January 2023 / INVESTMENT INSIGHTS

The Eurozone’s Recession Will Likely Be Deeper Than Expected

The European Central Bank may have to cease hiking earlier than planned.

The eurozone has been hit by a series of large macroeconomic shocks, but European Central Bank (ECB) policymakers—encouraged by real economy data—expect the currency bloc to grow by 0.5% in 2023. I disagree. As I see it, the combination of supply chain distortions, an energy price shock, a historic decline in real wages, and rapid monetary tightening will likely cause the eurozone economy to contract by around 1%.

The current slowdown in the eurozone began with supply chain distortions that arose from the coronavirus pandemic. A shortage of semiconductors then made the production of sophisticated manufacturing goods progressively harder. Containers got stuck in the wrong places, raising the costs of shipment across the world fivefold and significantly lengthened delivery of crucial subcomponents, weighing on supply chains.

The rise in gas prices since mid‑2021 exacerbated the supply problem as swathes of European industry rely on reliable and cheap energy provision. Finally, the war in Ukraine and the associated gas price movements last summer led to an unprecedented energy price shock in the eurozone.

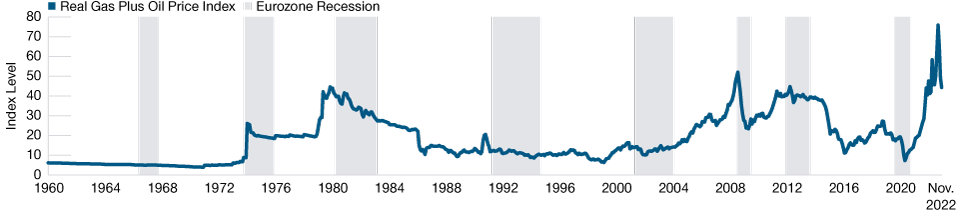

Real Energy Shocks Tend to Signal Recessions

(Fig. 1) The latest shock is unprecedented in size

As of November 30, 2022.

Source: World Bank, Analysis by T. Rowe Price.

These supply shocks alone would normally be sufficient to trigger a mild or technical recession (Figure 1)—but they also had important consequences for demand in the eurozone. The energy price shock and pent‑up demand for certain services caused inflation to spike—and wages have struggled to keep up. As a result, eurozone household wages are now shrinking at the fastest pace on record. Although some households built up a savings buffer during the pandemic, this was unequally distributed, which means that the net effect of lower disposable incomes is likely a decline in consumption.

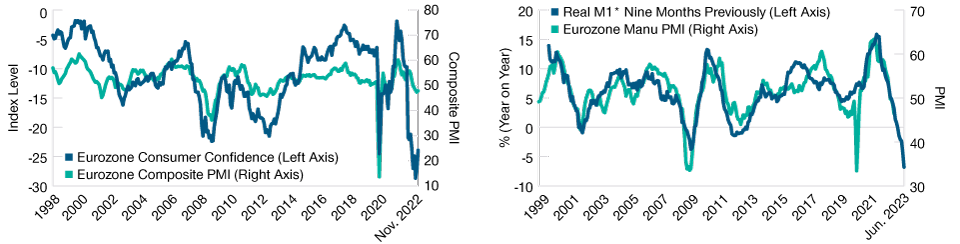

At the same time, the ECB has begun to tighten monetary policy in response to higher inflation by raising the deposit rate at the fastest pace since the beginning of the eurozone. The latest ECB survey of lenders implies that credit conditions for households have already tightened more than they did during the eurozone debt crisis. Monetary conditions in the eurozone are tightening rapidly, and it is likely that European manufacturing PMI will continue to decline over the next six months.

Consumer confidence is even weaker than PMI, which suggests that falling demand from lower disposable incomes and monetary tightening will appear in the data in the next three to six months (Figure 2). These additional adverse developments will likely exacerbate the energy price shock and push the eurozone into a sizable recession.

Despite this, ECB policymakers are confident that the coming recession will only be mild. There are several reasons for this. Supply chains, for example, are normalizing faster than expected. This led to stronger‑than‑expected car and industrial production in the third quarter. Energy prices have fallen rapidly, which has boosted consumer and business confidence. At the same time, real economy data have proven to be more resilient than anticipated.

Consumer Confidence Is Much Weaker Than Composite PMI

(Fig. 2) Real monetary conditions lead activity in the eurozone

As of November 30, 2022.

*M1 money supply comprises currency, demand deposits and other liquid deposits including savings.

The value of real M1 growth at any given time in the right‑hand chart above is from nine months previously. For example, the value shown for June 2023 reflects the year on year M1 growth in October 2022. This is to illustrate the delay in the reaction of economic activity to monetary tightening. Actual future outcomes may differ materially.

Sources: European Commission, European Central Bank, and Standard & Poor’s Global (see Additional Disclosure).

The main contributor to eurozone growth in the third quarter was domestic demand, which more than offset the negative impact of weak exports. However, surveys suggest that the strength of domestic demand is only temporary. Although lower energy prices may support a bounce in confidence and activity in the short term, mainly because of better‑than‑expected weather, the long‑term economic challenge of higher gas prices remains. The ECB has recently indicated that it will continue to raise rates at 50bps increments, leading to the biggest policy tightening since the launch of the euro. This will negatively effect domestic demand going forward.

A European Commission survey of manufacturing competitiveness in the eurozone has predicted a 25% decline in export growth over the next few quarters. Importantly, on the external demand side, manufacturing and services PMIs in the U.S., one of the largest eurozone trading partners, have now clearly entered recession territory. Uncertainties about the evolution of China’s zero‑COVID policies also pose a significant risk to external eurozone demand. It is possible that a rapid reopening of China’s economy will prove very economically disruptive in the short term. I believe these adverse external factors will add to weak domestic demand, resulting in a deeper eurozone recession than expected.

This view has important market implications. The ECB’s unwavering commitment to tightening policy in the short term means that it will likely hike into a recession—and potentially deliver on the aggressive hiking path priced into markets today. However, the ECB will likely not be able to maintain such a tight policy for very long, which suggests that markets need to price in more cuts. Over the next few months, we believe the 10‑year Bund may rise as a result of a rise in the 2‑year rate due to the ECB’s tightening. After that, we believe that expectations of rate cuts will be priced in as the real economy weakens. At that point, the two‑year yield will likely decline. The 10‑year yield would decline as well, but by less than the two‑year, leading to yield curve steepening. In this scenario, the euro would likely weaken against the U.S. dollar, owing to the eurozone’s weaker economy and expectations of future ECB monetary easing relative to the U.S.

T. Rowe Price cautions that economic estimates and forward‑looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual outcomes could differ materially from those anticipated in estimates and forward‑looking statements, and future results could differ materially from historical performance. Forward‑looking statements speak only as of the date they are made, and T. Rowe Price assumes no duty to and does not undertake to update forward‑looking statements.

Additional Disclosure

Copyright © 2023, S&P Global Market Intelligence (and its affiliates, as applicable). Reproduction of any information, data or material, including ratings (“Content”) in any form is prohibited except with the prior written permission of the relevant party. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content. A reference to a particular investment or security, a rating or any observation concerning an investment that is part of the Content is not a recommendation to buy, sell or hold such investment or security, does not address the suitability of an investment or security and should not be relied on as investment advice. Credit ratings are statements of opinions and are not statements of fact.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

202212‑2628071