- On U.S. Equities

- Focused on Fundamentals in an Unsettled Market

- Discerning the durable from the temporary is key to our process.

- 2022-02-01 02:54

- Key Insights

-

- Inflation and monetary policy are key macro factors that could drive near‑term volatility in equities, especially those trading at elevated valuations.

- Our patient investment strategy remains focused on buying and holding the special companies that we believe can compound in value over the long term.

- Near‑term challenges do not diminish long‑term opportunities driven by the transition to the cloud and the rise of e‑commerce and online advertising.

Stock prices tend to follow a company’s earnings and free cash flow over the long term. This simple premise underpins our patient investment strategy, which seeks to identify and invest in the special businesses that we believe have the potential to compound value over an extended period by sustaining strong growth rates in a variety of macroeconomic environments.

Taking the long view in a market fixated on the latest quarterly results and macroeconomic data can help us to uncover opportunities, typically in instances where our assessment of the potential durability of a company’s growth story may differ from the consensus view. However, we recognize that the disconnect between transient market sentiment and our view of long‑run business fundamentals can sometimes be painful for investors in the near term.

"...differentiating between volatility and actual business risk is more critical than ever..."

The rapid innovation and disruption occurring across industries, coupled with a market that is digesting dislocations stemming from the coronavirus pandemic and a flood of central bank liquidity, mean that differentiating between volatility and actual business risk is more critical than ever for growth investors with a longer time horizon.

Focused on Fundamentals in a Challenging Environment

The persistence of inflationary pressures and the Federal Reserve’s pivot to a more hawkish policy stance have fueled market volatility in recent months.

We favor companies that we believe are entrenched industry leaders, or could become industry leaders, and exhibit the potential to sustain a high level of earnings or cash flow growth over an extended period. This emphasis tends to lead us to higher‑quality companies that typically enjoy pricing power, which may help their underlying businesses to weather an inflationary environment better than firms that lack this competitive advantage.

Still, inflation and rising interest rates could continue to be near‑term headwinds for U.S. equities, with growth stocks arguably appearing more vulnerable because of the rapid expansion in valuation multiples that has occurred (Figure 1).

Accommodative monetary policies typically increase equities’ relative appeal, as the downward pressure on the yields to maturity offered by fixed income securities tends to push investors toward riskier assets. A flood of liquidity from central banks appeared to encourage speculation, with the low risk‑free rate of return1 increasing the market’s willingness to pay higher near‑term valuation multiples for the possibility of longer‑dated earnings growth. As this liquidity recedes, the level‑finding process will likely be most painful for names where valuations became the most disconnected from business fundamentals.

U.S. Equity Valuations Appear Elevated

(Fig. 1) 12‑month forward price to earnings vs. history

1 Twenty years ended December 31, 2021.

Source: T. Rowe Price analysis using data and analytics provided by FactSet Research Systems, Inc. All rights reserved. See Additional Disclosures. Actual outcomes may differ materially from forward estimates.

As our long‑time investors know, we are willing to own some stocks that may look expensive in the near term—if we believe the rate at which the business is creating value could support further upside in the coming years. But we aim to avoid names where we see the risk that an overextended valuation could get in the way of stock performance over a multiyear period.

We believe the risk/reward profiles of the portfolio’s largest positions are solid, thanks to what we regard as their strong growth potential and valuations that are undemanding on both a relative and an absolute basis. Nevertheless, we acknowledge the near‑term challenges that elevated valuations and concerns about slowing demand could pose for e‑commerce players, providers of cloud‑based enterprise software, and other companies that thrived at the height of the coronavirus pandemic.

In this momentum‑driven environment, upswings and downswings can be particularly violent and potentially out of step with long‑run fundamentals. However, we believe that our deep understanding of the key drivers of long‑term value creation in specific industries and at individual companies can help us to avoid overreacting to earnings hiccups or other setbacks that we view as temporary. Our rigorous research should also give us the conviction to take advantage of any opportunities that might emerge in an unsettled market.

We strive to be patient—but not complacent—investment managers and are constantly reassessing our existing and prospective holdings to keep on top of how companies and their competitive environments might evolve. The slightest whiff of potential disruption can compress a stock’s valuation multiple, even before this risk shows up in a company’s financial results—a dynamic that has weighed heavily on shares of legacy payment processors over the past 12 months. We are being nuanced and thoughtful with our positioning in the payments space as we consider how the competitive backdrop may shake out over time. As always, we look to prevent any near‑term errors from compounding over time.

Revisiting Key Secular Growth Trends

As markets have penalized some digital services companies amid concerns about persistent inflation and rising interest rates, it is instructive to revisit why we believe some of the key secular growth trends should drive value creation in the coming years. In our view, our edge comes not from investing behind the themes themselves but from leveraging our in‑depth understanding of individual companies and industries as we seek to identify compelling ideas where we have a differentiated view from the broader market.

The transition to cloud computing has been an important investment theme for more than a decade, but we believe this trend has significantly more room to run. In an increasingly digital world, cloud‑based software solutions are critical for companies across the economy to maintain their competitiveness and tend to drive productivity gains.

While we acknowledge that the sales environment may have become more challenging for some software companies in the near term, we believe that the coronavirus pandemic reinforced the business case for these investments. Adoption cycles tend to be longer for enterprises, which makes sense when considering the complexity and expense of updating workflows and legacy systems. Among software‑as‑a‑service providers, we favor companies that we believe could have a long growth runway, thanks to a large addressable market and forward‑thinking management teams that invest in innovation.

Our long‑run outlook on the digitalization of the economy and cloud adoption also has us excited about the tech giants that provide the critical infrastructure underpinning these trends. That Amazon.com and Microsoft’s profit margins in this business have held up despite Alphabet’s (Google’s parent company) aggressive push into the market speaks to the favorable industry structure and size of the opportunity, in our view. Potential strength in cloud services is one reason we believe that these companies’ scale and platform-like business models could help them to overcome the challenges posed by the law of large numbers.

Leading internet companies also have figured prominently in the fund for more than a decade. Today, our positioning emphasizes the multi‑chapter growth stories that could be driven by what we view as the accelerating convergence of e‑commerce and targeted online advertising—two large markets that still have significant room for further penetration.

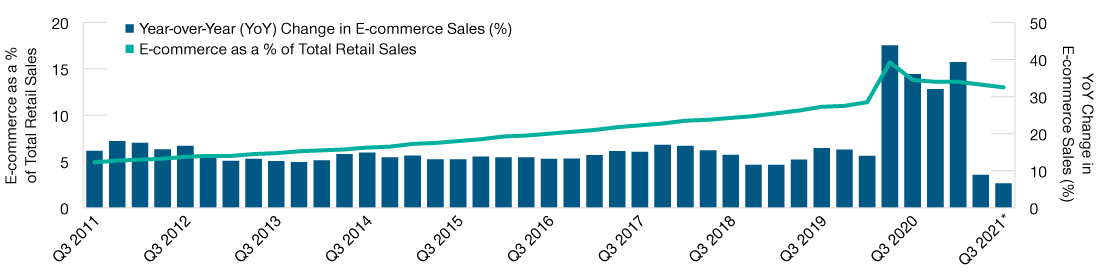

Data from the U.S. Census Bureau show that the online channel accounted for about 13% of retail sales in the third quarter of 2021 (Figure 2). This penetration rate marked a retrenchment from the spike that occurred at the height of the coronavirus. But it also serves as a reminder of how much headroom remains as last‑mile delivery logistics improve and innovative companies disrupt formerly resistant end markets, such as used cars and groceries.

Online Sales Growth in the U.S. Has Slowed After Pandemic Pop

(Fig. 2) But low penetration leaves headroom for long‑term growth

Ten years ended September 30, 2021.

Source: U.S. Census Bureau (November 18, 2021).

*Preliminary data.

Demand for online advertising also stands to grow significantly, in our view, to the extent that e-commerce ramps up and digital media takes share from legacy outlets.

An increased regulatory focus on consumer privacy and policy changes by key gatekeepers, such as Apple, have created some near‑term challenges for the efficacy of targeted advertising on popular social media applications. We view this headwind as transitory and believe that the long‑term trend favors internet companies with direct relationships with consumers and a wealth of first‑party data.

We also are finding opportunities among the emerging stack of modular e‑commerce solutions that help businesses sell their products online.

We believe that the disruption of the automobile industry has the potential to create massive opportunities over the next decade for companies that are well positioned in electric vehicles (EV) and autonomous driving. In our view, the transition away from the internal combustion engine should accelerate meaningfully over the next five to 10 years, as advances in battery technologies and scaled‑up production facilities help EVs to reach cost parity with fossil fuel‑powered vehicles. Meanwhile, a supportive regulatory environment in many countries, the buildout of infrastructure to charge the batteries that power EVs, and an increasing emphasis on the need to reduce carbon emissions should also act as tailwinds. We continue to monitor opportunities throughout the EV supply chain as well as innovations related to autonomous driving and technologies that could help to reduce carbon emissions from heavy‑ and medium‑duty trucks.

-

Securities mentioned in this material have the following weightings in the Blue Chip Growth Fund as of December 31, 2021: Amazon.com 9.79%, Microsoft 11.10%, Alphabet 10.21%, and Apple 7.76%.

Effective October 1, 2021, Paul Greene assumed sole portfolio management responsibility for the fund.

1 The risk-free rate of return is a theoretical return of an investment with zero risk. This metric, often tied to U.S. Treasury yields, is a rate against which other returns are measured.

2 T. Rowe Price active equity ETFs publish a daily Proxy Portfolio, a basket of securities designed to closely track the daily performance of the actual portfolio holdings. While the Proxy Portfolio includes some of the ETF’s holdings, it is not the actual portfolio. Daily portfolio statistics will be provided as an indication of the similarities and differences between the Proxy Portfolio and the actual holdings. The Proxy Portfolio and other metrics, including Portfolio Overlap, are intended to provide investors and traders with enough information to encourage transactions that help keep the ETF’s market price close to its NAV. There is a risk that market prices will differ from the NAV, ETFs trading on the basis of a Proxy Portfolio may trade at a wider bid/ask spread than shares of ETFs that publish their portfolios on a daily basis, especially during periods of market disruption or volatility and, therefore, may cost investors more to trade. The ETF’s daily Proxy Portfolio, Portfolio Overlap and other tracking data are available at troweprice.com.

Although the ETF seeks to benefit from keeping its portfolio information confidential, others may attempt to use publicly available information to identify the ETF’s investment and trading strategy. If successful, these trading practices may have the potential to reduce the efficiency and performance of the ETF.

ETFs are bought and sold at market prices, not NAV. Investors generally incur the cost of the spread between the prices at which shares are bought and sold. Buying and selling shares may result in brokerage commissions which will reduce returns.

-

Additional Disclosure

London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2022. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

Important Information

Call 1‑800‑225‑5132 to request a prospectus or summary prospectus; each includes investment objectives, risks, fees, expenses, and other information you should read and consider carefully before investing.

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are those of the authors as of January 2022 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

The fund is subject to market risk, as well as risks associated with unfavorable currency exchange rates and political economic uncertainty abroad. Growth stocks are subject to the volatility inherent in common stock investing, and their share price may fluctuate more than that of a income‑oriented stocks. Investing in technology stocks entails specific risks, including the potential for wide variations in performance and usually wide price swings, up and down. Technology companies can be affected by, among other things, intense competition, government regulation, earnings disappointments, dependency on patent protection and rapid obsolescence of products and services due to technological innovations or changing consumer preferences.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy.

Past performance is not a reliable indicator of future performance. All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc.

© 2022 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.