PIKing Your Spots in Private Credit

January 2026

Summary

- Payment-in-Kind (“PIK”) is a negotiated feature in private credit that allows borrowers to defer a portion or all of their cash interest, with the unpaid interest accruing to the principal balance

- PIK is generally priced at a premium relative to a cash-pay loan, as lenders seek to capture additional spread in exchange for the flexibility and foregone cash income

- OHA views PIK structured at origination as a strategic financing solution to support borrowers’ liquidity and growth goals

- OHA believes PIK created by amendment after origination can be an effective temporary tool in select circumstances, but may serve as a signal of credit stress

Eric Muller

Portfolio Manager & Partner, CEO – BDCs

Eric Muller

Portfolio Manager & Partner, CEO – BDCsPayment-in-Kind Overview

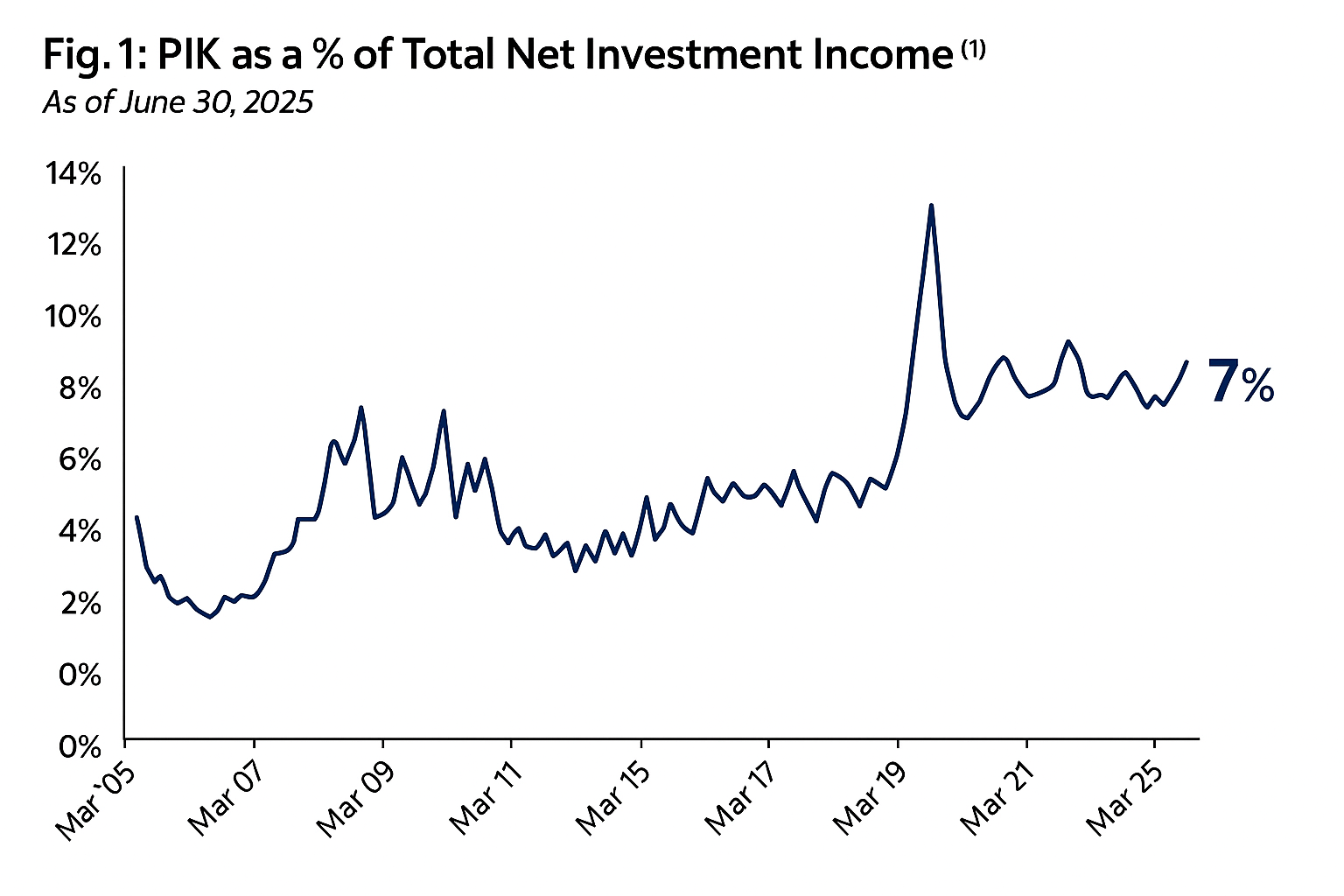

Payment-in-Kind, commonly referred to as PIK, allows borrowers to defer some or all of their cash interest payments by accruing them to the loan’s principal balance. At maturity, both the original principal and the accrued interest are repaid in full, typically with a higher spread compared to a traditional cash-pay loan. In recent years, private market borrowers have increasingly sought PIK financing to preserve liquidity and enhance flexibility following the rapid rise in base rates post-COVID-19.(2) Fig. 1 highlights this trend, with PIK now representing 7% of total net investment income.

OHA believes that a lender’s approach to PIK financing can significantly influence both risk and returns for end investors. In some cases, the use of PIK may be an early sign of underlying credit stress. However, when structured effectively, PIK can serve as a strategic tool for high-quality companies to preserve liquidity and invest in growth initiatives.

In this paper, we explore the scenarios where PIK may be utilized and the rationale as well as critical considerations for investors as PIK features become an area of increasing focus for private credit portfolios.

PIK Scenarios

PIK interest is most commonly utilized in one of two general scenarios: (I) at origination and (II) amendment after origination.

(I) PIK at origination is incorporated into the initial credit agreement and typically expires within the first two years of the loan’s life. This feature is most often offered to high-quality, high-growth companies to support further expansion initiatives such as M&A, synergy realization and organic growth.

In senior direct lending, PIK is commonly structured as partial PIK or PIK toggle, where lenders still receive most of the interest in cash. The cash-pay portion typically includes the base rate plus half of the loan’s spread component. For example, on a loan priced at SOFR + 500 basis points, the borrower might pay SOFR + 250 basis points in cash while PIKing the remainder of the spread.(3)(4) To compensate for added complexity, loans that are actively PIKing generally pay a 25 – 50 basis points premium to a comparable cash-pay loan.

While borrowers sometimes request PIK features, they still represent a modest portion of income in performing private credit. As shown in Fig. 1, in Q2 2025, just 7% of net investment income was PIK interest, underscoring the predominantly cash-pay nature of these portfolios.(1)

(II) PIK by amendment refers to a provision offered to existing borrowers who did not have a PIK option in their original loan documentation. It is sometimes extended to borrowers facing challenges in meeting their near-term cash interest obligations and seeking temporary relief to stabilize cash flows. Lenders entering these provisions may require additional collateral, such as incremental equity contribution in sponsor-backed deals, to seek additional downside protection.

PIK by amendment can be a highly effective tool for both borrowers and lenders in the right circumstances. A notable example occurred during the COVID-19 pandemic, when these provisions helped borrowers withstand widespread financial disruption. In such situations, the ability to PIK enabled companies to conserve cash and prioritize core operations while also offering lenders an attractive spread premium.

PIK by Type

Borrower Size Matters

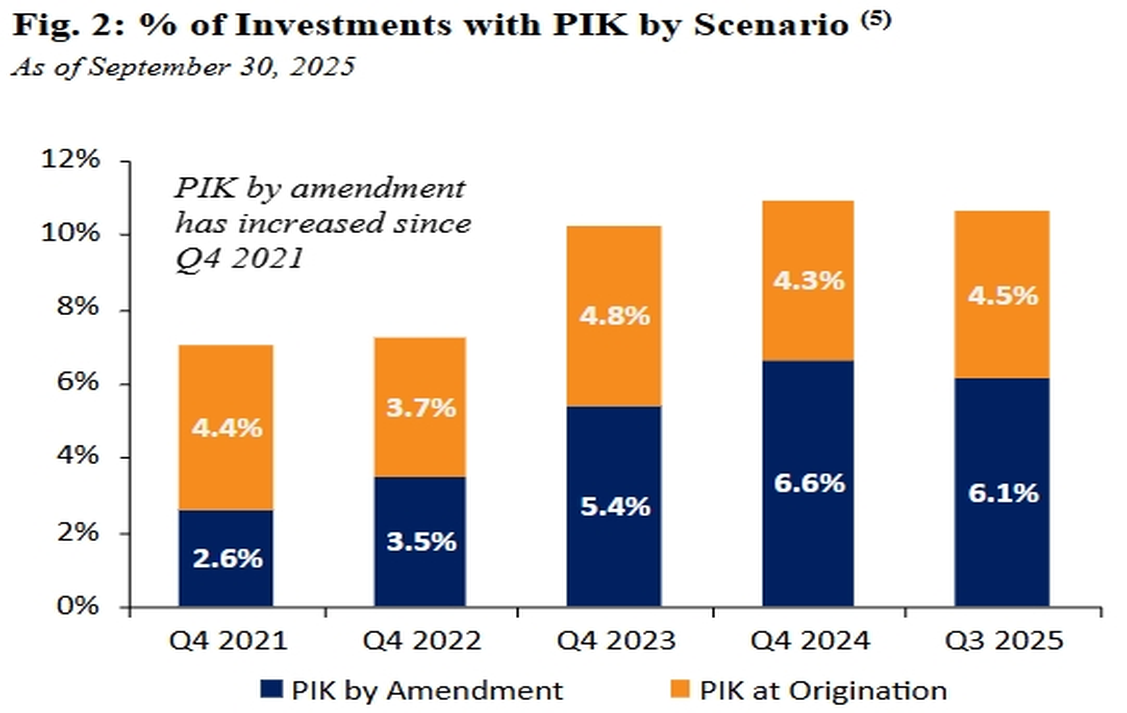

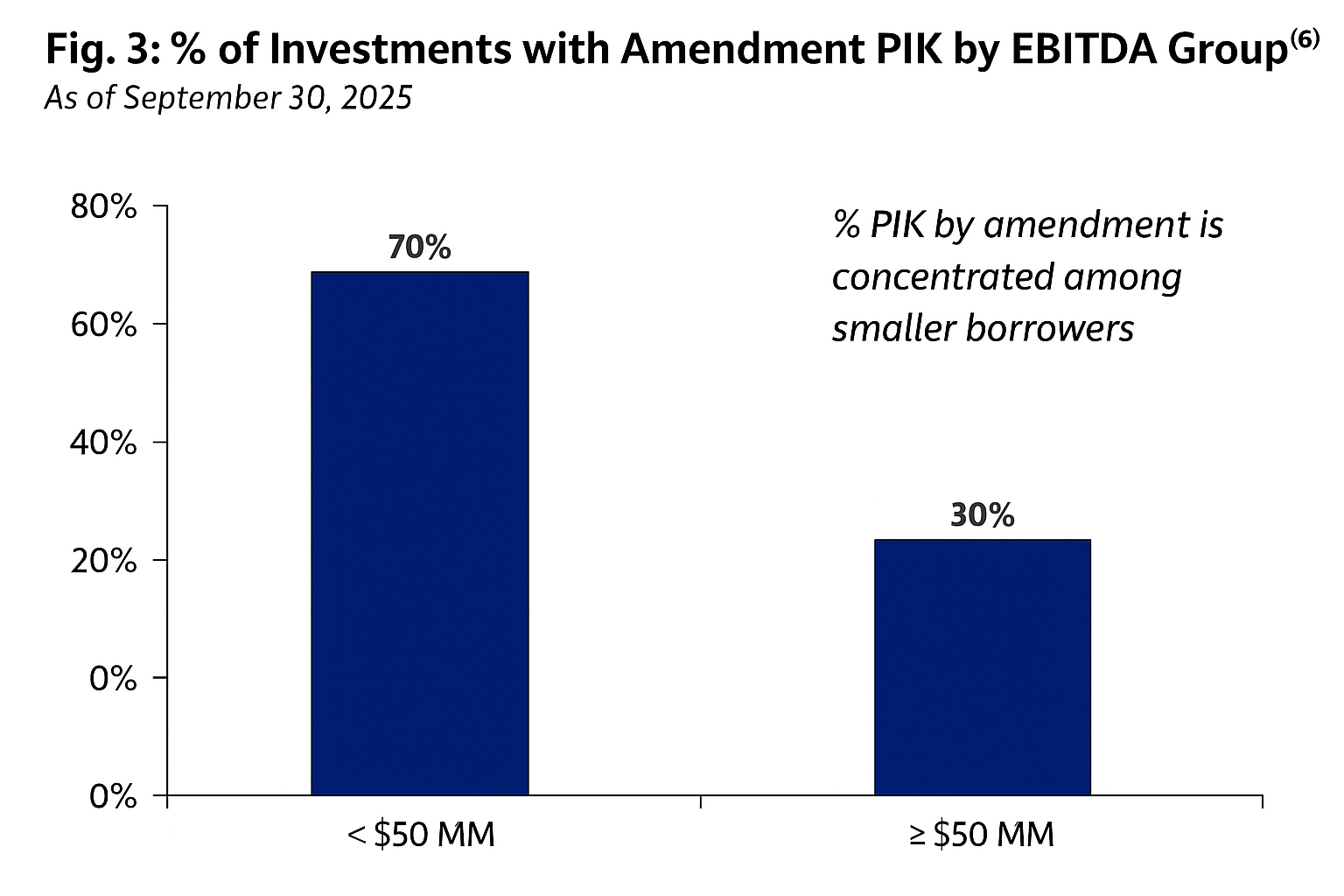

The use of PIK by amendment is a potential signal of credit stress. As shown in Fig. 2, PIK by amendment as a percentage of direct lending investments has risen from 2.6% in 2021 to 6.1% in Q3 2025, reflecting its growing prevalence. However, these PIK by amendment scenarios are concentrated among smaller borrowers, where 70% of PIKs by amendment are to borrowers with <$50 MM annual EBITDA, as shown in Fig. 3.(7)

OHA believes PIK by amendment is another indicator of the relative strength of larger companies compared to smaller companies. This characteristic reinforces OHA’s strategic focus on larger borrowers, aiming to mitigate downside risk and deliver attractive, risk-adjusted returns when evaluating private credit opportunities.

PIK Considerations

PIK financing can be an effective tool in private credit investing by helping to preserve borrower liquidity while delivering lenders an attractive spread premium. However, it is essential to thoroughly evaluate both the benefits and the considerations of PIK flexibility before incorporating it into a transaction.

Benefits

Growth Opportunity:

PIK features at origination allow high-quality senior direct lending borrowers to support future growth initiatives by reducing the burden of cash-pay interest during the first ~ two-years of the loan.

Spread Premium:

Lenders generally receive a 25 – 50 basis points premium when a PIK option is exercised to compensate for added structural complexity and foregone cash payments compared to a traditional cash-pay loan.

Capital Efficiency:

PIK financing does not require the lender to reserve capital for when a borrower draws on the commitment, as occurs in a typical senior private loan facility structure.

Considerations

Complexity:

PIK financing demands skilled lenders who can accurately assess the borrowers’ risk / reward profile, factoring in credit quality and liquidity needs. When executed effectively, this complexity creates an opportunity for experienced lenders to capture a meaningful spread premium while maintaining downside protection.

Context Matters:

Not all PIK opportunities are created equal, and given their higher-risk nature, lenders must determine whether incorporating PIK in a borrower’s loan structure is the appropriate solution.

Borrower Size:

Borrower size is a key consideration when evaluating private credit investments. Historically, smaller borrowers have been more likely to require PIK amendments after origination, which can introduce added complexity and risk. OHA believes its focus on larger borrowers is a critical part of its strategy to seek to generate alpha across market environments.

TAKEAWAYS

- OHA believes modest PIK exposure can be an effective way for lenders to capture additional spread, demonstrating the “complexity premium” offered by private credit

- OHA believes investors should carefully evaluate a manager’s underwriting process and structuring expertise when considering the use of PIK in private credit portfolios, as credit selection should be the largest determinant of performance over time

Industry spotlight: software credit

Read more to learn why OHA believes software companies can offer attractive all-weather investment profiles and inherent diversification as an “industry of industries”.

Spring 2024

Spring 2024

Credit market observations

Delve into OHA's analysis of credit markets, covering a wide range of assets including private, liquid, and structured credit.

Appendix and endnotes

1 Source: Cliffwater Direct Lending Index (“CDLI”).

2 Rapid rise in base rates defined as the period from 2022 – 2024.

3 The Secured Overnight Financing Rate (“SOFR”) is a broad measure of the cost of borrowing cash overnight collateralized by Treasury securities.

4 A basis point is equal to one hundredth of a percent (0.01%).

5 Source: Morgan Stanley Investment Research using Lincoln VOG Proprietary Private Market Database. Data represents Senior and Unitranche Term Loans. PIK by amendment defined as loans without PIK at close & with PIK in the current valuation period.

6 Source: Lincoln VOG Proprietary Private Market Database. Data represents Senior and Unitranche Term Loans.

7 Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”).

Key risks and disclosures

All investments are subject to market risk, including the possible loss of principal. Some or all alternative investments may not be suitable for certain investors. No assurance can be given that a fund’s investment objectives will be achieved. Alternative investments are speculative and involve a substantial degree of risk. Opportunities for withdrawal/redemption and transferability of interests are generally restricted, so investors may not have access to capital when it is needed. Any investor who subscribes, or proposes to subscribe, for an investment in a fund or separately managed account must be able to bear the risks involved and must meet relevant suitability requirements.

Fixed-income securities are subject to credit risk, liquidity risk, call risk, and interest-rate risk. As interest rates rise, bond prices generally fall. Investments in high-yield bonds involve greater risk of price volatility, illiquidity, and default than higher-rated debt securities. International investments can be riskier than U.S. investments due to the adverse effects of currency exchange rates, differences in market structure and liquidity, as well as specific country, regional, and economic developments.

The use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. The use of leverage and other speculative practices may increase the risk of investment loss or make investment performance volatile. In addition, the fees and expenses charged may be higher than the fees and expenses of other investment alternatives, which will reduce profits.

Important Information

All opinions and estimates are based on assumptions, all of which are difficult to predict and many of which are beyond the control of OHA. In preparing this document, OHA has relied upon and assumed, without independent verification, the accuracy and completeness of all information. OHA believes that the information provided herein is reliable; however, it does not warrant its accuracy or completeness. All charts and tables are shown for illustrative purposes only.

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action. The views contained herein are those of the authors as of December 2025 and are subject to change without notice; these views may differ from those of other OHA or T.Rowe Price associates. This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consult your financial advisor and consider your own circumstances before making an investment decision.

OHA is a T. Rowe Price company. © 2025 Oak Hill Advisors. All Rights Reserved. OHA is a trademark of Oak Hill Advisors, L.P. T. ROWE PRICE, INVEST WITH CONFIDENCE, the Bighorn Sheep design and related indicators (see troweprice.com/ip) are trademarks of T. Rowe Price Group, Inc. All other trademarks shown are the property of their respective owners. Use does not imply endorsement, sponsorship, or affiliation of Oak Hill Advisors with any of the trademark owners.

202512-5077002