February 2023 / INVESTMENT INSIGHTS

The Importance of Additionality in Impact Investing

Additionality can accelerate and strengthen impact investing.

Key Insights

- In the world of impact investing, additionality helps to generate positive outcomes that may not otherwise occur without the value of engagement or capital investment.

- It furthers the drive toward positive impact by accelerating or strengthening impact investment objectives.

- Collaboration with investee companies helps to drive ambitious impact goals, and we believe this ultimately contributes to stronger investment outcomes.

Those of us embedded in the world of impact; sustainable; or environmental, social, and governance (ESG) investing know well how prolific it has been in coining terms and concepts to describe the array of principles it encompasses. In our experience, some of these are more useful than others. One that is becoming increasingly focal for impact investors is “additionality.”

Among the range of ESG approaches and strategies, impact purports to be the purest and carries the most ambitious aims, as reflected in its dual mandate—measurable positive environmental and social impact alongside financial return. In our view, such an approach requires a commitment to additionality.

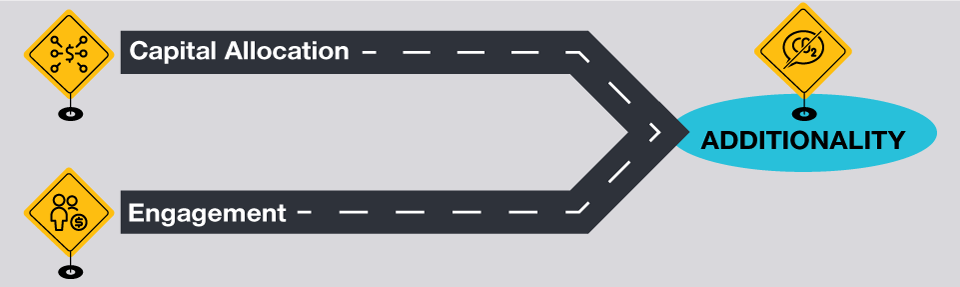

There are two channels for investors to create additionality: (1) capital, potentially at a lower relative cost to the issuer, and (2) influencing behavior through direct engagement with issuers.

What is “additionality”?

In its standard sense, “additionality” refers to a positive impact or outcome that would not have otherwise occurred without additional resources or capital investment. For example, the social housing units that would not have been built or the greenhouse gas emission reductions not realized, among other outcomes.

Within credit impact investing, ESG‑labeled bonds often specify the use of proceeds at the outset, with the capital raised designated for a particular environmental or social purpose. This can create additionality, though in our view, the bar should be set high for labeled bonds, and more importantly, impact investing should not stop there.

Impact investing is characterized by its ongoing and evolving nature, and it should go beyond the measured outcome of investing capital and then capturing the economics and activities. This means engaging and working with companies to help guide, strengthen, or accelerate their impact progress or journey, striving toward the best possible impact outcomes.

It can be particularly useful to provide guidance or views on impact or labeled bond frameworks and standards, on key performance indicators (KPIs), or to push for acceleration toward an existing indicator or target. This can result in better impact outcomes from an individual issuer while also improving collective, market‑wide standards and practices.

A very good example of this arose in the recent past. Banco Santander Chile approached us for our views on a framework for an inaugural benchmark‑sized social bond. The aim of the bond sale would be to raise money to enable greater social equity in Chile by financing affordable housing mortgages, thereby promoting financial inclusion by providing families with access to credit at a subsidized interest rate.

In giving our feedback and views on best practices, we highlighted potential to improve the refinancing lookback period, impact reporting disclosures, and views on future social bond issuance. In terms of disclosure recommendations, we recommended that reporting should include core social impact metrics related to affordable housing as defined by the International Capital Markets Association, as well as additional impact metric details on the target population for its mortgages.

Why is additionality important?

As the example of Banco Santander Chile illustrates, the additionality that we would hope to achieve would be shaping the company’s social bond framework, which will then, in turn, help to foster social mobility, reduce poverty, and increase financial inclusion. Engaging on the refinancing lookback period and emphasizing the need for a more stringent approach could help establish a higher standard and baseline for future social project financing.

Taking the question more broadly, we can go back to the key principles of impact investing, namely that the environmental and social pressure points facing the world have never been greater, but so, too, is the opportunity to invest in the companies at the forefront of addressing these challenges.

As investment managers, we aim to promote and progress the global impact agenda through positive feedback loops that additionality through company engagements can help create. Where an engagement leads to some improved behavior and strengthened or enhanced ambition on the part of a company, this should have positive knock‑on effects, such as setting standards for sector or industry peers as well as other investors. Global ESG and impact investor networks are useful here.

The Two Routes to Additionality

Capital and company engagement are the avenues to additionality

Source: T. Rowe Price.

How is additionality incorporated into fixed income impact investing?

Fixed income impact investing offers two channels for investor additionality: (1) capital, potentially at a lower relative cost to the issuer, and (2) direct engagement with issuers.

Raising Capital

Additionality through the capital channel remains key. The United Nations estimates that some USD 5 to 7 trillion dollars is needed per year to achieve its Sustainable Development Goals by 2030. We are seeing exciting developments in the area of labeled, use‑of‑proceeds bonds.

A recent example is a bond issued by the International Bank for Reconstruction and Development: a Wildlife Conservation Bond, also known as the “Rhino Bond,” which supports conservation efforts of the critically endangered black rhinoceros in South Africa. The conservation efforts will hopefully create additional social benefits, such as employment generation. At maturity, this AAA rated1 bond will offer investors principal redemption as well as a potential conservation success payment based on the final rhino population growth rate. This project exemplifies the viability of capital as a source of additionality.

Engagement

The fact that bond investors are a vital source of capital paves the way for us to engage with companies, which is where additionality will likely be mainly achieved. Scale, depth, and breadth of resources will be an advantage in this, as well as, ultimately, experience. The more engagement taking place, the better the understanding of best practices will become.

It is perhaps best to illustrate with some examples here. So far, we have found that the additionality we can help generate through engagement often relates to better disclosure or stronger labeled‑bond frameworks.

Engagements on impact reporting in power and consumer finance sectors

U.S. lender OneMain provides loans to “near prime” customers who are unable to obtain credit from mainstream banks or institutions. The company launched a social bond with the proceeds to provide credit access to vulnerable populations, including racial minorities and individuals residing in “credit insecure” or “credit at risk” counties.

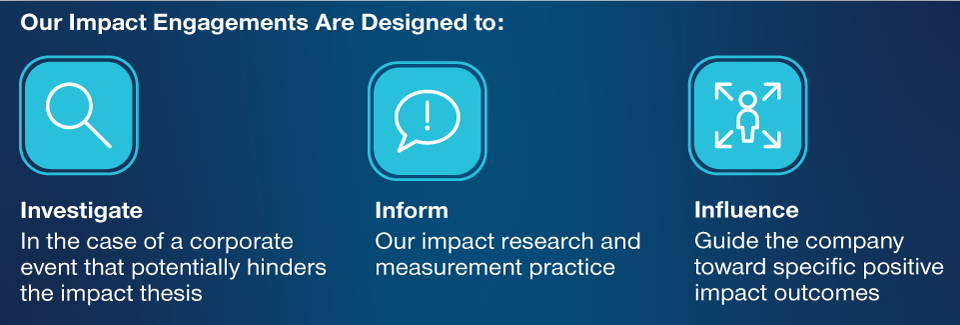

We Pursue Additionality Through Engagement

(Fig. 1) Engagements guide companies toward impact outcomes

As of December 31, 2022.

Source: T. Rowe Price.

Engaging on Impact Performance Indicators

(Fig. 2) Disclosure deepens understanding of impact performance

As of January 13, 2022.

For Illustrative Purposes only.

Source: T. Rowe Price.

We encouraged the company to research and report impact‑oriented KPIs derived from its products—for instance, to report on the number of customers helped to graduate up the FICO (credit rating) spectrum and to start tracking whether customers’ financial conditions improved during the life of their OneMain loan (Figure 2).

Conclusion: Additionality is integral to impact

Public‑impact investing requires an especially active, inclusionary approach that goes far beyond negative screening or integrating ESG factors into investment decisions—every single investment in the portfolio needs to help create a material positive environmental or social outcome. Additionality is a crucial cog in the wheel. It is essential that we continually foster additionality through our own active approach, our engagement, and our distribution of capital.

In our view, impact investing, bolstered by actions around additionality, will become increasingly fruitful over time as expertise develops and companies increasingly look to create positive impact and measure their performance against distinct social and environmental indicators. Companies that do this present an attractive impact investment proposition.

The specific securities identified and described do not represent all of the securities purchased, sold, or recommended for the portfolio, and no assumptions should be made that the securities identified and discussed were or will be profitable. T. Rowe Price may have ongoing business and/or client relationships with the companies mentioned in this material.

General Portfolio Risks:

Capital risk—The value of your investment will vary and is not guaranteed. It will be affected by changes in the exchange rate between the base currency of the portfolio and the currency in which you subscribed, if different.

Counterparty risk—An entity with which the portfolio transacts may not meet its obligations to the portfolio.

ESG and sustainability risk—May result in a material negative impact on the value of an investment and performance of the portfolio.

Geographic concentration risk—To the extent that a portfolio invests a large portion of its assets in a particular geographic area, its performance will be more strongly affected by events within that area.

Hedging risk—A portfolio’s attempts to reduce or eliminate certain risks through hedging may not work as intended.

Investment portfolio risk—Investing in portfolios involves certain risks an investor would not face if investing in markets directly.

Management risk—The investment manager or its designees may at times find their obligations to a portfolio to be in conflict with their obligations to other investment portfolios they manage (although, in such cases, all portfolios will be dealt with equitably).

Operational risk—Operational failures could lead to disruptions of portfolio operations or financial losses.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.