Market Outlook

2020 Midyear Market Outlook: A Focus on Credit Quality

June 19 2020The economic damage wrought by the coronavirus pushed credit quality into the spotlight in the first half of 2020, as fixed income investors sought shelter in sovereign debt and other top investment‑grade (IG) assets.

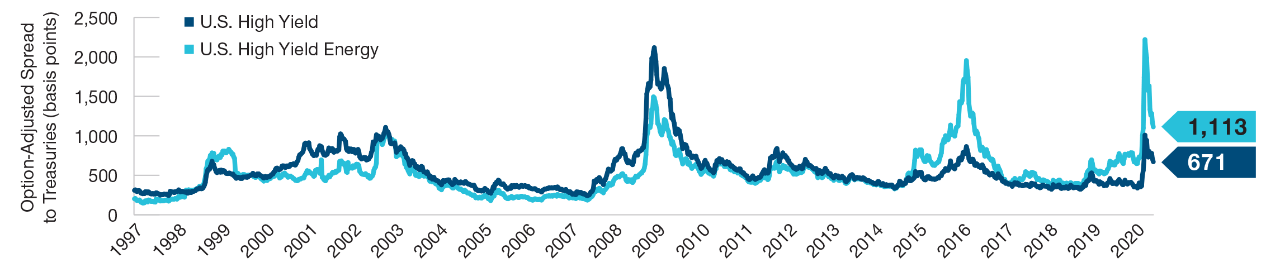

While credit spreads have narrowed from the worst of the market sell‑off in March, they remain wide and volatile, Vaselkiv notes.1 However, as in global equity markets, performance has been highly uneven.

In the high yield market, yield spreads for BB rated bonds perceived as defensive have tightened to pre‑crisis levels. Yet, some “fallen angels”—companies that have recently lost their IG ratings—have been forced to sell bonds with yields as high as 9% to shore up their balance sheets. In this environment, investors need to carefully analyze relative value on a case‑by‑case basis, Vaselkiv says.

Right now, corporate credit—both investment grade and high yield—remains our dominant theme.

In forecasting potential default rates, T. Rowe Price analysts have divided the high yield universe into three broad groups, Vaselkiv says:

- Industries like airlines and cruise lines that face existential risks. Some of these issuers are likely to undergo restructuring either inside or outside of bankruptcy. A number of energy companies also may fall into this category if oil prices remain below USD 40 a barrel.

- Cyclical industries, such as automakers and homebuilders, where revenues and profits have fallen sharply but new bond issues can help companies build bridges to recovery.

- Sectors that are well‑positioned to benefit from changing consumer behavior. These could include some media companies, quick‑service restaurants, and supermarket chains.

Many fixed income managers already have rotated into well‑positioned sectors and now are cautiously expanding their cyclical exposures, Vaselkiv says. How that latter category fares in the recovery will determine the peak default rate for the high yield universe as a whole. An aggregate rate close to 10% appears warranted, he adds.

Credit Spreads Have Tightened Since March but Remain Wide and Volatile

(Fig. 3) U.S. High Yield Spread History1

Past performance is not a reliable indicator of future performance.

January 1, 1997, through May 31, 2020.

Sources: Bloomberg Index Services Limited, and ICE BofAML (see Additional Disclosures). T. Rowe Price analysis using data from FactSet Research Systems Inc. All rights reserved.

1 U.S. High Yield = ICE BofA US High Yield Index. U.S. High Yield Energy = ICE BofA US High Yield Energy Index. A basis point is 0.01 percentage point.

Corporate Credit Remains the Theme

Attractive fixed income opportunities in the second half appear relatively limited, in Vaselkiv’s view. Defensive assets, such as U.S. Treasuries and other developed sovereigns, AAA rated munis, and even some high‑quality securitized sectors, are expensive and vulnerable to a further backup in interest rates if the recovery proves faster than expected and/or a vaccine becomes widely available.

In emerging fixed income markets, some specific opportunities appear attractive, but the sector as a whole remains under severe pressure from the pandemic and, in some countries, such as Brazil, from poor political leadership, Vaselkiv says. Sovereign default rates have risen.

“Right now, corporate credit—both investment grade and high yield—remains our dominant theme,” Vaselkiv concludes.

Get insights from our experts.

Subscribe to regular email updates and inform your client conversations.

Additional Disclosures

Information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The index is used with permission. The Index may not be copied, used, or distributed without J.P. Morgan’s prior written approval. Copyright © 2020, J.P. Morgan Chase & Co. All rights reserved.

Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). BARCLAYS® is a trademark and service mark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Bloomberg or Bloomberg’s licensors, including Barclays, own all proprietary rights in the Bloomberg Barclays Indices. Neither Bloomberg nor Barclays approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

ICE Data Indices, LLC (“ICE DATA”), is used with permission. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD PARTY SUPPLIERS DISCLAIM ANY AND ALL WARRANTIES AND REPRESENTATIONS, EXPRESS AND/OR IMPLIED, INCLUDING ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, INCLUDING THE INDICES, INDEX DATA AND ANY DATA INCLUDED IN, RELATED TO, OR DERIVED THEREFROM. NEITHER ICE DATA, ITS AFFILIATES NOR THEIR RESPECTIVE THIRD PARTY SUPPLIERS SHALL BE SUBJECT TO ANY DAMAGES OR LIABILITY WITH RESPECT TO THE ADEQUACY, ACCURACY, TIMELINESS OR COMPLETENESS OF THE INDICES OR THE INDEX DATA OR ANY COMPONENT THEREOF, AND THE INDICES AND INDEX DATA AND ALL COMPONENTS THEREOF ARE PROVIDED ON AN “AS IS” BASIS AND YOUR USE IS AT YOUR OWN RISK. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD PARTY SUPPLIERS DO NOT SPONSOR, ENDORSE, OR RECOMMEND T. Rowe Price OR ANY OF ITS PRODUCTS OR SERVICES.

Copyright © 2020, S&P Global Market Intelligence (and its affiliates, as applicable). Reproduction of any information, data or material, including ratings (“Content”) in any form is prohibited except with the prior written permission of the relevant party. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content. A reference to a particular investment or security, a rating or any observation concerning an investment that is part of the Content is not a recommendation to buy, sell or hold such investment or security, does not address the suitability of an investment or security and should not be relied on as investment advice. Credit ratings are statements of opinions and are not statements of fact.

The S&P 500 Index is a product of S&P Dow Jones Indices LLC, a division of S&P Global, or its affiliates (“SPDJI”) and has been licensed for use by T. Rowe Price. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC, a division of S&P Global (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by T. Rowe Price. T. Rowe Price’s Midyear Market Outlook is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500 Index.

Important Information

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are those of the authors as of June 2020 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation, investment advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Investors will need to consider their own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy.

Past performance is not a reliable indicator of future performance. All investments are subject to market risk, including the possible loss of principal. Investing in technology stocks entails specific risks, including the potential for wide variations in performance and usually wide price swings, up and down. Technology companies can be affected by, among other things, intense competition, government regulation, earnings disappointments, dependency on patent protection and rapid obsolescence of products and services due to technological innovations or changing consumer preferences. Fixed-income securities are subject to credit risk, liquidity risk, call risk, and interest-rate risk. As interest rates rise, bond prices generally fall. Investments in high-yield bonds involve greater risk of price volatility, illiquidity, and default than higher-rated debt securities. International investments can be riskier than U.S. investments due to the adverse effects of currency exchange rates, differences in market structure and liquidity, as well as specific country, regional, and economic developments. These risks are generally greater for investments in emerging markets. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc.

© 2020 T. Rowe Price. All rights reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the bighorn sheep design are, collectively and/or apart, trademarks or registered trademarks of T. Rowe Price Group, Inc.