Tectonic shifts create new opportunities

The economic distortions of the past few years have produced major changes to the global investment landscape. We are in a new regime of higher interest rates and stickier inflation. Investors will need to adapt to this new normal but could find opportunities by staying agile and taking a broad view. Read our 2024 Global Market Outlook for timely insights on navigating this transformed world.

Three themes for a world transformed

Global economies have stayed resilient amid uncertainty, but investors will need to adapt themselves to a new market regime.

We think the Fed is likely to remain on hold in 2024. High yield and shorter-term investment-grade corporate bonds could offer opportunities.

Equity investors may benefit from casting wider nets in 2024. We see opportunities in Japan, emerging markets, health care, and artificial intelligence (AI).

Global economies have stayed resilient amid uncertainty, but investors will need to adapt themselves to a new market regime.

We think the Fed is likely to remain on hold in 2024. High yield and shorter-term investment-grade corporate bonds could offer opportunities.

Equity investors may benefit from casting wider nets in 2024. We see opportunities in Japan, emerging markets, health care, and artificial intelligence (AI).

Key takeaways from our 2024 Global Market Outlook

Summary with global Investment Specialist Ritu Vohora, CFA®

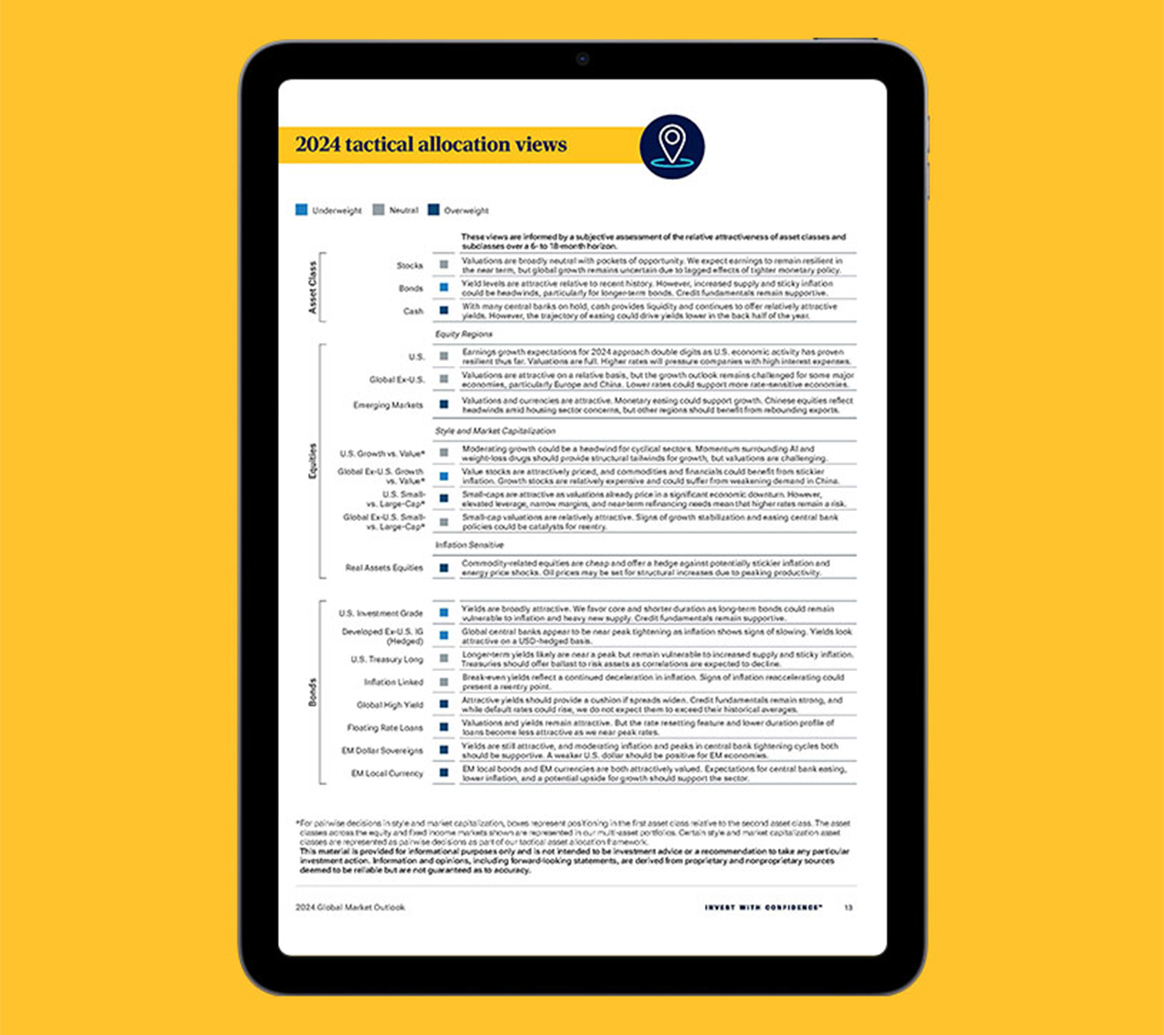

Tactical allocation views

Investment professionals from the T. Rowe Price Multi-Asset Division present their views on the relative attractiveness of asset classes and subclasses over the next six to 18 months.

Watch the CE webinar replay

Our chief investment officers weigh in on the state of markets and the economy heading into 2024. Continuing education (CE) credits available for financial professionals.

Important Information

CFA® and Chartered Financial Analyst are registered trademarks owned by CFA® Institute.

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are those of the speaker as of December 2023 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein, including forecasts and forward-looking statements, is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy or completeness. There is no guarantee that any forecasts made will come to pass.

The specific securities identified and described are for illustrative purposes only and do not represent all of the securities purchased, sold, or recommended by T. Rowe Price, and no assumptions should be made that investments in the securities identified and discussed were or will be profitable.

Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

All investments involve risk, including possible loss of principal.

International investments can be riskier than U.S. investments due to the adverse effects of currency exchange rates, differences in market structure and liquidity, as well as specific country, regional, and economic developments. These risks are generally greater for investments in emerging markets.

Small-cap stocks are generally more volatile than stocks of large, well-established companies.

Fixed income investing includes interest rate risk and credit risk. When interest rates rise, bond values generally fall. Investments in high yield bonds involve greater risk of price volatility, illiquidity, and default than higher-rated debt.

Investments concentrating in a specific sector can be more volatile than investments in a broader range of industries.

Diversification cannot assure a profit or protect against loss in a declining market.

T. Rowe Price Investment Services, Inc., distributor.

© 2023 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks or registered trademarks of T. Rowe Price Group, Inc.

202312-3272148