Market Review

- Global Markets Quarterly Update

- First Quarter 2022

- Key Insights

-

- Global fixed income and equity markets fell sharply in the first quarter as interest rate and inflation fears were compounded by Russia’s invasion of Ukraine.

- Despite the new uncertainties, most developed market central banks—with the notable exception of Japan—continued plans to gradually withdraw stimulus.

- The financial sanctions imposed on the Russian banking sector, as well as on the central bank and Ministry of Finance, have led to deep structural changes in Russia’s financial markets.

GET INSIGHTS FROM OUR EXPERTS

Receive timely market data and analysis to share with your clients.

Equity and fixed income markets pulled back sharply in the first quarter as interest rate and inflation fears were compounded by Russia’s invasion of Ukraine. The S&P 500 Index suffered its worst quarterly loss since the start of the pandemic, while the Bloomberg U.S. Aggregate Bond Index recorded its steepest decline since late 1980. All the major equity indexes fell more than 10% from recent highs, but a March rally pulled the broad S&P 500 Index, Dow Jones Industrial Average, and S&P MidCap 400 Index out of correction territory.

Fears that the Fed was “behind the curve” and would have to act aggressively to curb inflation weighed heavily on sentiment early in the quarter. The consumer price index rose 7.0% in December versus the year before, 7.5% in January, and 7.9% in February—the most since 1982. Breaking a recent pattern, however, February data did not surprise on the upside. Indeed, in a possible sign of peaking inflation, the pace of increase in the headline producer price index decelerated in February and the gain in core prices held steady with January. Nevertheless, the University of Michigan’s gauge of consumer sentiment hit a new decade low, with consumers continuing to cite inflation as a primary concern.

Growth Picks Up as Omicron Fades

Investors also worried about the impact of the omicron variant of the coronavirus as the year began, with data showing a sharp decline in spending in bars and restaurants. Retail spending rebounded in January, however, as online retailers and furniture stores saw large spending gains. An easing in omicron variant trends seemed to result in the economy regaining further momentum early in February, with IHS Markit’s composite gauge of service and manufacturing activity rebounding from an 18-month low. Services activity drove the rebound, but manufacturing output also improved, benefiting from a slight improvement in supply bottlenecks. Durable goods orders fell 2.2% in February, however, the first decline in five months. Conversely, the labor market remained robust throughout the quarter. Continuing claims for unemployment insurance fell to a 52-year low, while job openings hit a record high.

Warnings from U.S. and Ukrainian officials in mid-February that Russia was preparing to attack upended growth and inflation expectations, and the breadth of the invasion that began on February 24 took investors further by surprise. News of attacks on the Ukrainian capital, Kyiv, and other major cities sent stocks sharply lower—at its low at the start of trading on February 24, the S&P 500 Index hit 4,115, roughly 15.5% below its peak at the start of the year and firmly in correction territory.

Fed Stays Course Despite Russian Invasion

The strong sanctions on Russia that followed raised concerns about supply chains already stressed by the coronavirus. On March 8, the White House announced that the U.S. was cutting off all oil imports from Russia, while European countries adopted less stringent measures (see below). In response, oil prices surged to their highest level in a decade, while prices of other commodities rose as well in anticipation of falling Russian supply. Russia’s threat to ban nickel exports—it is the source of over 9% of the world’s supply—caused prices to double before trading was halted on the London Metal Exchange.

Despite the new source of fragility in the global economy, Fed officials communicated their resolve to act quickly to head off inflationary pressures, which they acknowledged were no longer “transitory.” Shorter-term Treasury note yields increased sharply in March as investors began to anticipate official short-term rates rising by around 175 basis points (1.75 percentage points) in 2022—an expectation confirmed by the official “dot plot” survey of policymakers’ expectations. Fed officials increased rates by a quarter point following their March meeting, their first hike since 2018.

Shares in Europe fell sharply under pressure from Russia’s invasion of Ukraine, high inflation, and the prospect of tighter monetary policy. In local currency terms, the pan-European STOXX Europe 600 Index ended about 6.6% lower. Major indexes in Germany, France, and Italy also pulled back. The UK’s FTSE 100 Index gained ground, on the other hand, aided in part by the pound’s weakness relative to the U.S. dollar. A weaker pound lends support to the index because many of its companies are multinationals with overseas revenues.

EU and UK Impose Tough Sanctions on Russia

The European Union (EU) and the UK joined the U.S. in imposing sanctions on Russia for invading Ukraine, curtailing Russian access to their capital markets and financial system. Some Russian banks, for example, were cut off from the Society for Worldwide Interbank Financial Telecommunication (SWIFT) payments messaging system. The EU also closed its airspace to Russia, tightened export controls on high-end technology, and took steps to freeze some assets of President Vladimir Putin and Foreign Minister Sergei Lavrov, among others. However, the EU stopped short of banning Russian energy imports, unlike the UK, which said it would phase out its oil and gas purchases from the country by year-end. Many large European companies said they would limit, freeze, or exit business with Russia. The London Stock Exchange excluded all Russian businesses from stock market indexes. At the end of March, Putin decreed that foreign buyers must pay for Russian natural gas in rubles, raising concerns about possible supply disruptions in Europe and the potential economic implications.

ECB to Scale Back Asset Purchases as Inflation Surges

Elevated inflation expectations prompted the European Central Bank (ECB) to stick to its intention of withdrawing economic stimulus. The ECB indicated in March that it could end its asset purchase program in the third quarter rather than at the end of the year. However, the bank also said that because of the heightened uncertainty, it could revise the schedule to reflect how the macroeconomic situation evolves. ECB President Christine Lagarde stressed that any change in interest rates would be “data dependent,” acknowledging that a move could happen a week or several months after the bond purchases cease. Policymakers appeared to grow more cautious about the outlook later in the month as fighting continued in Ukraine. Lagarde warned that “the longer the war lasts, the higher the economic costs will be and the greater the likelihood we end up in more adverse scenarios.”

Russia’s invasion of Ukraine appeared to boost eurozone inflation, with the preliminary estimate for March coming in at an annual rate of 7.5%. As the economy recovered from the lifting of coronavirus lockdowns, the labor market continued to tighten, with the unemployment rate falling to to a record low of 6.8% in February. However, a slump in business and consumer confidence indicated fear that a recession might be looming.

BoE Raises Interest Rates Three Times in a Row

The Bank of England (BoE) raised its key interest rate in February and March, aiming to curb inflation that it now expects to reach 8% by the end of June, in part due to Russia’s invasion of Ukraine. Markets judged the statement accompanying the March increase to be more dovish. “Some further modest tightening in monetary policy” might be needed over the coming months, the BoE asserted, while also acknowledging that “there were risks on both sides of that judgment depending on how medium-term prospects evolved.”

Japanese equities fell slightly in local currency terms during the quarter, but a 5% drop in the yen versus the U.S. dollar exacerbated losses to U.S. investors. Early in the three-month period, concerns about more aggressive monetary policy tightening by the U.S. Federal Reserve weighed on sentiment. These concerns lingered, and risk appetite suffered further as Russia invaded Ukraine in late February. In response to the ongoing conflict, the international community imposed tough sanctions on Russia—potentially hampering the global growth outlook—and commodity prices soared, exerting upward pressure on inflation. Losses were cushioned by the Bank of Japan’s (BoJ’s) continued commitment to its accommodative monetary policy, which sets it apart from other developed market central banks that are raising short-term interest rates and scaling back stimulus. The lifting of all domestic coronavirus restrictions provided a further boost.

Against the backdrop of monetary policy divergence, the yen weakened to around JPY 121.69 against the U.S. dollar, its lowest level in over six years, from 115.11 at the end of the previous quarter. The yield on the 10-year Japanese government bond rose to 0.22%, from the prior quarter-end’s 0.07%. It briefly reached the 0.25% ceiling the BoJ tries to impose in the pursuit of its policy of yield curve control, prompting the central bank to unleash a series of bond purchase operations that appeared to be enough to stabilize the yield curve.

On the data front, Japan’s economic growth in the fourth quarter of 2021 was downgraded to an annualized 4.6%, from 5.4%, on a smaller rise in private demand. Sentiment among big Japanese manufacturers fell in the first quarter for the first time since the outbreak of the coronavirus pandemic, the BoJ’s Tankan survey of business confidence showed.

Government Acts to Cushion Impact of Russian-Ukraine Conflict on Domestic Economy

In response to Russia’s initial infringement of Ukraine’s sovereignty and territorial integrity, whereby it recognized as independent the eastern breakaway regions of Donetsk and Luhansk and authorized the sending in of troops, Japan adopted a series of sanctions, addressing the issue in cooperation with the international community. Prime Minister Fumio Kishida said that the government would cooperate with the private sector to limit the impact on small and medium-sized companies and financial institutions. He also said that Japan had enough oil and gas reserves to cushion any short-term blow to energy supplies and that the government would implement measures to limit the impact of further oil price increases. In late March, Kishida said that the government would begin work as soon as possible on additional measures to boost the economy.

BoJ Stays on Dovish Course, Remains Committed to Meeting Inflation Target in Sustainable Manner

Although Japan’s core consumer price inflation remains muted, the country’s producer price index rose 9.3% in February from a year earlier—the steepest gain on record—driven primarily by higher energy prices. BoJ Governor Haruhiko Kuroda said that it was inappropriate to tighten monetary policy or withdraw stimulus, signaling that the central bank is staying on its dovish course despite soaring fuel costs exerting upward pressure on the price of goods traded between companies.

Weakness in Chinese stocks contributed to the worst quarter for Asian stock markets since the pandemic-driven downturn in early 2020. For the quarter ended March, the MSCI China Index fell 14.2% and the MSCI China A Onshore Index sank 14.7% in U.S. dollar terms. Tighter U.S. monetary policy, geopolitical tensions, China’s ongoing property sector downturn, and outbreaks of the highly contagious omicron variant of the coronavirus fueled the declines.

At the annual session of the National People’s Congress, China set a gross domestic product growth goal of “about 5.5%” for 2022, a target at the higher end of many economists’ forecasts and one that suggested that Beijing would step up stimulus while delaying structural reforms. Indeed, top officials later pledged to do more to stabilize financial markets and boost economic growth. China’s gross domestic product expanded at a better-than-expected 4% in the fourth quarter of 2021 and 8% for the full year, driven by record exports.

SEC Threatens Delistings

In March, the U.S. Securities and Exchange Commission (SEC) added six Chinese names to its provisional list of companies facing possible delisting from U.S. exchanges if they failed to comply with U.S. audit requirements. Washington has demanded full access to the books of U.S.-listed Chinese companies, but Beijing has refused to allow foreign inspection of auditing reports from local accounting firms. Recently, Chinese officials have signaled that they were willing to compromise to resolve the dispute.

Omicron Disrupts Production

In economic news, combined economic data releases for January and February for retail sales, industrial production, and fixed asset investment handily beat expectations. However, China’s official Purchasing Managers’ Index (PMI) readings weakened in March as omicron-related outbreaks in many cities led to lockdowns and disrupted industrial production. Both the manufacturing and services PMI readings lagged economists’ forecasts and came in below 50, indicating contraction. Earlier in the quarter, the Caixin China manufacturing PMI, a private survey that focuses on small private businesses, fell in January to its lowest level since February 2020 as production and new orders contracted.

In property sector news, reports of more defaults and credit ratings downgrades among China’s cash-strapped property companies continued to keep investors on edge, as well as announcements of delayed earnings releases by some companies.

New COVID-19 cases in China surged to over 100,000 in March, leading to renewed lockdowns in a few cities, including the financial center of Shanghai. China economists have begun to lower their 2022 economic growth forecasts due to the resurgent pandemic and the government’s zero-tolerance approach to the coronavirus.

Russia’s Stock Market Closes After Invasion

Russian assets declined as the Russian government massed military forces along Ukraine’s border yet insisted that it had no intention of invading. Toward the end of February, the government formally recognized two breakaway republics in eastern Ukraine as independent states. Russian President Vladimir Putin also dispatched “peacekeeping” troops into those breakaway regions; shortly thereafter, he ordered a “special military operation” to “demilitarize” Ukraine.

Various nations around the world condemned Russia’s actions and immediately implemented new sanctions in response, targeting a number of key Russian individuals and institutions. They also decided to cut off several Russian banks from the SWIFT system, an international banking and messaging network.

In response to a crash in the ruble versus the U.S. dollar, the Russian central bank boosted short-term interest rates to 20% and took other actions to try to soften the economic impact. The Russian stock market closed starting on February 28 but reopened partially on March 24, whereas the bond market closed for only a few days. Banks and the foreign exchange (FX) market remained open.

The financial sanctions imposed on the Russian banking sector, as well as on the central bank and Ministry of Finance, have led to deep structural changes in the Russian financial markets, according to T. Rowe Price sovereign analyst Peter Botoucharov. The Russian ruble is now a nonconvertible currency, which means no foreign residents can buy or sell rubles, so FX trading is essentially restricted to the clearing of trade flows (i.e., U.S. dollars or euros that are paid for energy and commodities). Similarly, because local bonds are denominated in rubles, trading in Russian government bonds has been very limited. In light of these tight limits on trading, many consider the Russian financial markets to be “uninvestable,” and a number of index providers have decided to remove Russian assets from their equity, fixed income, and emerging markets indexes.

While some expected that the Russian army would quickly overwhelm and overrun the country, Ukrainian resistance largely stalled the invading army’s advance. There were a number of meetings between Russian and Ukrainian representatives that raised hopes for the conflict to end with a diplomatic solution. As of the end of March, however, a ceasefire agreement remained elusive, and Russian attacks caused widespread damage, as well as the displacement of about 4 million refugees, according to United Nations data.

Stocks Jump in Peru

Peruvian stocks, as measured by MSCI, returned 34.90% in the first quarter versus -6.92% for the MSCI Emerging Markets Index. Thanks in part to rising commodity prices, the resource-rich Latin America region was somewhat insulated from the geopolitical turmoil in emerging Europe. Peruvian assets also performed well despite ongoing political uncertainty.

President Pedro Castillo has been in office for less than one year, and his administration has been impacted by several scandals that have forced him to dismiss, reshuffle, or accept the resignation of various cabinet ministers. His fourth and current cabinet, led by Prime Minister Anibal Torres, narrowly won a vote of confidence from the legislature in early March. Peru’s Congress has been hesitant to vote against Castillo’s cabinet selections because the loss of two confidence votes could lead to a dissolution of Congress and snap elections.

Also, Castillo has already survived two impeachment attempts. The most recent one, which took place in March, stemmed in part from growing evidence that he participated in a corruption ring that led to the improper granting of a state contract to a consortium for the construction of a bridge, as well as to the purchase of biodiesel from a petrochemical company.

The March 28 vote in the unicameral legislature was 55 in favor of impeachment, 54 against, and 19 abstentions. While additional impeachment attempts are possible, T. Rowe Price emerging markets sovereign analyst Aaron Gifford believes it will be difficult for lawmakers to reach the two-thirds (87 of 130) threshold without support from more deputies from centrist and leftist political parties. In any event, Gifford believes that the political climate in Peru will remain tense and that gridlock will hinder the government’s efforts to pass legislation or implement radical policies.

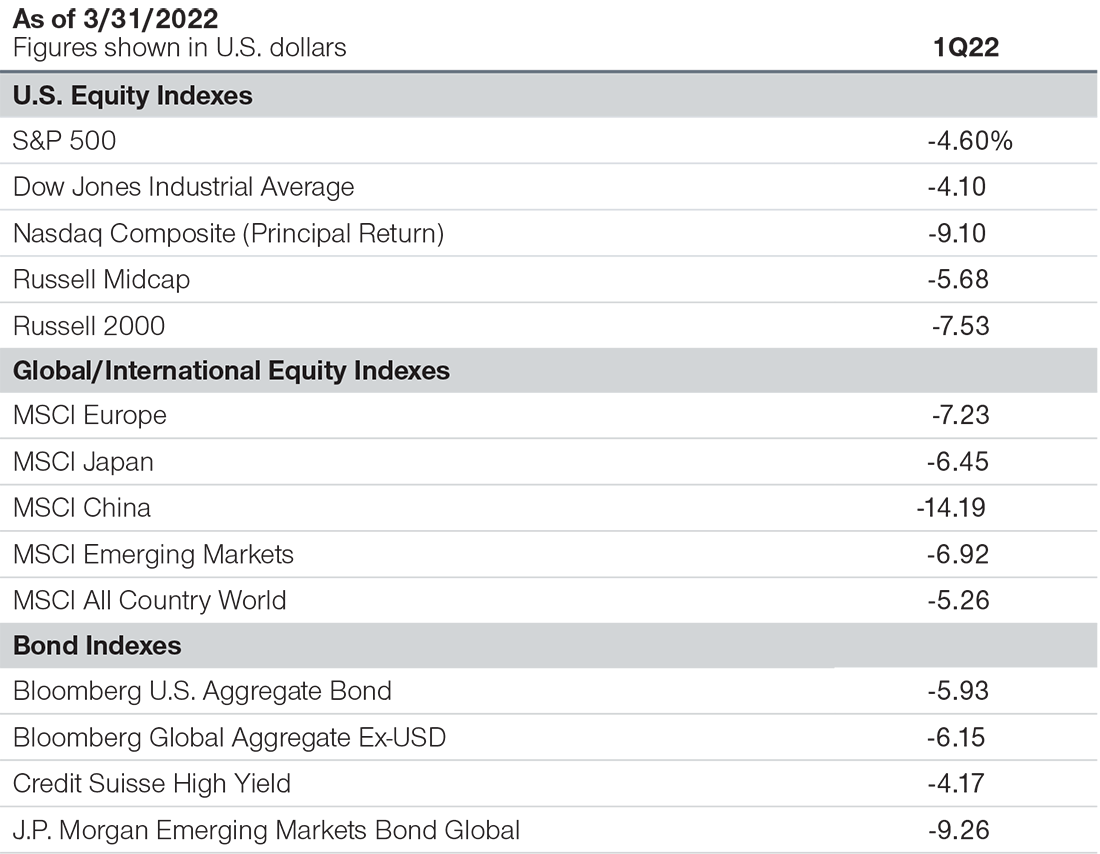

Major Index Returns

Total returns unless noted

Past performance is not a reliable indicator of future performance.

Note: Returns are for the periods ended March 31, 2022. The returns include dividends and interest income based on data supplied by third‑party provider RIMES and compiled by T. Rowe Price, except for the Nasdaq Composite Index, whose return is principal only.

Sources: Standard & Poor’s, LSE Group, Bloomberg Barclays, MSCI, Credit Suisse, Dow Jones, and J.P. Morgan (see Additional Disclosures).

The four-decade bull market for bonds, supported by low inflation and declining rates, may finally be coming to an end. For bond investors, this is a particularly precarious time given heightened rate sensitivity through heavy weightings in longer-dated securities that offer low yields and, therefore, provide little income to help offset capital losses as rates rise.

For the Fed, the tables have also turned. In recent years, the U.S. Federal Reserve has enjoyed the luxury of easing aggressively to counter multiple crises while not stoking inflation. Due to exogenous factors impacting supply—in particular, COVID and the war in Ukraine—inflation has now spiked higher and forced the Fed into a battle that they haven’t had to fight in decades. The market seems to agree that the Fed will remain steadfast in its campaign over the course of this year. Ironically, however, both the Fed and the market see the need for lower policy rates as soon as 2024, meaning bonds may not be out of favor for long.

While the world has been battling to overcome the impact of something to the scale not seen since the influenza pandemic of 1918, we are facing new challenges that may have similarly distant precedents in history. COVID variants have extended supply chain issues and stoked higher inflation, defying expectations just a few months ago that these issues would be transient. Unfortunately, the invasion of Ukraine in Europe—the military scale of which has not seen since 1939—has exacerbated inflation risks and economic uncertainty. The narrative today has quickly turned to fears of “stagflation” with comparisons being made to the oil embargo of 1973 in the U.S. that led to runaway inflation, unprecedented rate hikes, and a recession.

While the world is very different today and some of the challenges are distinct, history can repeat itself. Although stagflation is not our base case, and we remain hopeful for a resolution in Ukraine, the potential for low-probability, tail risk events is heightened and warrants caution.

THE IN-DEPTH MARKET DETAILS YOU NEED

Subscribe to regular email updates and inform your client conversations.

-

Additional Disclosures

The S&P 500 Index is a product of S&P Dow Jones Indices LLC, a division of S&P Global, or its affiliates (“SPDJI”) and has been licensed for use by T. Rowe Price. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC, a division of S&P Global (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); T. Rowe Price is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500 Index.

London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2022. FTSE Russell is a trading name of certain of the LSE Group companies. “Russell®” is a trade mark(s) of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The LSE Group is not responsible for the formatting or configuration of this material or for any inaccuracy in T. Rowe Price Associates’ presentation thereof.

MSCI and its affiliates and third party sources and providers (collectively, “MSCI”) makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. Historical MSCI data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

“Bloomberg®” and Bloomberg U.S. Aggregate Bond, Bloomberg Global Aggregate Ex‑USD are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the index (collectively, “Bloomberg”) and have been licensed for use for certain purposes by T. Rowe Price. Bloomberg is not affiliated with T. Rowe Price, and Bloomberg does not approve, endorse, review, or recommend its products. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to its products.

© 2022 CREDIT SUISSE GROUP AG and/or its affiliates. All rights reserved.

Information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The index is used with permission. The Index may not be copied, used, or distributed without J.P. Morgan’s prior written approval. Copyright © 2022, J.P. Morgan Chase & Co. All rights reserved.

Important Information

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy. Actual future outcomes may differ materially from estimates or any forward-looking statement provided.

Past performance is not a reliable indicator of future performance. All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc., distributor, T. Rowe Price Associates, Inc., investment adviser, and T. Rowe Price Investment Management, Inc., investment adviser.

© 2022 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.