- On U.S. Fixed Income

- Attractive Income Bolsters High Yield Bonds

- Recent downturn may also offer price appreciation opportunities.

- 2022-07-28 13:31

- Key Insights

-

- High yield bonds have had a difficult 2022 from a performance perspective, but we are finding unique opportunities in the current environment.

- We believe that much of the value of the asset class can be realized by staying invested and potentially benefiting from the compounding effect of its relatively high coupon payments.

- Historically, some of the best opportunities in high yield bonds have come on the heels of pronounced downturns in the asset class.

Like many asset classes, high yield bonds have had a difficult start to 2022 from a performance perspective. In fact, high yield bonds had their worst-ever performance in the first half of a year. In times like these, it is natural for investors to question their investments; however, we continue to view the asset class as a strategic long-term investment and a mainstay allocation as part of a well-diversified portfolio. Historically, some of the best opportunities in high yield bonds have come on the heels of pronounced downturns in the asset class.

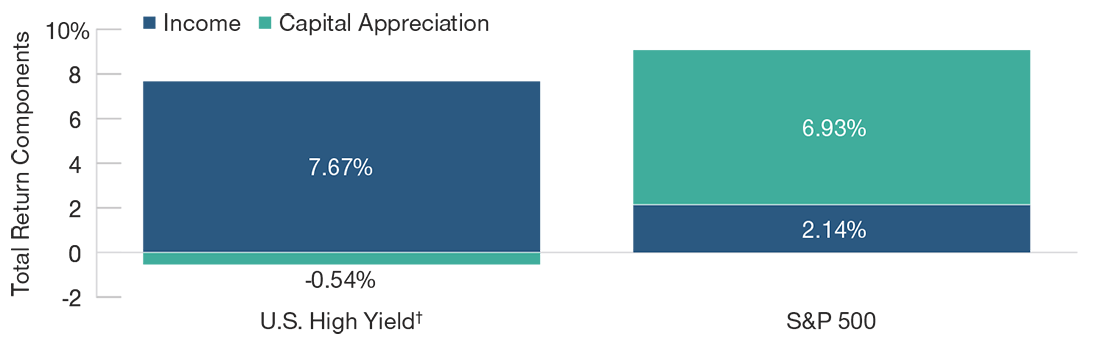

Income Has Been the Key Driver of Long-Term Return*

(Fig. 1) Compounding of coupon payments can be meaningful.

Past performance is not a reliable indicator of future performance. Index performance is for illustrative purposes only and is not indicative of any specific investment. Investors cannot invest directly in an index.

As of June 30, 2022.

Source: FactSet Research Systems, analysis by T. Rowe Price.

*20 years ended June 30, 2022

† ICE BofA U.S. High Yield Constrained Index.

Income as Key Source of Return

An analysis of historical sources of return shows that, unlike stocks, high yield bonds have typically derived their long-term returns from income rather than capital appreciation. Their relatively high and generally consistent coupon payments are a key reason why high yield bonds have historically exhibited lower volatility when compared with equities, and this trend has continued to hold true so far this year. For long-term investors, we believe much of the value of the asset class can be realized simply through clipping coupons. Figure 1 uses data over a 20-year time period, which includes both the global financial crisis and the current downturn, so this concept of income as the key driver of returns has held true even during periods that include major market drawdowns.

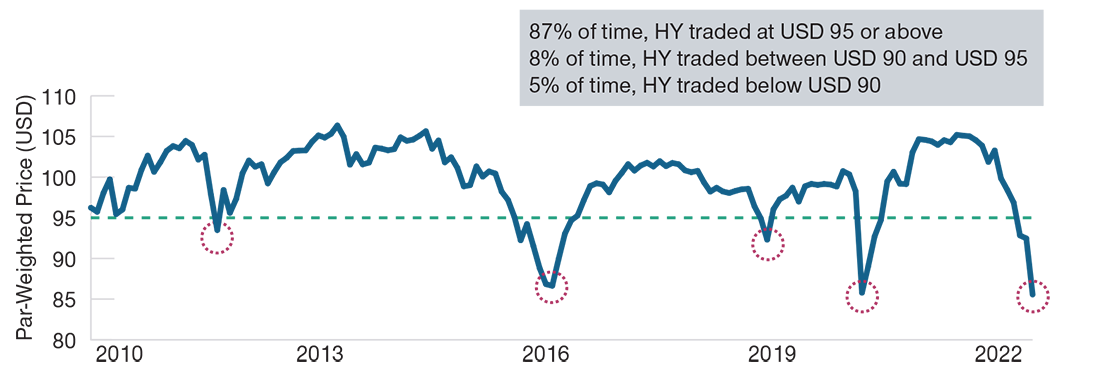

Capital Appreciation Opportunities

However, opportunities to benefit from additional returns through price appreciation do exist and can serve as attractive entry points for investors. Looking back at historical prices for the ICE BofA U.S. High Yield Constrained Index for January 1, 2010 to June 30, 2022, 87% of the time, the high yield index traded at a dollar price of USD 95 or above. These levels leave little room for capital appreciation; thus, returns during these time periods tend to be heavily driven by income.

However, 8% of the time, the index traded below USD 95, and 5% of the time, it was below USD 90. These discounted levels, though often short-lived, can provide attractive entry points and create more potential for capital appreciation as average dollar prices move back toward par. That said, low dollar price levels typically are accompanied by periods of significant market stress, which can make it more difficult to stomach putting money to work. While it is virtually impossible to accurately predict a market bottom, timing the bottom does not necessarily need to be perfect to potentially benefit from this dynamic.

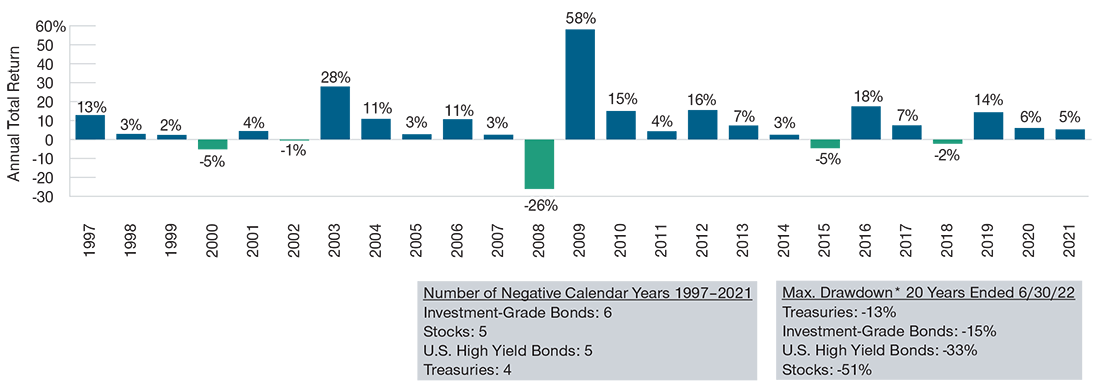

Patience Has Paid Off Historically

Looking at index calendar year returns over the last 25 years, there have only been five years with negative returns and, for investors that had the patience to stay invested, negative return years typically were immediately followed by outsized positive return years. Though it can be difficult to stay the course during market corrections, remaining invested rather than liquidating positions at what is often the worst time to do so may be a prudent approach and can potentially better position investors to benefit from future returns.

Low Dollar Prices Present Opportunities

(Fig. 2) U.S. high yield par-weighted* dollar price

Past performance is not a reliable indicator of future performance.

As of June 30, 2022.

Source: FactSet Research Systems, analysis by T. Rowe Price.

*ICE BofA U.S. High Yield Constrained Index weighted by bond face amount outstanding. Gray-box stats provided are based on month-end prices over the time period from January 1, 2010–June 30, 2022.

Drawdowns Have Typically Been Followed by Strength

(Fig. 3) Historical calendar year returns, U.S. high yield

Past performance is not a reliable indicator of future performance.

As of June 30, 2022.

Source: FactSet Research Systems, analysis by T. Rowe Price. Index performance is for illustrative purposes only and is not indicative of any specific investment.

Investors cannot invest directly in an index. U.S. high yield bonds represented by ICE BofA U.S. High Yield Constrained Index; investment-grade bonds by Bloomberg US Corporate Investment Grade Index; stocks by S&P 500 Index; Treasuries by ICE BofA US Treasury Index.

*Drawdown is the size of a market decline from highest price to lowest price.

Why Now?

The high yield market has been weighed down this year by an evolving narrative that has shifted focus from inflation and rising rates to concerns over slowing growth and the potential for a recession. However, with average high yield bond prices in the 80s, USD, the market is already pricing a fairly large probability of a recessionary outcome. We believe these prices have created an interesting opportunity set for investors if and when things improve. Though the exact timing around when market conditions will improve remains to be seen, there are several things the high yield market has going for it today:

- As rates have risen year-to-date, yields today are higher than they were at the start of the year, and, thus, prospects for income have improved. This should serve as a current benefit to income-oriented investors.

- The year-to-date sell-off has resulted in cheaper valuations and created unique opportunities within the high yield bond market. We have taken advantage of this dynamic and invested in what we view to be good companies at attractive dollar prices across the credit ratings spectrum. We have found compelling opportunities within lower dollar price BBs (bonds with the highest non-investment grade rating) as well as within higher beta1 parts of the market where risk has sold off indiscriminately.

- Credit fundamentals remain supportive. Credit spreads2 have widened year-to-date, ending the second quarter at levels that are wider than their historical averages. Meanwhile, defaults remain well below their long-term averages as many companies refinanced their debt during the period of extremely low rates, thereby extending maturities. Though defaults may tick slightly higher from here due to inflation and a more hawkish Fed, we expect they will remain well below average for the foreseeable future given the lack of near-term bond maturities.

- Technicals remain supportive as year-to-date outflows industrywide have been met with a relatively quiet new issue calendar. Additionally, yields and bond prices are reaching attractive levels, which may begin to lure investors back into the market.

- The overall quality of the high yield market has improved in recent years, as the proportion of BBs—many with the potential to be upgraded to investment grade—has increased. At the same time, the proportion of CCCs—the segment of the market that is most likely to default—has decreased.

Though our outlook for high yield is still constructive, risks remain. We continue to look to invest in companies that are better positioned to withstand inflation and rising rates. Also, given the increased risks around the potential for a recession, we continue to stress-test credits for their potential resilience in such an environment.

Barring another large global increase in commodity prices or another major global supply chain disruption in the next few months, it is likely that we will see the peak of U.S. inflation in the second half of 2022, followed by a gradual easing of pressures on both the level of inflation and rates that could provide relief to markets. We also continue to keep a close watch on future maturity walls, which could eventually force companies to refinance their debt at meaningfully higher rates.

Find this article interesting?

Subscribe to get email updates including article recommendations relating to global fixed income.

-

1 Beta measures the volatility, or risk, of a security relative to the risk of the broad market.

2 Credit spreads measure the additional yield that investors demand for holding a bond with credit risk over a similar-maturity, high-quality government security. In this case, we use spread to worst, which is the spread received on a bond that is redeemed by the issuer on the earliest possible date in its contract.

-

Important Information

Call 1-800-225-5132 to request a prospectus or summary prospectus; each includes investment objectives, risks, fees, expenses, and other information you should read and consider carefully before investing.

Fixed-income securities are subject to credit risk, liquidity risk, call risk, and interest-rate risk. As interest rates rise, bond prices generally fall. Investments in high-yield bonds involve greater risk of price volatility, illiquidity, and default than higher-rated debt securities. This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are those of the authors as of July 2022 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy.

Past performance is not a reliable indicator of future performance. All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc.

© 2022 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.