- Asset Allocation Insights

- Recession Signals Flashing Yellow

- 2022-06-08 13:58

- Key Insights

-

- Some major indexes have approached bear market territory, and concerned investors are asking if the U.S. economy could be heading for a recession.

- The global economy faces notable headwinds, and we believe that investors should adopt a defensive posture over the near term.

The persistent sell-off in global markets has many investors asking whether the U.S.—the world’s largest economy—could be heading for a recession. With some major indexes in or near bear market territory, this is a valid concern given that, historically, eight out of the nine S&P 500 bear markets since 1950 have been associated with a recession.

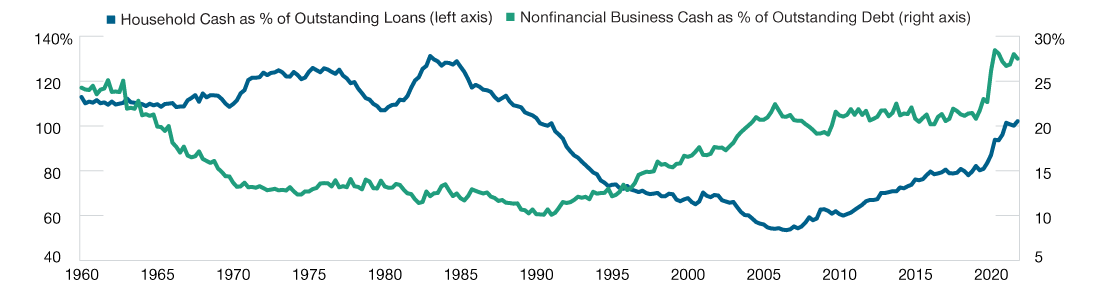

Although the global economy is on relatively solid footing to withstand slowing growth, it faces notable headwinds. On one hand, consumers and corporations have plenty of cash and limited debt levels (Figure 1), and the general slowdown started during a period of rapid economic growth.

On the other hand, global central banks—led by the U.S. Federal Reserve—are tightening monetary policies aggressively, while governments around the world are pulling back dramatically on fiscal stimulus measures. Further, the pandemic has negatively disrupted supply chains and labor markets, and Russia’s military aggression in Ukraine has damaged the global supply of energy, food products, and numerous industrial metals.

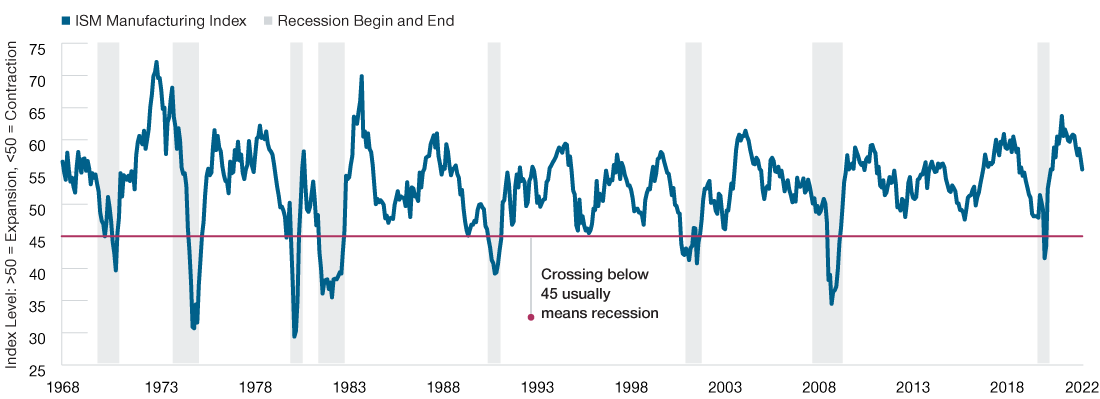

When gauging the probability of a recession, investors can assess various factors. For instance, the ISM Manufacturing Index is a barometer of economic activity that is published monthly by the Institute for Supply Management. A reading below 45 on this index typically implies that a recession could be imminent (Figure 2). Deteriorating solvency is another red flag—in particular, widening credit spreads and significant negative performance in the high yield bond sector could indicate rising market fears about an increase in bankruptcies. A persistent uptick in the unemployment rate over several months would also be a concerning data point.

In our view, global markets are facing a challenging economic environment, and a recession in the U.S. could drive down financial markets even further. As a result, we believe that investors should adopt a defensive posture over the near term.

Reason for Optimism, Strong Balance Sheets

(Fig. 1) Household and corporate wealth could help buffer slowing growth

March 1960 to December 2021.

Source: U.S. Bureau of Economic Analysis/Haver Analytics.

Household Cash Includes: Households/Nonprofit Institutional Service Households: Assets: Money Mkt. Fund Shares + Currency and Deposits End of Period (EOP), Not Seasonally Adjusted (NSA), in Billions of Dollars (Bil.$.).

Household Loan Includes: Households/Nonprofit Institutional Service Households: Liabilities: Loans, EOP, NSA, Bil.$.

Nonfinancial Business Cash Includes: Nonfinancial Corporate Business: Assets: Money Mkt. Fund Shares + Currency and Deposits EOP, NSA, Bil.$ + Nonfinancial

Noncorporate Business: Assets: Money Mkt. Fund Shares + Currency and Deposits EOP, NSA, Bil.$.

Nonfinancial Business Debt Includes: Nonfinancial Noncorporate Business: Liabilities: Loans + Nonfinancial Corporate Business: Liabilities: Loans + Nonfinancial

Corporate Business: Liabilities: Debt Securities.

ISM Manufacturing Index Is an Effective Gauge for Economic Growth

(Fig. 2) The index provides a timely barometer of economic activity

January 1968 to April 2022.

Sources: Institute for Supply Management, National Bureau of Economic Research/Haver Analytics.

-

Important Information

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are those of the authors as of June 2022 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy. Actual future outcomes may differ materially from any estimates or forward-looking statements made.

Past performance is not a reliable indicator of future performance. All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc.

© 2022 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.