Asia Reform: A Potential New Era for a Changing Region

EXECUTIVE SUMMARY

Developing Asia is undergoing the most sweeping and fundamental reform movement in many years, underscored by the election of new leaders in recent years who seem committed to tackling the region’s longstanding challenges. Given the magnitude of the challenge, progress will come in fits and starts, but we are optimistic about the reform potential in Asia, particularly in countries with new leadership. Certainly, Asia has many other attributes that make it an attractive investment destination. The broad push for reform could also help reshape the region over the next decade while offering many exciting investment opportunities.

It was no coincidence that India and Indonesia were two of the world’s best-performing stock markets in 2014, with each posting gains in excess of 20%* despite losing momentum in the year’s second half. After electing reform-minded leaders who are pursuing policies aimed at reviving economic growth and investment, both countries exemplify renewed optimism for fundamental change in the region.

While investor enthusiasm has lately been giving way to more realistic expectations, the sweeping changes unfolding in the region’s economies, capital markets, governments, and companies could make emerging Asia one of the most promising regions for investors over the next decade.

Since 2012, Asia’s four-largest economies—China, Japan, India, and Indonesia—have all undergone change in political leadership that should prove beneficial for investors over time. Beyond that, countries across Asia are pursuing varied economic and structural reforms that should underpin corporate and market performance. Other countries, including Myanmar, the Philippines, Singapore, and Thailand, may hold elections over the next couple of years.

Asia’s new leaders seem committed to tackling such longstanding challenges as reducing government bureaucracy and bottlenecks, improving infrastructure, liberalizing financial systems, creating more regulatory and labor flexibility, revising taxation policies, attacking corruption, reforming land acquisition, revamping state-owned enterprises, and encouraging foreign investment.

Indeed, reforms in key areas such as infrastructure, labor laws, taxation, and fiscal policy in particular are needed to put regional growth back on an upward trajectory and, in many cases, help foster more efficiently run businesses.

To be sure, the reform movement in Asia is a multiyear effort and some changes will fall short of expectations or not be achieved at all. A healthy dose of skepticism and patience is needed to scope out where meaningful change may actually occur.

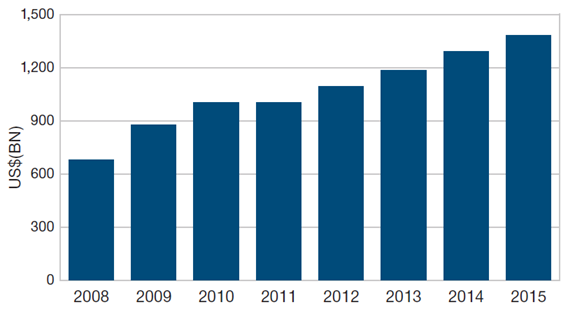

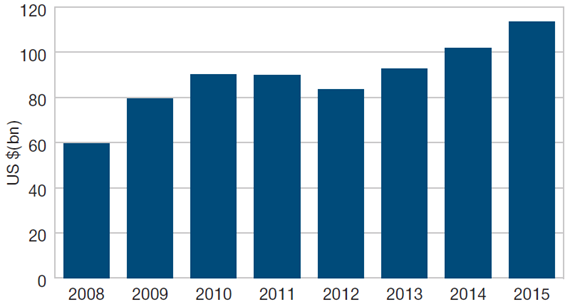

FIGURE 1: Asia ex-Japan Infrastructure Investment

2013–2015 Estimated As of December 31, 2013

Sources: CLSA and CAST

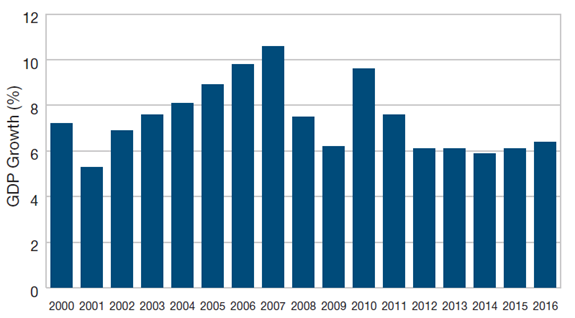

FIGURE 2: Reform Is Key in Asia ex-Japan GDP Growth

2014–2016 Estimated As of December 31, 2014

Source: FactSet

Reforms in key areas such as infrastructure, labor laws, taxation, and fiscal policy are needed to boost regional growth back to an upward trend.

After all, in the years following the global financial crisis, reform momentum languished in the region as economies rebounded and some governments became less committed to the process. In India, corruption scandals that erupted in 2010 in some industries, including coal and telecommunications, contributed to an environment of fear and paralysis.

However, we are optimistic about the reform potential in Asia, particularly in countries with new leadership. This includes China, though its government is more focused on improving the quality of growth as it transitions from an investment-led to a consumption-driven economy.

The following is a look at how reform efforts are playing out in three of developing Asia’s most important economies: India, Indonesia, and China.

INDIA: NEW LEADERSHIP CONFRONTS MAJOR CHALLENGES

India’s stock market soared after the landslide election victory in May 2014 of the main opposition Bharatiya Janata Party (BJP) led by Narendra Modi, who came into office with a reputation for getting things done after serving as leader of Gujarat state. Investors since then have become more guarded about the new government’s ability to implement reforms, particularly since the BJP does not have a majority position in the Upper House of Parliament—a major stumbling block.

However, Prime Minister Modi has managed to introduce business-friendly policies aimed at jump-starting the sluggish economy with an eye toward boosting the manufacturing sector, streamlining government decision-making, and attracting more foreign investment. And the upper house of Parliament has made progress this year in passing badly needed supply-side reform measures. But the challenges are huge and won’t be overcome in the very near term.

INDONESIA: MAKING A COMEBACK AFTER SLOWING GROWTH

Indonesia, one of the countries most distressed by the 1997 Asia financial crisis, has undergone a political transformation over the past 16 years, moving from military-backed rule to a democratically elected government. After a tightly contested presidential election last July, the former furniture exporter turned politician Joko Widodo came into office with high expectations after earning a reputation for pragmatism, efficiency, tenacity, and running a clean government as the governor of Jakarta.

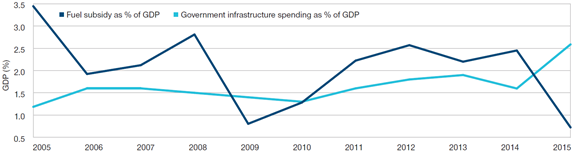

Since assuming power last October, President Widodo has revamped the fiscal budget and eliminated most fuel subsidies—a huge chunk of the state budget—with plans to channel the money into badly needed infrastructure and social policies.

Anyone who has tried to navigate Jakarta’s notorious traffic jams knows that Indonesia is in dire need of an infrastructure upgrade to improve its roads and railways, air transport, and port capacity. It’s encouraging that costly fuel subsidies will no longer usurp funds for much-needed infrastructure spending. Also, starting this year, new projects are subject to the Land Acquisition Act, which will facilitate economic growth and more manufacturing capacity.

Certainly, the challenges are daunting. As in India, more reforms are needed to speed up the decision-making process and tackle corruption. Fundamental changes are needed in the regulatory arena to boost investment in many sectors, especially energy. Poor labor laws must also be overhauled to encourage foreign and domestic investment. We are encouraged by the new government’s commitment to reform, although progress so far has been decidedly mixed.

However, Indonesia has staged a huge comeback since 2013 when it was branded as one of the “fragile five” emerging markets seen as most vulnerable to capital flight. Government officials expect Indonesia’s economy will expand this year from 5.4% to 5.8%, up from 5.0% in 2014. Commodity exports, a main driver of the economy, have recently weakened, but expected monetary easing and greater infrastructure spending should sustain moderate growth.

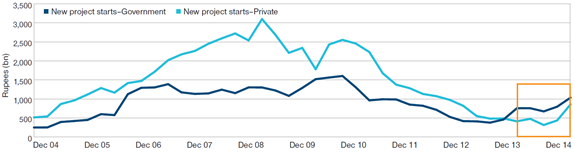

FIGURE 8: Indonesia Infrastructure Investment

2013–2015 Estimated

As of December 31, 2013

Sources: CLSA, CAST, and Ministry of Statistics and Program Implementation (MOSPI)

Indonesia also has a strong structural story due to a young population, cheap labor, an emerging middle class, and the potential to garner a higher share of foreign direct investment within Asia.

Indonesia’s reform potential is probably less appreciated by investors than it is in India, so there may be more room for positive surprises. But these changes will play out over many years. Looking ahead, we continue to monitor political developments in Indonesia with an eye toward building our positions if more uncertainty creates attractive buying opportunities.

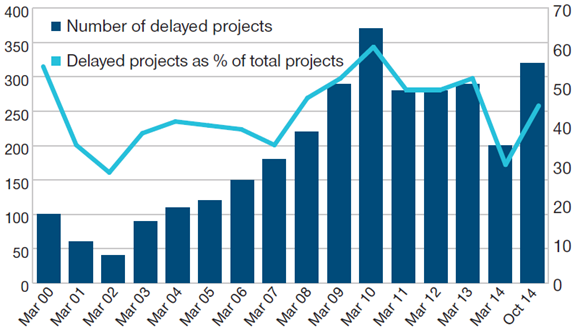

FIGURE 9: Indonesia: Lower Fuel Subsidy Allow For More Infrastructure Investment

2014–2015 Estimated

As of December 31, 2014

Sources: CLSA and Government of Indonesia

CHINA: UNDERGOING AN ECONOMIC TRANSFORMATION

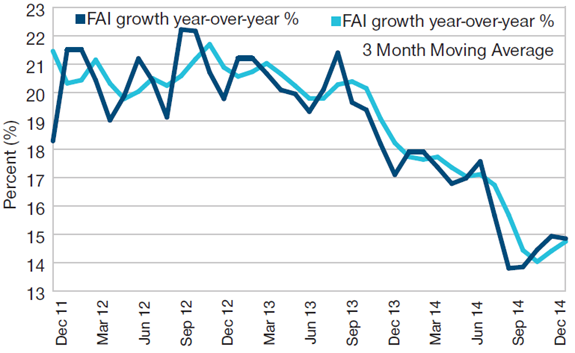

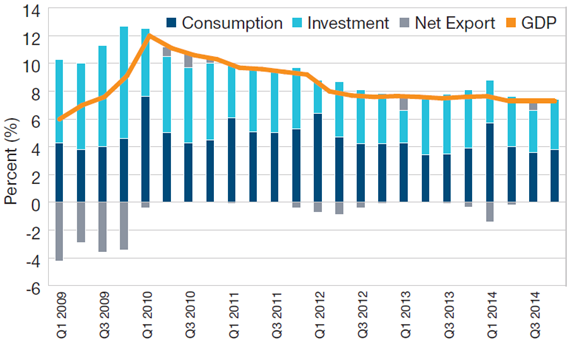

Investors in China have been focused on its slowing economy, which grew at a 7.4%* rate in 2014, a 24-year low. China’s transition to an economy driven more by consumption and higher value-added manufacturing and less by fixed-asset investment is ushering in a period of lower growth. But since President Xi Jinping and Premier Li Keqiang assumed power in early 2013, the new leadership has been pushing reforms on several fronts aimed at improved efficiency and quality of economic growth.

Given the size and complexity of China’s economy, implementing reform is extremely challenging, and there will certainly be successes and failures. However, a serious effort is underway.

In November 2013, the Third Plenum of the 18th Party Congress provided a high-level, but comprehensive, road map for possible reforms over the next five plus years. It calls for cracking down on corruption, controlling local government debt, encouraging a cleaner environment, land reform, efforts to cut red tape and facilitate development of private companies, more innovation and entrepreneurship, and closing excess capacity in some industries.

Reforming state-owned enterprises (SOEs) by increasing management incentives with stock ownership, encouraging greater competition among companies, and making SOEs more profitable are other key objectives.

Financials sector liberalization and tax reform rank high on the agenda. Efforts to open China’s capital account— allowing for easier investment flows in and out of the country—and to make its currency more freely convertible will be important for investors.

The Shanghai-Hong Kong Stock Connect, a cross-border program that allows mainland investors to trade Hong Kong-listed shares and international investors to trade Shanghai A-listed shares, is one of the efforts to test the opening of China’s capital account. Demand was weak at the beginning of the program but has since gathered very strong momentum as policymakers also announced significant easing measures to combat the slowing economy.

There are also efforts to reform social security with the goal of improving coverage and portability of pensions and health insurance. Local governments have relaxed the one-child policy for certain family groups, which could boost rural and urban consumption, although birthrates have yet to pick up meaningfully. A higher birthrate is important for China to address a host of demographic challenges, such as a shrinking labor force and a rapidly aging society.

Other efforts are underway to enhance the social safety net, such as providing more social benefits for those who move from the countryside to urban areas for work, facilitating social mobility, and encouraging consumption.

Reforms in land ownership rules are also underway in rural areas, and in the broader property sector, that could deter speculation and promote consolidation among developers. And several reforms are being pursued in the energy and power sectors. Improvements in energy efficiency and air quality in major cities should support private sector investment.

Although China’s growth rate likely will continue to slow with its economic transformation, in the long run, the ambitious reform program should prove beneficial for investors in China and emerging Asia given China’s huge influence on the region. More importantly, perhaps, the reform effort should continue to unveil new investment opportunities.

FIGURE 10: China—Fixed-Asset Investment (FAI) Growth

As of December 31, 2014

Sources: CEIC and Morgan Stanley

FIGURE 11: China—Contribution to GDP Growth

As of September 30, 2014

Sources: Haver Analytics and Morgan Stanley

Decline in fixed-asset investment leads to swelling GDP without a rapid pickup in the service economy.

The reform initiatives in China make us incrementally more positive on some segments of the market. When we invest in China, we consider what sectors could be beneficiaries of economic direction and policy reform—for example, gas distribution and renewable energy companies that stand to benefit from a cleaner environment—and which ones could be adversely affected.

We have limited exposure to fixed-asset investment cyclical stocks, such as steel companies and real estate developers. We have avoided banks due to our concerns about the level of nonperforming loans in China’s financial system. We are closely monitoring the reform of state-owned enterprises, though we have invested in this sector in a limited way.

Our China holdings are currently biased toward businesses that will benefit from growing domestic consumption, largely Internet and traditional consumer-driven companies, as well as clean energy companies and other businesses whose management teams are making a concerted effort to improve profitability in the coming years.

BEGINNING OF THE BEGINNING

Certainly, the changes unfolding in Asia extend beyond these three major markets and economies. The Philippines, for example, stands out as one of Asia’s better-performing economies and markets in recent years, as evidenced by relatively high stock valuations. The country’s GDP is forecast to exceed 6% this year—the second-highest growth rate in Asia after China, according to the Asian Development Bank.

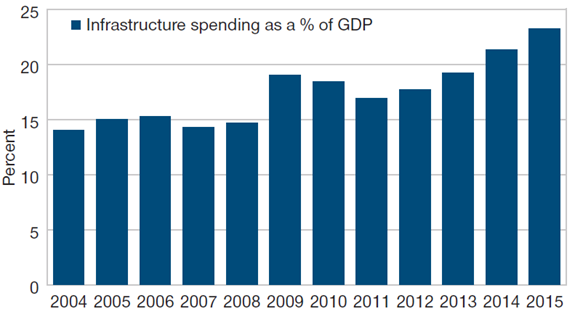

We believe that the Philippines represents one of Asia’s best economic stories due to its high growth, current account surplus, easing inflation, and stable political leadership. Indeed, President Benigno Simeon Aquino III has led efforts to structurally reduce interest rates, encourage foreign investment, and increase investment in infrastructure. The Philippines will elect a new president in May 2016, but President Aquino is expected to aggressively pursue new reforms and infrastructure projects over the next year.

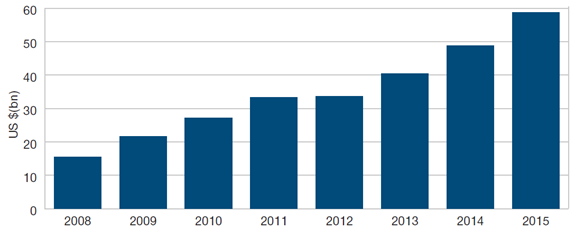

FIGURE 12: China’s Infrastructure Boom

2015 Estimated As of December 31, 2014

Source: CLSA

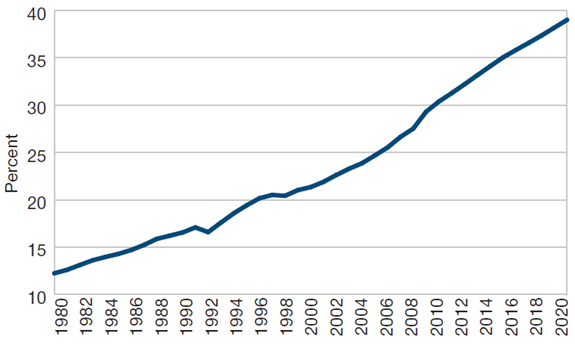

FIGURE 13: Asia ex-Japan’s Growth Share of Global GDP

Shares of World Output, Purchasing Power Parity weights

2015–2020 Estimated As of April 30, 2015

Source: IMF April 2015 World Economic Outlook

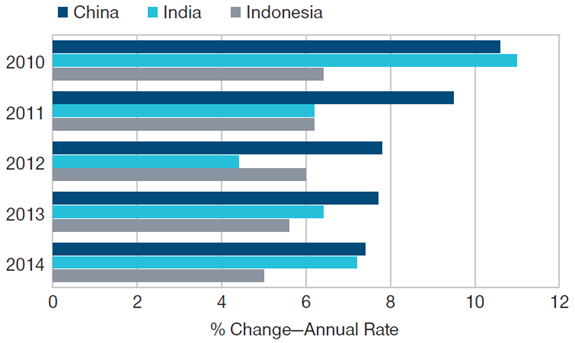

FIGURE 14: Slowing Growth in Key Asian Markets

Annual GDP growth in China, India, and Indonesia

As of December 31, 2014

Sources: Haver Analytics, China National Bureau of Statistics, India Central Statistics Office, and Badan Pusat Statistik

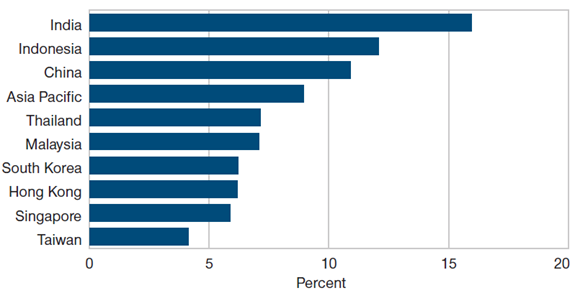

FIGURE 15: Per Capita Disposable Income Growth

Compound annual growth rate 2012–2020 Projections As of December 31, 2014

Source: CLSA

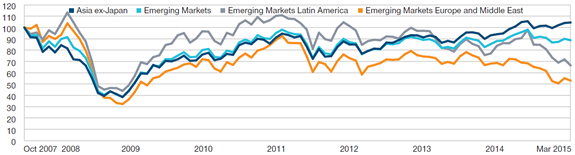

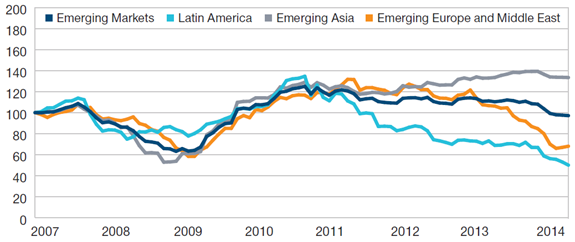

In addition to the widespread reforms, there are other reasons for optimism about Asia’s investment potential. The region has led emerging markets in recent years, both in stock performance and earnings growth, which we believe are on a rising trend supported by a recovery in profit margins and greater capital expenditure discipline.

Companies are much more focused on their businesses, expanding margins, and driving revenue growth. Moreover, stock valuations across Asia generally are still well below previous peak levels, though there are wide variations across countries.

While the pace of economic growth has slowed since 2010 and remains well below its longer-term potential, most economies in the region have bottomed out and are on a recovery path. With the exception of China, most saw improvement in 2014 and are expected to show better growth this year.

The renewed focus on infrastructure should provide a catalyst for economic revival, particularly in Southeast Asia. CLSA, a leading Asia research firm, projects that infrastructure spending in Singapore, Indonesia, Malaysia, Thailand, and the Philippines will increase 14% this year to $105 billion. Asia’s share of global economic activity and market capitalization continues to expand, driving demand for Asian assets.

Economic imbalances such as current account deficits have improved in many countries that were in dire shape as recently as two years ago, notably India and Indonesia, making them less vulnerable to capital outflows resulting from higher U.S. interest rates. Importantly, some countries in Asia are beneficiaries of lower oil and other commodity prices, helping boost trade balances. Inflation has come down significantly, and governments in many countries have cut interest rates to spur growth.

Rising disposable incomes and an expanding middle class continue to support many investment opportunities in a broad range of industries that benefit from rising household consumption. These are long-term, secular trends that show no signs of abating anytime soon.

Whether or not the 21st century proves to be the Asian century, as some had projected based on the region’s robust economic performance over the past three decades, is impossible to say with certainty. Nevertheless, by some projections, Asia could account for about half of global economic growth by 2050.

In any case, we believe that much of Asia is at the beginning of a sweeping push for economic, political, and structural reforms that could reshape the region in the next decade.

Footnotes

*Sources: Rimes and MSCI

*Sources: China National Bureau of Statistics and Haver Analytics

*Sources: Rimes and MSCI

2015-GL-1887

Informazioni importanti

Il materiale ha solo scopo informativo e/o di marketing e non è un consiglio o una raccomandazione di investimento. Consigliamo ai potenziali investiori di richiedere una consulenza legale, finanziaria e fiscale indipendente prima di assumere qualsiasi decisione di investimento. I rendimenti passati non sono indicativi di quelli futuri. Il valore di un investimento puó oscillare e gli investitori potrebbero non ottenere l'intero importo investito.

Il materiale non è stato verificato da alcuna autorita di vigilanza in alcuna giurisdizione.

Informazioni e opinioni sono ottenute/ tratte da fonti ritenute affidabili ma non garantiamo completezza ed esaustivitá, né che eventuali previsioni si concretizzino. I pareri contenuti sono soggetti a cambiamento senza preavviso e possono differire da altre società del gruppo T. Rowe Price.

È vietata la diffusione, in qualsiasi forma, della pubblicazione e/o dei suoi contenuti. Il materiale è destinato all’uso esclusivo in Italia. Vietata la distribuzione retail.