- On Stable Value

- Five Reasons to Consider Stable Value in a Plan Lineup

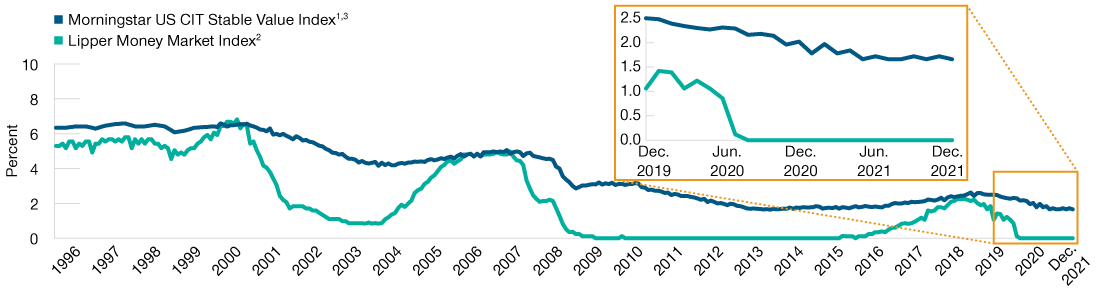

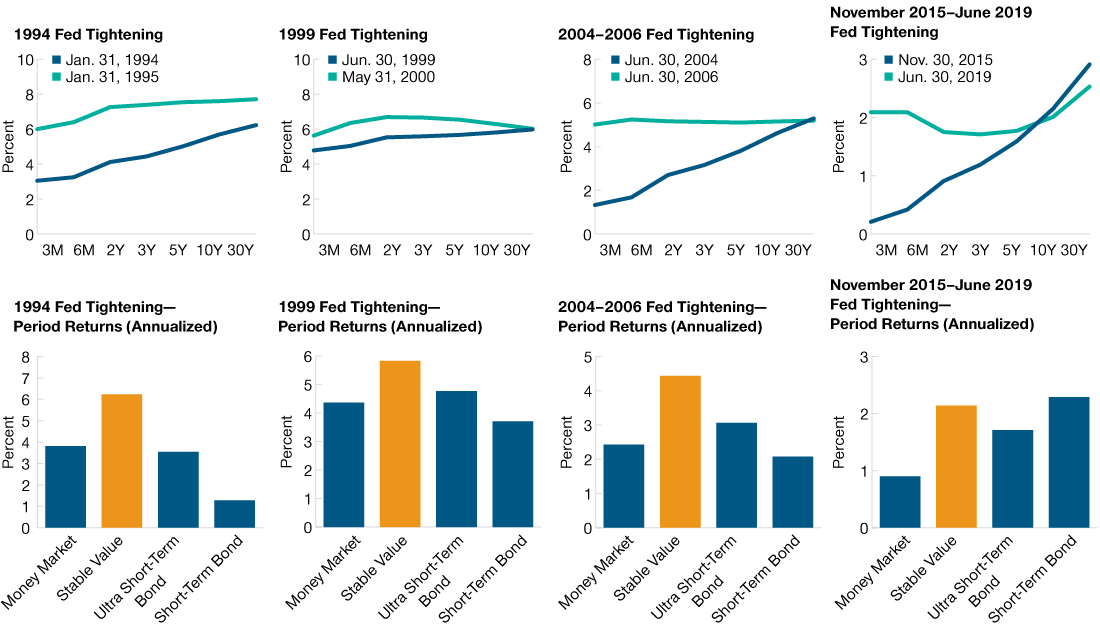

- Asset class has performed well in multiple rate environments.

- 2022-03-09 18:25

- Key Insights

-

- Considering market volatility and the impending interest rate hikes, stable value deserves consideration for retirement investing.

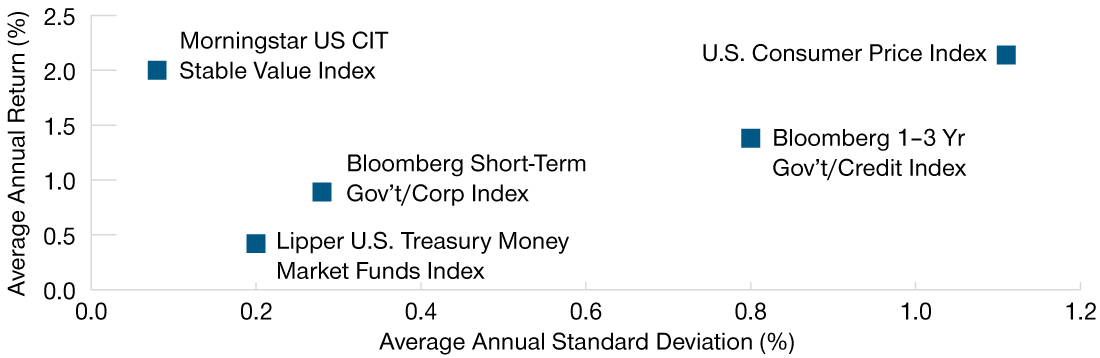

- Stable value offers many of the same desirable features as money market portfolios with some potential for a more attractive risk/return profile.

- We believe stable value should be considered as a standalone investment option in every plan and as an option in other retirement products.

-

1 According to the Stable Value Investment Association. As of September 30, 2021.

-

Additional Disclosures

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

Bloomberg® and the Bloomberg 9–12 Month T‑Bill Index, the Bloomberg U.S. 1–3 Year Government/Credit Bond Index, and Bloomberg Short‑Term Gov’t/Corp Index are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the index (collectively, “Bloomberg”) and have been licensed for use for certain purposes by T. Rowe Price. Bloomberg is not affiliated with T. Rowe Price, and Bloomberg does not approve, endorse, review, or recommend its products. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to its products.

Portions of the information contained in the above were supplied by Lipper, a Refinitiv Company, subject to the following: Copyright 2022 © Refinitiv. All rights reserved. Any copying, republication or redistribution of Lipper content is expressly prohibited without the prior written consent of Lipper. Lipper shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon.

© 2022 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Important Information

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are those of the authors as of March 2022 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy.

Past performance is not a reliable indicator of future performance. All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc. For Institutional Investors Only.

© 2022 T. Rowe Price. All rights reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the bighorn sheep design are, collectively and/or apart, trademarks or registered trademarks of T. Rowe Price Group, Inc.