- 2022 Global Market Outlook

- Focus on Fundamentals

- 2021-12-07 12:18

Global equity markets demonstrated resilience in 2021, although the rise of the omicron variant put a damper on optimism as the year drew to a close. Looking ahead to 2022, the question is whether earnings growth will continue to support U.S. equity valuations that appear stretched in absolute terms.

Although signs of speculative excess abounded in 2021 in areas like cryptocurrencies and nonfungible tokens, the U.S. stock market did not appear to be in bubble territory, Page asserts. But equity valuations were a bit of a puzzle, he says.

- As of mid‑November 2021, the price/earnings (P/E) ratio on the Russell 3000 Index was almost at the top of its historical range since 1989.

- Relative to real (after‑inflation) bond yields, however, the index’s earnings yield was in the least expensive percentile for that same period.

“So I can say that U.S. stocks looked almost as expensive as they’ve ever been, but also almost as cheap as they’ve ever been, and both statements are technically correct if you look through the right lens,” Page observes.

Much will depend on the strength of earnings growth in an environment where the spread of coronavirus variants and the potential for rising interest rates both pose significant—if contrary—risks to the global economic recovery.

Throughout most of 2021, U.S. equity gains were supported by a steady stream of upward earnings revisions, Thomson notes. Despite a nearly 23% rise in the S&P 500 Index in the first 10 months of the year, the index P/E actually fell over that same period as earnings rose faster than stock prices.1

If the recovery remains on track, earnings growth should continue in 2022, Thomson predicts. But with S&P 500 operating margins at a record level, U.S. earnings momentum is likely to slow. “The starting point for profitability is very high,” Thomson says. “It’s going to be a hard hurdle to beat.”

Beyond 2022, the hurdles look even tougher to clear, Thomson warns. “The next two to three years could be very difficult from an earnings growth perspective. At a minimum, we could well see below‑normal growth. But the stock market simply has not factored that in.”

Although Stocks Do Not Appear Expensive Relative to Bonds, Earnings Momentum Could Slow

(Fig. 1) Distribution of U.S. equity valuations and operating margin for companies in the S&P 500 Index

As of November 30, 2021.

1 Valuation measures are based on the Russell 3000 Index. Stock versus bond yield percentile has been reversed. The earnings yield is earnings per share divided by stock price.

Sources: Bloomberg Finance L.P., Strategas Research Partners, and Standard & Poor’s (see Additional Disclosures); data analysis by T. Rowe Price.

Slowing earnings momentum also is likely to produce more uneven results across companies, Thomson says, requiring investors to be more selective but potentially creating opportunities for active portfolio managers to add value for their clients.

Likewise, rising costs could put a premium on stock selection skill. “Companies that can pass through inflation should continue to see earnings growth,” Thomson says. “But for companies that don’t have pricing power, it could be an issue.”

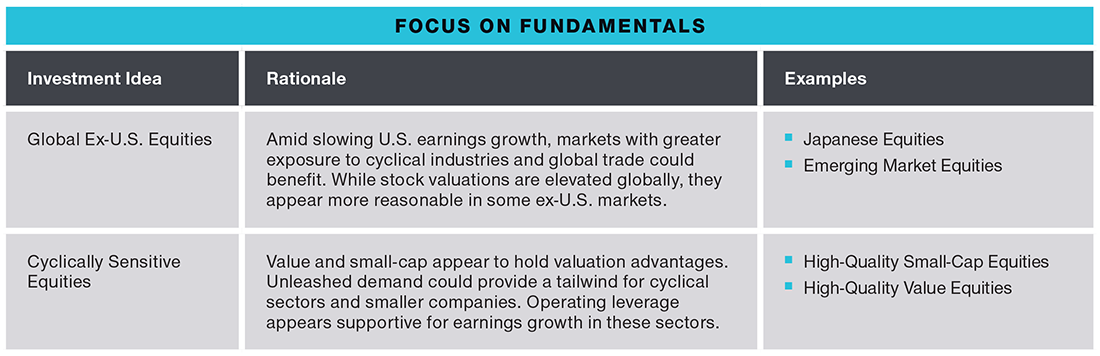

The earnings picture for ex‑U.S. equities is more mixed, Thomson says. While earnings growth has been surprisingly strong in Europe, momentum in Japan has been slowed by a sluggish domestic economy.

Looking to 2022, however, Thomson suggests that Japan could offer potential relative valuation opportunities if the global recovery remains on track, as could equities, credit, and currencies in select emerging markets (EM). A contrarian case can be made for Chinese equities, he adds, as Beijing moves to restimulate an economy that appears close to stall speed.

Valuation fundamentals and cyclical factors could favor the “recovery trade” in 2022, Page says. Financial stocks, which carry a heavy weight in the value universe, historically have tended to outperform in a rising interest rate environment, he observes. And small‑cap stocks typically have done well during economic recoveries.

Companies that can pass through inflation should continue to see earnings growth. But for companies that don’t have pricing power, it could be an issue.

— Justin Thomson, Head of International Equity and Chief Investment Officer

In a period of rising rates and higher inflation, the growth style could underperform, Thomson concedes. This could have implications for key growth sectors—technology in particular—that have led equity markets for much of the past decade.

“Companies that can grow earnings persistently over a long period of time are extremely rare,” Thomson says. “So I think the odds that technology will continue to be a dominant sector are rather low.”

For illustrative purposes only. This is not intended to be investment advice or a recommendation to take any particular investment action.

-

1 Past performance is not a reliable indicator of future performance.

-

Additional Disclosures

Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). BARCLAYS® is a trademark and service mark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Bloomberg or Bloomberg’s licensors, including Barclays, own all proprietary rights in the Bloomberg Barclays Indices. Neither Bloomberg nor Barclays approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

Copyright © 2021, S&P Global Market Intelligence (and its affiliates, as applicable). Reproduction of any information, data or material, including ratings (“Content”) in any form is prohibited except with the prior written permission of the relevant party. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content. A reference to a particular investment or security, a rating or any observation concerning an investment that is part of the Content is not a recommendation to buy, sell or hold such investment or security, does not address the suitability of an investment or security and should not be relied on as investment advice. Credit ratings are statements of opinions and are not statements of fact.

Information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The index is used with permission. The Index may not be copied, used, or distributed without J.P. Morgan’s prior written approval. Copyright © 2021, J.P. Morgan Chase & Co. All rights reserved.

Copyright © 2021, Markit Economics Limited. All rights reserved and all intellectual property rights retained by Markit Economics Limited.

Important Information

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are those of the authors as of December 2021 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

Risks: International investments can be riskier than U.S. investments due to the adverse effects of currency exchange rates, differences in market structure and liquidity, as well as specific country, regional, and economic developments. These risks are generally greater for investments in emerging markets. Small-cap stocks have generally been more volatile in price than the large-cap stocks. The value approach to investing carries the risk that the market will not recognize a security’s intrinsic value for a long time or that a stock judged to be undervalued may actually be appropriately priced. Sustainable investing may not succeed in generating a positive environmental and/or social impact. Fixed-income securities are subject to credit risk, liquidity risk, call risk, and interest-rate risk. As interest rates rise, bond prices generally fall. Investments in high-yield bonds involve greater risk of price volatility, illiquidity, and default than higher-rated debt securities. In periods of no or low inflation, other types of bonds, such as US Treasury Bonds, may perform better than Treasury Inflation Protected Securities. Investments in bank loans may at times become difficult to value and highly illiquid; they are subject to credit risk such as nonpayment of principal or interest, and risks of bankruptcy and insolvency. Diversification cannot assure a profit or protect against loss in a declining market.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy. Actual future outcomes may differ materially from any estimates and forward-looking statements made.

Past performance is not a reliable indicator of future performance. All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc.

© 2021 T. Rowe Price. All rights reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the bighorn sheep design are, collectively and/or apart, trademarks or registered trademarks of T. Rowe Price Group, Inc.