- 2022 Global Market Outlook

- Growth Delayed, Not Derailed

- 2021-12-07 12:14

Despite headwinds from the pandemic, the global economic recovery still appeared on track as 2021 neared its end. But inflation risks have risen. In 2022, investors will need to watch what fiscal and monetary policymakers do to try to stem price pressures while sustaining growth.

Although a COVID‑19 resurgence in Europe and the emergence of the highly mutated omicron variant are reminders that the pandemic is still with us, the net economic effect of past waves—such as the spread of the delta variant—has been to postpone activity, not prevent it. This pattern could give a modest boost to growth in the first half of 2022, Page says.

The bearish economic case now centers on monetary and fiscal policy, Page contends. As governments and central banks withdraw the massive stimulus applied during the pandemic, economic growth inevitably will slow sharply—or so the argument goes.

But slower growth doesn’t necessarily mean low growth, Page responds. He points to a number of tailwinds that he thinks could sustain the recovery in 2022:

- Consumers are in a strong cash position, especially in the United States, where over USD 2 trillion is sitting in checking accounts and other short‑term deposits.

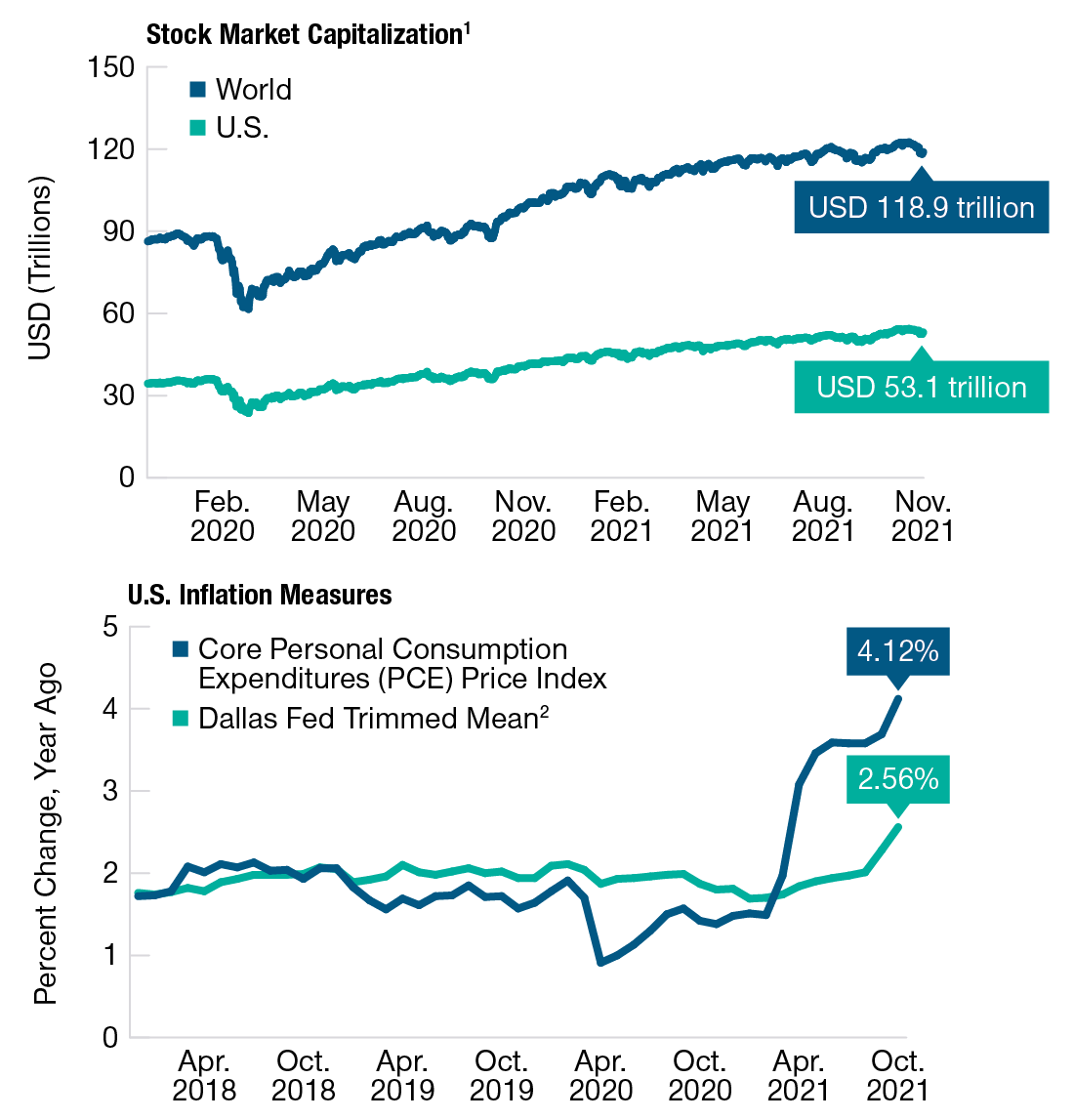

- Asset appreciation has boosted household wealth both in the U.S. and globally.

- Pent‑up demand for housing should continue to fuel new home construction.

- Corporate balance sheets generally are in strong shape, with high liquidity and low debt ratios.

- Transportation bottlenecks appeared to ease in late 2021, as seen by a sharp drop in global seaborne shipping costs.

Wealth Effect Could Be a Tailwind for Growth—but Also for Inflation

(Fig. 1) Global and U.S. stock market capitalization and core measures of U.S. consumer inflation

Past performance is not a reliable indicator of future performance.

Market capitalization data as of November 30, 2021. Inflation data as of October 31, 2021.

1 Bloomberg World Exchange Market Capitalization. Tickers on Bloomberg: Market Cap: WCAU (World) and WCAUUS (United States).

2 The Dallas Federal Reserve Bank’s PCE trimmed inflation rate is designed to exclude extremely low or extremely high changes among 178 goods and services series tracked by the U.S. Bureau of Economic Analysis’ PCE Chain‑Type Price Index in order to smooth volatility and show the underlying inflation trend. These 178 categories add up to roughly 100% of nominal personal consumption. On average since 2009, the calculation has trimmed 24% of expenditures from the lower tail of the distribution of price increases and 31% from the upper tail.

Sources: Bloomberg Finance L.P., Bloomberg Index Services Limited (see Additional Disclosures), U.S. Bureau of Economic Analysis, and Federal Reserve Bank of Dallas.

The question, Vaselkiv says, is whether global consumers will convert their improved financial positions into higher spending. Assuming pandemic disruptions remain relatively manageable, he sees the potential for a surge in pent‑up demand in 2022 for travel, entertainment, and other “quality of life” services, as well as for new cars as auto production normalizes.

With interest rates still low and banks eager to put deposits to work, loan growth also could drive consumer demand, Vaselkiv adds.

But the same factors—free cash, wealth, pent‑up demand—potentially supporting growth also could prolong the sharp upswing in inflation seen in the second half of 2021.

Unless pandemic conditions deteriorate significantly, improving global supply chains and factory reopenings could ease the upward pressure on prices in 2022, Page suggests.

Much of the 2021 inflation surge, he notes, was concentrated in specific products—such as used cars and gasoline—that were particularly hard hit by supply/demand imbalances. The hefty price hikes in these goods seen in 2021 are unlikely to be repeated in 2022, he argues.

The bad news: Prices for many other key items—such as some foodstuffs, rent, apparel, and airfares—have lagged broader inflation. As higher energy costs and the appreciation in home prices ripple through the economy, price increases for these goods are likely to play catch‑up, Vaselkiv warns. Rents, in particular, appear poised to accelerate in 2022, Page adds.

Rising wages could present a longer‑term structural inflation risk, Vaselkiv says. While faster income growth should help support consumer spending, it could contribute to a wage‑price spiral as businesses pass along higher costs—in turn putting more upward pressure on wages.

“If inflation starts to permeate into wages, and that starts to drive inflation expectations, then maybe inflation will not be as transitory as we thought,” Thomson adds.

Profit margins have been very high for very long. But now the pendulum is swinging from capital to labor.

— Mark Vaselkiv, Chief Investment Officer, Fixed Income

Demographic and labor market trends could heighten that risk. Vaselkiv notes that occupations in a number of key sectors—including transportation, health care, and education—are seeing a wave of retirements, or soon will, as the baby boomer generation passes out of the workforce.

Meanwhile, large companies with deep pockets, such as Amazon, can afford to raise wages aggressively to attract the workers they need, Vaselkiv says. Other service industries and smaller companies could be hard pressed to compete.

“Profit margins have been very high for very long,” Vaselkiv notes. “But now the pendulum is swinging from capital to labor.”

For illustrative purposes only. This is not intended to be investment advice or a recommendation to take any particular investment action.

-

Additional Disclosures

Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). BARCLAYS® is a trademark and service mark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Bloomberg or Bloomberg’s licensors, including Barclays, own all proprietary rights in the Bloomberg Barclays Indices. Neither Bloomberg nor Barclays approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

Copyright © 2021, S&P Global Market Intelligence (and its affiliates, as applicable). Reproduction of any information, data or material, including ratings (“Content”) in any form is prohibited except with the prior written permission of the relevant party. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content. A reference to a particular investment or security, a rating or any observation concerning an investment that is part of the Content is not a recommendation to buy, sell or hold such investment or security, does not address the suitability of an investment or security and should not be relied on as investment advice. Credit ratings are statements of opinions and are not statements of fact.

Information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The index is used with permission. The Index may not be copied, used, or distributed without J.P. Morgan’s prior written approval. Copyright © 2021, J.P. Morgan Chase & Co. All rights reserved.

Copyright © 2021, Markit Economics Limited. All rights reserved and all intellectual property rights retained by Markit Economics Limited.

Important Information

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are those of the authors as of December 2021 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

Risks: International investments can be riskier than U.S. investments due to the adverse effects of currency exchange rates, differences in market structure and liquidity, as well as specific country, regional, and economic developments. These risks are generally greater for investments in emerging markets. Small-cap stocks have generally been more volatile in price than the large-cap stocks. The value approach to investing carries the risk that the market will not recognize a security’s intrinsic value for a long time or that a stock judged to be undervalued may actually be appropriately priced. Sustainable investing may not succeed in generating a positive environmental and/or social impact. Fixed-income securities are subject to credit risk, liquidity risk, call risk, and interest-rate risk. As interest rates rise, bond prices generally fall. Investments in high-yield bonds involve greater risk of price volatility, illiquidity, and default than higher-rated debt securities. In periods of no or low inflation, other types of bonds, such as US Treasury Bonds, may perform better than Treasury Inflation Protected Securities. Investments in bank loans may at times become difficult to value and highly illiquid; they are subject to credit risk such as nonpayment of principal or interest, and risks of bankruptcy and insolvency. Diversification cannot assure a profit or protect against loss in a declining market.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy. Actual future outcomes may differ materially from any estimates and forward-looking statements made.

Past performance is not a reliable indicator of future performance. All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc.

© 2021 T. Rowe Price. All rights reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the bighorn sheep design are, collectively and/or apart, trademarks or registered trademarks of T. Rowe Price Group, Inc.