Browse our library for latest insights

2022 has brought the market to a challenging inflection point, delaying investors' hopes for a return to normal.

Discover how we're preparing for what's ahead.

Supplementary Insights

China Equities – Are the Clouds Set to Clear?

Embracing uncertainty and inefficiencies to focus on future drivers of growth.

Japan Equities – In a More Uncertain Environment, Focus on Fundamentals

Maintaining perspective on long-term opportunities.

Key Themes

Navigating Challenging Currents

COVID-19 left lingering economic scars, and investors also face inflation, conflict, and slowing growth.

Fundamentals Matter

Corporate earnings growth may be slowing, but promising investments may still be found by focusing on quality.

Flexible Fixed Income

Opportunities in fixed income are there for investors who can stay nimble and flexible.

Managing Through Geopolitical Risks

Russia-Ukraine conflicts have broad implications, and investors should be aware of elevated geopolitical risks.

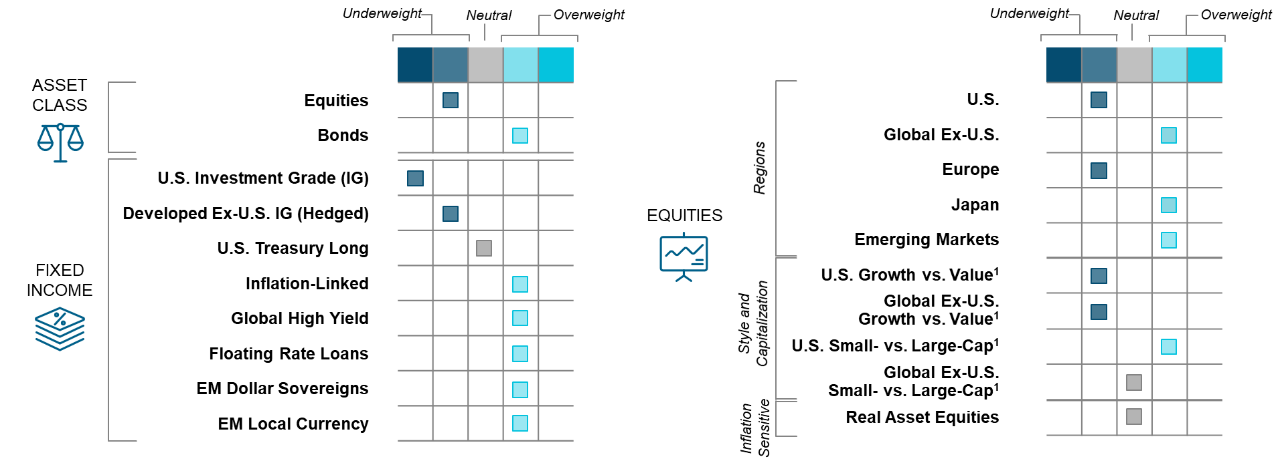

Tactical Allocation Views

As of May 31, 2022

The tactical allocation views are prepared by the T. Rowe Price Multi-Asset Division and informed by a subjective assessment of the relative attractiveness of asset classes and subclasses over a 6- to 18-month horizon.

This material is not intended to be investment advice or a recommendation to take any particular investment action.

1 For paired decisions in style and market capitalization, positioning within each box shows position in the first-mentioned asset class relative to the second asset class.

The asset classes across the equity and fixed income markets shown are represented in our Multi-Asset portfolios. Certain style & market capitalization asset classes are represented as pairwise decisions as part of our tactical asset allocation framework.

Want to know more?

Learn more about T. Rowe Price

Get in touch

Important Information

The above is being furnished for informational purposes only and does not constitute an investment advice. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. Past performance is not a reliable indicator of future performance. Investment involves risk. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

Information and opinions contained in this website are as of the date of publication and are subject to change without notice. While the information is obtained or derived from sources believed to be reliable and current at the date of publication, we cannot guarantee their accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The opinions expressed may also not reflect the opinions of any other T. Rowe Price Group companies.