Many plan sponsors face the complex process of adapting their retirement benefit structures due to closing or freezing their existing defined benefit (DB) plans or as a result of merger and acquisition activity, leading to plans with multiple benefit structures based on legacy companies. As a result, many organizations now offer a variety of benefit structures to their employees, leaving plan sponsors uncertain about how to factor these differences into decisions about their defined contribution (DC) plans—most notably, the plan’s qualified default investment alternative (QDIA).

We believe plan sponsors that have made changes to their DB plans, shifted from DB to DC plans, or merged plan populations should take these changes into account when they assess whether the underlying glide path in their QDIA solution is appropriate for their aggregate workforces and their stated retirement objectives.

One key component of DC plan structures is the selection of the QDIA and the potential impact of that decision on retirement outcomes. One of our key observations is that the traditional approaches to QDIA evaluation and selection being used today suggest that the problems associated with changing benefit structures may not be fully understood by some plan sponsors.

Our analytical work has focused on the principles that we believe should guide the glide path evaluation process and that, in our view, may help plan sponsors make more informed choices about their glide path design as a conduit for promoting income replacement during retirement.

It Is Important to Account for the DB Benefit

The evolution of benefit structures has resulted in DC plans becoming a primary retirement vehicle for many employees, which has increased the importance of the evaluation and selection of QDIAs in supporting the sponsor’s plan objectives. Typically, underlying the QDIA is an asset allocation glide path that changes over time as participants move through their preretirement and postretirement life cycles. Ideally, the glide path evaluation process should consider a sponsor’s full retirement benefit structure.

"The foundational premise of our research is that the presence of a DB plan in an organization’s benefit package can materially affect outcomes for DC participants."

The foundational premise of our research is that the presence of a DB plan in an organization’s benefit package can materially affect outcomes for DC participants. Thus, we believe that DB structures should be considered carefully when evaluating and selecting QDIA glide paths. Just as important, this impact may vary, and trade‑offs between higher growth potential and account balance variability will need to be considered in the selection process. Critical considerations in this process include the design of the DB plan, participant income and savings behaviors, and the design of and degree of reliance on the DC plan.

A second premise of our work, but no less important, is that contrary to popular belief, there simply is no single correct “rule of thumb” for assessing a DB plan’s impact on glide path suitability. In fact, we advocate flexibility and emphasize the importance of connecting the glide path assessment back to sponsor objectives and how well funded participants are in terms of replacing their preretirement incomes.

No Easy Task but Worth the Journey

Incorporating DB plan coverage into glide path design is not a straightforward exercise:

- Some retirement analysts believe that a DB benefit provides a secure source of income, much like a high‑quality bond, and thus DC assets can be more heavily invested in equities to offset the bond‑like predictability offered by the DB plan.

- Other industry experts argue that the DB plans provide additional retirement wealth, reducing the need to emphasize growth‑seeking assets in the DC plan glide path.

Although these two views appear contradictory, both potentially can be right under certain circumstances—but context is important. This mixture of conflicting and complementary forces illustrates why generalizations about DB impact on DC plan design can oversimplify a highly nuanced subject.

Glide Path Risk and Reward Should Be Defined in Terms of Their Impact on Potential Participant Outcomes

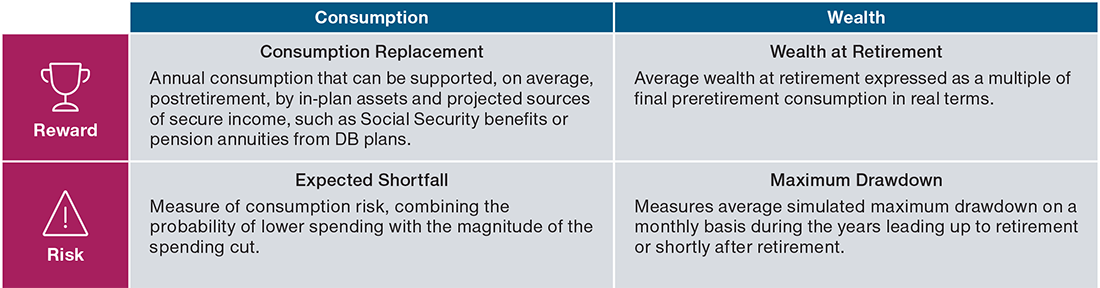

(Fig. 1) Key evaluation metrics

The Road Map: What to Expect From Our Research

While the reliance of most organizations on DC plans is well understood, what remains a critical area of discovery is whether plan sponsors are positioning their DC plan participants in ways that will increase their potential to meet their retirement objectives. We believe this question deserves further exploration.

This paper is the first installment in a series from T. Rowe Price that addresses key themes for organizations that have evolved their benefit structures. Our research effort is intended to cover a broad range of questions that we are often asked by our clients. These include:

- What impact should a DB plan have on DC glide path design?

- How should sponsors handle differences in DB plan eligibility (e.g., should they be open to all participants, frozen, closed to some participants, etc.) and benefit formulas within their participant base?

- Does the DC match formula matter?

However, these questions only scratch the surface of insights we hope to offer to plan sponsors winding their way through the complex maze of glide path suitability analysis.

Installment 2: Glide Path Evaluation Is Not an Easy Task

Glide path risk and reward should be defined in terms of the utility derived from both a participant’s retirement consumption and wealth (Figure 1), rather than simple market return and volatility metrics. Sponsors should focus on glide path suitability versus optimality (Figure 2), as preferences will vary across a participant population.

"Glide path risk and reward should be defined in terms of the utility derived from both a participant’s retirement consumption and wealth, rather than simple market return and volatility metrics."

To understand how DB plan coverage can impact the selection of a DC plan glide path, one must first have a framework for evaluating glide paths and retirement outcomes overall. Accordingly, the second installment in our series explores how T. Rowe Price analyzes retirement and investment trade‑offs—specifically, as they relate to a participant’s life cycle spanning the asset accumulation and decumulation phases.

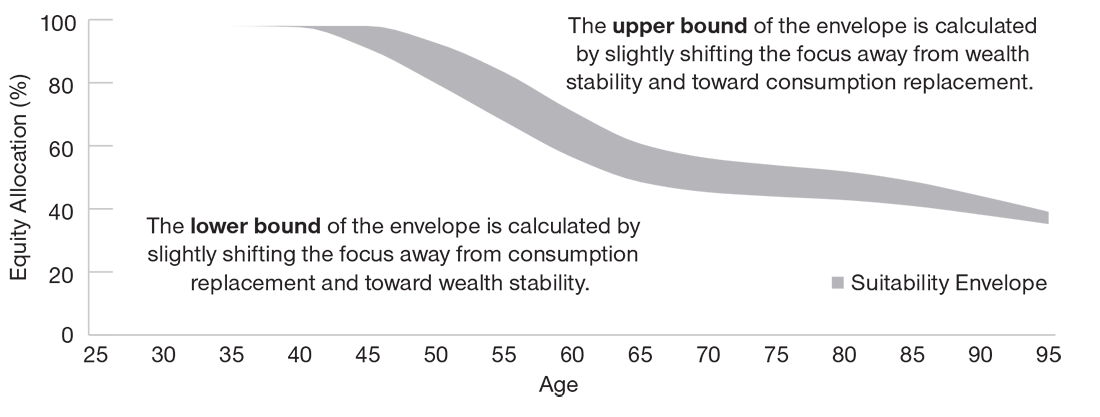

We describe our economic utility framework and explain why we believe the level and reliability of retirement income are both crucial to estimating potential retirement outcomes. Our framework considers sponsor preferences regarding trade‑offs between increased consumption replacement and decreased account balance variability.

Managing the Trade‑Off Between Consumption Replacement and Wealth Stability

(Fig. 2) A hypothetical glide path suitability envelope

Installment 3: Closed or Frozen DB Plans Present Unique Challenges

We believe that determining an appropriate glide path for all participants is possible, considering those without DB plan benefits alongside participants that have access to DB benefits.

"We believe that determining an appropriate glide path for all participants is possible, considering those without DB plan benefits alongside participants that have access to DB benefits."

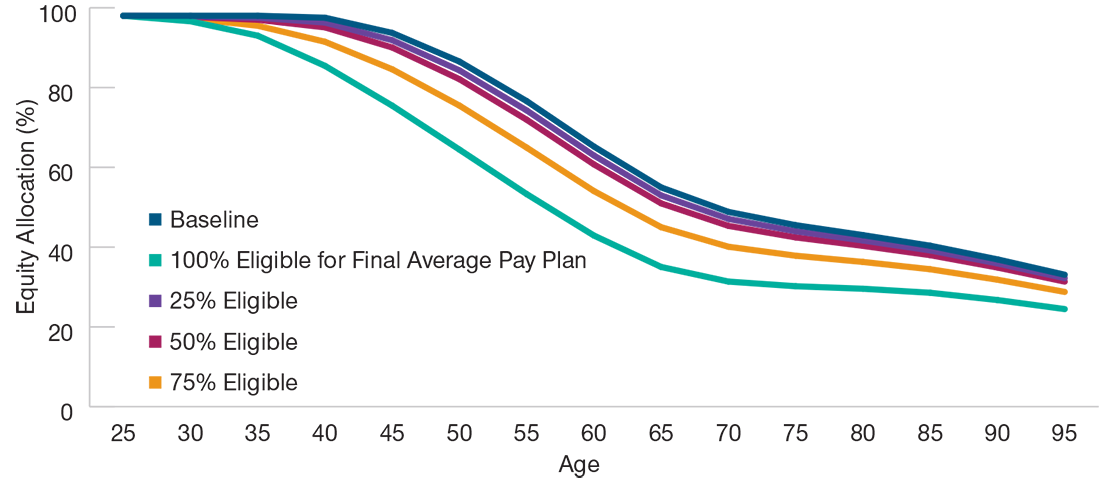

Many DB plan sponsors are managing closed and/or frozen plans. Even sponsors with ongoing DB plans may be considering closing or freezing those plans in the future. These situations offer relatively unique challenges for DC glide path evaluation and selection in that some participants may have legacy DB benefits while others likely will not (Figure 3). The third installment in our series of papers explores several questions surrounding this dynamic:

- How should a glide path be designed if it must cover both groups of DC participants—both those with and without DB plan coverage?

- Can a single DC glide path serve both cohorts well? Or should a plan sponsor focus on the potential outcomes of one specific group of participants?

- What could be the consequences for one cohort of DC participants if their DC allocations follow a glide path selected based on the characteristics of the other cohort?

How Glide Paths Can Change Based on Defined Benefit Eligibility

(Fig. 3) Hypothetical impacts of participant DB eligibility

Installment 4: Evaluating Opportunity Costs

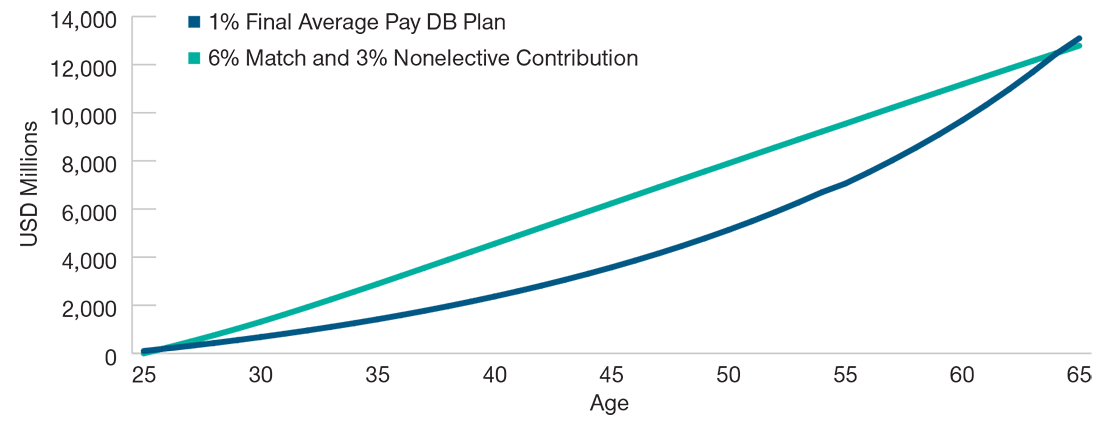

Because sponsors have finite budgets, offering a DB plan may come at the opportunity cost of less generous DC plan benefits (Figure 4). We think plan sponsors should evaluate the potential impact on QDIAs through this lens.

"Because sponsors have finite budgets, offering a DB plan may come at the opportunity cost of less generous DC plan benefits. We think plan sponsors should evaluate the potential impact on QDIAs through this lens."

The potential dichotomy between DB participants and nonparticipants naturally leads to another aspect of DB and DC interactivity. When sponsors make the decision to restrict DB plan benefits to new participants, they often enhance the DC benefit in some way to offset the loss of the DB plan. Stated differently, there often is a desire to improve the DC plan to make it equivalent or nearly equivalent to the discontinued DB benefit.

In the fourth installment of our series, we examine this substitution effect—how sponsoring a DB plan is often at the opportunity cost of not offering a richer DC plan. Does the existence of a DB plan make a participant wealthier, or should we control for this additional postretirement income before evaluating the outcomes that potentially could be provided by different glide paths? Is there something inherent about the DB benefit structure—typically an annuity based on pay—that changes the appropriateness of various DC glide paths?

DB Coverage May Pose Opportunity Costs for DC Plan Benefits

(Fig. 4) Hypothetical cumulative benefit costs for 10,000 25‑year‑old employees

Installment 5: Taking Specific DB Plan Features Into Account

Different DB plan designs provide different levels and patterns of consumption replacement in retirement, and these differences should be reflected accordingly in a glide path design.

"Different DB plan designs provide different levels and patterns of consumption replacement in retirement, and these differences should be reflected accordingly in a glide path design."

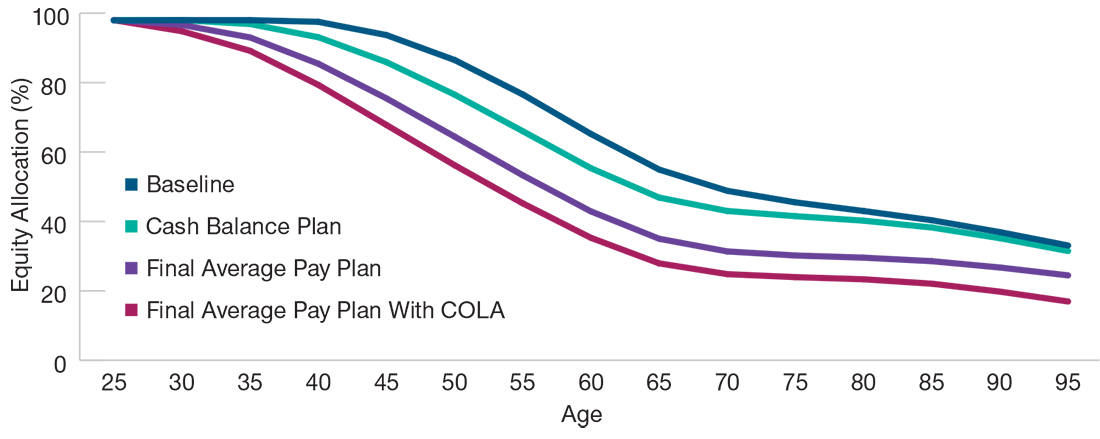

Broadly painting all DB plan designs with the same strokes results in oversimplification. DB plans vary by richness, by accrual structure, by their cost‑of‑living adjustments (COLAs), and by whether or not they offer early retirement subsidies—just to name a few potential features. Accrual patterns for cash balance plans are very different than for a final average pay (FAP) plan, for example.

A DB benefit that is adjusted for inflation in retirement—like those offered by many public plan sponsors—provides real income replacement akin to Social Security benefits, whereas an unadjusted DB benefit suffers from purchasing power deflation as participants age.

In the fifth installment of our series, we explore these DB benefit nuances and explain how we think they should be reflected in QDIA glide path evaluation and selection (Figure 5).

DB Plan Design Impacts the Suitability of DC Glide Paths

(Fig. 5) Centers of hypothetical suitability envelopes for different DB plan designs

Installment 6: Employer DC Plan Contributions Impact Glide Path Design

Employer contributions within DC plans can take many forms. Sponsors should consider these differences, along with varying employee savings behavior, in their assessments of glide path design.

"Employer contributions within DC plans can take many forms. Sponsors should consider these differences...in their assessments of glide path design."

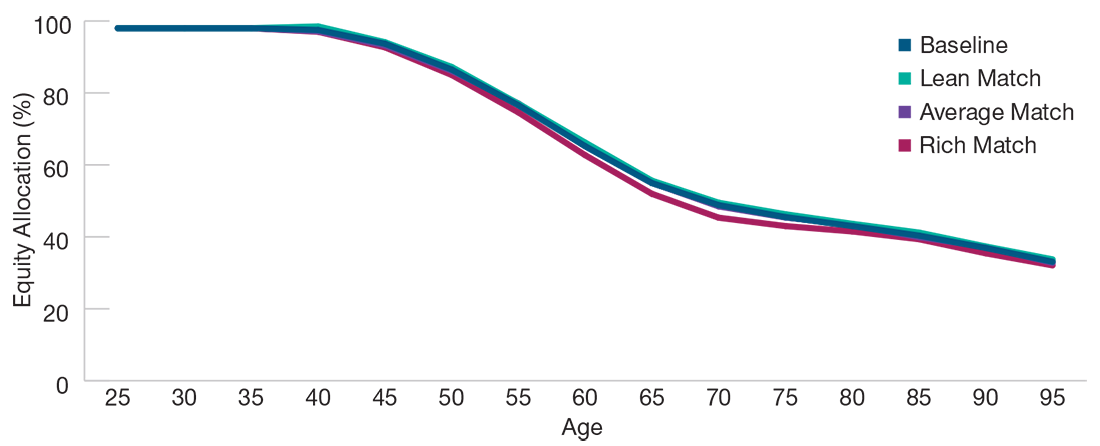

DC plans can have a variety of structures. Across our recordkeeping platform, we see plan designs with very generous employer matching contributions, no matches at all, discretionary profit sharing contributions, consistent nondiscretionary employer contributions, plans that have suspended their match, and everything in between.

In the sixth installment of our series, we discuss how the wealth provided by the employer portion of the DC plan can impact possible outcomes for participants following various glide paths (Figure 6).

Effects of Employer Generosity on Participant Savings Behavior Can Influence Glide Path Design

(Fig. 6) Employer match and its hypothetical glide path impact

Installment 7: The Potential Impact of DB Plans on Early Retirement

If a DB plan encourages employees to retire earlier than they otherwise would have, the DC plan glide path should anticipate this earlier transition from accumulation to decumulation.

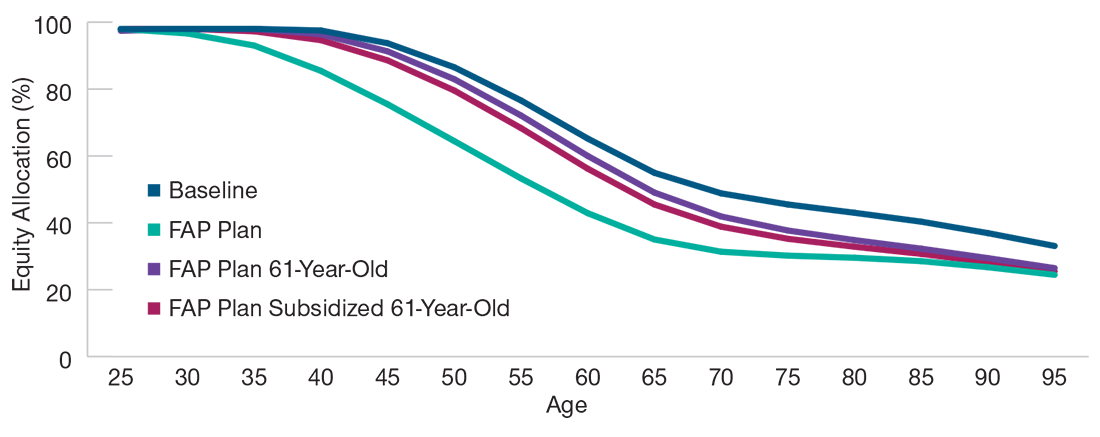

Our research indicates that participants that have DB plan benefits often retire earlier than the general population. This is particularly true when plans offer early retirement subsidies, providing a retirement benefit that is more valuable than the actuarially reduced benefit.

Many DC plan glide paths, including the ones offered by T. Rowe Price in our flagship commingled vehicles, are built on the assumption that participants will retire at a specific age, typically 65. An earlier retirement date impacts retirement savings and spending in several ways. Most obviously, the accumulation phase is shorter, while the decumulation phase is longer.

Less obviously, an early retiree also is likely to have a lower annual retirement liability—at least in nominal dollars—compared with a later retiree whose salary has continued to grow into their last few working years. In the seventh installment of our series, we plan to explore further the notion that DB plans often incentivize early retirement (Figure 7).

Varying Retirement Ages and Their Impact on Glide Path Design

(Fig. 7) Centers of hypothetical suitability envelopes for different retirement ages

Conclusions

We look forward to going on this journey with you. We hope the rigorous research captured in our papers provides actionable insights into the common retirement issues posed above. We hope our assessment of changing benefit structures will help plan sponsors make more informed decisions pertaining to QDIA evaluation and glide path suitability in the pursuit of successful retirement outcomes for participants.

We recognize that there are many DB plans and DB/DC combinations in use and that there are relevant, important topics we may not have listed here. Questions or suggestions for further issues to explore are welcome and encouraged.

Following the release of the first seven papers in this series, we plan to release an eighth installment addressing additional questions from plan sponsors and summarizing conversations sparked by the first seven installments. In addition, we plan to summarize our overall findings and direct sponsor attention to those aspects of their DC and DB plan interactions that we believe have the most overall impact on participant outcomes.