retirement savings | march 28, 2024

You’re Age 35, 50, or 60: How Much Should You Have Saved for Retirement by Now?

It’s important to make steady progress toward saving for retirement, no matter what your age.

Key Insights

Savings benchmarks based on age and salary can serve as a helpful way to track progress against saving for retirement.

Saving 15% of income per year (including any employer contributions) is an appropriate savings level for many people.

Having one to one-and-a-half times your income saved for retirement by age 35 is an attainable target for someone who starts saving at age 25.

Roger Young, CFP®

Thought Leadership Director

If you want to track your progress toward a goal, chances are there is an app that can do that for you. For example, you can track your steps, your packages, your diet, and even your family’s whereabouts.

But when it comes to saving for your retirement, how much time do you spend tracking your progress? And at what point in your life should you start paying attention?

Retirement planning can be intimidating at any age—even more so early in your career. When retirement seems so far in the future, it’s hard to plan for it with so many competing priorities in the present. For example, in addition to your regular bills, you may have student loans to repay. Or you may be trying to save money to purchase a home or save for your kids’ college education.

Still, it’s important to make steady progress toward saving, no matter what your age. Moreover, taking stock of where you stand can help you plan with more intention based on your situation.

Subscribe to T. Rowe Price Insights

Receive monthly retirement guidance, financial planning tips, and market updates straight to your inbox.

Why now is the right time to review your portfolio.

Market uncertainty, major life events, and the rising cost of living can impact your investment strategy.

Get a free portfolio review:

What Should I Have Saved by Age 35, 50, and 60?

There is a lot of research showing that people tend to rely on approximations or rules of thumb when it comes to financial decisions.

With this in mind, many financial firms publish savings benchmarks that show the ideal levels of savings at different ages relative to an individual’s income. A savings benchmark isn’t a replacement for comprehensive planning, but it is a quick way to gauge whether you’re on track. It’s much better than the alternative some people use—blindly guessing! More importantly, it can act as a catalyst to take action and start saving more.

However, for the benchmark to be useful, it needs to be realistic. Setting the target too low can lead to a false sense of confidence; setting it too high can discourage people from doing anything. Articles on retirement savings goals have generated spirited discussion about the reasonableness of the targets.

As a result, my colleagues and I have reevaluated how to calculate achievable benchmarks. We started with the goal in mind: determining the amount of assets needed by age 65. While that number depends on a lot of factors, income is the biggest one. Since higher earners will get a smaller portion of their income in retirement from Social Security, they generally need more assets in relation to their income. We estimated that most people looking to retire around age 65 should aim for assets totaling between 7½ and 13½ times their preretirement gross income.

From there, we identified savings benchmarks at other ages based on a reasonable trajectory of earnings and savings rates. We didn’t presume that everyone starts saving our recommended 15% of their income immediately upon receiving their first paycheck. Rather, our hypothetical investor starts saving 6% at age 25 and ramps up savings by one percentage point each year until reaching an appropriate level. We found that 15% of income per year (including any employer contributions) is an appropriate savings level for many people, but we recommend that higher earners aim beyond 15%.

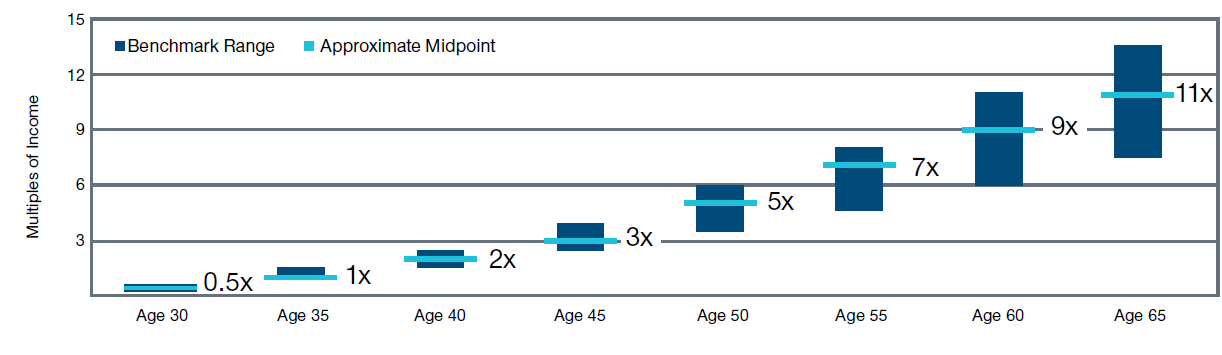

So to answer the question, we believe having one to one-and-a-half times your income saved for retirement by age 35 is a reasonable target. By age 50, you would be considered on track if you have three-and-a-half to six times your preretirement gross income saved. And by age 60, you should have six to 11 times your salary saved in order to be considered on track for retirement.

For example, a 35-year-old earning $60,000 would be on track if she’s saved about $60,000 to $90,000.

Savings Benchmarks by Age—As a Multiple of Income

| Investor's Age | Savings Benchmarks |

|---|---|

| 30 | 0.5x of salary saved today |

| 35 | 1x to 1.5x salary saved today |

| 40 | 1.5x to 2.5x salary saved today |

| 45 | 2.5x to 4x salary saved today |

| 50 | 3.5x to 6x salary saved today |

| 55 | 4.5x to 8x salary saved today |

| 60 | 6x to 11x salary saved today |

| 65 | 7.5x to 13.5x salary saved today |

Key Assumptions: Household income grows at 5% until age 45 and 3% (the assumed inflation rate) thereafter. Investment returns before retirement are 7% before taxes, and savings grow tax-deferred. The person retires at age 65 and begins withdrawing 4% of assets (a rate intended to support steady inflation-adjusted spending over a 30-year retirement). Savings benchmark ranges are based on household income levels described on page 4. Target multiples at retirement reflect estimated spending needs in retirement (including a 5% reduction from preretirement levels), taxes, and Social Security benefits based on the SSA.gov Quick Calculator. See Additional Disclosures.

The Benchmarks for Those Closer to Retirement

The range gets wider as you get older, so we also provide more detailed estimates for people approaching retirement. This helps someone find a realistic target based on income and marital status, which affect Social Security benefits.

A Closer Look at Savings Benchmarks Later in Your Career

| Married, Dual Income | Married, Sole Earner | Single | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Current Household Income | Age 55 | Age 60 | Age 65 | Age 55 | Age 60 | Age 65 | Age 55 | Age 60 | Age 65 |

| $100,000 | 5.5x | 7.5x | 9x | 4.5x | 6x | 7.5x | 6.5x | 8.5x | 10.5x |

| $150,000 | 6x | 8.5x | 10x | 5.5x | 7.5x | 9x | 7x | 9x | 11.5x |

| $200,000 | 6.5x | 8.5x | 10.5x | 6.5x | 8.5x | 10.5x | 7.5x | 10x | 12.5x |

| $250,000 | 6.5x | 9x | 11x | 7x | 9.5x | 11.5x | 8x | 10.5x | 13x |

| $300,000 | 7x | 9x | 11.5x | 7.5x | 10x | 12.5x | 8x | 11x | 13.5x |

Assumptions: See “Savings Benchmarks by Age—As a Multiple of Income” above. “Dual income” means that one spouse generates 75% of the income that the other spouse earns.

How to Stay on Track

The point of benchmarks isn’t to make you feel superior or inadequate. It’s to prompt action, coupled with a guidepost to inform those actions, even if that means staying the course. If you’re not on track, don’t despair. Determine the percentage of income you may need to save going forward. Focus less on the shortfall and more on the incremental steps you can take to rectify the situation:

Make sure you are taking advantage of the full company match in your workplace retirement plan.

If you can increase your savings rate right away, that’s ideal. If not, gradually save more over time.

If you have a company retirement plan that enables automatic increases, sign up.

If you are struggling to save, many employers offer financial wellness programs or other tools that can help with budgeting and basic finances.

If you’re age 50 or older, you can make catch-up contributions in both your workplace retirement plan and individual retirement account (IRA).

Looking for more information on where you stand with your retirement savings? Visit the T. Rowe Price Retirement Income Calculator to test different scenarios.

Use these savings benchmarks to get more comfortable with planning for retirement. Then go beyond the rule of thumb to fully understand your potential retirement expenses and income sources. Beyond your savings, think about what you are saving for and how you envision spending your time after years of hard work. After all, that’s the reason why you are saving in the first place.

Past performance cannot guarantee future results. All investments are subject to market risk, including the possible loss of principal.

All charts and tables are shown for illustrative purposes only.

View investment professional background on FINRA's BrokerCheck.

202403-3461024

Next Steps

Are you on track? Visit the T. Rowe Price Retirement Income Calculator to get an estimate on where you stand.

Contact a Financial Consultant at 1-800-401-1819.

Learn More About How to Save for Retirement

Additional Disclosure

Benchmarks are based on a target multiple at retirement age and a savings trajectory over time consistent with that target and the savings rate needed to achieve it. Household income grows at 5% until age 45 and 3% (the assumed inflation rate) thereafter. Investment returns before retirement are 7% before taxes, and savings grow tax-deferred. The person retires at age 65 and begins withdrawing 4% of assets (a rate intended to support steady inflation-adjusted spending over a 30-year retirement). Savings benchmark ranges are based on individuals with current household income approximately between $75,000 and $300,000, and couples with income between $100,000 and $400,000. Target multiples at retirement reflect estimated spending needs in retirement (including a 5% reduction from preretirement levels); Social Security benefits (using the SSA.gov Quick Calculator, assuming claiming at full retirement ages, and the Social Security Administration’s assumed earnings history pattern); state taxes (4% of income, excluding Social Security benefits); and federal taxes. We assume the household starts saving 6% at age 25 and increases the savings rate by 1% annually until reaching the necessary savings rate. Benchmark ranges reflect the higher amounts calculated using federal tax rates as of January 1, 2024, or the tax rates as scheduled to revert to pre-2018 levels after 2025. Approximate midpoints for age 35 and older are rounded up to a whole number within the range.

Important Information

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are those of the authors as of February 2024 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types; advice of any kind; or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based on sources we consider to be reliable; we do not, however, guarantee its accuracy.