- On Multi-Asset Investing

- Navigating the Model Portfolio Landscape

- Key Considerations for Model Selection and Implementation.

- Key Insights

-

- Model portfolios present financial professionals with opportunities to simplify their investment process and potentially enhance outcomes for their clients.

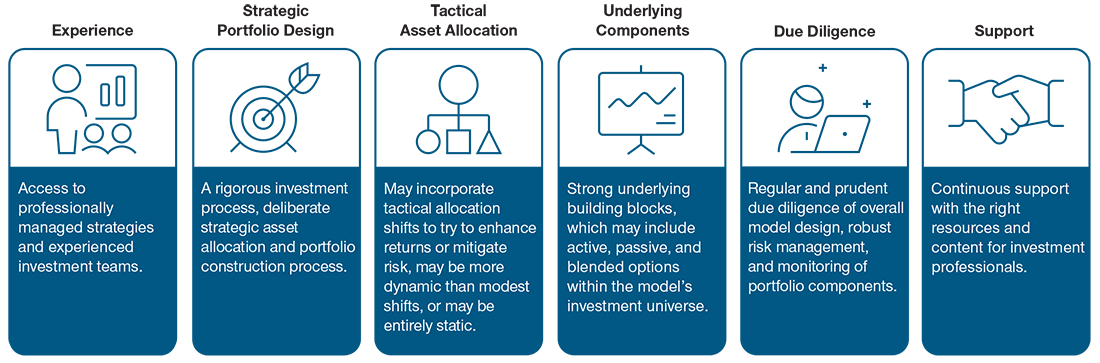

- We believe model portfolios should be evaluated on six key factors: experience, design, asset allocation, underlying components, due diligence, and support.

- A well-defined process for model selection and a clear view of what factors matter most can help financial professionals in their model searches.

The popularity of model investment portfolios1 has surged in recent years, as have the number and variety of offerings available. Model portfolios allow financial professionals to simplify their investment process, potentially reduce risk and improve performance, and—most importantly—increase time spent with their clients. However, as the model portfolio industry evolves, financial professionals must weigh a range of considerations in order to select model portfolios on behalf of their clients.

"...financial professionals must weigh a range of considerations in order to select model portfolios on behalf of their clients."

A Complex Landscape

According to the most recent Morningstar model portfolio landscape report, asset managers and strategists have launched more than 400 models since 2018, resulting in over 1,500 model portfolios across 140 firms and 100 peer categories within Morningstar’s model database.2 This broad menu of models seeks to address a variety of client goals and objectives and includes active, passive, and blended products, as well as models that concentrate on specific focuses—such as regions and styles—and on other factors such as environmental, social, and governance considerations.

A Broad Range of Returns

Evaluating model portfolio performance presents a unique challenge. More than 25% of the models in the newly created Morningstar model database do not report performance at all, while other models provide only hypothetical track records rather than actual historical account returns. In this evolving space, Morningstar’s peer groups remain broadly defined, and, for model portfolios that do have reported returns, absolute and relative performance within those peer groups can be highly variable.

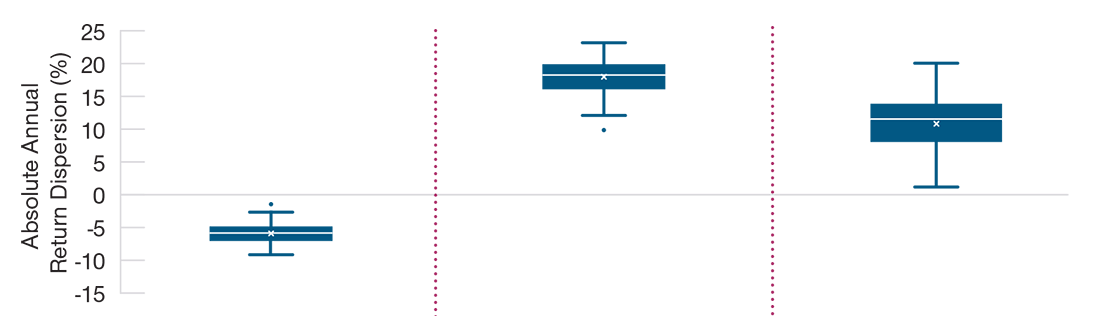

We examined the investment performances reported in Morningstar’s U.S. Model Allocation 50%–70% Equity category to better understand the range of returns for model portfolios within the peer universe. We found that the return dispersion3 within the category was more than 7% in each of the last three calendar years. Moreover, our analysis of the three years ended December 31, 2020, indicated that return dispersion widened as the number of model portfolios in the Morningstar category increased over time (Figure 1).4

Our analysis suggests that such dispersion can be attributed to a variety of factors, including:

- portfolio construction choices

- the level of diversification or concentration within a model portfolio

- the split between active and passive management within models

- the underlying component security selection and tracking error5

- whether a model is more strategic or tactical in nature6

As the model landscape continues to evolve and the regulatory environment shifts, we believe financial professionals need to have a well-defined process for model selection and ongoing monitoring.

Broad Peer Groups May Complicate Model Selection

(Fig. 1) Return dispersion for U.S. models in Morningstar’s 50%–70% equity allocation category.

As of 12/31/2020.

Past results are not a reliable indicator of future results.

Source: Morningstar Direct (see Additional Disclosures). All data analysis by T. Rowe Price. The box-and-whisker chart visualizes the range of model portfolio annual returns. The cross (“x”) is the mean annual return, the center horizontal line is the median annual return. The box represents the middle 50% of all the annual returns. The upper and lower whiskers are the maximum and minimum annual returns per model over the period studied that are within 1.5 times the middle 50% of all the annual returns.

Returns outside this range are considered outliers, and are indicated by dots above or below the whiskers.

N : The number of model portfolios for which data was available in each given year.

Considerations for Model Selection

In a fast-growing space with many options and highly variable outcomes, comprehensive due diligence can be a daunting task. We believe there are a few key considerations that can help financial professionals identify potentially appropriate options for their clients from a growing and changing opportunity set.

Model Portfolios Are Not Created Equal

Evaluating the differences between models can help financial professionals navigate a complex landscape.

Experience: We believe financial professionals should look for model portfolios with institutionally managed strategies and experienced investment teams. It’s worth asking who manages the portfolios. Not all models have dedicated portfolio management teams, which may be an important criterion for many financial professionals. It can be helpful to examine the manager’s track record for delivering asset allocation guidance. We think financial professionals also should consider the quality of a firm: What is its reputation, and what qualities are associated with its culture? These qualities should align with the financial professional’s own perspective and their clients’ goals.

Strategic Portfolio Design: Starting from a broad universe of options, financial professionals typically seek to narrow their searches by identifying portfolios suited to a client’s investment goals and risk tolerance, usually closely tied to the portfolio’s neutral7 asset allocation. Some model portfolios may be designed to target particular outcomes, such as capital appreciation or income generation, while others may be intended to fill in gaps in existing portfolios. We believe financial professionals should view portfolio design as a critical consideration in their selection process. How did the portfolio manager arrive at a particular asset mix or global diversification profile? The strategic allocation determines the target mix of different asset classes over the long term, and should be consistent with an investor’s objectives, risk tolerance, and time horizon.

Underlying Components: In addition to considering the overall design and management of the model at the top level, we believe financial professionals should examine the characteristics of the model’s underlying components and look for models that feature underlying investment vehicles that also have experienced management teams with track records of delivering strong absolute and relative performance over full market cycles. Some of the questions we believe financial professionals should ask:

- How were the underlying components selected? Are they entirely proprietary or are third-party funds included?

- Does the model use mutual funds or exchange-traded funds?

- Are the underlying funds actively or passively managed, or do they include a mix of both? How was this distribution determined?

- What are the historical and estimated future tracking errors of the underlying funds?

- Were the funds selected with an awareness of tax implications?

- What is your client’s fee budget and cost sensitivity? Is there an overlay fee or is the fee a weighted average of underlying funds?

For more information on best practices for manager selection, please refer to our guide on the topic, Part I: Best Practices for Manager Selection.

Tactical Asset Allocation: A model portfolio’s approach to strategic and tactical asset allocation is another important consideration. Some model portfolios also may feature tactical asset allocation guidance—incremental moves to overweight or underweight certain asset classes based on shorter-term views of the market, with the goal of enhancing returns. If tactical allocation is a feature of the model, we believe financial professionals should consider how these tactical views are implemented in the portfolio, as well as their frequency and magnitude. Tactical asset allocation can potentially enhance the value proposition of a model portfolio as the manager can dynamically shift positioning based on forward-looking views. Does the manager have a track record of improving outcomes through tactical asset allocation? Additionally, how frequently are their model portfolios rebalanced?

Ongoing Monitoring and Risk Management: It is important to consider risk management and the need for ongoing oversight of the model from the level of the overall model and the underlying components. By outsourcing portfolio design to a model provider, financial professionals should consider whether the model team and provider have regular processes in place to evaluate risk on a backward- and forward-looking basis. For instance, what processes are in place to monitor and manage the portfolio’s asset allocations or potential risk exposures?

"We believe a final consideration for financial professionals should be the quality of the support they can expect from the model portfolio provider."

Support: Finding a model portfolio that meets client needs can be a daunting task. We believe a final consideration for financial professionals should be the quality of the support they can expect from the model portfolio provider. Does the provider have dedicated resources needed to provide high-quality collateral to help investors understand their models? In our view, this support can play an important role as financial professionals seek to build their practices and can help educate clients on portfolio performance, positioning changes if the model includes tactical shifts, important market themes, and the rationales behind the investment decisions reflected in a model.

The below illustrations show some of the potential types of model approaches, and is not an all-inclusive list. The asset classes/sub-asset classes noted are also for illustrative purposes only. This material is not intended to be investment advice or a recommendation to take any particular investment action. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision. All investments are subject to market risk, including the possible loss of principal. Diversification cannot assure a profit or protect against loss in a declining market. There is no assurance that any investment objective will be achieved.

(Fig. 2) A Hypothetical All-in-One Model Approach

| Role | Offers an efficient way to access diversified model portfolios that seek to meet a variety of client goals and risk objectives. |

| Potential Benefits | A fully outsourced investment management process including strategic asset allocation, fund selection, tactical asset allocation (if applicable), and risk monitoring. |

| Potential Considerations | Investment professionals may be more reliant on content provided by the model manager to keep themselves and their clients abreast of model changes and their rationales. |

Source: T. Rowe Price. For illustrative purposes only. Not representative of an actual investment.

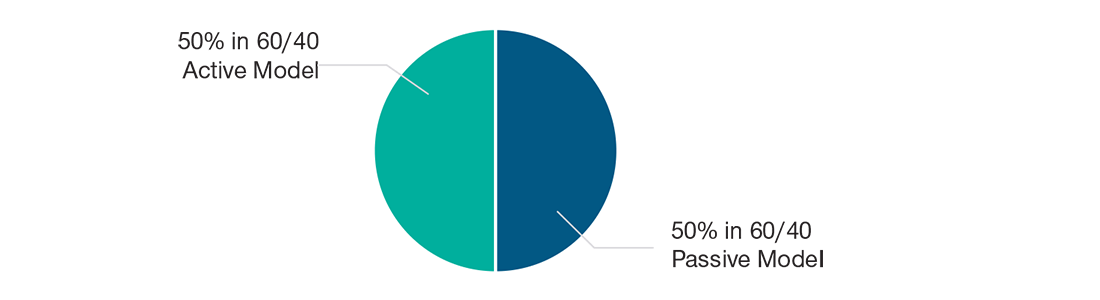

(Fig. 3) A Hypothetical Multi-Model Hybrid Active/Passive Approach

| Role | A “model of models” combining an active and passive diversified model with similar asset allocations. |

| Potential Benefits | Potentially offers more flexibility for investment professionals to combine models and control tracking error or cost consistent withtheir clients’ preferences and goals. |

| Potential Considerations | A single model that is explicitly hybrid in nature may be a more efficient approach as the management team may have considered which exposures should be implemented actively or passively. |

Source: T. Rowe Price. For illustrative purposes only. Not representative of an actual investment.

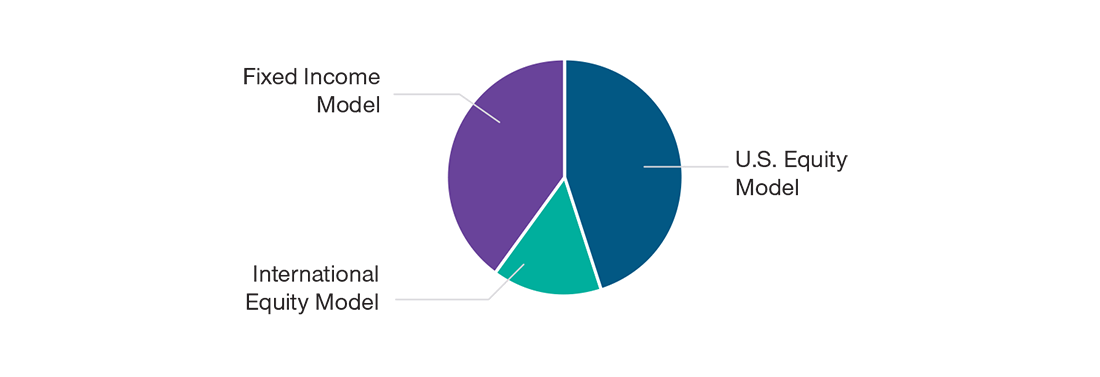

(Fig. 4) A Hypothetical Multi-Model Building Block Approach

| Role | A model selected by asset class or other building blocks from more than one model provider. |

| Potential Benefits | May offer increased customization opportunities; potentially may provide efficient tactical levers (e.g., stocks versus bonds, U.S. versus non-U.S. markets). |

| Potential Considerations | Strategic asset allocation is owned by the financial professional. Asset class exposure choices can have significant influence on absolute and relative performance. |

Source: T. Rowe Price. For illustrative purposes only. Not representative of an actual investment.

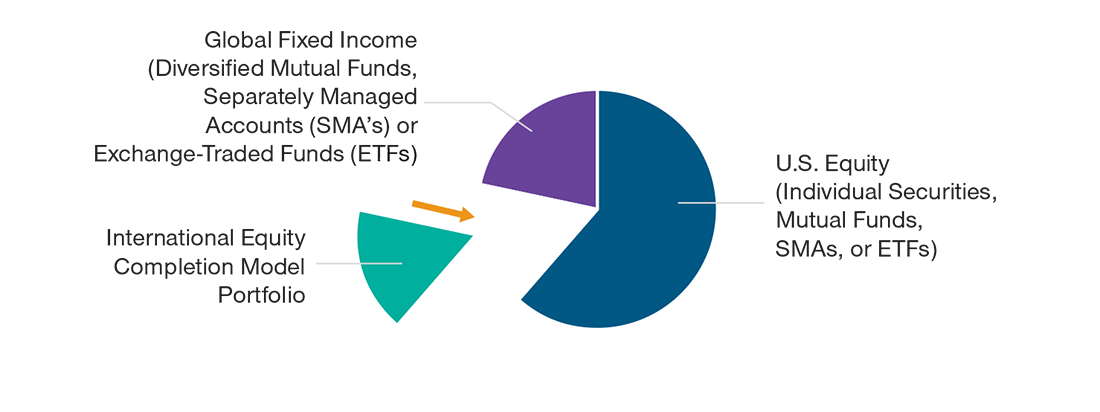

(Fig. 5) A Hypothetical Completion Approach

| Role | Fill in (i.e., complete) a client’s portfolio with a focused model portfolio to complement existing investment strategies. |

| Potential Benefits | For investment professionals who prefer to maintain portfolio management responsibility in an asset class, a completion approach offers a way to close gaps and potentially achieve efficient diversification. |

| Potential Considerations | There may still be gaps versus global markets. While a completion model can help close a portfolio gap, financial professionals should consider the level of diversification within the model investments. |

Source: T. Rowe Price. For illustrative purposes only. Not representative of an actual investment.

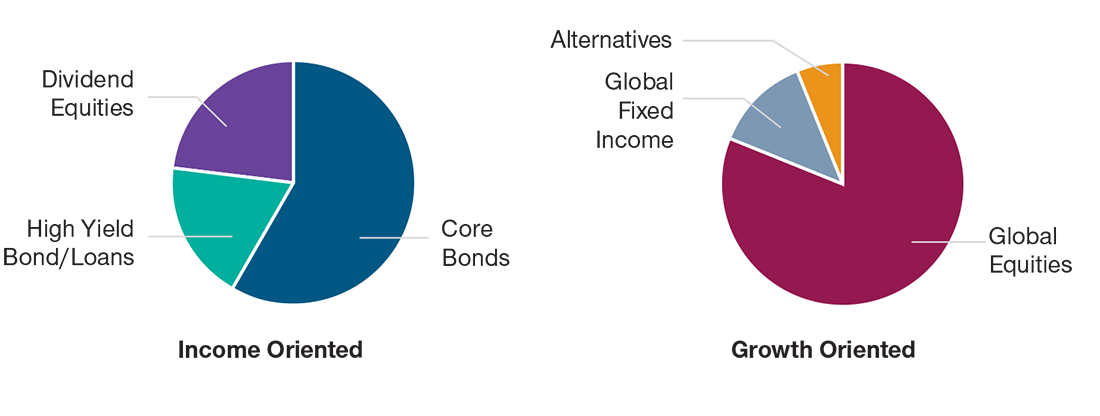

(Fig. 6) Hypothetical Outcome-Oriented Approaches

| Role | Model portfolios that target a specified investment objective. |

| Potential Benefits | Potentially may map efficiently to specific objectives in ways that resonate with clients. |

| Potential Considerations | Be sure to look under the hood. Exposures may vary significantly across models with identical stated outcome objectives. For example, income-oriented models may reach for yield with relatively riskier asset classes. |

Source: T. Rowe Price. For illustrative purposes only. Not representative of an actual investment.

A Variety of Approaches

Just as models may be highly varied in their portfolio construction and design, financial professionals can use models to address a wide range of client needs and in a variety of ways. For some clients, allocating to a single model might be an appropriate approach, while other clients may benefit from using models to augment their existing portfolios, or even a combination of multiple models to achieve a diversified allocation. The five possible illustrative approaches above demonstrate potential benefits and some considerations that we believe financial professionals may want to examine for each approach.

It should be noted that an overly customized approach may result in over-diversification and diminished cost efficiency. However, thoughtful tailoring of multiple models offers the ability to simplify the investment process while retaining some portfolio design levers to build allocations that should be consistent with a financial professional’s investment philosophy and clients’ goals.

Conclusions

The model landscape comprises a broad range of objectives and applications. In a subsequent study, we will detail T. Rowe Price’s approach to model portfolio design and management.

Model portfolios potentially offer access to institutional-quality expertise, scalable and diversified investment solutions, a spectrum of model portfolio approaches that can be used to pursue a range of objectives, and ongoing support to deliver insights, services, and solutions to financial professionals and their clients.

However, the potential benefits of using model portfolios are rivaled only by the challenges in identifying options for clients in an increasingly complex space. We believe a well-defined process for model selection and a clear view of what factors matter most can help financial professionals in this process.

1 Model portfolios are a professionally-managed investment solution provided by asset managers to financial intermediaries, reflecting a design for a group of underlying investments that together target a certain investment objective, or a range of risk or return levels. Model portfolios are typically not directly investable, and financial professional’s actual implementation of provided design may vary from the asset manager’s suggested design.

2Morningstar, 2020 Model Portfolio Landscape, August 2020.

3 Return dispersion demonstrates the range of annual returns for models within the Morningstar category in the calendar year. The analysis uses the Morningstar Model Allocation-50 to 70% Equity universe and excludes all model portfolio performance that use any type of hypothetical performance such as back-tested performance. The universe analyzed herein is composed of seeded separate accounts which are managed in the style of the respective models.

4 We noted that although the 50%–70% Equity category has a 20% range in equity exposure, the overall equity allocation only drove a portion of the observed dispersion. For example, considering the 2020 return dispersion and S&P 500 Index (as a proxy for the equity allocation) total return (dividends reinvested) of 18.33%, the portfolios with the highest and lowest equity weights would have about 20%*18.33%=3.7% dispersion from just equity beta differences. Equity beta is the level of systematic risk in an equity investment. This risk is driven by macroeconomic events and is inherent in equity markets. This is only about a fifth of the performance dispersion of 20% we observed in 2020 (see Figure 1). This figure would be lower if computed based on MSCI All Country World Index performance of 16.4%.

5Tracking error is a measure of how closely portfolios track their benchmark.

6 The strategic allocation of a model refers to its static design, which generally reflect a longer-term outlook and can include exposures not represented in the benchmark in order to seek higher potential returns or moderate risk. Tactical allocations within a model refers to dynamic shifts in allocation to particular assets to reflect nearer-term market views.

7The neutral asset allocation of a model or portfolio refers to the long term, strategic allocation of a model to particular investments. These weights may deviate over time due to market movement or, if applicable, due to tactical decisions made to overweight or underweight a particular asset class.

-

Additional Disclosure

©2021 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Important Information

This material is being furnished for general informational purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, and prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services.

The views contained herein are those of the authors as of June 2021 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy.

Past performance is not a reliable indicator of future performance. All investments are subject to market risk, including the possible loss of principal. Fixed-income securities are subject to credit risk, liquidity risk, call risk, and interest-rate risk. As interest rates rise, bond prices generally fall. Investments in high-yield bonds involve greater risk of price volatility, illiquidity, and default than higher-rated debt securities. Investments in bank loans may at times become difficult to value and highly illiquid. International investments can be riskier than U.S. investments due to the adverse effects of currency exchange rates, differences in market structure and liquidity, as well as specific country, regional, and economic developments.

Alternative investments may be more difficult to value and monitor, involve higher risks, and may use leverage which can magnify the effect of losses. Diversification cannot assure a profit or protect against loss in a declining market. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc., Distributor. Investment advisory services are provided by T. Rowe Price Associates, Inc. T. Rowe Price Associates, Inc. and T. Rowe Price Investment Services, Inc. are affiliated companies.

© 2021 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.