- On Economics

- Reports of a Looming Recession May Be Exaggerated

- The global economy is probably more resilient than you think.

- 2022-03-09 20:52

Over the past few months, it has seemed like economists have been in a race with interest rate markets to see who can be fastest to change their monetary policy outlook. As interest rates go up and central banks indicate that indeed they will accelerate the pace of monetary tightening, predictions of a recession are starting to make a comeback.

With the U.S. Federal Reserve expected to hike rates up to seven times in 2022 and begin a balance sheet runoff, it is not difficult to see why some investors are worried about the spectre of overtightening—while inflation remains elevated, the Fed and other leading central banks are unlikely to become more dovish. Yet while this may lead to a very bumpy ride through the first half of this year, I think predictions of a recession in 2023 are premature.

Why a Global Recession is Unlikely

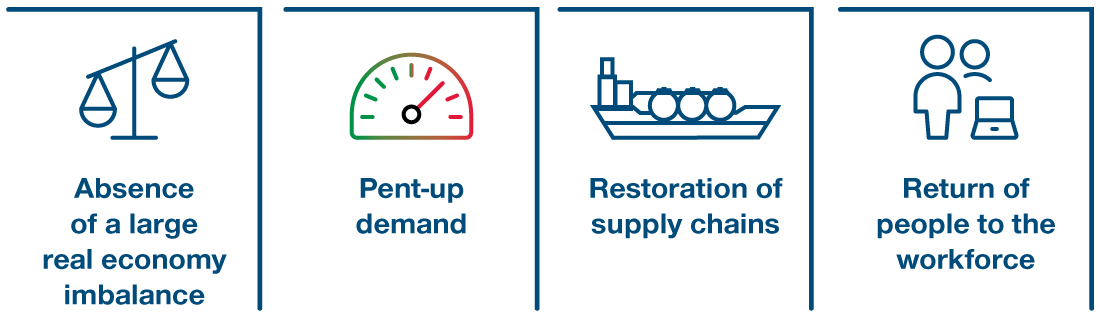

Four key factors shaping a more benign outlook

Four Headwinds to Growth

The global economy faces several headwinds that I expect will hit growth hard over the coming months. First, inflation has been rising faster than wages, causing real income growth to flatline across the major regions of the world. Unsurprisingly, retail sales indicate that consumers have lost their mojo. Given the additional pressures of broad‑based inflation and rising oil prices, this headwind appears likely to continue over the next quarter or two.

"The global economy faces several headwinds that I expect will hit growth hard...."

Second, fiscal consolidation will deliver another blow to U.S. households’ incomes as the failure to pass the Build Back Better fiscal package will see the expiration of the Child Tax Credit. These hits to household income come at a time when the consumption of goods is bloated and already in need of an adjustment.

Third, during the second half of last year, financial conditions turned from a tailwind to a headwind—one that has accelerated amid growing inflation concerns. The tightening of monetary policy by the world’s central banks has been synchronized but completely uncoordinated, and when that happens, it usually ends up with financial conditions being tightened excessively—once you add up all the papercuts, it amounts to a real injury. And some of these papercuts are not so small: The rate that U.S. households pay on a 30‑year mortgage has risen by 1.20 percentage points since the sell-off started in September.

Finally, Europe, battered by sharply rising energy prices, is confronted with the unusual risk of a war on the continent. Rising uncertainty tends to weigh on activity the same as a monetary tightening. Russia’s invasion of Ukraine, and the sanctions subsequently imposed on Russia by other countries, are likely to cause long-term disruption. Given the pivotal role of Russia in the European energy supply chain, it is only too easy to see how additional geopolitical uncertainty will deliver another blow to households’ and businesses’ wallets.

Why a Recession Is Unlikely

If all these concerns are weighing on the outlook for growth, then why do I think that warnings of a recession in 2023 are premature? Recessions usually originate as the result of the interaction of two forces: a shock, which often takes the form of an aggressive tightening of monetary conditions, and an amplifier, a real economy imbalance that usually builds as the economy grows above potential for some time. It is the interaction between these two forces that creates the negative feedback loop that tends to push us into a recessionary tailspin.

"After a decade of deleveraging by the private sector, there were no major imbalances prior to the COVID shock...."

Central bank monetary tightening means we have a fertile ground for the shock (indeed, this is one of the reasons I expect a near-term growth scare). However, the economy probably has not accumulated a sufficiently large real economy imbalance to create a negative feedback loop. After a decade of deleveraging by the private sector, there were no major imbalances prior to the COVID shock and there has not been a capital expenditure (capex) boom since. Household consumption of goods is above the historic norm and in need of adjustment, but this is unlikely to tip the economy over the edge. True, labor markets are tight and will likely cause a slowdown in global growth. However, consumer and corporate balance sheets are strong, so I do not expect this to turn into a vicious downward spiral.

Other factors should also boost the global economy’s resilience. Capex, for example, has fallen meaningfully below trend since COVID, which suggests there is some pent‑up demand—an impression reinforced by lean inventories in need of a rebuild (especially within the auto sector). What’s more, the tightness of the labor market means companies are unlikely to let workers go because they might struggle to rehire.

Additionally, supply chains should begin to normalize as we progress through 2022, which will provide another fillip to production and, most likely, to demand. Finally, more people should flow back into the workforce as the year progresses and COVID outbreaks lessen in severity. This should allow some moderation in central bank hawkishness.

Further Volatility Looms, However

Could I be wrong? Yes. My most obvious concern is the interaction between inflation and the labor market. Inflation and wage pressure may prove to be so stubborn that the only way for the central bank to return to their inflation targets is via a recession that restores a substantial slack in the labor market.

"Tighter monetary policy combined with slowing growth will likely result in a further flattening of the yield curve...."

Where does all this leave financial markets? I believe the combination of high inflation, central bank tightening, and slowing growth will not be welcomed by risk assets, which I expect to remain volatile throughout 2022—or at least until central banks are convinced they have brought inflation back onto a trajectory that is compatible with their inflation targets. Tighter monetary policy combined with slowing growth will likely result in a further flattening of the yield curve in the core economies—most likely characterized by a resilient front end and, in the near term, a rally in long yields.

-

Important Information

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are those of the authors as of March 2022 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy. Actual future outcomes may differ materially from any forward‑looking statements made.

Past performance is not a reliable indicator of future performance. All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc.

© 2022 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.