Employer Conversations

Winning the Minds of Plan Participants

Participants are often in the dark about the benefits of staying in-plan after they retire. But you can take steps to both address their concerns and help them make good choices.

Key Insights

- A surprising number of retirees are keeping their assets in a company-sponsored plan past retirement.

- Those investors don’t necessarily understand the advantages of remaining in-plan.

- Offering guidance around the financial transition to retirement is a golden opportunity to improve outcomes for participants and plans alike.

Retirement is often the culmination of years of saving in a company-sponsored retirement plan. But more than a milestone, it’s a fork in the road. It’s a time when participants make big decisions about investing and spending in retirement. For plan sponsors, it’s a chance to offer guidance—before the retiree looks elsewhere.

Only 13% of people who retired from 2016 to 2018 withdrew their entire retirement-plan balance or rolled it over into an IRA

Staying in Plans After Retirement

At retirement, many investors choose to stay in their former employer’s 401(k) or 403(b) plan. Only 13% of people who retired from 2016 to 2018 withdrew their entire retirement-plan balance or rolled it over into an IRA, according to the University of Michigan Health and Retirement Study.

For many plan sponsors, this is good news. It means more participants and assets in their plans, which can deliver economies of scale to the entire plan. Many employers also see benefits in having the opportunity to support their loyal workforce in retirement.

In 2012, 45% of retirement account assets remained in plans for at least a year after retirement. By 2019, that figure jumped up to about 60%.

A Good Outcome with Mixed Reasons

Increasingly, plan participants who left their employer at or after age 65 have assets in their employer-sponsored retirement plan. In 2012, 45% of retirement account assets remained in plans for at least a year after retirement. By 2019, that figure jumped up to about 60%.1

There are many reasons why a new retiree would keep their money in an employer-sponsored plan. They may feel a level of trust in the manager and administrator of the plan, or the task of rearranging their finances may simply be at the bottom of a to-do list.

Three Things Participants Often Get Wrong About Their Retirement Plan

There are also many misconceptions among retired and working investors alike about what they can do with their retirement assets. In a series of focus groups in multiple cities, T. Rowe Price tried to understand some of those reasons.

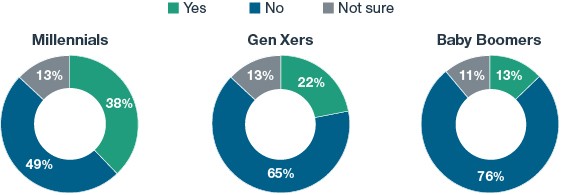

Participant Survey Responses by Generation

Has your employer informed you about potential advantages to staying in your workplace retirement plan after you retire?

RSS5 © 2019 NMG Consulting. All rights reserved. Conducted for T. Rowe Price by NMG Consulting.

Different generations feel differently about the information they’ve received from their plan sponsors. Knowing who you’re missing can help you tailor your message, and how you deliver it.

1. They didn’t know they could keep assets in the plan.

Surprisingly, many in these focus groups didn’t know they could keep money in their employer’s retirement plan after retirement. Upon learning they could manage their retirement assets in the plan sponsored by their former employer, many were open to the idea.

2. But they’re not sure they want to.

But those investors also expressed reservations—some of which represent real opportunities for plan sponsors to step in and offer valuable guidance.

3. They’re worried about costs.

The cost of an employer-sponsored plan is one common concern. Respondents believed, often incorrectly, that their in-plan fees are higher than the ones they’d pay elsewhere. They also expressed fears about hidden fees that don’t exist at the retail level. Many of their fears about the fees in employer-sponsored plans stem from a sentiment that employers aren’t interested in lowering plan-related fees.

That misconception presents an opportunity for employers to tell the story of their process for managing their plans and illustrate their fee-conscious approaches to selecting plans and managers. It’s also a chance to explain to participants how the buying power and economies of scale of their employer-sponsored plan can lead to lower fees.

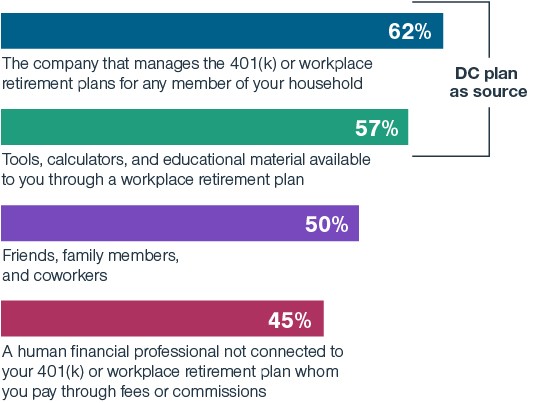

Take advantage of the fact that DC plans are the first place that participants turn to for knowledge. Telling a compelling story about plan management can help ease other misconceptions. These include a sense that the sponsor isn’t always looking out for their participants’ best interests. In addition to the morale boost that comes with knowing their employer is looking out for them, better-educated plan participants are more likely to keep assets in the plan at retirement.

Take Action: Here's What Your Plan Participants Need to Know

Telling employees more about your defined contribution plan is vital. Employees in every generation lack awareness of the benefits of their employer-sponsored plan, according to survey data from those same focus groups.

What do they need to know? In addition to the key benefits such as the tax advantages, investment options, and the possible match, there are a few elements that can help a plan better serve participants for the long haul.

Participants’ Sources of Advice to Achieve Their Lifetime Financial Goals

RSS5 © 2019 NMG Consulting. All rights reserved. Conducted for T. Rowe Price by NMG Consulting.

- Explain fees. Participants may need to hear that their employer-sponsored plan has the potential for lower fees than investors can find in retail markets.

- Focus on oversight. Sponsors should also explain the investment oversight they conduct on their plan.

- Highlight information. It can also help to explain that would-be retirees will have access to credible information, resources, and account services after they leave the company.

- Ease the transition. Retiring and shifting from a savings mindset to a spending mindset presents a host of challenges for investors of all experience levels. Offering practical guidance at that turning point can prove to participants that the plan continues to assist them for years to come.

Many participants will stay in their employer-sponsored plan after retirement. By better communicating the strengths of their plan, sponsors can keep more participants in the plan for longer periods and make those participants feel better about their financial futures.

Get More Information

There's much more ground to cover with respect to this insight. Dive deeper with the full white paper, which provides even more research and analysis on improving outcomes for participants and plans alike.

1 Source: T. Rowe Price Retirement Plan Services, Inc. Percent of account value retained by defined contribution plan participants age 65 or older after 1, 2, 3, 4, or 5 calendar years following separation from service.

Sources:

T. Rowe Price Retirement Plan Services, Inc. Percent of account value retained by defined contribution plan participants age 65 or older after 1, 2, 3, 4, or 5 calendar years following separation from service.

Retired participants age 60–69. Health and Retirement Study (HRS Core) public use data set. Produced and distributed by the University of Michigan with funding from the National Institute on Aging (grant number NIA U01AG009740). Ann Arbor, MI, 2014 and 2016.

Important Information

This material is provided for general and educational purposes only and not intended to provide legal, tax, or investment advice. This material does not provide recommendations concerning investments, investment strategies, or account types; it is not individualized to the needs of any specific investor and not intended to suggest any particular investment action is appropriate for you, nor is it intended to serve as the primary basis for investment decision-making.

The views contained herein are those of the authors as of March 2020 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

All investments involve risk, including possible loss of principal. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc., Distributor.

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.