- On Retirement

- Retirement Isn’t Passive; Target Date Strategies Shouldn’t Be Either

- Active versus passive debate misses the mark, in our view.

- 2022-05-05 13:27

- Key Insights

-

- Actively managed building blocks within target date portfolios provide diversification potential that may not be possible to achieve with passive components.

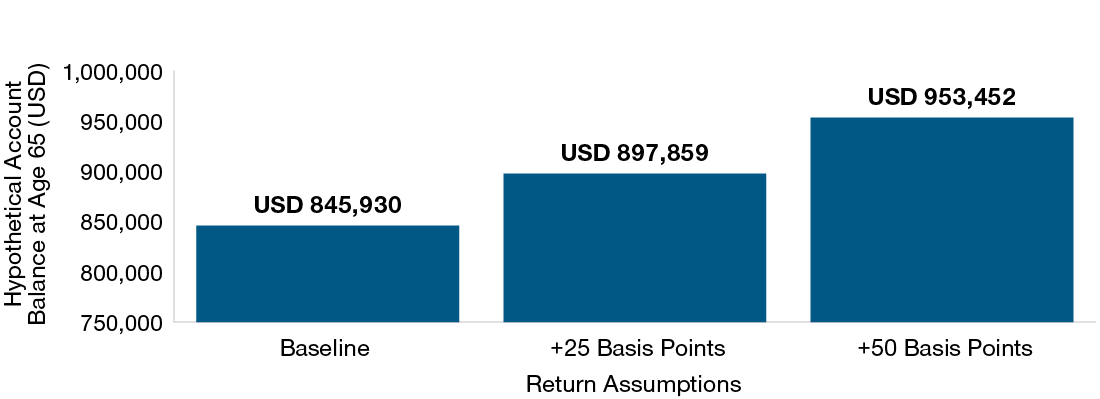

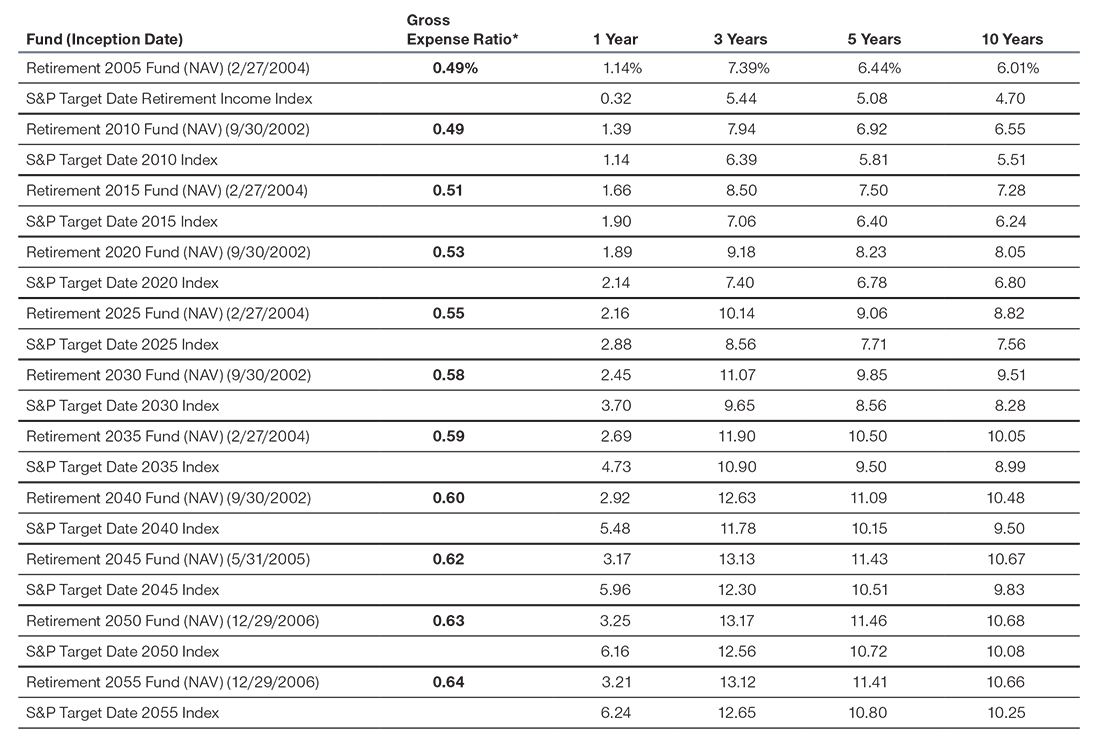

- We believe skilled active management has the potential to generate meaningful outperformance, improving investors’ ability to reach retirement objectives.

- Fiduciary duties do not require plan sponsors to select passive vehicles. An array of options, including actively managed funds, can be appropriate offerings.

-

Additional Disclosures

Bloomberg® and the Bloomberg Global Aggregate Bond Index are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the index (collectively, “Bloomberg”) and have been licensed for use for certain purposes by T. Rowe Price Investment Services, Inc. Bloomberg is not affiliated with T. Rowe Price Investment Services, Inc., and Bloomberg does not approve, endorse, review, or recommend the T. Rowe Price Retirement Funds. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to the T. Rowe Price Retirement Funds.

ICE Data Indices, LLC (“ICE DATA”), is used with permission. ICE DATA, ITS AFFILIATES, AND THEIR RESPECTIVE THIRD‑PARTY SUPPLIERS DISCLAIM ANY AND ALL WARRANTIES AND REPRESENTATIONS, EXPRESS AND/OR IMPLIED, INCLUDING ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, INCLUDING THE INDICES, INDEX DATA, AND ANY DATA INCLUDED IN, RELATED TO, OR DERIVED THEREFROM. NEITHER ICE DATA, ITS AFFILIATES, NOR THEIR RESPECTIVE THIRD‑PARTY SUPPLIERS SHALL BE SUBJECT TO ANY DAMAGES OR LIABILITY WITH RESPECT TO THE ADEQUACY, ACCURACY, TIMELINESS, OR COMPLETENESS OF THE INDICES OR THE INDEX DATA OR ANY COMPONENT THEREOF, AND THE INDICES AND INDEX DATA AND ALL COMPONENTS THEREOF ARE PROVIDED ON AN “AS IS” BASIS AND YOUR USE IS AT YOUR OWN RISK. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD‑PARTY SUPPLIERS DO NOT SPONSOR, ENDORSE, OR RECOMMEND T. Rowe Price OR ANY OF ITS PRODUCTS OR SERVICES.

The informational piece, entitled Selecting, Evaluating, and Monitoring Investments in DC Plans: A Legal Perspective, which may be considered advertising under the ethical rules of certain jurisdictions, is provided on the understanding that it does not constitute the rendering of legal advice or other professional advice by Goodwin Procter or its lawyers. Prior results do not guarantee a similar outcome. Goodwin Procter is an international legal practice carried on by Goodwin Procter LLP and its affiliated entities. For further information about our offices and the regulatory regimes that apply to them, please refer to our Legal Notices. © 2022 Goodwin Procter. All rights reserved. Goodwin Procter LLP, 100 Northern Avenue, Boston, MA 02210.

Important Information

Call 1-800-225-5132 to request a prospectus or summary prospectus; each includes investment objectives, risks, fees, expenses, and other information you should read and consider carefully before investing.

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. This material does not provide fiduciary recommendations concerning investments or investment management.

The views contained herein are those of the authors as of May 2022 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy.

The principal value of the Retirement Funds is not guaranteed at any time, including at or after the target date, which is the approximate year an investor plans to retire (assumed to be age 65) and likely stop making new investments in the fund. If an investor plans to retire significantly earlier or later than age 65, the funds may not be an appropriate investment even if the investor is retiring on or near the target date. The funds’ allocations among a broad range of underlying T. Rowe Price stock and bond funds will change over time. The funds emphasize potential capital appreciation during the early phases of retirement asset accumulation, balance the need for appreciation with the need for income as retirement approaches, and focus on supporting an income stream over a long‑term postretirement withdrawal horizon. The funds are not designed for a lump‑sum redemption at the target date and do not guarantee a particular level of income. The funds maintain a substantial allocation to equities both prior to and after the target date, which can result in greater volatility over shorter time horizons.

All investments are subject to risk, including the possible loss of principal. When valuations fall and market and economic conditions change it is possible for both actively and passively managed investments to lose value.

Derivatives may be riskier or more volatile than other types of investments because they are generally more sensitive to changes in market or economic conditions. Fixed-income securities are subject to credit risk, liquidity risk, call risk, and interest-rate risk. As interest rates rise, bond prices generally fall. Investments in high-yield bonds involve greater risk of price volatility, illiquidity, and default than higher-rated debt securities. International investments can be riskier than U.S. investments due to the adverse effects of currency exchange rates, differences in market structure and liquidity, as well as specific country, regional, and economic developments. These risks are generally greater for investments in emerging markets.

Past performance is not a reliable indicator of future performance. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc., distributor. For Investment Professional and Plan Sponsor Use only.

© 2022 T. Rowe Price. All Rights Reserved. T. Rowe Price, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.