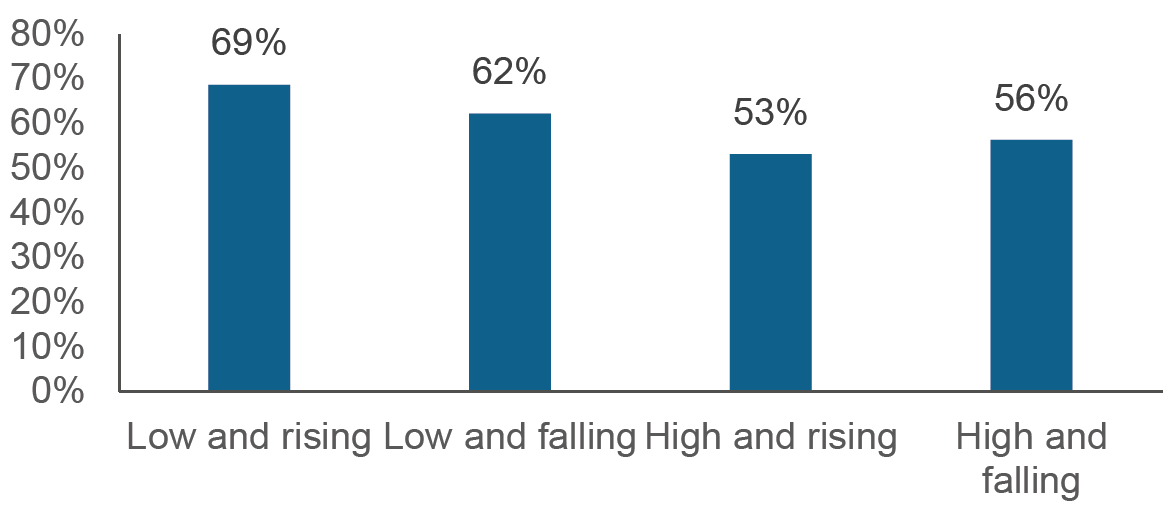

To extend the analysis, would equity performance differ depending on whether inflation is high and rising or high and falling? We assess the S&P 500’s monthly returns in four different inflationary regimes, focusing on how often they delivered positive returns when inflation rose or fell from high or low levels (Figure 3).

As the data indicates, equities generally fare better when inflation is low. Comparatively, their performance tends to lag when inflation is high, even if the latter is easing. We think this is likely linked to the second-order effects that high inflation can have on the economy through contractionary monetary policy, as we referenced earlier.

Accordingly, we believe that the interaction of inflation with the growth trajectory of the economy matters. Put in another way, is the economy in expansion or a slowdown? Research from Goldman Sachs suggests that median monthly U.S. equity returns in inflationary environments tend to be higher when the economy is expanding.1

FIGURE 2: Equities Have the Potential to Shrug Off High or Rising Inflation

S&P 500 returns and year-on-year change in U.S. PCE core price index

Past performance is not a reliable indicator of future performance.

As of December 7, 2022.

S&P 500 and U.S. PCE core price index data are quarterly.

Source: Bloomberg Finance L.P.

FIGURE 3: Inflation Levels and Paths Have Mixed Implications for Equities

Percentage of positive monthly S&P 500 returns

Past performance is not a reliable indicator of future performance.

January 1, 1962, to October 31, 2022.

Low/high inflation defined as U.S. Consumer Price Index (CPI)below/above 3%.

Rising/falling inflation based on month-on-month CPI trajectory.

Source: T. Rowe Price analysis using data from Bloomberg Finance L.P.

2. Earnings and Multiples

What about the impact of high inflation on corporate earnings? According to Goldman Sachs’ research, inflation tends to be positively correlated with nominal earnings. This reflects the net effect of two opposing forces—rising prices typically boost nominal sales, while cost inflation typically leads to margin compression.

In practice, inflation’s impact on earnings will vary by sector and its ability to pass on higher input costs. But as long as costs do not increase at the same rate as revenues, the rise in margins should normally translate into greater nominal earnings.

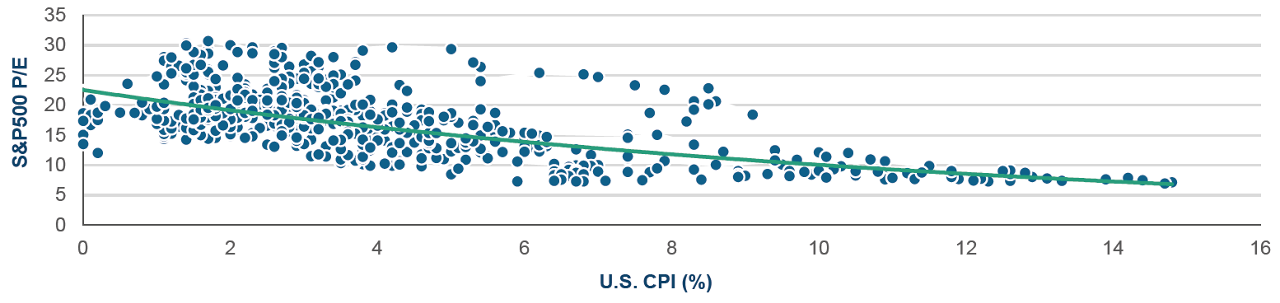

Turning to market multiples, we find that they broadly contract with higher inflation as investors apply a higher discount rate to future earnings. An analysis of the S&P 500’s price-to-earnings (P/E) ratio against inflation illustrates this (Figure 4).

3. Investor Positioning

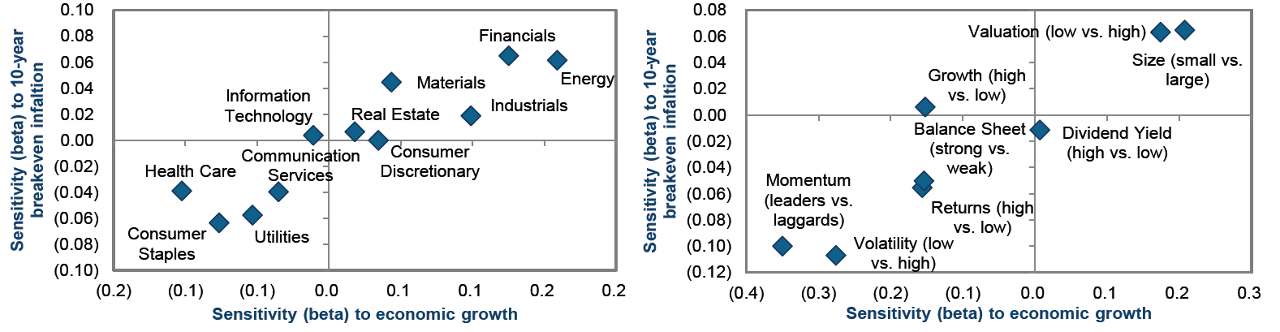

Equity investors tend to track earnings growth. Goldman Sachs’ research indicates that in inflationary periods, the boost to nominal sales growth typically more than offsets margin compression for sectors whose revenues are closely linked to commodities and other primary factors of production (such as energy) or interest rates (such as financials), subject to the stage of the economic cycle. Historical data measuring the sensitivity of S&P 500 sector excess returns under various permutations of inflation and economic growth bears this out (Figure 5).

This data may provide a helpful framework for investors trying to weigh current inflation against expected inflation as they evaluate their portfolio positioning. After all, inflation will not stay high forever, and most investors have an eye on the future—not the past. An investor who expects rising inflation and stronger economic growth, for example, may orient toward sectors such as financials and energy. Conversely, an investor positioning for a slower macroeconomic environment may shift toward slightly lower-beta sectors such as health care.

In a similar vein, certain equity factors that are more levered to economic growth may also benefit from inflation (Figure 5). Depending on the outlook for inflation and growth, an investor may lean toward higher- beta factors such as small caps, or “safer” factors such as a strong balance sheet.

FIGURE 4: Market Multiples Tend to Fall with Inflation

S&P 500 P/E versus year-on-year change in monthly U.S. CPI

Past performance is not a reliable indicator of future performance.

January 30, 1970, to October 31, 2022.

Source: T. Rowe Price analysis using data from Bloomberg Finance L.P.

FIGURE 5: Inflation May Favor Some Sectors and Equity Factors More Than Others

Sensitivity of S&P 500 sector excess returns and equity factors to inflation and economic growth (2001-2022)

Past performance is not a reliable indicator of future performance.

As of December 13, 2022.

Sensitivity to economic growth is measured using Goldman Sachs' U.S. MAP economic surprise index.

Source: Goldman Sachs Research.

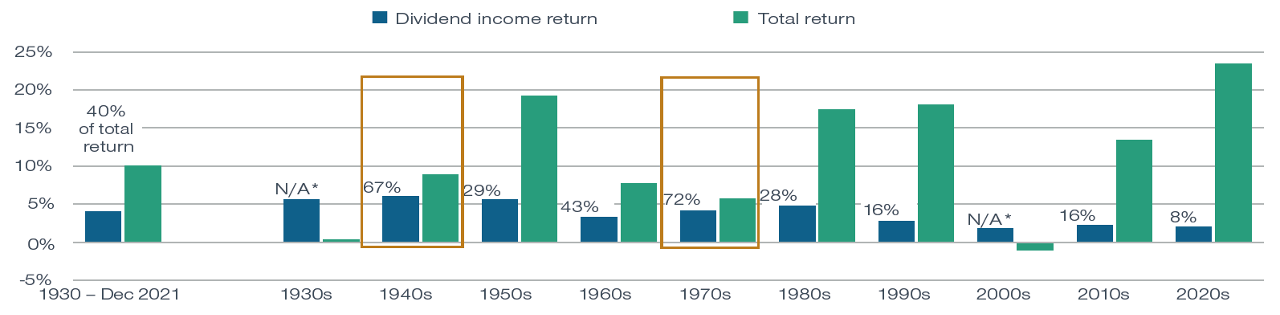

FIGURE 6: Dividends Can Add Significantly to Returns When Inflation is High

S&P 500 annualized total return, dividend income return, and dividend income as percentage of total return

Past performance is not a reliable indicator of future performance.

As of December 31, 2021.

* Not applicable; data for the 1930s and 2000s is disproportionately high versus the other decades due to the low or negative total returns during these periods. The information provided in this analysis may not represent the full value of reinvested dividends (see Additional Disclosure).

Source: Ned Davis Research, Inc.

Dividends are an oft-ignored part of the investing framework, but they arguably take on more importance in periods of elevated inflation. As history shows, the proportion of total returns coming from dividends can be significant when inflation is high, like it was in the 1940s and 1970s (Figure 6). To some extent, this ties in with the data on equity factors earlier—companies with stronger balance sheets that can pay or raise dividends are likely to find more favor with investors compared with firms that may be cutting distributions.

Concluding Thoughts

High inflation, especially when it surpasses wage growth, can suppress demand and have knock-on impacts on investments and capital allocation. Central banks are therefore focused on keeping inflation within reasonable limits. While it is impossible to predict perfectly if inflation will stay higher for longer or ease from here, insights from the past can nonetheless help us to assess the possibilities and build a diversified portfolio that is likely to be best suited for the environment.

After all, as a well-known saying goes, “Those who cannot remember the past are condemned to repeat it.”

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

February 2023 / INVESTMENT INSIGHTS