2024 U.S. Retirement Market Outlook

Three Themes Shaping the U.S. Retirement Landscape

A surge in retirees and a complex market environment are creating new challenges for retirement savers. We are closely watching these themes impacting the U.S. retirement industry.

Retirement Income

Growing demand could drive innovation and adoption of retirement income solutions.

What has changed?

Growing demand and supportive legislation that could drive adoption of in-plan solutions

What's next?

Continued innovation in product design beyond guaranteed solutions

Watch out for

Threat of litigation that could affect adoption of innovative solutions

Evolving from an exploratory to decision-oriented posture

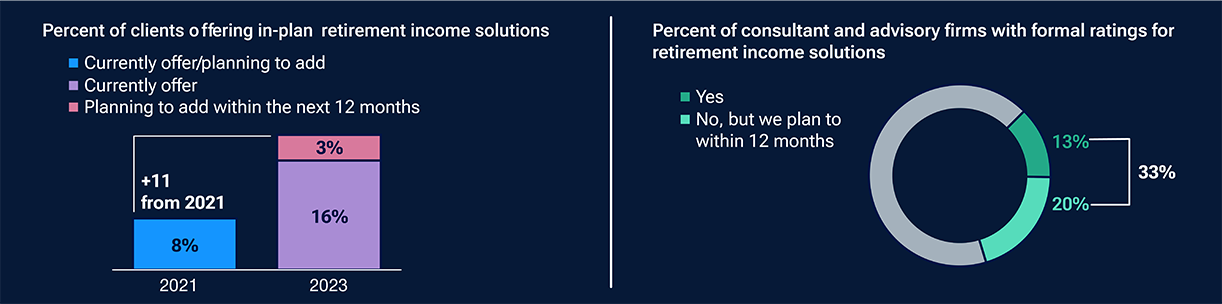

Data suggest that more plans, consultants, and advisors are taking a position on retirement income:

Source: T. Rowe Price, 2023 Defined Contribution Consultant Study; 2021 Defined Contribution Consultant Study.

Decision opportunities for plan sponsors and retirement professionals:

- As litigation persists, our industry experts are discussing legislation that could benefit retirees and protect plan fiduciaries.

- There are opportunities for advisors and consultants to discuss the potential cost, portability, and educational challenges of income solutions with plan sponsors who are worried about complexity.

- While guaranteed products have dominated the retirement income narrative, the demand for diverse solutions continues.

Personalization

Targeted experiences can drive behavioral change and improve retirement outcomes.

What has changed?

Diverse workforce needs targeted communications, savings and wellness solutions

What's next?

Financial wellness programs could be the top area for future growth in non-investment services

Watch out for

Growth of personalized managed solutions can help keep assets in plan

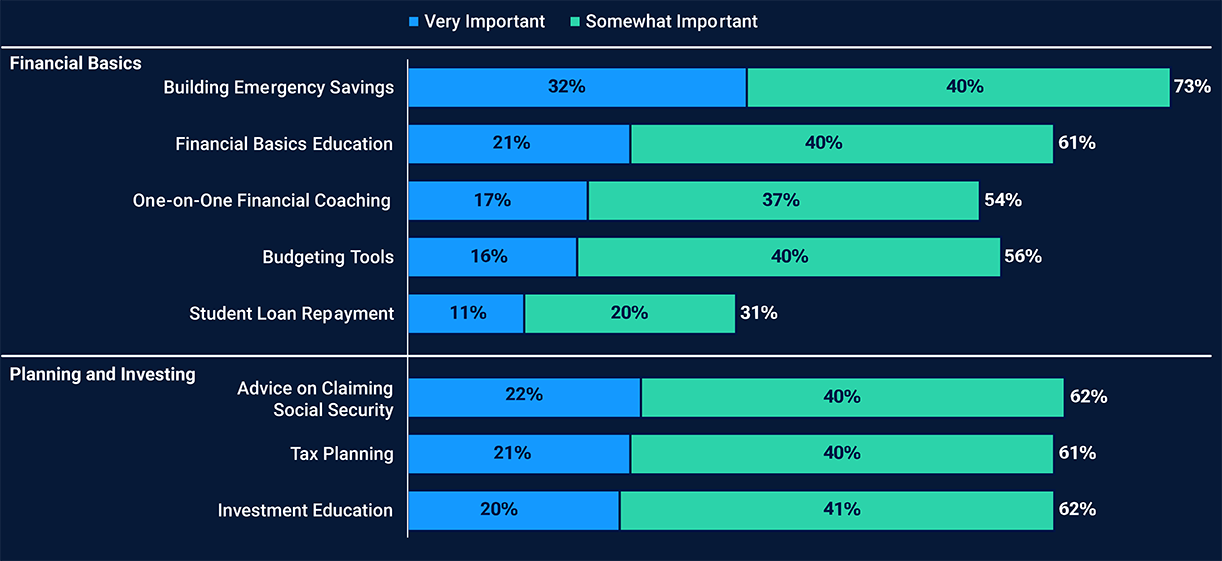

Participants need help with financial basics, planning, and investing

The importance of workplace financial solutions to participants:

Source: T. Rowe Price Retirement Savings and Spending Study, 2022.

Numbers may not total due to rounding.

Discussion opportunities for plan sponsors and retirement professionals:

- Having access to participant-level data can help recordkeepers, consultants, and advisors unmask roadblocks that prevent saving and reveal relevant services that help them save.

- Employees put trust in their employers, but employers need to offer personalization solutions in order to keep retiring participants in the plan.

- Employers can use informal forums to foster discussions about personal finances to encourage participants to engage and gather information about where employees may be struggling.

Diversification

A complex market environment sharpens focus on diversification opportunities.

What has changed?

The changing economic environment requires reassessment of fixed income

What's next?

Look beyond U.S. investment-grade bonds to supplement core fixed allocation and consider other sectors, such as high yield, bank loans, emerging markets debt

Watch out for

Active management to be key for fixed income diversification

Interest rate and inflation concerns are top of mind

Factors that influence evaluation of strategies with a goal of capital preservation and/or fixed income investment options in plan

| Fixed Income | Capital Preservation | ||||||

| 2021 | 2023 | Change | 2021 | 2023 | Change | ||

| Current interest rate environment | 89% | 81% | -8 | 89% | 94% | +5 | |

| Greater focus on diversification opportunities | 48 | 81 | +33 | 33 | 29 | -4 | |

| Interest rate expectations | 81 | 77 | -4 | 74 | 71 | -3 | |

| Inflation concerns | 70 | 74 | +4 | 48 | 68 | +20 | |

| Poor performance | 26 | 52 | +26 | 19 | 36 | +17 | |

Source: T. Rowe Price, Defined Contribution Consultant Study; 2021 Defined Contribution Consultant Study.

Percentages represent the portion of respondents who selected the respective factors listed on the left side of the chart.

Discussion opportunities for plan sponsors and retirement professionals:

- With the growth of global fixed income markets, it might be time to review the investment menu for additional opportunities for diversification and potential excess returns.

- Active management is key for fixed income diversification, especially in certain fixed income sectors where credit risk is a primary risk.

Contact Us

Broker-Dealer

877.561.7670

AdvisorServices@troweprice.com

RIA, Regional Banks, and National Banks

877.561.7670

AdvisorServices@troweprice.com

DCIO

800.371.4613

DCIO_Sales_Desk@troweprice.com

Variable Annuity

855.829.5343

VA_Sales_Desk@troweprice.com

Source information:

T. Rowe Price research shared throughout this report as "our research" was compiled from the sources listed on page 13 of the full article.

202312-3281632