Emergency Fund Planning

Executive Summary

In many cases, it may fall to you to introduce financial wellness concepts and provide foundational financial guidance in an employee education setting. This article provides you with a handout that explains the reasons why an emergency fund is necessary, and recommendations for how much to set aside based on varying scenarios.

Financial emergencies happen. A job loss. A large, unexpected expense. Whether you call it a cash reserve, emergency fund, or rainy day fund, it’s important to have available money on the side.

Why Do I Need an Emergency Fund?

The primary purpose of an emergency fund is to help keep your finances and savings goals intact should you experience a financial shock. By using this earmarked account to get through a period of uncertainty, you don’t have to put additional expenses on a credit card or take money out of retirement savings.

Some examples where an emergency fund can be used include:

- Job loss. Loss of income from a job or due to disability is already a tough period to get through emotionally, but knowing you have a cash reserve on the side may help reduce some of the anxiety. Use the money to pay everyday expenses, including your mortgage payment.

- Large, unanticipated expenses. While you can budget for routine household repairs, maintenance, and regular health care costs, for example, there may be an unplanned financial surprise.

- Need for flexibility. Beyond paying unexpected expenses, an emergency fund could offer some flexibility if you wanted the freedom to leave your job to try something new. While it may not rise to the level of an emergency, having a cash reserve may give you the peace of mind and assurance to make changes in your life without additional financial stress.

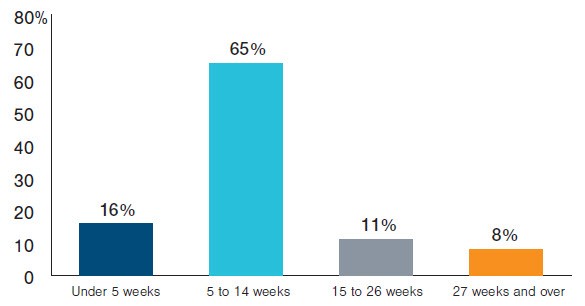

Unemployed Persons by Duration of Unemployment

Source: U.S. Bureau of Labor Statistics, seasonally adjusted, July 2020.

How Much Should I Set Aside?

- If you are a two-earner household, then an amount that can cover three to six months of expenses may be sufficient as you have another income to fall back on.

- If you are relying on only one income in your household or your income is less predictable—for example, you rely on commissions or work on a freelance basis—you may want to consider having six months of expenses or more saved.

- If you expect that a job search in your field might take longer than six months, a larger fund could be appropriate.

Why You Don’t Want to Take Money Out of Retirement Accounts

Keeping retirement savings on track is a priority for most individuals. If you take money out of an IRA or cash out your retirement savings when changing jobs, in most cases, you will pay a 10% early distribution penalty if under age 59½ in addition to taxes on the amount withdrawn.

How Do I Get Started?

An emergency fund should be in an account of stable investments, such as a bank savings or money market account that you can access at any time.

- The easiest way to get started is to direct money on a regular basis from your paycheck or checking account into your emergency fund.

- For starters, try to save $1,000–$5,000 right away. Then, understand your expenses to build your reserve up over time. Try to complete the process within one to two years.

Why is $1,000–$5,000 a good starting point? Many people may struggle to cover these kinds of expenses without having to borrow money or sell something.

$1,000 available for emergencies could help cover expenses like:

- Car or health insurance deductibles

- Minor home repairs

- Replacing a broken appliance

- Unplanned travel due to family illness or death

- Gift expenses for a wedding or baby shower

Unexpected expenses that could cost thousands of dollars:

- Medical emergency, especially if uninsured

- Major home and auto repairs

- Pet emergency visit or illness

- Unplanned moving or relocation costs

Final Thoughts

Getting an emergency fund in place may take some sacrifice. You may need to modify other savings programs and cut spending for a short period of time while building up your cash reserves.

If you have to reduce your retirement plan contribution in order to prioritize funding your emergency account, make sure you resume saving for retirement once the account is fully funded. If you can contribute enough to get any company match, if available, while simultaneously funding your emergency reserve, that would be ideal. T. Rowe Price suggests saving at least 15% of your salary (including any company contributions) for your retirement goals.

If you are struggling to save, getting on strong financial footing can help. Your employer may offer a financial wellness program to help with your finances.

Also, don’t forget to start replenishing your emergency fund after you withdraw from it.

Find this article interesting?

Subscribe to get email updates including article recommendations relating to DC Resources.

Charts are shown for illustrative purposes only.

This material is provided for general and educational purposes only and not intended to provide legal, tax, or investment advice. This material does not provide recommendations concerning investments, investment strategies, or account types; it is not individualized to the needs of any specific investor and not intended to suggest any particular investment action is appropriate for you, nor is it intended to serve as the primary basis for investment decision-making.

T. Rowe Price Investment Services, Inc.