March 2023 / INVESTMENT INSIGHTS

Global Impact Equity Strategy Focus

STRATEGY SUMMARY

- The Global Impact Equity Strategy seeks long‑term growth of capital by searching for positive environmental or social impact to help it outperform the MSCI All Country World Index Net Index.

- The strategy maintains a focus on companies that we believe offer a positive impact today and an underappreciated impact in the future, as well as sustainability and robustness of future earnings and cash flow growth.

- Our fundamental research platform and dedicated Responsible Investing team—which is focused on environmental, social, and governance (ESG) issues—provide the breadth of resources and global perspective necessary in building a positive impact portfolio.

- The strategy’s investment approach is aligned to the United Nations Sustainable Development Goals.

- Every investment decision is aligned to our three defined impact pillars—climate and resource impact, social equity and quality of life, and sustainable innovation and productivity—in aiming to ensure material and measurable environmental or social impact as businesses address globally recognized pressure points.

- We quantify impact outcomes individually and collectively to form a defined impact measurement framework.

- We actively engage with companies on ESG issues and apply a strategy‑specific proxy voting policy that reflects the dual nature of our mandate.

Investment Philosophy

Our investment philosophy is founded on the following:

1. Four principles form our Impact Charter

Our investment process embeds clear principles of materiality and measurability and forms the basis for identifying positive impact for clients. We adopt a forward‑looking perspective on change, while aiming to ensure that all investment decisions are based on a clearly defined positive impact thesis. We also aim to be additional by capturing positive environmental and/or social outcomes on a global basis and by committing to use our scale and resources to promote and progress the impact agenda. Due to the very complex friction points that exist for our planet and our global community, delivering impact requires patience and an understanding of change. This is why being resilient in applying an impact‑oriented investment approach is imperative. Our approach aligns with the United Nations Sustainable Development Goals (UN SDGs), a globally recognized framework designed to end poverty, protect the planet, and ensure prosperity. We believe this is the best way to align all stakeholders in the impact journey, encompassing our clients, our investment team, and the businesses our strategy owns.

2. Durability and time horizon are key

Stocks have the potential to deliver superior returns when the durability and persistence of earnings and cash flow are underappreciated by the market or where economic return improvement is mispriced. Adopting a long‑term view allows us to identify inefficiencies embedded in equity markets, especially in an era of change, disruption, and shortened time horizons. We also apply a long‑term investment horizon when measuring impact, given the patience and resilience that our environmental and social transition journey necessitates.

3. Secular change matters

Investing in companies that we believe are on the right side of secular change is key to unlocking improving economic returns in business models, especially in an era of shifting consumer, business, and regulatory preferences. While impact investing has traditionally been associated with private investments, the opportunity to own and engage with companies that create a positive impact is broader than ever before in public equity markets.

4. Research is crucial

Based on our fundamental and responsible investing research resources, our approach produces a holistic view of companies and embodies the different perspectives necessary to invest for future impact and pursue better investment outcomes. We integrate our stock perspectives to identify, in our view, underappreciated impact and mispriced economic return improvement on a truly global, stock‑by‑stock basis. We apply a forward‑looking, research‑driven, and high‑conviction approach to our stock choices. This is important with respect to prudent risk management, as well as alignment with the UN SDGs, as we seek to engage with the full breadth of impact opportunities that exist in an evolving and complex world.

Portfolio Management

The Global Impact Equity Strategy is managed by Hari Balkrishna, who has ultimate responsibility for investment decisions. He has 17 years of investment experience and, between 2015 and 2020, was the associate portfolio manager of our Global Growth Equity Strategy. Hari has lived and worked on five continents and has a deep appreciation for the many different social systems around the world as well a personal passion for addressing climate change. He is supported by experienced regional and global sector advisors who act as a counseling body and provide critical insights as needed. This resource enables a global perspective, a critical foundation of success for traditional or impact investors aiming to address truly global issues. The search for high‑quality impact ideas is supported by T. Rowe Price’s world‑class research platform, comprising a team of more than 200 fundamental analysts, which gives Hari and his team access to ideas. The Global Impact Equity team works closely with the analysts in our Responsible Investing (RI) team, particularly on developing impact models for companies and measuring the potential and actual impact from an investment.

Defining the Investment Universe

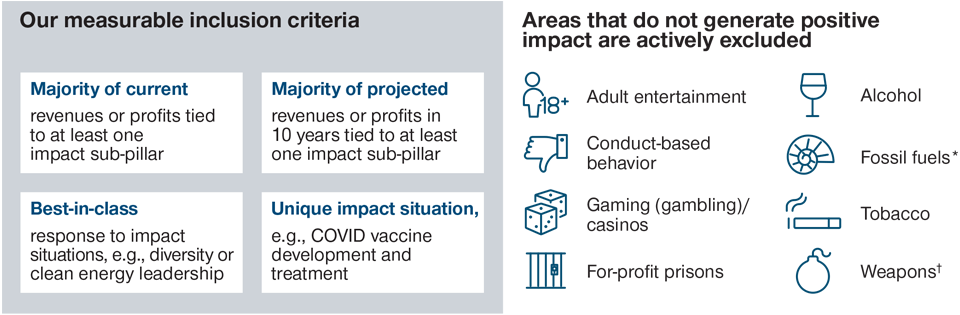

All of the Global Impact Equity Strategy investments start with a stock‑by‑stock assessment of impact materiality. The responsible investing team defines our impact universe through careful screening; a deep understanding of environment, social, and governance (ESG) factors; and industry‑specific, forward‑looking impact inclusion criteria. The universe also excludes areas of the global market that, in our view, generate significant harm. These include adult entertainment, alcohol, fossil fuels,1 gambling, tobacco, for‑profit prisons, weapons, and stocks that screen individually on conduct‑based metrics.

Our team’s starting point is to screen using our Impact Lens framework to quantify a company’s alignment to one of our three proprietary impact pillars and eight sub‑pillars, as well as at least one of the UN SDGs.

Our Impact Investment Pillars Guide Our Decision‑Making

“Do no harm,” governance, and sustainability analysis are all embedded in our choices

1 Fossil fuel exclusion has the potential to adapt over time as companies with exposure to fossil fuel production demonstrate a clear path to energy transition with substantive reporting and targets. Fossil fuel companies defined as those that generate >5% of revenues from the production of thermal coal and companies that are identified within the oil or gas industry through the GICS and/or BICS classification.

All Decisions Endure Careful Impact Screening to Ensure Materiality and Measurability

Screening is generally applied only to the relevant company itself and to its subsidiaries. Minority holdings (less than 50% ownership) are generally not considered for screening purposes.

*Fossil fuel exclusion has the potential to adapt over time as companies with exposure to fossil fuel production demonstrate a clear path to energy transition with substantive reporting and targets. Fossil fuel companies defined as those that generate >5% of revenues from the production of thermal coal and companies that are identified within the oil or gas industry through the GICS and/or BICS classification.

†Includes assault-style weapons, controversial weapons and conventional weapons.

Our impact universe comprises companies meeting at least one of four criteria for inclusion in the portfolio: the majority of current revenues or profits are tied to at least one impact sub‑pillar, the majority of projected revenues or profits in 10 years are tied to at least one impact sub‑pillar, best‑in‑class responses to impact situations, or a unique impact situation.

Portfolio Construction

In constructing the portfolio, Hari leverages the analysis undertaken by the global investment team and the RI team and applies his judgment to create a global portfolio of typically 55 to 85 of our highest‑conviction opportunities within the impact universe. The RI team’s proprietary Responsible Investing Indicator Model (RIIM), which systematically and proactively evaluates the RI profile of over 15,000 corporate securities, helps assess the quality and long‑term sustainability of the companies in which we invest.

We seeks stocks with clear impact and financial return markers, based on product, industry, governance, and growth potential. Hari collaborates closely with our global team of sector analysts and regional specialists to conduct in‑depth, fundamental research to identify the most attractive stock‑based opportunities, integrating our perspectives on financial returns alongside the positive and negative impact of business activity.

All our stock selection decisions begin with a clearly defined positive impact thesis, which proactively and systematically integrates ESG considerations. Credible ESG solutions require investment, and we have been building capability in the field of responsible investing for a number of years in order to fully embed ESG integration within our decisions. Our philosophy is that ESG factors cannot be a separate or tangential part of a traditional investment thesis; they have to be integrated alongside fundamental factors to create the best outcome for clients.

The process of ESG integration takes place on three levels: first, as our fundamental and responsible investing research analysts incorporate ESG factors into their analysis; second, as we use T. Rowe Price’s proprietary RIIM analysis at regular intervals to help us understand the ESG characteristics of single stocks and the aggregate portfolio; and third, as the portfolio manager integrates ESG considerations within his company interactions and the portfolio construction process.

Accelerating Impact Through Active Ownership

We truly believe impact is achieved within an investment portfolio in more ways than simply owning and capturing the economics and activities of certain types of companies. Our approach involves directing fresh capital toward desired impact outcomes alongside impact‑oriented company engagements, proxy voting, and the associated influence feedback loop.

Engagement program

The central focus of our engagement program is at the company level. We identify specific factors through our research that could be potential impediments to a security’s performance. We may at times suggest to a company that it make a specific change, or we may seek to gain more information on an ESG issue, to ensure our investment decisions are well informed. We believe this company‑specific approach results in the highest impact because it is aligned with our firm’s core investment approach: active management rooted in fundamental investment analysis.

Proxy voting

Proxy voting is a crucial link in the chain of stewardship responsibilities. Each vote represents both the privileges and the responsibilities that come with owning a company’s equity instruments.

We take our responsibility to vote our clients’ shares very seriously, taking into account both high‑level corporate governance principles and company‑specific circumstances. Our overarching objective is to cast votes to foster long‑term, sustainable success for the company and its investors.

Our proxy voting program serves as one element of our overall relationship with corporate issuers. We take a hands‑on approach to joining voting and engagement activities as part of our commitment to additionality.

Measuring Impact

Given our mandate’s dual nature, impact measurement and management is integral to our investment process. We believe that measuring and managing impact fulfills three objectives:

- To monitor our investments’ progress toward clearly defined outcomes through key performance indicators (KPIs).

- To assist in our corporate engagements and to ensure that we identify any deviation from our impact and investment thesis.

- To report progress and impact delivery to our clients.

We use the five dimensions of impact framework to carry the impact due diligence of a given stock. This framework was developed by the Impact Management Project, an impact practitioner community of over 2,000 organizations. This framework leads to assessing a company’s ability to deliver impact on a holistic basis, including the risks that may affect its ability to deliver the targeted impact.

The five dimensions are:

- What is the impact goal?

- Who experiences the outcome?

- How much of the outcome is occurring (scale, depth, and duration)?

- Contribution—Would this change likely have happened anyway?

- Risk—What is the risk to people and the planet if the impact does not occur as expected?

Within this process and depending on data availability, we also use guidance and metrics from the IRIS+ Catalog of Metrics, developed by the Global Impact Investing Network (GIIN). This analysis leads us to formalize an impact thesis, highlight negative externalities and risks, and define KPIs for each stock.

As part of our approach to impact measurement, we use a “Theory of Change” model, which we believe provides a clear and comprehensive framework to evaluate how the efforts of each holding is delivering impact, through the measurement of achieved outcomes.

In our annual impact report, we detail outcomes at the company level based on the KPIs and provide several stock case studies in which we discuss what we are monitoring to improve measurement and/or track the company’s progress toward its impact goal.

Disciplined Approach to Risk

We do not believe that an investment approach can be successful if risk is viewed as something distinct from the rest of portfolio management. Accordingly, we incorporate risk management throughout every step of our investment processes.

The Global Impact Equity Strategy applies a high‑conviction, impact‑oriented approach, but with a mindset that valuation matters in generating alpha and in managing absolute and relative risks. We maintain a focus on companies that we believe offer a positive impact today and an underappreciated impact in the future, as well as sustainability and robustness in their future earnings and cash flow growth with compelling management quality and expert capital allocation. We inherently believe in our ability to identify such businesses during challenging times and will always take an active approach to diversification, challenging ourselves on the individual and aggregate risks to which we are exposed.

Risks—The following risk is materially relevant to the portfolio:

Country (China)—Chinese investments may be subject to higher levels of risks such as liquidity, currency, regulatory and legal risks due to the structure of the local market.

Currency—Currency exchange rate movements could reduce investment gains or increase investment losses.

Emerging markets—Emerging markets are less established than developed markets and therefore involve higher risks.

Small and mid-cap—Small and mid-size company stock prices can be more volatile than stock prices of larger companies.

Stock Connect—Stock Connect is subject to higher regulatory, custody, and default risks as well as liquidity risk and quota limitations.

General Portfolio Risks

Equity—Equities can lose value rapidly for a variety of reasons and can remain at low prices indefinitely.

Environmental, social, and governance and sustainability—ESG and Sustainability risk may result in a material negative impact on the value of an investment and performance of the portfolio.

Geographic concentration—Geographic concentration risk may result in performance being more strongly affected by any social, political, economic, environmental or market conditions affecting those countries or regions in which the portfolio’s assets are concentrated.

Hedging—Hedging measures involve costs and may work imperfectly, may not be feasible at times, or may fail completely.

Investment portfolio—Investing in portfolios involves certain risks an investor would not face if investing in markets directly.

Management—Management risk may result in potential conflicts of interest relating to the obligations of the investment manager.

Market—Market risk may subject the portfolio to experience losses caused by unexpected changes in a wide variety of factors.

Operational—Operational risk may cause losses as a result of incidents caused by people, systems, and/or processes.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.