- Asset Allocation Insights

- Outlook May Favor High Yield Bonds Over Equities

- 2022-10-07 13:29

- Key Insights

-

- An unfavorable macroeconomic backdrop is weighing on the near-term global economic outlook and is a headwind for equity markets.

- In our view, high yield bond fundamentals are strong, and they could offer investors a compelling yield advantage relative to equities.

The confluence of several factors—including tightening monetary and fiscal policies, geopolitical turmoil, and stubbornly high inflation—has created an environment in which the potential risks for equities outweigh the potential rewards in the near to medium term.

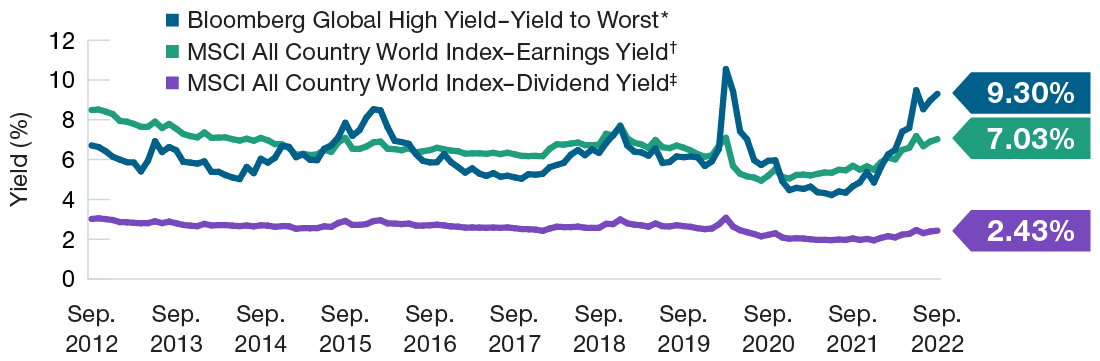

For investors seeking alternatives, we believe that high yield bonds currently may offer a compelling yield advantage relative to equities. In particular, a comparison against the forward equity earnings yield, which accounts for a company’s entire earnings and not just the portion paid out in dividends, shows a significant yield advantage for global high yield (Figure 1). Further, while equity earnings may be revised downward if economic growth weakens, a potential added advantage for high yield bond investors is that cash flows are unlikely to be affected unless a company defaults.

High Yield Advantage Over Equities

(Fig. 1) High yield bonds could offer a more attractive risk/reward trade-off in the near term

10 years ended September 20, 2022.

Past performance is not a reliable indicator of future performance. Actual outcomes may differ materially from expectations.

Sources: Bloomberg Index Services Limited and MSCI. T. Rowe Price analysis using data from FactSet Research Systems Inc. All rights reserved. See Additional Disclosures.

* Yield to worst is a measure of the lowest possible yield that can be received on a bond with an early retirement provision.

† Forward earnings yield is calculated by dividing the expected earnings per share (EPS) in the next twelve months by the current share price.

‡ Forward dividend yield is the percentage of a company’s share price that is expected to be paid out in dividends over the next year.

Although we recognize that credit risk is a valid concern, credit quality in the high yield universe has steadily improved, on average, since the end of the 2008–2009 global financial crisis. Over the past 15 years, the share of high yield bond issuers in the Credit Suisse High Yield Index rated1 higher than single B—levels typically deemed less susceptible to default risk—has increased from 37% to 59%.

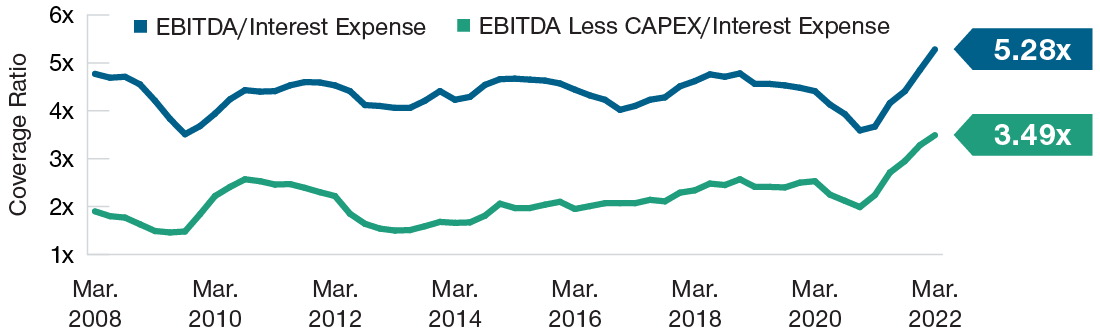

High yield sector fundamentals are also generally stronger since 2008, with corporate balance sheets holding more cash and less leverage, as illustrated by interest coverage ratios (Figure 2). While earnings could decline in a recessionary scenario, we believe healthy balance sheets could help limit widespread default risk.

In our view, financial markets face a challenging economic environment, with an increasing likelihood of a global recession within the next year. While our Asset Allocation Committee remains cautious and is maintaining a notable underweight allocation to equities, we believe that high yield bonds are supported by strong sector fundamentals and could offer relatively attractive yields.

Stronger Fundamentals Lower Potential Default Risk

(Fig. 2) Interest coverage ratios show that company earnings for high yield issuers far exceed their ongoing interest expense

March 31, 2008, to March 31, 2022.

Past performance is not a reliable indicator of future performance.

Sources: Based on J.P Morgan North America Credit Research. Not from an Index.

EBITDA = Earnings Before Interest, Taxes, Depreciation, and Amortization.

CAPEX = Capital Expenditures.

Get insights from our experts.

Subscribe to get email updates including article recommendations relating to asset allocation.

-

1 The credit ratings are based on methodology of Credit Suisse using Moody’s, Standard & Poor’s and Fitch ratings. A bond is considered non‑investment grade (or high yield) if it has a rating of BB+ or below from Standard & Poor’s and Fitch, or Ba1 or below from Moody’s. A rating of “B” represents the second-highest rung of non-investment-grade credit ratings from S&P and Fitch. Investors cannot invest directly in an index.

-

Additional Disclosures

Bloomberg® and Bloomberg Global High Yield Index are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the index (collectively, “Bloomberg”) and have been licensed for use for certain purposes by T. Rowe Price. Bloomberg is not affiliated with T. Rowe Price, and Bloomberg does not approve, endorse, review, or recommend its products. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to its products.

MSCI. MSCI and its affiliates and third party sources and providers (collectively, “MSCI”) makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. Historical MSCI data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

Important Information

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are those of the authors as of October 2022 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy. Actual outcomes may differ materially from any estimates or forward-looking statements provided.

Past performance is not a reliable indicator of future performance. All investments are subject to market risk, including the possible loss of principal. Fixed‑income securities are subject to credit risk, liquidity risk, call risk, and interest‑rate risk. As interest rates rise, bond prices generally fall. Investments in high‑yield bonds involve greater risk of price volatility, illiquidity, and default than higher‑rated debt securities. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc.

© 2022 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.

202210-2463978