We are retirement investment experts.

For more than 85 years, we’ve helped clients like yours achieve the retirement plan outcomes they want.

Over $627 Billion of the firm’s assets under management are represented by defined contribution assets

20+ years of experience delivering target date solutions

30+ years of experience providing recordkeeping services and managing stable value assets

BIG OPPORTUNITY

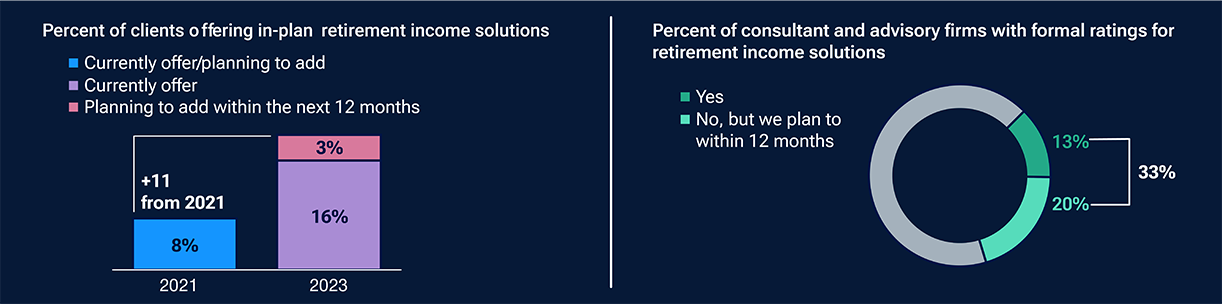

Data suggest that more plans, consultants, and advisors are taking a position on retirement income:

Decision opportunities for plan sponsors and retirement professionals:

- As litigation persists, our industry experts are discussing legislation that could benefit retirees and protect plan fiduciaries.

- There are opportunities for advisors and consultants to discuss the potential cost, portability, and educational challenges of income solutions with plan sponsors who are worried about complexity.

- While guaranteed products have dominated the retirement income narrative, the demand for diverse solutions continues.

Source: T. Rowe Price, 2023 Defined Contribution Consultant Study; 2021 Defined Contribution Consultant Study.

CLIENT-FOCUSED PRODUCTS

Here are some strategies to consider while evaluating retirement income solutions.

Target Funds and Retirement Funds

Every retirement investor is different. Our target date solutions are designed to help plan participants reach their long-term investment goals—whatever they happen to be.

Stable Value Common Trust Fund

Consider this potential retirement income tool that seeks to provide maximum current income while maintaining stability of principal.

ACTIONABLE INSIGHTS

Essential retirement income research

Strong demand around one to five years before and after retirement highlight an opportunity for digital solutions.

How do you create the "best" retirement income strategy? Clearing up confusion about different retirement income products creates opportunity for traditional advice providers.

A surge in retirees and a complex market environment are creating new challenges for retirement savers. We are closely watching these themes impacting the U.S. retirement industry.

Strong demand around one to five years before and after retirement highlight an opportunity for digital solutions.

How do you create the "best" retirement income strategy? Clearing up confusion about different retirement income products creates opportunity for traditional advice providers.

A surge in retirees and a complex market environment are creating new challenges for retirement savers. We are closely watching these themes impacting the U.S. retirement industry.

Check out our full collection of retirement income insights.

INTERACTIVE TOOLS

Are plan participants on track for retirement?

Help them find out by sharing tools like the Retirement Income Calculator. Bring additional value to your clients by using this interactive Retirement Income Evaluation Framework as a discussion guide to assist plan sponsors when evaluating the retirement income solutions available in their plans.

Retirement investors can use the Retirement Income Calculator to find out where they stand and to better prepare for retirement. They can even test different scenarios to see how changes might affect their likelihood of success.

Life is about more than a retirement account balance. This interactive discussion guide can help plan participants gain clarity and peace of mind around making the retirement they want a reality.

Take the next step.

Contact us.

- Uncover new investment opportunities.

- Get expert help with the heightened regulatory environment and due diligence.

- Learn about our programs to scale and grow your business.

- Register for timesaving tools and services.

Risk Considerations: All investments are subject to market risk, including the possible loss of principal.

The principal value of target date funds is not guaranteed at any time, including at or after the target date, which is the approximate year an investor plans to retire. These funds typically invest in a broad range of underlying mutual funds that include stocks, bonds, and short-term investments and are subject to the risks of different areas of the market. In addition, the objectives of target date funds typically change over time to become more conservative. Target date funds do not guarantee a particular level or duration of income.

The T. Rowe Price common trust funds (“Trusts”) are not mutual funds, rather the Trusts are operated and maintained so as to qualify for exemption from registration as mutual funds pursuant to Section 3(c)(11) of the Investment Company Act of 1940, as amended. The Trusts are established by T. Rowe Price Trust Company under Maryland banking law, and their units are exempt from registration under the Securities Act of 1933. Investments in the Trusts are not deposits or obligations of, or guaranteed by, the U.S. government or its agencies or T. Rowe Price Trust Company and are subject to investment risks, including possible loss of principal. If a Trust seeks to preserve the value of your investment at $1.00 per unit, it cannot guarantee to do so.

Differences between investment vehicles may include investment minimums, objectives, holdings, sales and management fees, liquidity, volatility, tax features, and other features, which may result in differences in performance.

202403-3435287