- On U.S. Equities

- Why Valuations and Dividends Matter

- An emphasis on fundamentals is key to identifying opportunities.

- 2022-03-24 18:54

- Key Insights

-

- Despite macro‑level uncertainties, we believe that the relative setup for value and dividend‑paying stocks appears favorable for long‑term investors.

- A deep understanding of individual companies and industries is critical to finding possible opportunities among inexpensive and higher‑yielding stocks.

- Our financials and utilities holdings exemplify this marriage of valuation discipline with our rigorous analysis of long‑term business fundamentals.

From our vantage point, the near‑term outlook for U.S. equities appears as murky as ever. Macro uncertainties abound, from the trajectory of the coronavirus pandemic and the duration of inflationary pressures to the ramifications of Russia’s invasion of Ukraine and the extent to which the Federal Reserve plans to tighten monetary policy. How these factors play out are likely to influence stock market returns in 2022.

"...dividends could become a more important component of equity performance."

Our disciplined, fundamentals‑driven approach is not immune to near‑term fluctuations in the broader market. However, we believe that value‑oriented stocks could benefit, on a relative basis, in an investment environment where extended valuations may be a concern for longer‑duration growth stocks. And if elevated valuations presage a period of lower returns for the stock market, dividends1 could become a more important component of equity performance.

With or without these potential style‑ and factor‑related2 tailwinds, we remain steadfast in our belief that rigorous fundamental analysis of individual companies and a deep understanding of industry‑level dynamics can help us to identify potentially mispriced stocks that could offer a compelling risk/reward profile over a longer time frame.

For us, it’s not enough for a stock to trade at a low valuation multiple or to offer the prospect of an above‑market dividend yield. We prize names where we see these qualities and possible drivers that could change the prevailing narrative and help to narrow the discount at which the stock trades to our view of its intrinsic value. Our investments in financials and utilities exemplify this marriage of valuation discipline with our rigorous analysis of a company’s long‑term business prospects.

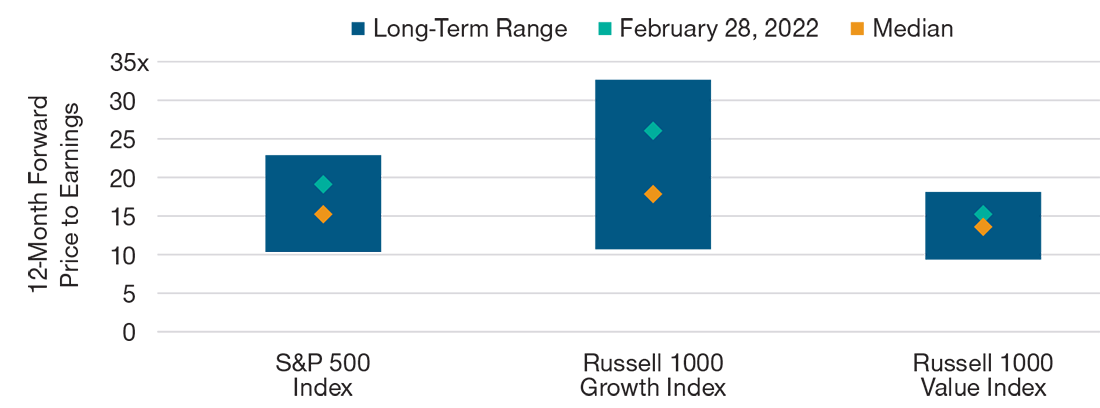

Value Stocks Look Appealing Relative to Their Growth Counterparts

(Fig. 1) 12‑month forward price to earnings vs. history

Twenty years ended February 28, 2022. Value is represented by the Russell 1000 Value Index and Growth is represented by the Russell 1000 Growth Index.

Source: T. Rowe Price analysis using data and analytics provided by FactSet Research Systems, Inc. All rights reserved. See Additional Disclosures. Actual outcomes may differ materially from forward estimates.

Valuation Matters for Growth and Value Stocks

We would characterize the past few years as an abnormal environment in which the economic disruptions produced by the coronavirus pandemic and the extraordinarily accommodative policies pursued by the Fed and other central banks contributed to significant dislocations in the stock market.

Chief among these excesses was what we regard as a lack of valuation discipline, especially when it comes to high‑flying names exposed to popular growth themes. With the market awash in liquidity from fiscal and monetary stimulus, the low risk‑free rate of return3 encouraged speculative behavior and a willingness to pay higher near‑term valuations for longer‑dated cash flows. And when the broader market trades at an elevated valuation, that, in turn, can provide a justification for paying more for other growth stocks on the grounds that they look inexpensive relative to the market. But high valuations typically carry heightened expectations, creating the risk of meaningful volatility if a company suffers an earnings hiccup or other setback.

"...elevated inflation and the prospect of the Fed raising interest rates could instill some valuation discipline and refocus the market’s attention on business fundamentals."

We believe that elevated inflation and the prospect of the Fed raising interest rates could instill some valuation discipline and refocus the market’s attention on business fundamentals. Growth stocks are often viewed as longer‑duration assets because the emphasis is on the potential upside to future cash flows, arguably making them vulnerable to rising interest rates.

The setup in large‑cap value stocks strikes us as less compelling than in fall 2020, as optimism for economic normalization has closed some of the most extreme divergences. Nevertheless, the value factor’s decade of underperformance versus growth, as well as its relative valuation, may lend further support to this reversal, in our view (Figure 1). On a relative basis, we regard the near‑term environment as potentially more challenging for growth stocks.

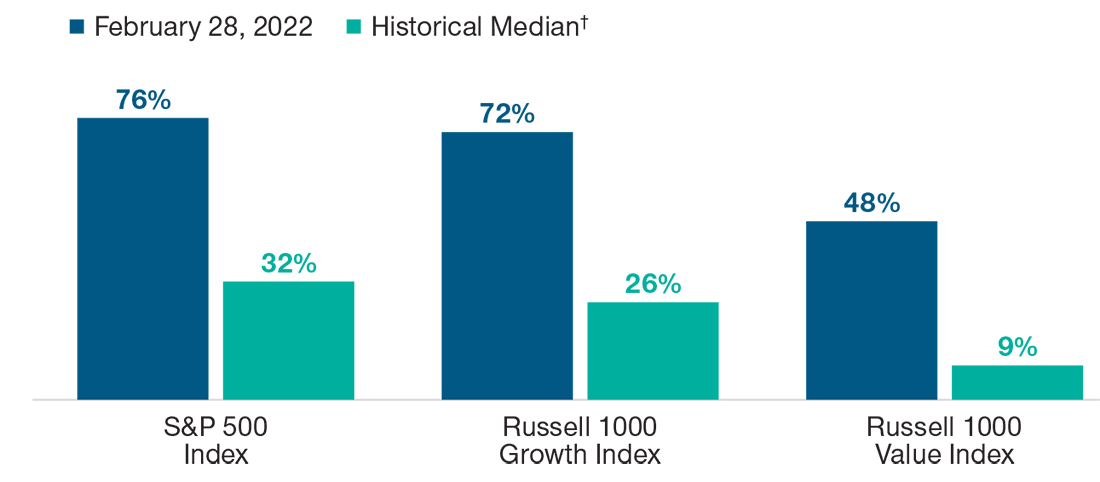

A Favorable Backdrop for Dividend Payers?

Entry prices matter to investment returns, especially over the long term. Historical market data show that when the S&P 500 was priced at higher valuation multiples, the large-cap index’s annualized returns over the subsequent decade were muted (Figure 2).

Elevated Valuations May Indicate Potential for Lower Future Returns

(Fig. 2) S&P 500 12‑month forward price to earnings vs. subsequent 10‑year return

Valuations are for the 20 years ended February 28, 2012, rolled monthly. Total returns are through February 28, 2022.

**Depicts where the S&P 500 12-month forward price-to-earnings falls on the line of best fit. The line of best fit is based on historical data. This is not to be considered a specific estimate of future returns and is for illustrative purposes only. Actual outcomes may differ materially.

Past performance is not a reliable indicator of future performance.

Source: T. Rowe Price analysis using data and analytics provided by FactSet Research Systems, Inc. All rights reserved. See Additional Disclosures.

Periods of lower equity market returns can boost the appeal of stocks that historically have paid an above‑average dividend yield, as dividends may represent a larger component of total returns. Across growth and value style factors recently, the market appears to ascribe little relative value to higher‑yielding large‑cap equities, especially relative to historical levels (Figure 3). We believe that this dislocation could create a favorable setup for equities with higher dividend yields or, at the very least, make for a potentially fruitful hunting ground for value‑oriented investors.

Lower‑Yielding Equities Trading at Elevated Valuations vs. Higher‑Yielding Peers

(Fig. 3) Median P/E* Ratio of Lowest‑Yielding Quintile Divided by Highest‑Yielding Quintile

Past performance is not a reliable indicator of future performance.

*Twelve-month forward price-to-earnings ratio.

† January 31, 1990, to February 28, 2022, monthly observations.

Source: T. Rowe Price analysis using data and analytics provided by FactSet Research Systems, Inc. All rights reserved. See Additional Disclosures. Actual outcomes may differ materially from forward estimates.

Stocks in each index are sorted each month based on dividend yield and then divided into quintiles. Dividend yield is the most recent dividend payment, annualized and divided by the stock price.

What about the risk that inflation and rising interest rates could erode the value of future dividends? In our view, this headwind applies more to stocks where dividend yield historically has accounted for the bulk of the total return. Although we appreciate the appeal of an above‑average dividend yield, our primary focus is on identifying valuation anomalies that could create the potential for price appreciation as the market comes around to a company’s qualities. The fund’s exposure to cyclical businesses could also help to offset this headwind.

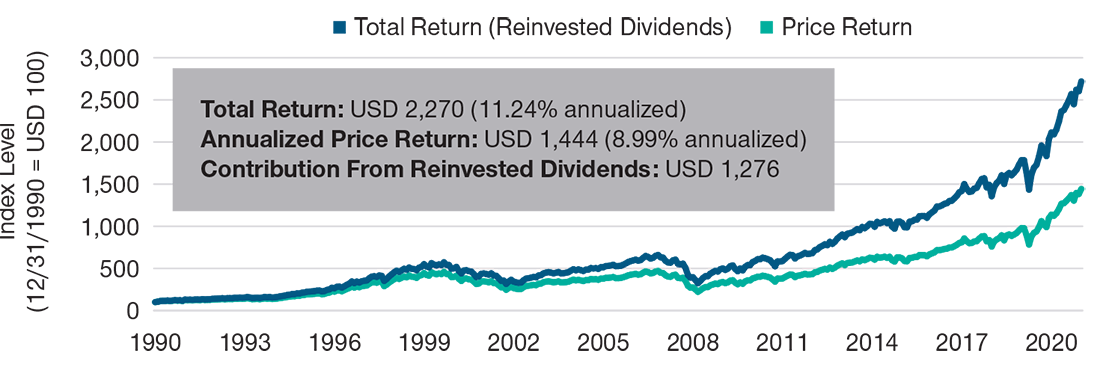

Near‑term considerations aside, reinvested dividends historically have accounted for a meaningful proportion of the total return generated by equities over longer time frames (Figure 4).

Fundamental Analysis: Key to Unlocking Potential Value

A low valuation or an above‑average dividend yield are not sufficient reasons to invest in a stock, in our view. Not all cheap or high‑yielding equities are misunderstood by the market. For example, a company’s business might be at risk of secular disruption or there may be questions about the sustainability of its cash flows or current dividend rate.

"We are not looking for the cheapest or highest-yielding stocks; we are looking for the most compellingly valued names relative to our view of their long-term prospects."

We think of ourselves as informed contrarians. Our nuanced approach pursues companies that trade at a discount to our view of their intrinsic value, often because the market does not appear to have priced in the potential for improvements in the underlying business. We are not looking for the cheapest or highest‑yielding stocks; we are looking for the most compellingly valued names relative to our view of their long-term prospects.

Our investment thesis for longtime holding Qualcomm, for instance, does not rest solely on what we regard as the chipmaker’s undemanding valuation or the stock’s dividend yield. Although Apple’s plan to start producing its own modem chips could be a headwind, we believe that the market does not fully appreciate the extent to which Qualcomm could benefit over the long term from other competitors exiting the market for key components used in 5G‑enabled smartphones. The proliferation of connected devices in a so‑called Internet of Things could be another possible tailwind, in our view.

Dividends Have Contributed Meaningfully to Long‑Term Total Returns

(Fig. 4) S&P 500 Index Price Appreciation vs. Total Return

December 31, 1990, to December 31, 2021.

Past performance is not a reliable indicator of future performance.

Index performance is for illustrative purposes only and is not indicative of any specific investment. It does not reflect the deduction of fees or other costs associated with an actual investment.Investors cannot invest directly in an index.

Source: T. Rowe Price analysis using data and analytics provided by FactSet Research Systems, Inc. All rights reserved. See Additional Disclosures

The financials sector is an area where we are finding compelling values and potentially attractive dividend yields. Although banks’ net interest margins4 typically expand in a rising‑rate environment, we favor investments where the potential upside resides in company‑specific factors that could play out regardless of the Fed’s monetary policy decisions. In the case of Wells Fargo, we believe that the company has several levers it could pull to reduce costs and improve its overall efficiency. If this multiyear self‑help effort bears fruit, we see the possibility for the company’s valuation to approach those of its peers.

We are also drawn to utilities, a traditional dividend‑paying sector that we view as a likely secular winner in the energy transition away from fossil fuels. Here, our highest‑conviction holdings are names, such as Georgia‑based Southern Company, that we believe can grow their rate base5 at a steady clip and may be viewed more favorably by the market if they surmount certain company‑specific challenges.

Fundamental analysis is critical to identifying potential upside catalysts that may not have surfaced in the narrative surrounding a company or in its quarterly financial metrics. In some instances, these improvements take place incrementally. We spend a lot of time and effort evaluating corporate management teams and their strategies, with an emphasis on their understanding of the competitive environment and how they might allocate capital to unlock value.

Although market volatility can be painful, these fluctuations can also create opportunities for value‑oriented investors. We remain focused on fundamentals as we seek to identify near‑term valuation anomalies where we believe that the market does not fully appreciate a company’s business prospects.

-

Securities mentioned in this material have the following weightings in the Equity Income Fund as of February 28, 2022: Qualcomm 2.78%, Wells Fargo 3.81%, and Southern Company 2.70%.

1 Dividends are not guaranteed and are subject to change.

2 Factors are quantifiable characteristics that can explain differences in stock returns.

3 A theoretical return of an investment with zero risk. This metric, often tied to U.S. Treasury yields, is a rate against which other returns are measured.

4 Net interest margin is the spread between the rate a financial institution generates on its loan products and the rate it pays on deposit accounts.

5 Rate base is the net value of a utility’s plant, property, and equipment on which it can earn a return.

-

Additional Disclosures

The S&P 500 Index is a product of S&P Dow Jones Indices LLC, a division of S&P Global, or its affiliates (“SPDJI”) and has been licensed for use by T. Rowe Price. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC, a division of S&P Global (“S&P”); DowJones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). T. Rowe Price is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500 Index.

Copyright © 2022, S&P Global Market Intelligence (and its affiliates, as applicable). Reproduction of any information, data or material, including ratings (“Content”) in any form is prohibited except with the prior written permission of the relevant party. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content. A reference to a particular investment or security, a rating or any observation concerning an investment that is part of the Content is not a recommendation to buy, sell or hold such investment or security, does not address the suitability of an investment or security and should not be relied on as investment advice. Credit ratings are statements of opinions and are not statements of fact.

London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2022. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

Important Information

Call 1-800-225-5132 to request a prospectus or summary prospectus; each includes investment objectives, risks, fees, expenses, and other information you should read and consider carefully before investing.

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are those of the authors as of March 2022 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

The fund is subject to market risk, as well as risks associated with unfavorable currency exchange rates and political economic uncertainty abroad. The value approach to investing carries the risk that the market will not recognize a security’s intrinsic value for a long time or that a stock judged to be undervalued may actually be appropriately priced. The fund’s value investing style may become out of favor, which may result in periods of underperformance.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy.

Past performance is not a reliable indicator of future performance. All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc.

© 2022 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.