T. Rowe Price - Where Better Decisions Begin

At T. Rowe Price, we have one business – investments, and one purpose – to help our clients confidently achieve long-term financial success.

Founded in 1937, T. Rowe Price is built on the enduring philosophy of our founder – meeting the individual needs of discerning clients. For over 80 years and through changing investment and economic environments, the core principles, unique investment insights and active management that guide our business have remained the same – helping our clients to invest confidently and at the same time grow our reputation.

The Bighorn Sheep

Since the 1970s the Bighorn Sheep has been the symbol of T. Rowe Price. Why? Because it reflects the core aspects of our culture, values and investment philosophy. As an agile and surefooted climber its ability to navigate rough terrain echoes the way we follow a disciplined path through all market conditions – with the sharp vision and focus needed to provide more reliable investment returns.

At a Glance*

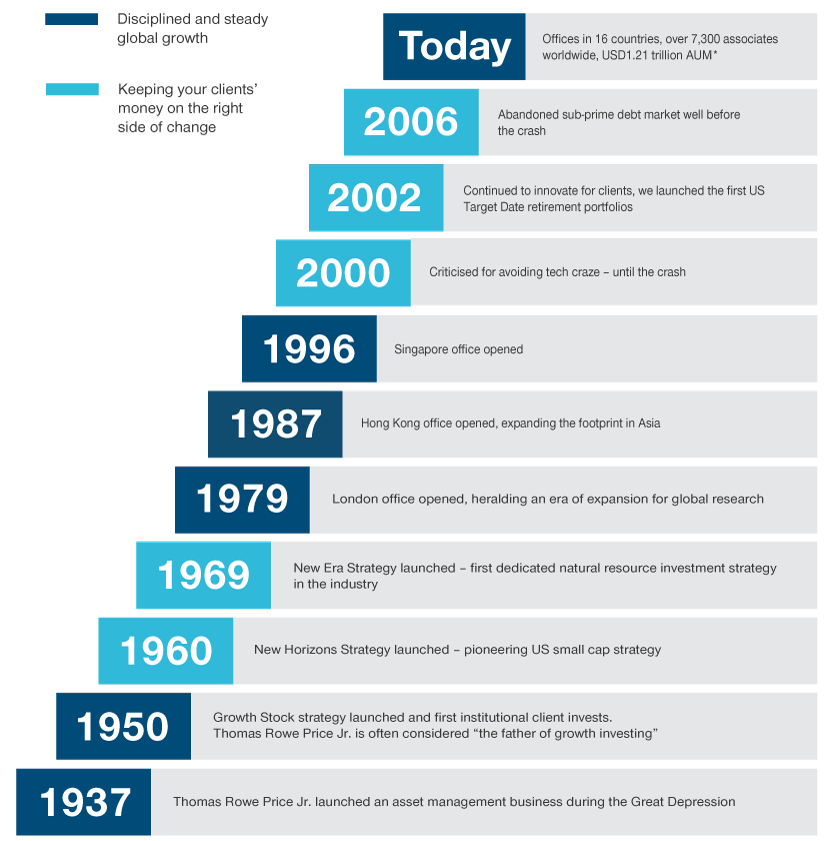

Our History

Founded in 1937 by Thomas Rowe Price Jr., the firm focused on building a reputation for the highest character and the soundest investment philosophy. This philosophy has continued as we have grown from the 1930’s to today.

In 1979 the firm partnered with Robert Fleming Holdings to open our first international office in London and began to expand globally. Since then, T. Rowe Price has expanded to Asia and Europe, and is now one of the largest investment firms in the world, managing USD1.21tn* for clients in 50 countries.

Our Philosophy

Going Beyond the Numbers

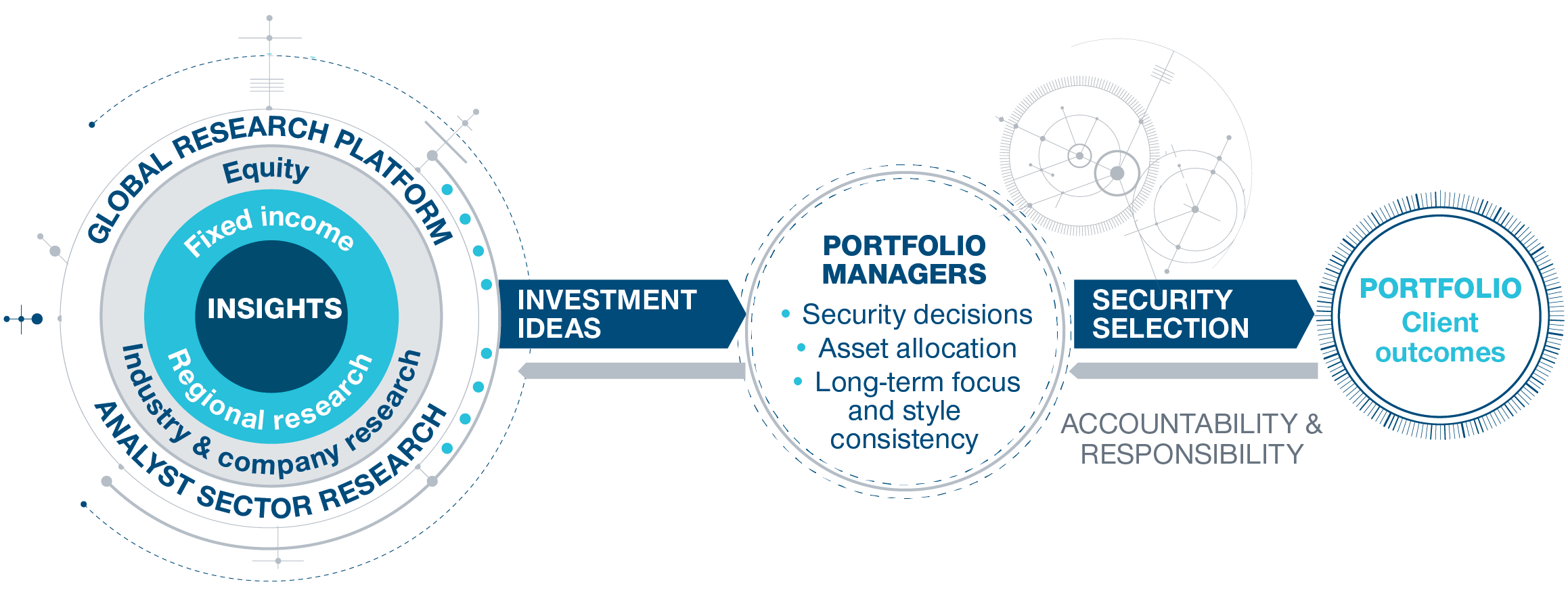

Research informs our decision making and guides our culture of collaboration and diverse thinking.

Our global research platform is the engine behind our portfolios. We have 304* specialist equity and fixed income research analysts based in 9 offices around the world, collaborating through joint analyst meetings and regularly sharing their research across asset classes and regions.

Our team provides a 360-degree view on all investments, delivering insights and best ideas to our portfolio managers. Going beyond the numbers to keep our investors on the right side of change.

Our Capabilities

As a global investment manager, we actively listen, anticipate, and develop investment strategies that align to the needs of our clients. For over 80 years this has directed the evolution of our investment capabilities across equity, fixed income and multi asset and led to a broad range of strategies across capitalisations, sectors, styles and regions. Each strategy is supported by our proprietary global research platform and experienced investment teams.

Equity Expertise

Established in 1937 and includes 368* Equity Professionals covering the following classes:

- Asia-Pacific Equity (including Japanese Equity)

- Emerging Markets Equity

- European Equity

- Global Equity

- US Equity

Fixed Income Expertise

Established in 1971 and includes 217* Fixed Income Professionals covering the following asset classes:

- Emerging Markets Fixed Income

- European Fixed Income

- Global Credit

- Global Fixed Income

- High Yield

- US Fixed Income

Multi Asset

Established in 1990 and includes 76* multi-asset professionals covering a range of investment solutions including:

- Durable alpha

- Income solutions

- Portfolio redesign

- Retirement solutions

- Volatility management

- Wealth accumulation

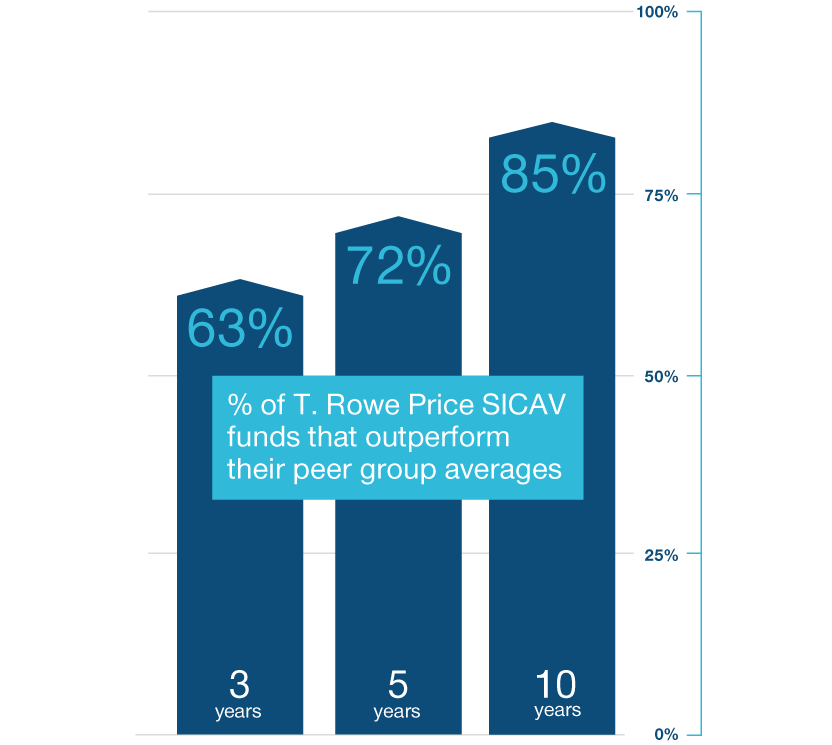

Consistently Meeting Expectations

85% of our SICAV funds with a 10 year track record have outperformed their Morningstar Category Median1

SICAV Fund Outperformance of Morningstar Category Median

As of 31 December 2019

The outperformance figures are based on rankings of our A share classes where available and I share classes for those funds that do not have an A share class.

Past performance is not a reliable indicator of future performance.

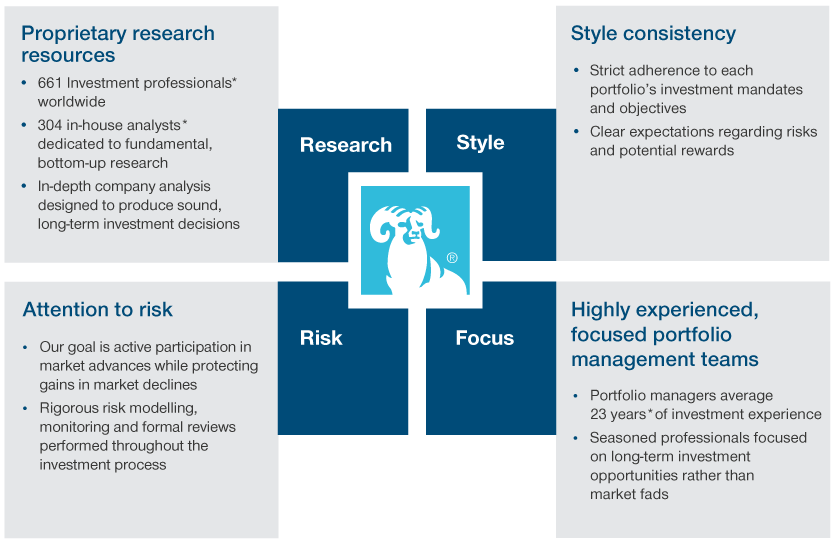

Cornerstones of our Investment Approach

Since 1937, our investment approach has remained the same*.

Our Culture

From the beginning, having diverse perspectives has been a cornerstone of our approach at T. Rowe Price. It ensures we have the best talent available and a culture that leverages different backgrounds, perspectives and experiences to meet our clients' needs. We have always embraced a culture of diversity and collaboration, and we consider this indivisible from the firm’s mission to help clients succeed.

This same philosophy guides our community efforts. By helping to improve the quality of life for those around us, we believe our own lives will be enriched in the process. We are committed to making a positive social impact in our global communities, from financial education for children to local volunteering. In 2017 alone, the T. Rowe Price foundation provided US$10 million to non-profit organisations.

Important Information

1Past performance is not a reliable indicator of future results. As at 31 December 2019. © 2019 Morningstar. All Rights Reserved. The information contained herein:

(1) is proprietary to Morningstar; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. The outperformance figures are based on rankings of our A share classes where available and I share classes for those funds that do not have an A share class.

Fund outperformance bar chart:

Past performance is not a reliable indicator of future results.

Source: Copyright © 2019 FactSet Research Systems Inc. All rights reserved.

*All figures as at 31 December 2019. Firmwide AUM includes assets managed by T. Rowe Price Associates, Inc. and its investment advisory affiliates.

202003-1095453