With Fed Tightening on Tap, What’s In Store for Local Currency Bonds?

EXECUTIVE SUMMARY

Volatility comes with the territory when investing in emerging markets (EM). Even so, the performance gyrations of EM local currency bonds have undoubtedly unnerved investors, causing some to question whether the asset class is a prudent investment choice. Since returning nearly 17% in 2012, the broad EM local sector has more than given back these gains1 amid concerns about tighter U.S. monetary policy, unyielding dollar strength, and lackluster global growth. Although volatility will likely persist in the near term, we believe an inflection point is near. We maintain that local currency bonds hold considerable merit for longer-term investors seeking global diversification, relatively attractive yields, and a shorter duration than developed market sovereigns.

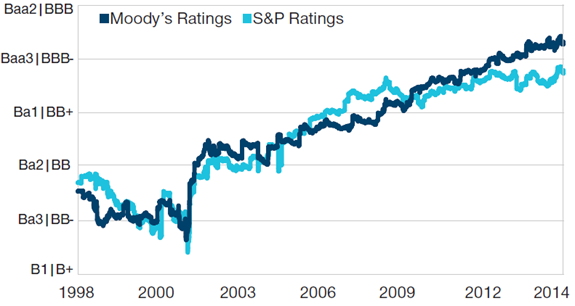

A steady improvement in credit quality since the turn of the century has permitted a growing number of developing countries to issue debt in their home currencies rather than borrowing in U.S. dollars or euros. This privilege has reduced issuers’ foreign exchange (FX) risk, one of the catalysts of the wave of crises that befell many developing economies in the 1990s and early 2000s. Indeed, these chaotic events—which were sparked by an unsustainable combination of heavy foreign currency debts, fixed exchange rates, and large external and/ or fiscal imbalances—put in motion economic reforms that have propelled the EM asset class to largely investment grade today (see Figure 1).

FIGURE 1: Fundamental improvements have enabled increased local currency issuance

Average rating of the J.P. Morgan Emerging Markets Bond Index Global from January 1998 to February 2015.

Sources: J.P. Morgan, Moody’s, Standard & Poor’s, and T. Rowe Price.

Many developing countries abandoned exchange rate pegs and allowed their currencies to more freely float, effectively untethering domestic monetary policy from foreign central banks. In the process, many accumulated large foreign exchange (FX) reserves, which provide a liquidity buffer in the event of capital flight. Monetary policy has generally become less prone to political influence, allowing central bankers to make pragmatic decisions that support sustainable growth and investor confidence. Prudent fiscal policy has kept debt levels low relative to economic output even as the debt burdens of advanced economies mounted. And political systems in many developing nations have become more democratic, leading to greater economic inclusion. This, in turn, has given rise to stronger domestic demand and less reliance on exports as the main engine of growth.

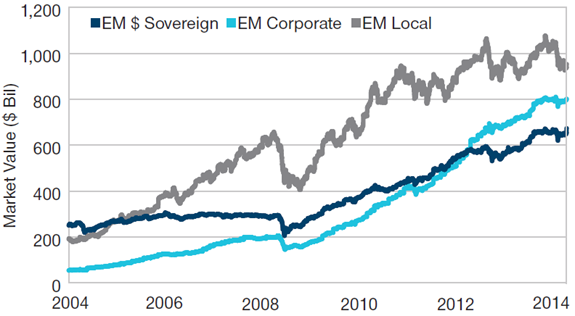

Local debt markets took root during this evolution and expanded rapidly. According to J.P. Morgan, there was $6.4 trillion in local currency government debt outstanding in mid-2014, nearly six times the total in 2002. While not all of this is investable, local markets have surpassed both the external sovereign and corporate markets in overall size (see Figure 2). Local markets are also more liquid than hard currency debt markets, particularly corporates. The level of foreign participation varies by country, but as the name implies, a significant portion of local markets is supported by domestic institutions such as insurers and pension funds. This dedicated buyer base, with increasing assets under management, supplies liquidity at times when international investors are less active.

FIGURE 2: EM local markets larger, more liquid than external debt markets

From January 2004 to February 2015

Market value of the J.P. Morgan GBI-EM Global (EM Local)*, J.P. Morgan CEMBI Broad (EM Corporate), and J.P. Morgan EMBI Global (EM $ Sovereign) Indexes.

*Excludes China and India given access challenges. Sources: J.P. Morgan and T. Rowe Price.

CURRENCIES HAVE FUELED RECENT VOLATILITY

EM local debt has important distinctions from hard currency sovereign debt—the more traditional route for international investors to access emerging fixed income markets. Hard currency bonds, typically dollar denominated, are priced at a spread to similar-maturity Treasury yields, which represents the market’s perception of the issuer’s credit risk. Total returns are driven by coupon payments, changes in underlying Treasury rates, and fluctuations in the risk premium as investors grow more or less confident in an issuer’s credit quality.

In contrast, local currency debt is predominantly a rate and currency instrument rather than a credit instrument (although an element of credit risk is factored into yields). Along with coupons, return drivers consist of fluctuations in local interest rates— largely steered by individual countries’ responses to domestic growth and inflation—and movements in FX rates. Historically, the bond components of total return have produced generally stable results, while the FX component has been a source of volatility.

Looking at recent performance, the strong results delivered by EM local bonds in 2012 continued into the early months of 2013 as extremely low rates in advanced economies compelled investors to cast a wider net for yield. But the tone suddenly changed in May of that year when Fed officials intimated that quantitative easing would not go on ad infinitum. Local rates rose sharply and currencies sold off as investors retreated from EM assets in response to rising U.S. Treasury rates and expectations for a withdrawal of global monetary liquidity. Countries that depend most heavily on external financing were hardest hit as foreign capital exited.

Since early 2014, EM local bonds have largely rallied along with developed market sovereigns, benefiting from a disinflationary environment amid sluggish global growth and plummeting commodity prices. However, solid performance on the rates side was not enough to offset overwhelming strength in the dollar, which pulled total returns for U.S.-domiciled investors well into negative territory. Notably, European and Asian investors in EM local markets fared much better as the European Central Bank and the Bank of Japan employed unorthodox policy to stimulate weak economies, in the process weakening their currencies.

A DIFFERENT ENVIRONMENT THAN 2013

The prospect of Fed rate hikes has made investors cautious about EM assets in general, as many market participants fear a reprise of the “taper tantrum” that led to large-scale capital outflows in 2013. While there will probably be turbulence as the market recognizes that the Fed intends to follow through on its well-telegraphed plans to tighten policy, we do not anticipate the market response to be as violent for two reasons:

- Investor positioning is lighter. Attracted by high yields and currency momentum, investors plowed into EM local funds following the 2008 financial crisis. These one-way flows suddenly reversed course in June 2013, which marked the start of an extended period of cash outflows that have only recently ebbed. With the departure of many speculative investors, the asset class appears to be more firmly supported by a base of longer-term investors who should be less prone to panic selling.

- Valuations have broadly cheapened over the past two years—particularly on the FX side, where a number of currencies are trading at all-time lows versus the U.S. dollar and look extended on a real effective exchange rate basis. Two years ago, the Fed’s taper talk blindsided investors who were apparently shocked that the central bank might one day begin withdrawing accommodation. Today, markets have already started to price in tighter Fed policy. The main questions now are when tightening will begin and how high rates will eventually go.

EXPECT DIFFERENTIATED PERFORMANCE BY COUNTRY IN 2015

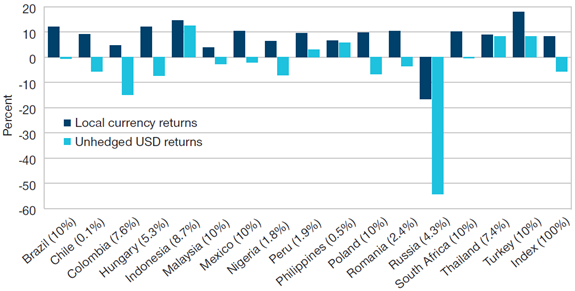

Last year saw widespread dispersion in the performance of individual countries. As shown in Figure 3, nearly 67 percentage points separated the top performer (Indonesia) from the worst (Russia) in unhedged dollar terms. This trend seems likely to persist this year, though probably not to such an extreme degree.

FIGURE 3: Solid bond performance (ex Russia) in 2014 eroded by currency declines

Local currency and unhedged USD returns by country for the J.P. Morgan GBI-EM Global Diversfied Index. Percent market value as of December 31, 2014, in parentheses.

Sources: J.P. Morgan and T. Rowe Price.

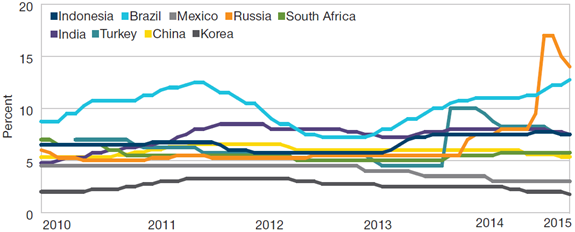

Idiosyncratic stories abound, and countries are at different stages of economic and interest rate cycles as growth trends remain disparate (see Figure 4). Some Asian markets such as India, Indonesia, Sri Lanka, and the Philippines are recording economic growth rates in excess of 5%, while European and Latin American economies are running at a more subdued pace. Indeed, two of the largest markets— Brazil and Russia—will suppress overall EM growth numbers given their formidable economic challenges. A continued deceleration in China will also have a negative impact on countries that are major commodity exporters.

FIGURE 4: Policy rates following different paths

From January 2010 to March 2015

Sources: Haver Analytics and T. Rowe Price.

With an index-level yield over 6%, we expect carry to be a primary return driver in 2015. Duration should also provide a lift. Although local rates have rallied over the past year, they remain attractive relative to developed market sovereigns and have room to decline further amid generally subdued inflation pressures. Moreover, interest rate cycles for a significant portion of the EM universe are more closely aligned with Europe and Japan—where monetary policy will remain highly accommodative—than with the U.S., where tightening appears to be forthcoming. While rates in more dollar-centric markets, such as Mexico, have relatively high correlations with the U.S., others are driven more by local and regional policy trends. Thailand, for instance, is a lower-beta market that tends to be less sensitive to fluctuations in Treasuries.

Currencies will remain a performance headwind in the near term, but this should gradually subside as the year progresses. History shows that dollar strength can persist for long periods. However, the dollar has already made a significant move to the upside. In addition, a protracted period of unilateral dollar strength seems less plausible in an increasingly intertwined global economy. Rampant dollar strength combined with weakness abroad would eventually weigh on the U.S. economy and, as a consequence, the strong dollar dynamic. On the other side of the equation, a rising dollar and cheapening foreign currencies will likely stimulate exports to the U.S., bolstering EM growth and currencies.

Indeed, although not yet seen throughout the entire asset class, the sharp decline in EM currencies has helped increase export competitiveness and lessened demand for imports, improving current account balances and growth prospects. And terms of trade have improved for some countries, most notably for energy importers such as Turkey that benefit from lower oil prices. As these trends become more widespread, they should provide firmer support for currencies.

EM currencies would also benefit from faster growth in Europe, which may be in the offing in the second half of 2015. Easier credit conditions, a cheaper euro, and a loosening of fiscal restraints appear to be enabling a European recovery, which would be positive for global trade. A confirmed stabilization in oil prices would also boost confidence in the asset class, even though only about a quarter of its constituents are energy exporters. Low oil prices are actually a net positive for many EM countries, particularly in Asia and Europe.

For 2015, our expectations are for mid-single-digit returns for the broad asset class in U.S. dollar terms, as the bond and currency components pull in different directions. For euro- and yen-based investors, performance should be even better, with EM currency appreciation supplementing bond returns. Currency headwinds should begin to abate for U.S. investors as we get past the initial Fed rate hike, which has been the market’s primary focus. For now, we generally prefer to use more fragile developed and emerging currencies as funding vehicles for higher-conviction EM currency positions rather than selling the dollar.

AN EMPHASIS ON COUNTRIES THAT POSSESS GROWTH, REFORM, AND YIELD

With the dollar producing headwinds and the cost of capital potentially rising, we are focused on markets that possess traits that are most likely to encourage capital flows. Specifically, we prefer some combination of above-average growth, structural reforms that should enhance future growth potential, and relatively high yields. For example:

- Indonesia has bolstered its external defenses against capital flight by building up FX reserves. President Joko Widodo (aka Jokowi) has taken advantage of the plunge in oil prices to reduce fuel subsidies and increase infrastructure spending to boost output. Although GDP growth has slowed, it should still exceed 5% this year, which looks decent in a slow-growth world. The Bank of Indonesia has cut rates once this year and may do so again, providing a tailwind for bonds. However, we hold a more cautious view on the rupiah, as the government prefers a weaker currency to help the economy’s transition from natural resources to manufacturing.

- In Mexico, the Peña Nieto administration has instituted much-needed economic reforms, most notably in the energy and telecom sectors. While growth remains modest, it should pick up over the medium term as these reform efforts take hold. Mexico should also benefit from improved labor market competitiveness, eventual access to low-priced energy from its northern neighbors, market-friendly macro policies, and low debt levels. The peso and local Mexican bonds look attractive after recent weakness.

- There are high hopes that India’s Prime Minister Narendra Modi will implement promised reform measures that include phasing out subsidies, removing barriers to foreign investment, and restructuring a byzantine tax system that burdens businesses. If progress is made, India’s growth rate could potentially surpass China’s in the years ahead. Strong growth and an improved external balance support the rupee, and the Reserve Bank of India has scope to cut rates, which is positive for local currency bonds (though caps on foreign ownership can make it challenging to access the local bond market).

- In Eastern Europe, Serbia has a strong political mandate for fiscal adjustment and structural reforms, such as privatizing state-owned enterprises and improving the business climate and rule of law. The new government has ample FX reserves and has committed to an agreement with the International Monetary Fund that provides a liquidity backstop in exchange for fiscal consolidation. Serbia’s small local currency bond market offers very high yields in a disinflationary environment, and external balance improvements support the dinar.

AN ATTRACTIVE ASSET CLASS FOR GLOBAL DIVERSIFICATION

With Treasury yields likely to rise from low levels and negligible yields on offer in Europe and Japan, investors across developed markets have substantial incentive to diversify globally. However, a traditional international bond portfolio that consists mostly of the largest debt issuers (i.e., developed market governments) has serious drawbacks in the current environment: Yields are minimal, and interest rate risk is high. In our view, EM local bonds present a much more compelling alternative (see Figure 5).

Based on the yield and duration data in Figure 5, a 100 basis point rise in rates would result in a more than 6% capital loss for a U.S. investor in international bonds (excluding the impact of currency movements). An EM local portfolio offers a more attractive value proposition, as the combination of higher carry and lower duration provide better protection against rising rates. Local rates would need to rise by about 125 basis points before the carry is depleted. With their higher duration and lower yield, a portfolio of international bonds provides far less cushion against rising rates.

This holds true not only for rates but also for currency fluctuations. As Figure 5 shows, both asset classes have a similar negative correlation with the U.S. dollar. However, with their much lower yield, a relatively modest move higher in the dollar versus other major currencies could result in a negative total return for conventional international bonds.

FIGURE 5: EM local bonds offer higher yields, shorter durations

As of February 27, 2015

Sources: Barclays, J.P. Morgan, and T. Rowe Price.

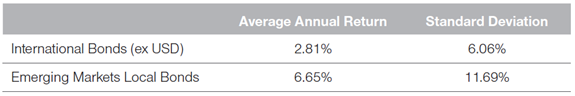

As investors are well aware, volatility in EM local assets can be high. Over the past 10 calendar years, the standard deviation for EM local bond returns was nearly double that of international bonds (see Figure 6). However, investors earned significantly higher returns to compensate for the additional volatility, resulting in better risk-adjusted performance.

FIGURE 6: Volatility higher for EM local bonds, but so are returns

Ten-year period ended December 31, 2014

Past performance cannot guarantee future results.

Sources: Barclays, J.P. Morgan, and T. Rowe Price.

Investors may also want to consider adding EM local exposure as a way to reduce credit risk in portfolios without sacrificing yield. With yields on investment-grade credit at unappealing levels, many investors have moved down in credit quality to attain higher returns. EM local bonds offer yields that are comparable with high yield corporates. However, given their superior credit quality,2 investors can take on less credit risk—essentially exchanging it for currency risk—while receiving similarly attractive yields.

In a world of very low yields, tepid growth, and central bank intervention in developed bond markets, we believe an EM local allocation is a sensible component of a global fixed income allocation. For a U.S.-based investor, it helps diversify away from the dollar— which cannot rise indefinitely—while also offering higher yields, potential for capital appreciation, and shorter duration than more traditional international bonds. For investors located in Europe and Japan, where central banks are keen on weakening their currencies and have made holding domestic bonds a high-risk/low-reward endeavor, we believe EM local assets are particularly attractive.

1 Returns based on the J.P. Morgan GBI-EM Global Diversified Index. In unhedged U.S. dollar terms.Source: J.P. Morgan GBI-EM Global Diversified Index. As of March 31, 2015.

2As of February 2015, the average rating of bonds in the J.P. Morgan GBI-EM Global Diversified Index by Fitch, Moody’s, and Standard & Poor’s was BBB+, Baa2,and BBB+, respectively.

2015-GL-1680

Informazioni importanti

Il materiale ha solo scopo informativo e/o di marketing e non è un consiglio o una raccomandazione di investimento. Consigliamo ai potenziali investiori di richiedere una consulenza legale, finanziaria e fiscale indipendente prima di assumere qualsiasi decisione di investimento. I rendimenti passati non sono indicativi di quelli futuri. Il valore di un investimento puó oscillare e gli investitori potrebbero non ottenere l'intero importo investito.

Il materiale non è stato verificato da alcuna autorita di vigilanza in alcuna giurisdizione.

Informazioni e opinioni sono ottenute/ tratte da fonti ritenute affidabili ma non garantiamo completezza ed esaustivitá, né che eventuali previsioni si concretizzino. I pareri contenuti sono soggetti a cambiamento senza preavviso e possono differire da altre società del gruppo T. Rowe Price.

È vietata la diffusione, in qualsiasi forma, della pubblicazione e/o dei suoi contenuti. Il materiale è destinato all’uso esclusivo in Italia. Vietata la distribuzione retail.