Client Conversations

Saving for Retirement: The Benefit of Regular Contributions

The amount you’re able to save has the greatest impact on your retirement success. We recommend saving at least 15% of your gross income throughout your working career in order to save enough for a retirement that could last decades. This amount includes any employer contribution.

Why 15%?

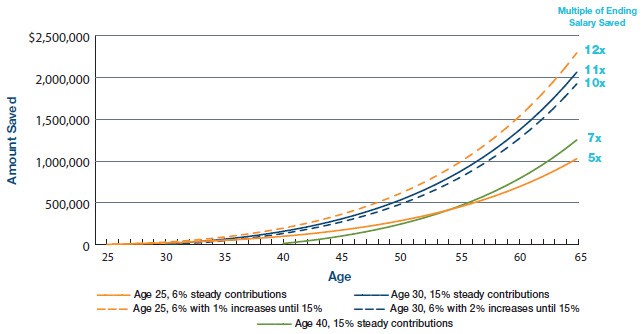

Many individuals will cover their retirement expenses through a combination of Social Security benefits and personal savings. At the onset of retirement, you might need to replace about 75% of your preretirement income. While Social Security benefits may provide a portion of this income, you may need your personal savings to replace a little less than half of your preretirement income. Taking these factors into account means you may need to have saved about 11 times or more of your final salary at retirement.

Get an Early Start

The sooner you can start saving the better off you’ll be in the long run. For many individuals, saving 15% of their income right away may be a stretch for their current financial situation. If you can increase the amount you save over time, it can make a significant difference and get your retirement savings on track.

Assumptions: Examples beginning at age 25 assume a beginning salary of $40,000 escalated 5% a year to age 45 then 3% a year to age 65. Examples beginning at age 30 assume a beginning salary of $50,000 escalated 5% a year to age 45 then 3% a year to age 65. Example beginning at age 40 assumes a beginning salary of $80,000 escalated 5% a year to age 45 then 3% a year to age 65. Annual rate of return is 7%. All savings are assumed tax-deferred. Multiple of ending salary saved divides final ending portfolio balance by ending salary at age 65. This example is for illustrative purposes only and is not meant to represent the performance of any specific investment option. The assumptions used may not reflect actual market conditions or your specific circumstances, and do not account for plan or IRS limits. Please be sure to take all of your assets, income, and investments into consideration in assessing your retirement savings adequacy.

This chart compares savers beginning at ages 25, 30, and 40. A 25-year-old saving 6% of salary and increasing each year by 1% until reaching 15% may have 12 times her final salary saved at age 65. If the 25-year-old never increases the savings rate, he may have only five times his final salary saved. A 30-year-old saving 15% over the horizon may have 11 times his final salary saved by age 65. At the same time, a 30-year-old saving 6% of salary and increasing that amount 2% each year to 15% may still have about 10 times her final salary at age 65. And, a 40-year-old saving 15% over the horizon may have about seven times his final salary at age 65.

How a Systematic Approach to Saving Adds Value

Using payroll deductions and other automated savings programs to set aside money for short- and long-term financial goals provides advantages, including:

- You pay yourself first. Directing money from your paycheck or bank account to fund your savings goals prevents you from spending it on other things. You are making savings a priority and are more likely to achieve your goals.

- You benefit from compounded growth. Over time, your money has the potential to earn money. Contributions and earnings can continue to grow, especially in tax-advantaged accounts.

- You don’t overthink it. An automated approach provides a disciplined saving process that helps take the emotion out of investing.

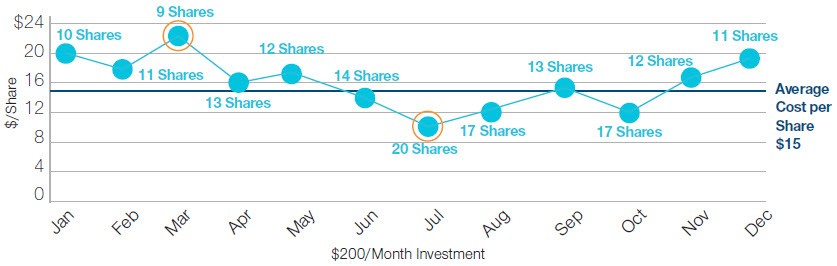

- You can take advantage of the market’s ups and downs. Over the long term, you will benefit from investing through different market conditions: buying fewer shares when prices increase and buying more shares when the market declines. This may help to lower your overall average cost.

Take advantage of your workplace plan

Many companies may provide “matching contributions” in their workplace retirement plan such as a 401(k) plan. The employer may also make other discretionary contributions. Additionally, some companies may automatically increase your contribution rate 1% or 2% each year if you sign up. Make sure you understand your company’s retirement plan and to take full advantage of these saving opportunities.

Investing on a Regular Basis

Consider this example of investing a constant dollar amount over the course of a year. The share price fluctuates from a high of $22 a share to a low of $10 a share. At the highest price point (March), nine shares are purchased with the $200 monthly investment. At the lowest price point (July), the same $200 buys 20 shares—more than twice the amount bought in March. Accumulating more shares when the price is lower means benefiting when the market and the price of the investment rebound.

Investing a constant dollar amount, also known as dollar cost averaging, cannot assure a profit or protect against loss in a declining market. Since such a plan involves continuous investment in securities regardless of fluctuating price levels, investors should consider their financial ability to continue purchases through periods of low and high price levels. This is a hypothetical example and is for illustrative purposes only. Number of shares rounded to whole numbers and may not equal total shares due to rounding.

Final Thoughts

Planning for retirement involves many steps. One step is determining how much you may need to save to fund a retirement that could last decades. Start as soon as you can and save on a regular basis—increasing the amount during your working years. Automating your saving and investing approach may help you chart a course to achieve your retirement savings goal.

Charts are shown for illustrative purposes only. All investments involve risk, including possible loss of principal.

This material is provided for general and educational purposes only, and not intended to provide legal, tax or investment advice. This material does not provide recommendations concerning investments, investment strategies or account types; and not intended to suggest any particular investment action is appropriate for you. Please consider your own circumstances before making an investment decision.

T. Rowe Price Investment Services, Inc.