How a 529 Plan Can Benefit You

Investing in a 529 plan can make it easier to save for the future with benefits designed to help you reach your unique savings goals.

What Is a 529 Plan? How Does It Work?

College savings plans, also called 529 plans, are accounts specifically designed to help you save for education expenses in a tax-advantaged way.

Here's how it works:

- You create and control an account on behalf of your beneficiary or future student.

- You make contributions to your account using after-tax dollars.

- Investments grow tax-deferred, and earnings are tax-free when used for qualified education expenses.

That means you can use your full balance for expenses like tuition and fees, room and board, and books and supplies at any eligible public or private college, university, or trade or vocational school anywhere in the U.S. A 529 plan can also be used tax-free to cover certain tuition expenses at K-12 public, private, and religious schools.1

Get More From Your Savings

529 plans offer the potential of higher returns and tax-advantaged growth compared with lower-yielding bank accounts.2

In addition to any growth being tax-deferred, you may also be eligible for a state income tax deduction depending on your state of residence. If you live in Arizona, Arkansas, Kansas, Maine, Minnesota, Missouri, Montana, Ohio, or Pennsylvania, contributions to any 529 plan are eligible for the state's income tax deduction.3

In fact, if you save $200 per month in a bank account versus investing that same amount in a 529 plan, you could be leaving a lot of money on the table over the course of 18 years. Assuming approximate earnings of 0.09% interest in a bank account versus 6% earnings with a tax-deferred investment account, like a 529 plan, that could mean over $30,000 more in your pocket.4

Saving In a Bank Account vs a 529 Account

Use Your Account for College and More

Explore all the ways in which your 529 savings can be used with the interactive tool below.

Three Steps to Get Started Today

Saving for your child's future education has never been easier.

Open a T. Rowe Price College Savings Plan Account

With a T. Rowe Price College Savings Plan account, you can save for your child's future education expenses.

Choose an Investment Option

Select from flexible portfolio options according to your investment comfort level and the number of years until you will first use your savings.

Review Investment OptionsSave Regularly

Once you open a T. Rowe Price College Savings Plan account, you can tailor your contributions to your current budget. It's easy to save with one-time contributions or recurring contributions with the option of increasing over time.

Add Recurring Contributions

Invest in the Next Generation

Anyone can open and contribute to a T. Rowe Price College Savings Plan. Whether you're a grandparent, family member, or friend, it's a great way to save for college. There are no limits on age, income, or state of residency.

Estate planning

You can significantly reduce the value of your taxable estate by funding a 529 plan. When you contribute to your grandchild's account, the contributions are (with some exceptions) removed from your taxable estate and considered a gift to the grandchild, with the additional gift tax advantages described below.6

Give a gift of education

For 2024, the maximum annual gift amount is $18,000 per individual per year without paying gift taxes. With a 529, you can contribute up to $90,000 (or $180,000 for a married couple) to a beneficiary in one year and average the gift over five years without paying gift taxes. Future years may differ.

Grandparent-owned 529s and financial aid

Starting in the 2024-2025 school year, distributions from a grandparent-owned 529 account will no longer count as income to the student on the Free Application for Federal Student Aid.

Explore Extra Features

The T. Rowe Price College Savings Plan offers additional features for account owners:

Gifting

Utilize a online gifting tool that allows your family and friends to contribute to your child's college savings plan in lieu of traditional gifts for celebrations such as graduations, holidays, and birthdays.

Learn MoreCollege Financing Planner

The College Financing Planner provides customized projections to estimate your future college expenses so that you can create a plan to start saving.

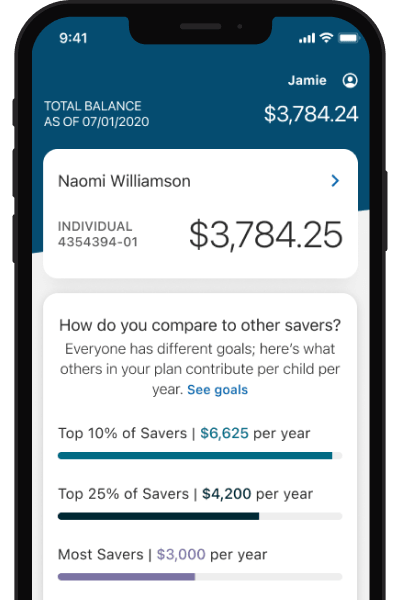

Start CalculatingReadysave™ 529 App

Manage Your Account Anywhere, Anytime.

-

Contribute at your pace

Add money to your balance as a one-time or recurring contribution.

-

Regularly monitor your account

Check your account balance, transaction history, and investment allocations.

-

Gifting from friends and family

Easily invite friends and family to help give your savings a boost with Ugift™.

Questions?

Our customer service representatives are here to help. Just give us a call at 800-369-3641 Monday through Friday from 8 a.m.-8 p.m. eastern time.

1While distributions from 529 college savings plans for elementary or secondary education tuition expenses are federally tax-free, state tax treatment will vary and could include state income taxes assessed, the recapture of previously deducted amounts from state taxes, and/or state-level penalties. You should consult with a tax or legal advisor for additional information.

2Unlike a traditional bank account that offers Federal Deposit Insurance Corporation (FDIC) protection, investments in 529 plans are generally not guaranteed, and you could lose money, including your principal, by investing in them. There may be other material differences between savings accounts and 529 college savings plan accounts that should be considered prior to investing.

3List of tax-parity states as of April 2023. If you have questions about your specific situation, please speak with a state tax professional.

4This representation demonstrates the difference between hypothetical rate of return in a bank account and a 529 college savings plan account, compounded monthly, but not between any two specific products. This example doesn't represent the return on any particular investment, and these rates are not guaranteed.

6Gift and estate tax issues can be complex; see a tax professional to discuss your situation in detail.