Retirement

Considerations for Plan Sponsors

Constructing More Effective Defined Contribution Investment Lineups

In-depth analysis and insights to inform your decision-making.

Executive Summary

With defined contribution (DC) plans serving as the primary vehicle for retirement savings in the U.S. and concerns continuing about workers’ ability to reach their retirement goals, the structure of investment lineups has never been more important.

Here we explore three key areas of consideration DC plan sponsors face: regulatory and fiduciary issues, cultural and employee demographics, and research and industry trends. In addition, we present a road map to help guide decision-makers in evaluating and structuring an effective investment lineup for their plans.

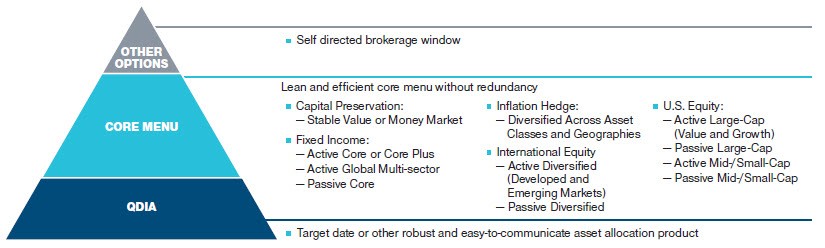

This Paper Discusses Seven Key Best Practice Considerations:

- Offer asset allocation products such as target date options as the default option.

- Offer either a stable value or a money market investment option.

- Consider expanding the fixed income offerings beyond U.S. investment grade.

- Provide the full opportunity set of U.S. equities, but keep the number of options low and minimize any overlap.

- Offer a diversified international equities option.

- Minimize sector and other specialty investment options.

- Consider a self-directed brokerage approach to appeal to highly engaged participants.

Sample Best Practice Lineup

Read the Full Article

As DC plans continue to grow in prominence as the sole retirement income source for many participants, plan sponsors are facing important decisions about how to construct lineups.

T. Rowe Price does not select investment options for retirement plans or provide investment advice with respect to that selection. This material is provided for general and educational purposes only and is not intended to provide legal, tax, or fiduciary investment advice. This material is not individualized to the needs of any benefit plan, nor is it intended to serve as the primary basis for an investment decision. The T. Rowe Price group of companies, including T. Rowe Price Associates, Inc., and/or its affiliates, receives revenue from T. Rowe Price investment products and services.

T. Rowe Price Investment Services, Inc., distributor, T. Rowe Price mutual funds.

202209-2431217