NEWS

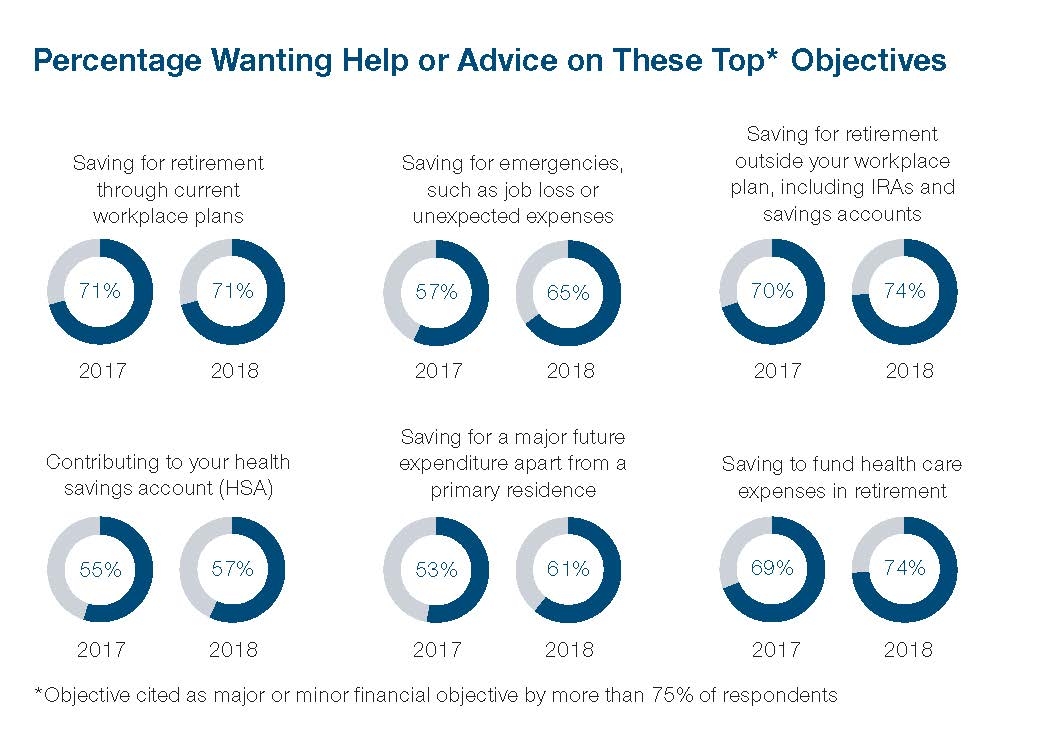

The demand for financial advice has increased among individuals’ major or minor financial objectives, according to a study of current workers recently conducted by T. Rowe Price. The study, “Retirement Savings and Spending: Behaviors and Attitudes toward Financial Advice,” found that since 2017, the need for advice has risen for the majority of the financial objectives listed in the study. Three of the most cited objectives for which respondents identified a need for advice were related to retirement: saving for retirement outside of your workplace plan (74 percent), saving to fund health care expenses in retirement (74 percent), and saving for retirement through current workplace plans (71 percent).

Additionally, respondents indicated which type of financial advice–selecting investments, figuring out how much to save, and tracking progress--would be the most useful to help reach each financial objective. Advice on how much to save was the most cited type of financial advice for a majority of the financial objectives, followed by tracking progress. For objectives related to retirement, 34 percent indicated they want advice on how much to save for retirement outside of a workplace plan, 32 percent for saving to fund healthcare expenses in retirement, and 31 percent for saving for retirement through current workplace plans.

Meanwhile, while the need for financial advice has increased, 60 percent of respondents aren’t receiving financial advice, with 43 percent citing cost as the reason.

GENERATIONAL ATTITUDES ON ADVICE

· The majority of respondents, across all generations, rely on their 401(k) provider “a great deal” or “somewhat” for financial advice, including advice for financial decisions not related to retirement (64 percent). Among the workers who say they turn first to their 401(k) plan provider, 68 percent are millennials, 66 percent are Generation X, and 55 percent are baby boomers.

· Attitudes about advice delivery differ between generations. Millennials prefer advice that is accessible on their mobile devices, Generation X wants advice services that fit into their busy schedules, and baby boomers cite ease of use as their primary concern.

· Millennial workers are the most comfortable with digital tools and calculators compared to other generations. Sixty-four percent of millennials state they rely on them “somewhat” or “a great deal” compared to 55 percent of Generation X and 42 percent of baby boomers.

“As individuals juggle many financial goals, their need for financial advice has grown and we see many turning to their retirement provider for that guidance,” said Aimee DeCamillo, head of T. Rowe Price Retirement Plan Services, Inc. “The availability of financial wellness programs alongside a retirement plan is more important than ever. Employers can support this growing need by offering access to educational resources, greatly influencing not just the retirement readiness of their employees but their overall financial health as well.”

ADVICE NEEDS BEYOND RETIREMENT

· Reducing debt. Sixty-three percent of respondents say that reducing debt is a major or minor financial objective where advice would be useful. While the majority of respondents state that they “always” or “often” pay their credit card balances in full when due (57 percent), credit card balances are the highest form of debt held (75 percent), followed by car loans (54 percent).

· Saving for emergencies. Sixty-five percent of respondents say that saving for emergencies is a major or minor financial objective where advice would be useful. While 31 percent say they currently have an emergency fund in place, nearly half state they would turn to their credit card if faced with a financial emergency (47 percent) or to family members (32 percent).

· Managing and budgeting day-to-day expenses. Fifty-six percent of respondents say that managing and budgeting day-to-day expenses is a major or minor financial objective where advice would be useful: 42 percent have a fixed spending budget, while 63 percent are able to stick to a budget if they have one. Seventeen percent of respondents also cite having trouble paying their monthly bills “always” or “often.”

“While the 401(k) provider is universally where individuals look for financial advice, the preferences for how advice is delivered seems to differ across the generations,” said Sudipto Banerjee, senior manager of thought leadership at T. Rowe Price. “Millennials view digital tools and calculators as an important aspect of advice delivery, while Generation X and baby boomers look for convenience and accessibility as they accumulate assets. While these preferences seem to differ widely at a glance, they share a common theme: simplicity. People need financial advice and they want it at their fingertips.”

ABOUT THE STUDY

The findings are based on a national study of 3,005 adults age 21 and older who have never retired and are currently contributing to a 401(k) plan or are eligible to contribute and have an account balance of at least $1,000. NMG Consulting conducted the online survey for T. Rowe Price from July 24, 2018 to Aug. 14, 2018. This is the fourth edition of the study, following the 2014, 2015, and 2017 installments. Data from prior studies is used in this report for comparison purposes.

ABOUT T. ROWE PRICE

Founded in 1937, Baltimore-based T. Rowe Price Group, Inc. is a global investment management organization with $1.01 trillion in assets under management as of October 31, 2018. The organization provides a broad array of mutual funds, subadvisory services, and separate account management for individual and institutional investors, retirement plans, and financial intermediaries. The organization also offers a variety of sophisticated investment planning and guidance tools. T. Rowe Price’s disciplined, risk-aware investment approach focuses on diversification, style consistency, and fundamental research. For more information, visit troweprice.com, Twitter, YouTube, LinkedIn, Instagram, or Facebook.